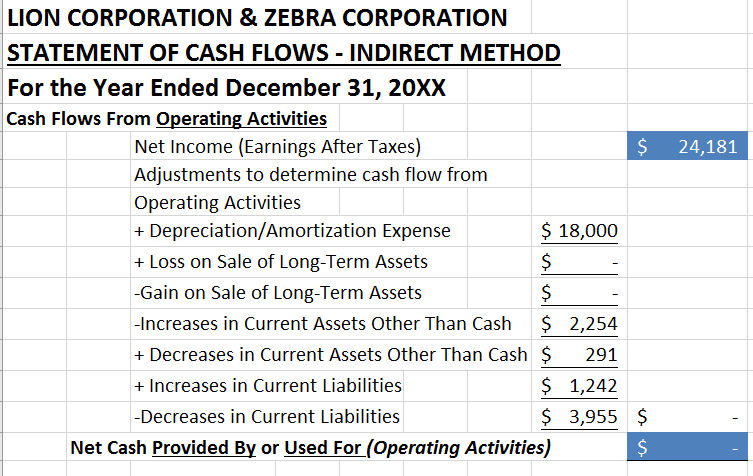

Use the income statement, balance sheet and additional information to fill in the blanks on statement of cash flows.

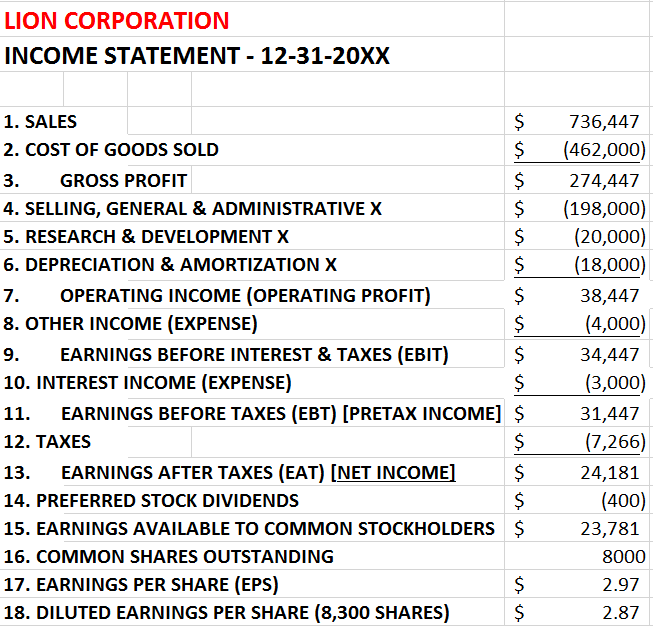

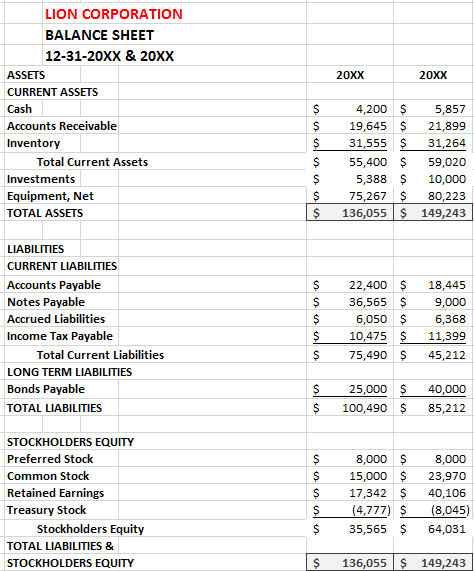

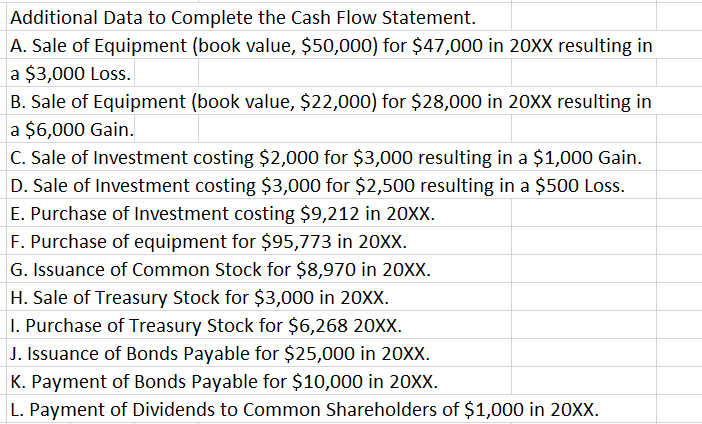

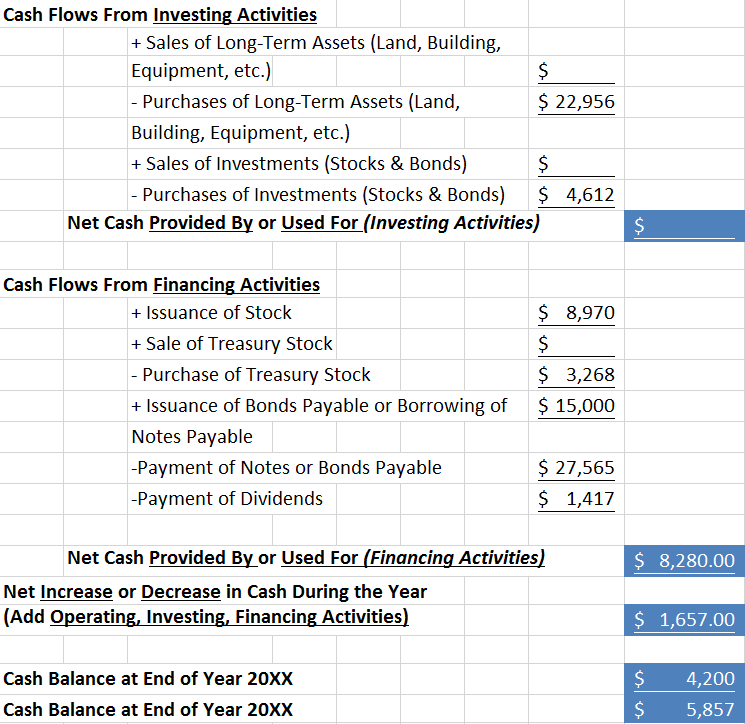

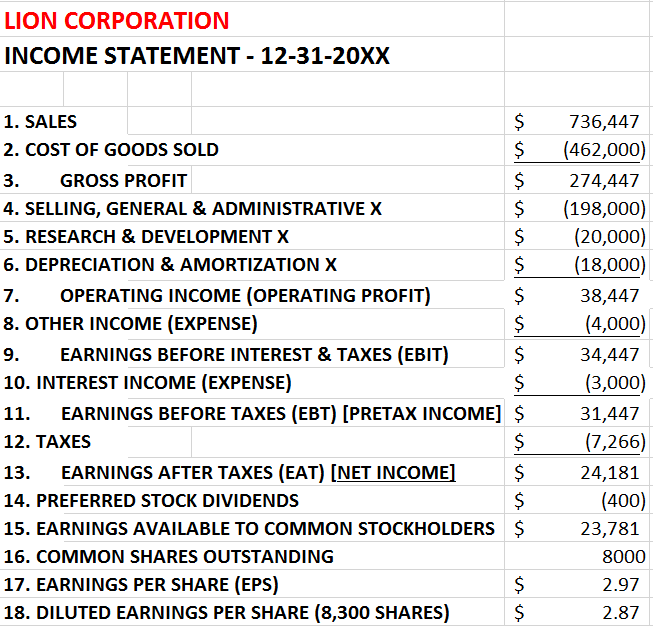

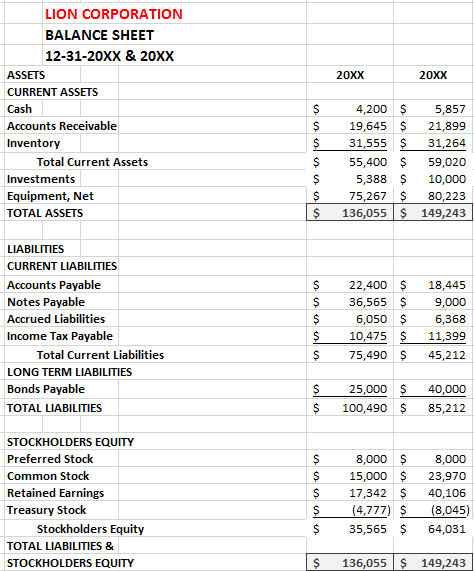

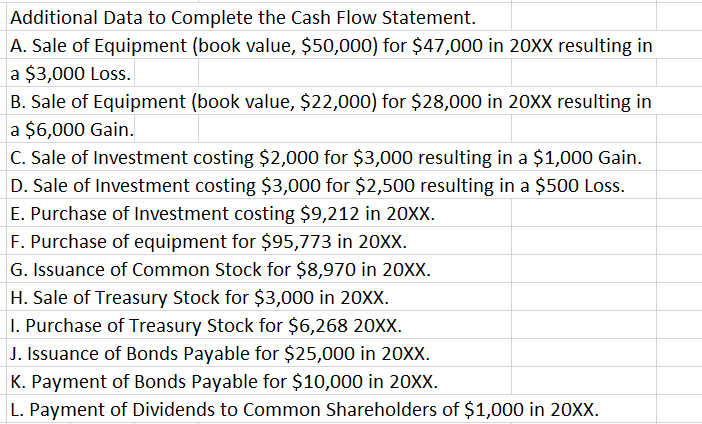

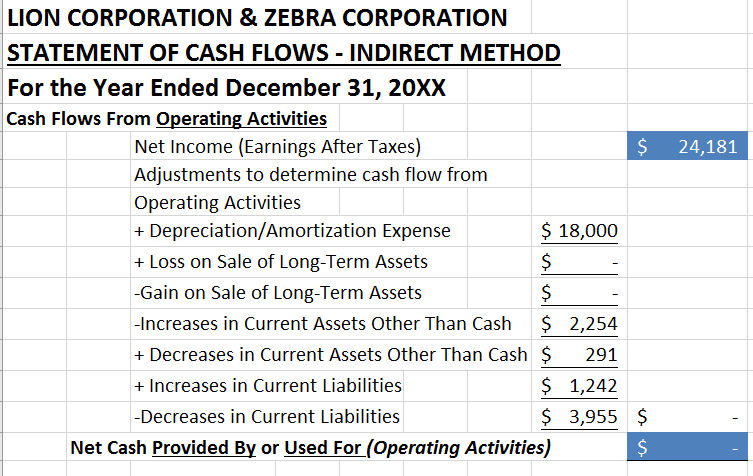

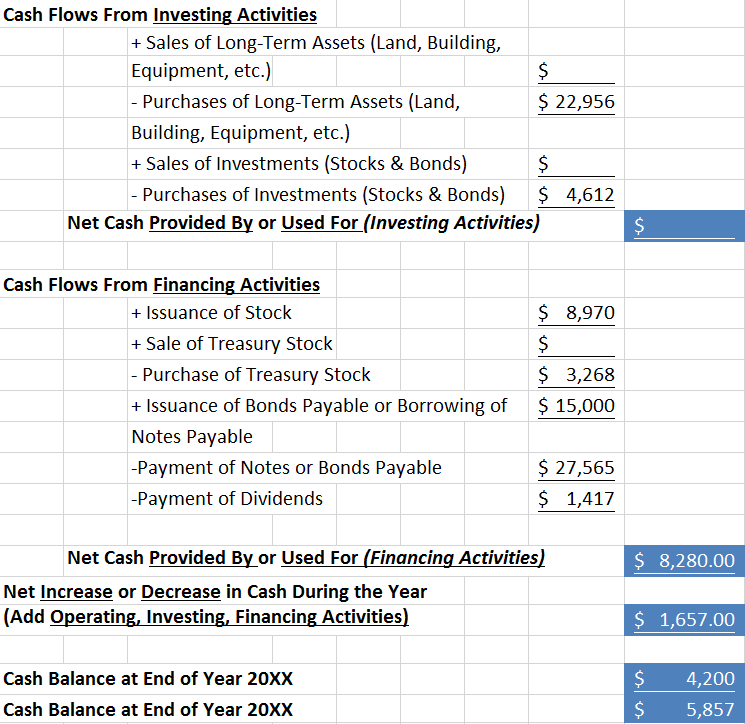

ION CORPORATION INCOME STATEMENT - 12-31-20XX 1. SALES 2. COST OF GOODS SOLD 3. 4. SELLING, GENERAL & ADMINISTRATIVE X 5. RESEARCH & DEVELOPMENT X 6. DEPRECIATION & AMORTIZATION X 7. OPERATING INCOME (OPERATING PROFIT) 8. OTHER INCOME (EXPENSE) 9.EARNINGS BEFORE INTEREST & TAXES (EBIT) 10. INTEREST INCOME (EXPENSE) 11. EARNINGS BEFORE TAXES (EBT) [PRETAX INCOME]$31,447 12. TAXES 13. EARNINGS AFTER TAXES (EAT) NET INCOME| 14. PREFERRED STOCK DIVIDENDS 15. EARNINGS AVAILABLE TO COMMON STOCKHOLDERS $ 16. COMMON SHARES OUTSTANDING 17. EARNINGS