Answered step by step

Verified Expert Solution

Question

1 Approved Answer

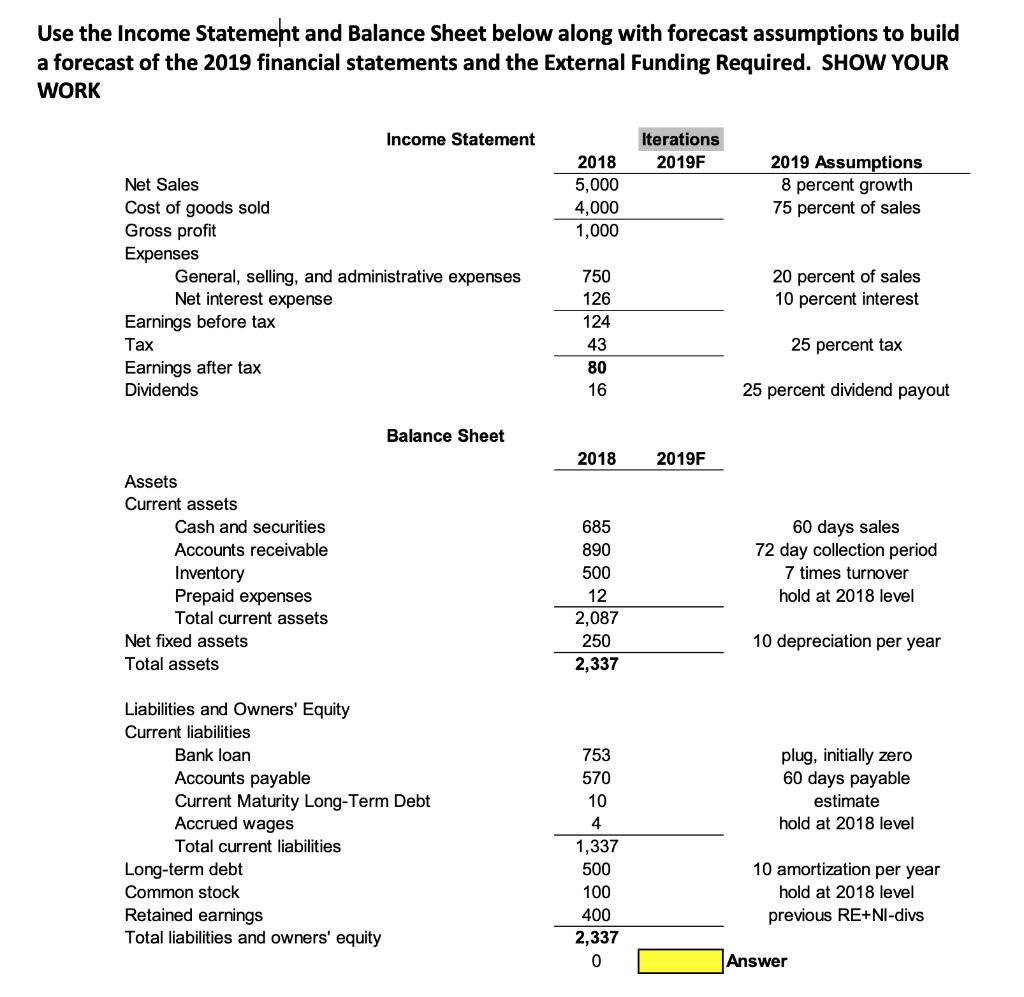

Use the Income Statement and Balance Sheet below along with forecast assumptions to build a forecast of the 2019 financial statements and the External

