Answered step by step

Verified Expert Solution

Question

1 Approved Answer

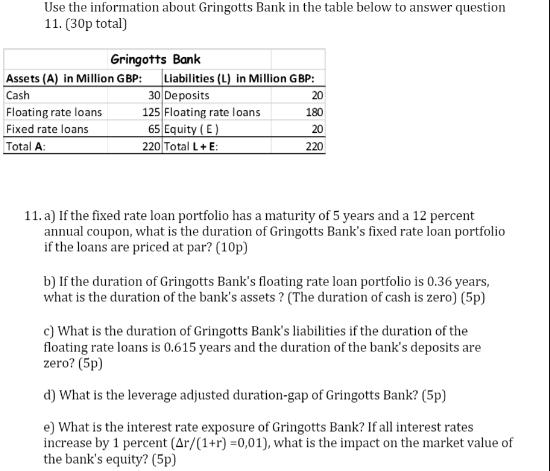

Use the information about Gringotts Bank in the table below to answer question 11. (30p total) Gringotts Bank Assets (A) in Million GBP: Liabilities

Use the information about Gringotts Bank in the table below to answer question 11. (30p total) Gringotts Bank Assets (A) in Million GBP: Liabilities (L) in Million GBP: Cash 30 Deposits 201 Floating rate loans Fixed rate loans Total A: 125 Floating rate loans 180 65 Equity (E) 20 220 Total L+E: 220 11. a) If the fixed rate loan portfolio has a maturity of 5 years and a 12 percent annual coupon, what is the duration of Gringotts Bank's fixed rate loan portfolio if the loans are priced at par? (10p) b) If the duration of Gringotts Bank's floating rate loan portfolio is 0.36 years, what is the duration of the bank's assets? (The duration of cash is zero) (5p) c) What is the duration of Gringotts Bank's liabilities if the duration of the floating rate loans is 0.615 years and the duration of the bank's deposits are zero? (5p) d) What is the leverage adjusted duration-gap of Gringotts Bank? (5p) e) What is the interest rate exposure of Gringotts Bank? If all interest rates increase by 1 percent (Ar/(1+r) =0,01), what is the impact on the market value of the bank's equity? (5p)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the duration of Gringotts Banks fixed rate loan portfolio we use the formula Duration C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started