PER SHARE (EPS) 18. DILUTED EARNINGS PER SHARE (8,300 SHARES) $736,447 (462,000) $274,447 $ (198,000) $(20,000) $(18,000) 38,447 (4,000) 34,447 (3,000) GROSS PROFIT (7,266) 24,181 (400) 23,781 8000 2.97 2.87 LION CORPORATION BALANCE SHEET 12-31-20XX & 20XX ASSETS CURRENT ASSETS Cash Accounts Receivable Inventory 20XX 20XX 200 5,857 $19,645 $21,899 31,55531264 $55,400 $ 59,020 5,388 10,000 S 75.267 80.223 149,243 Total Current Assets Investments Equipment, Net TOTAL ASSETS 136,055 LIABILITIES CURRENT LIABILITIES Accounts Payable Notes Payable Accrued Liabilities Income Tax Payable $22,400 $ 18,445 $36,565 9,000 6,050 $ 6,368 11,399 $75,490 $45,212 10,475 Total Current Liabilities LONG TERM LIABILITIES Bonds Payable TOTAL LIABILITIES S 25,00040,000 $100,490 85,212 STOCKHOLDERS EQUITY Preferred Stock Common Stock Retained Earnings Treasury Stock 8,000 8,000 $15,000 $ 23,970 $17,342 $ 40,106 (4.777) S(8,045) $ 35,565 $ 64,031 Stockholders Equity TOTAL LIABILITIES & STOCKHOLDERS EQUITY 55 S149,243 Additional Data to Complete the Cash Flow Statement. A. Sale of