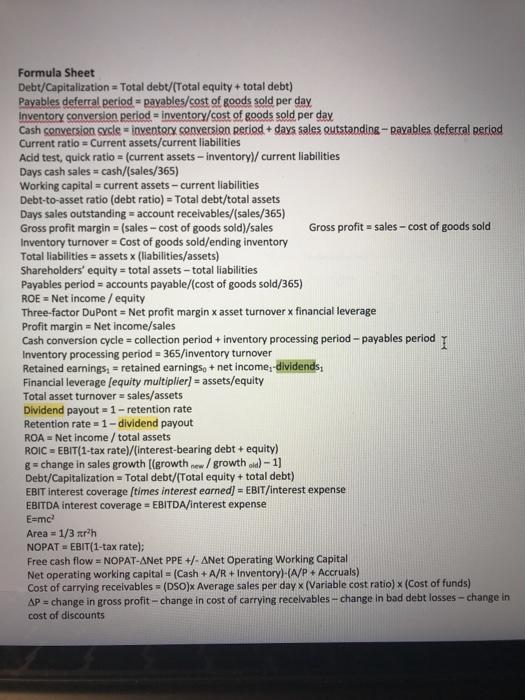

Use the Income Statement and Balance Sheet below along with forecast assumptions to build a forecast of the 2019 financial statements and the External Funding Required. SHOW YOUR WORK Net Sales Cost of goods sold Gross profit Expenses General, selling, and administrative expenses Net interest expense Earnings before tax Tax Earnings after tax Dividends Assets Current assets Cash and securities Accounts receivable Inventory Prepaid expenses Total current assets Net fixed assets Total assets Income Statement Long-term debt Common stock Retained earnings Total liabilities and owners' equity Balance Sheet Liabilities and Owners' Equity Current liabilities Bank loan Accounts payable Current Maturity Long-Term Debt Accrued wages Total current liabilities 2018 5,000 4,000 1,000 750 126 124 43 80 16 2018 685 890 500 12 2,087 250 2,337 753 570 10 4 1,337 500 100 400 2,337 0 Iterations 2019F 2019F 2019 Assumptions 8 percent growth 75 percent of sales 20 percent of sales 10 percent interest 25 percent tax 25 percent dividend payout 60 days sales 72 day collection period 7 times turnover hold at 2018 level 10 depreciation per year plug, initially zero 60 days payable estimate hold at 2018 level 10 amortization per year hold at 2018 level previous RE+NI-divs Answer Formula Sheet Debt/Capitalization = Total debt/(Total equity + total debt) Payables deferral period= payables/cost of goods sold per day Inventory conversion period inventory/cost of goods sold per day Cash conversion cycle = inventory conversion period + days sales outstanding-pavables deferral period Current ratio Current assets/current liabilities Acid test, quick ratio = (current assets-inventory)/ current liabilities Days cash sales cash/(sales/365) Working capital current assets-current liabilities Debt-to-asset ratio (debt ratio) = Total debt/total assets Days sales outstanding account receivables/(sales/365) Gross profit margin = (sales-cost of goods sold)/sales Inventory turnover = Cost of goods sold/ending inventory Total liabilities = assets x (liabilities/assets) Shareholders' equity = total assets-total liabilities Payables period = accounts payable/(cost of goods sold/365) ROE = Net income / equity Gross profit= sales-cost of goods sold Three-factor DuPont = Net profit margin x asset turnover x financial leverage Profit margin = Net income/sales Cash conversion cycle = collection period + inventory processing period - payables period I Inventory processing period = 365/inventory turnover Retained earnings, retained earnings, + net income,-dividends, Financial leverage [equity multiplier] = assets/equity Total asset turnover = sales/assets Dividend payout=1-retention rate Retention rate = 1-dividend payout ROA= Net income / total assets ROICEBIT(1-tax rate)/(interest-bearing debt + equity) g=change in sales growth [(growth new/growth old)-1] Debt/Capitalization = Total debt/(Total equity + total debt) EBIT interest coverage [times interest earned] EBIT/interest expense EBITDA interest coverage = EBITDA/interest expense E=mc Area = 1/3 xrh NOPAT = EBIT(1-tax rate); Free cash flow = NOPAT-ANet PPE +/- ANet Operating Working Capital Net operating working capital = (Cash + A/R + Inventory)-(A/P + Accruals) Cost of carrying receivables = (DSO)x Average sales per day x (Variable cost ratio) x (Cost of funds) AP = change in gross profit-change in cost of carrying receivables - change in bad debt losses-change in cost of discounts

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started