Answered step by step

Verified Expert Solution

Question

1 Approved Answer

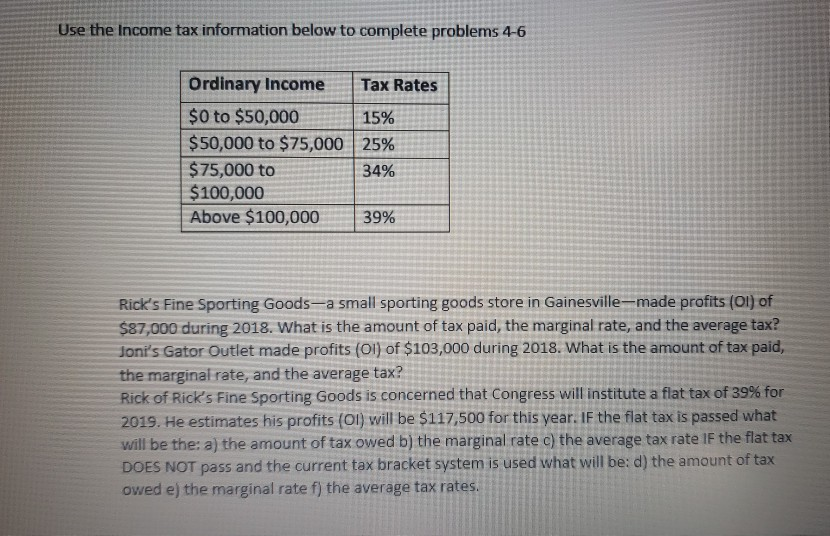

Use the income tax information below to complete problems 4-6 Ordinary Income Tax Rates $0 to $50,000 15% $50,000 to $75,000 25% $75,000 to 34%

Use the income tax information below to complete problems 4-6 Ordinary Income Tax Rates $0 to $50,000 15% $50,000 to $75,000 25% $75,000 to 34% $100,000 Above $100,000 39% Rick's Fine Sporting Goods-a small sporting goods store in Gainesville-made profits (Ol) of $87,000 during 2018. What is the amount of tax paid, the marginal rate, and the average tax? Joni's Gator Outlet made profits (OI) of $103,000 during 2018. What is the amount of tax paid, the marginal rate, and the average tax? Rick of Rick's Fine Sporting Goods is concerned that Congress will institute a flat tax of 39% for 2019. He estimates his profits (Ol) will be $117,500 for this year. If the flat tax is passed what will be the: a) the amount of tax owed b) the marginal rate c) the average tax rate IF the flat tax DOES NOT pass and the current tax bracket system is used what will be: d) the amount of tax owed e) the marginal rate f) the average tax rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started