Equipment (book value, $50,000) for $47,000 in 20XX resulting in a $3,000 Loss. B. Sale of Equipment (book value, $22,000) for $28,000 in 20XX resulting in a $6,000 Gain. C.Sale of Investment costing $2,000 for $3,000 resulting in a $1,000 Gain. D. Sale of Investment costing $3,000 for $2,500 resulting in a $500 Loss. E. Purchase of Investment costing $9,212 in 20XX. F. Purchase of equipment for $95,773 in 2OxX. G. Issuance of Common Stock for $8,970 in 20XX. H.Sale of Treasury Stock for $3,000 in 20xX I. Purchase of Treasury Stock for $6,268 20xX J. Issuance of Bonds Payable for $25,000 in 20XX K. Payment of Bonds Payable for $10,000 in 20XX L. Payment of Dividends to Common Shareholders of $1,000 in 20XX. LION CORPORATION & ZEBRA CORPORATION STATEMENT OF CASH FLOWS INDIRECT METHOD For the Year Ended December 31, 20XX Cash Flows From Operating Activities 24,181 Net Income (Earnings After Taxes) Adjustments to determine cash flow from Operating Activities Depreciation/Amortization Expense Loss on Sale of Long-Term Assets Gain on Sale of Long-Term Assets -Increases in Current Assets Other Than Cash$ + Decreases in Current Assets Other Than Cash $ + Increases in Current Liabilities -Decreases in Current Liabilities $18,000 2,254 291 $ 1,242 3,955$ Net Cash Provided By or Used For (Operating Activities,) Cash Flows From Investing Activities + Sales of Long-Term Assets (Land, Building, Equipment, etc.) - Purchases of Long-Term Assets (Land, Building, Equipment, etc.) + Sales of Investments (Stocks & Bonds) 22,956 $ Net Cash Provided By or Used For (Investing Activities) Purchases of Investments (Stocks & Bonds) 4,612 Cash Flows From Financing Activities + Issuance of Stock $ 8,970 +Sale of Treasury Stock $ 3,268 $ 15,000 Purchase of Treasury Stock + Issuance of Bonds Payable or Borrowing of Notes Payable Payment of Notes or Bonds Payable Payment of Dividends $27,565 $ 1,417 Net Cash Provided By or Used For (Financing Activities) $8,280.00 $ 1,657.00 $4,200 Net Increase or Decrease in Cash During the Year (Add Operating, Investing, Financing Activities) Cash Balance at End of Year 20XX Cash Balance at End of Year 20XX $ 5,857