Answered step by step

Verified Expert Solution

Question

1 Approved Answer

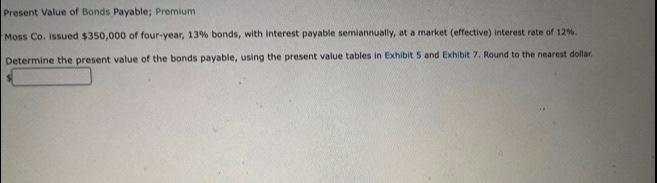

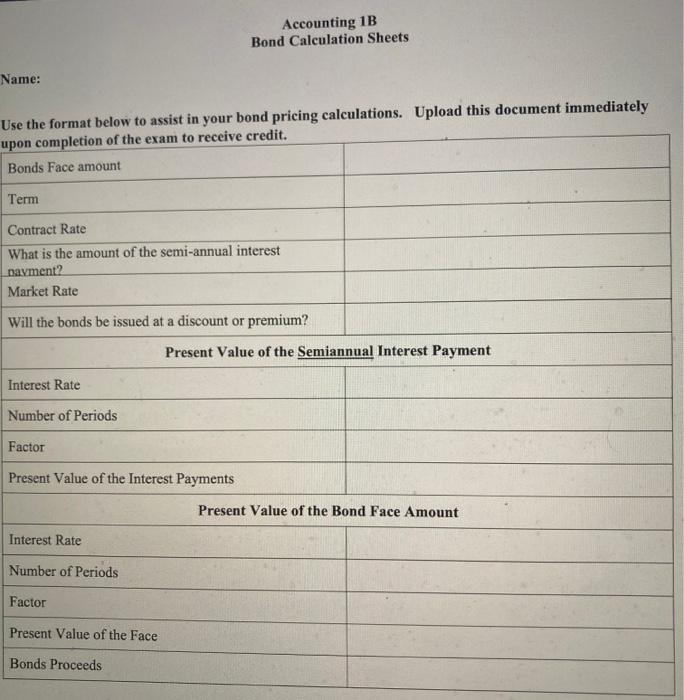

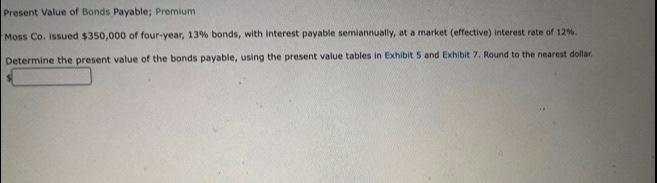

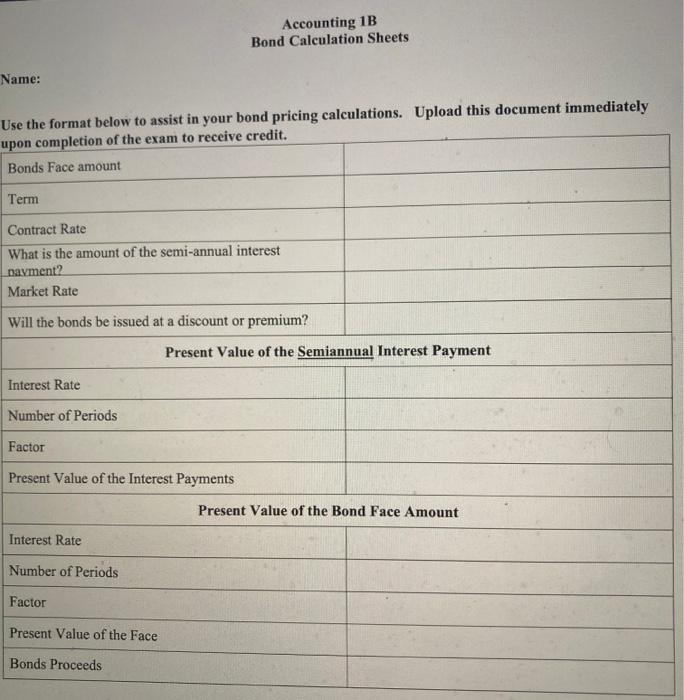

use the info provided in the first picture to break down the second picture of the bond calculations sheet resent Value of Bonds Payable: Premium

use the info provided in the first picture to break down the second picture of the bond calculations sheet

resent Value of Bonds Payable: Premium Mons Co. issued $350,000 of four-year, 13% bonds, with interest payable femiannually, at a market (effective) interest rote of 12%. Determine the present value of the bonds payable, using the present value tables in Exhibit 5 and Exhibit 7. Round to the nearest dollar. Accounting 1B Bond Calculation Sheets Name: Use the format below to assist in your bond pricing calculations. Upload this document immediately upon completion of the exam to receive credit. Bonds Face amount Term Contract Rate What is the amount of the semi-annual interest navment? Market Rate Will the bonds be issued at a discount or premium? \begin{tabular}{|l|} \hline Interest Rate \\ \hline Number of Periods \\ \hline \end{tabular} Factor Present Value of the Interest Payments Present Value of the Bond Face Amount Interest Rate Number of Periods Factor Present Value of the Face Bonds Proceeds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started