USE THE INFORMATION AND SOLVE ALL THE QUESTION FOR ME PLS!!!

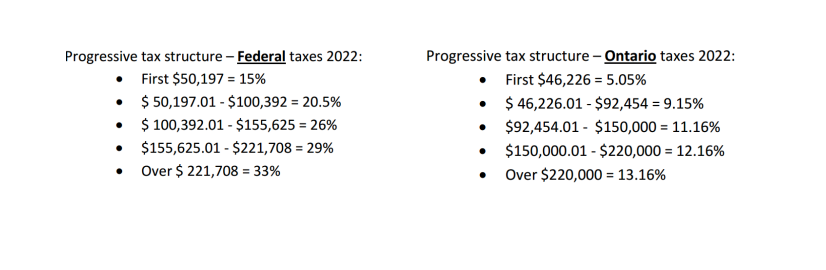

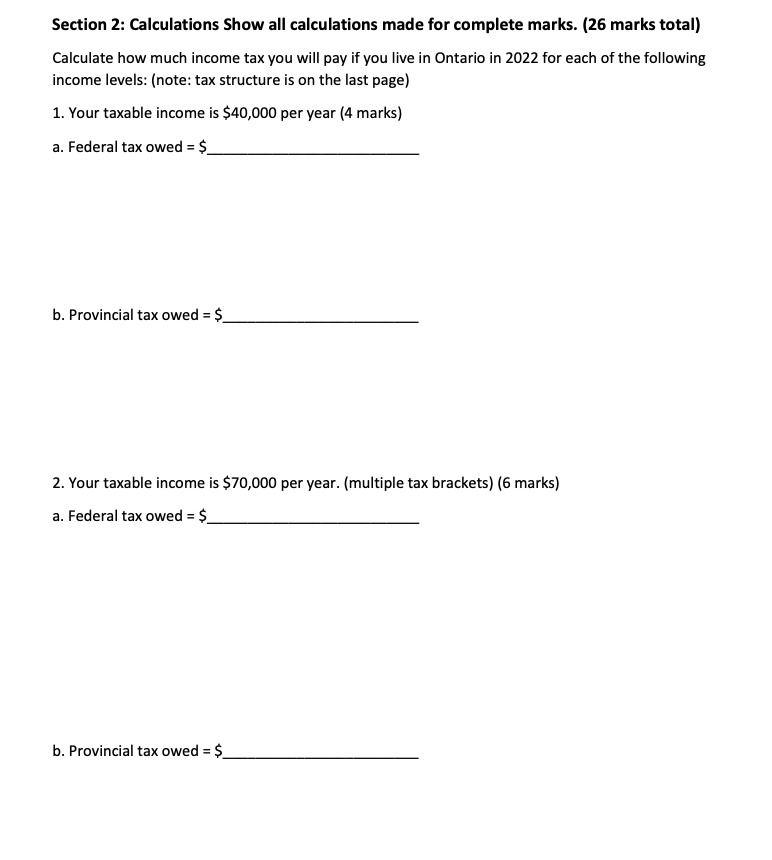

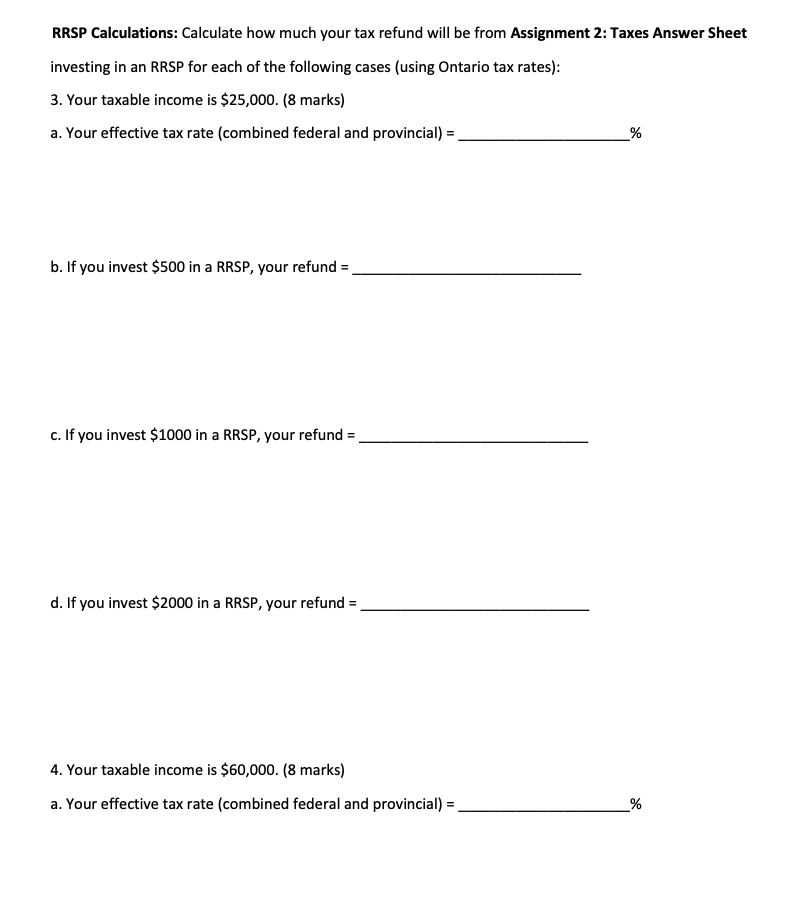

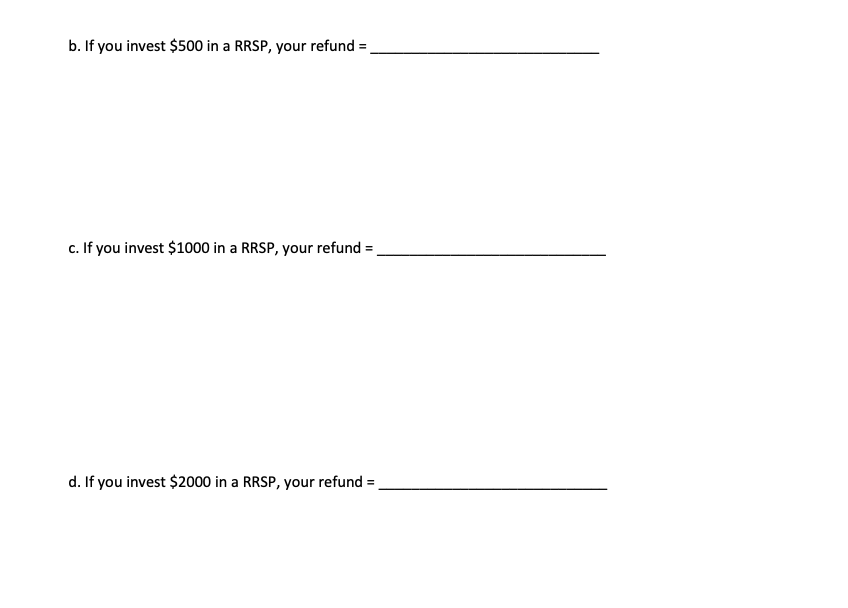

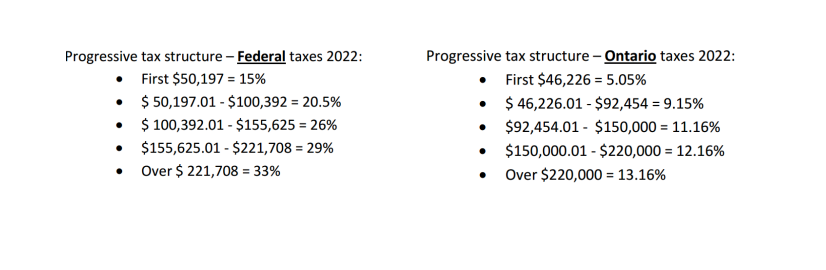

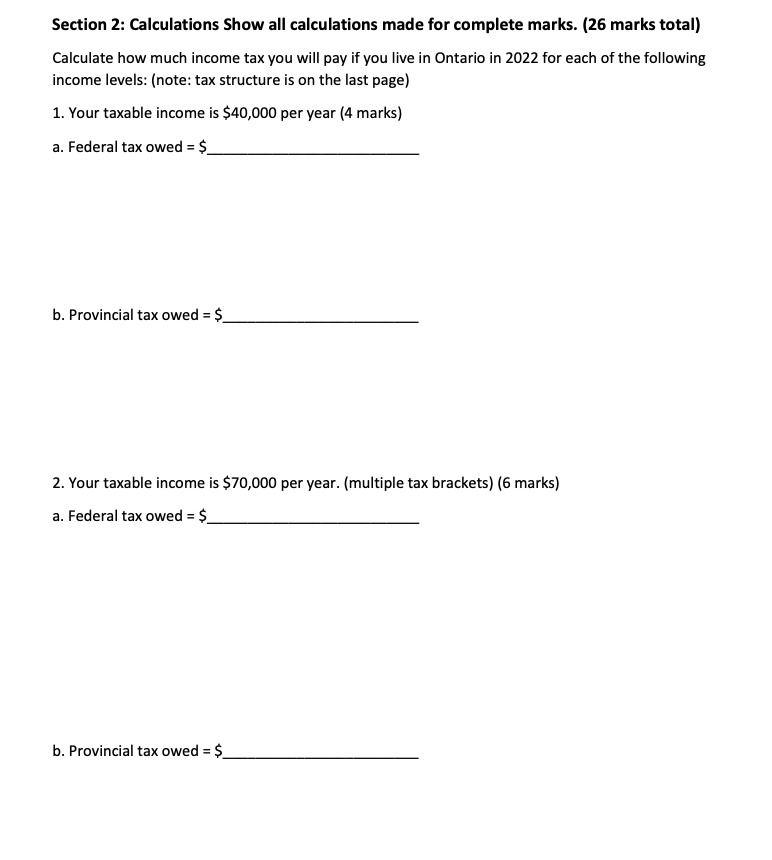

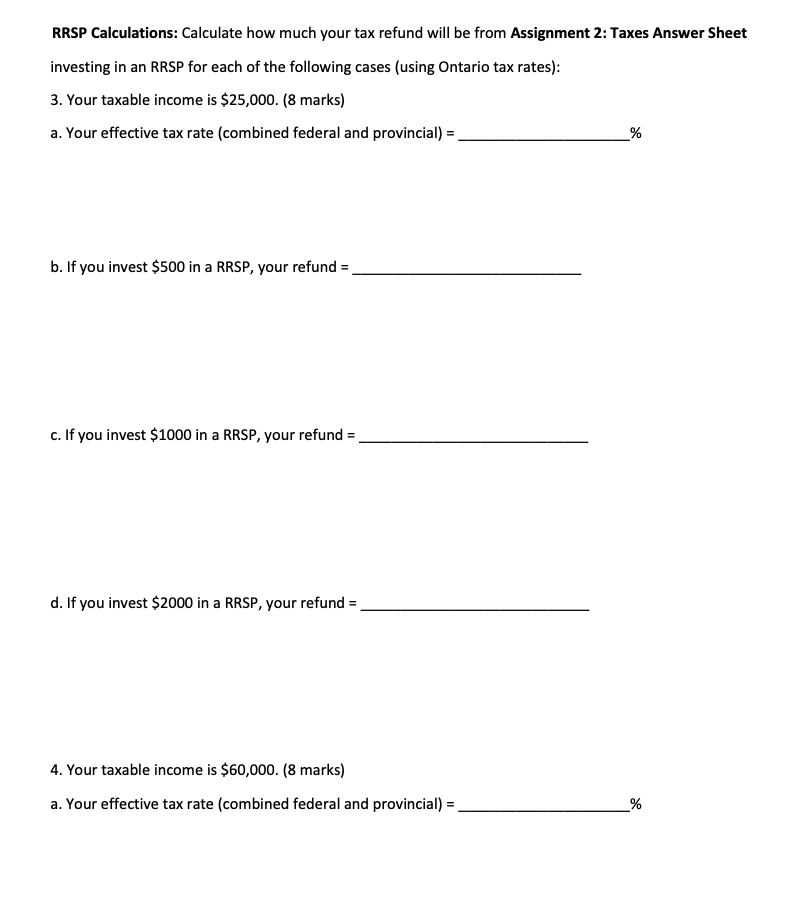

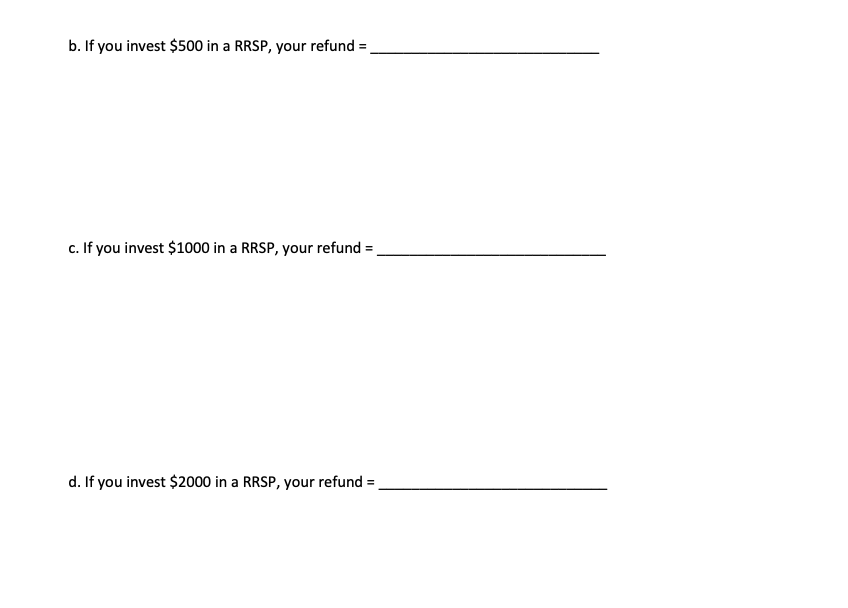

Progressive tax structure - Federal taxes 2022: Progressive tax structure Ontario taxes 2022: - First $50,197=15% - First $46,226=5.05% - $50,197.01$100,392=20.5% - $46,226.01$92,454=9.15% - $100,392.01$155,625=26% - $92,454.01$150,000=11.16% - $155,625.01$221,708=29% - $150,000.01$220,000=12.16% - Over $221,708=33% - Over $220,000=13.16% Section 2: Calculations Show all calculations made for complete marks. (26 marks total) Calculate how much income tax you will pay if you live in Ontario in 2022 for each of the following income levels: (note: tax structure is on the last page) 1. Your taxable income is $40,000 per year (4 marks) a. Federal tax owed =$ b. Provincial tax owed =$ 2. Your taxable income is $70,000 per year. (multiple tax brackets) (6 marks) a. Federal tax owed =$ b. Provincial tax owed =$ RRSP Calculations: Calculate how much your tax refund will be from Assignment 2: Taxes Answer Sheet investing in an RRSP for each of the following cases (using Ontario tax rates): 3. Your taxable income is $25,000. (8 marks) a. Your effective tax rate (combined federal and provincial) = % b. If you invest $500 in a RRSP, your refund = c. If you invest $1000 in a RRSP, your refund = d. If you invest $2000 in a RRSP, your refund = 4. Your taxable income is $60,000. ( 8 marks) a. Your effective tax rate (combined federal and provincial) = % b. If you invest $500 in a RRSP, your refund = c. If you invest $1000 in a RRSP, your refund = d. If you invest $2000 in a RRSP, your refund = Progressive tax structure - Federal taxes 2022: Progressive tax structure Ontario taxes 2022: - First $50,197=15% - First $46,226=5.05% - $50,197.01$100,392=20.5% - $46,226.01$92,454=9.15% - $100,392.01$155,625=26% - $92,454.01$150,000=11.16% - $155,625.01$221,708=29% - $150,000.01$220,000=12.16% - Over $221,708=33% - Over $220,000=13.16% Section 2: Calculations Show all calculations made for complete marks. (26 marks total) Calculate how much income tax you will pay if you live in Ontario in 2022 for each of the following income levels: (note: tax structure is on the last page) 1. Your taxable income is $40,000 per year (4 marks) a. Federal tax owed =$ b. Provincial tax owed =$ 2. Your taxable income is $70,000 per year. (multiple tax brackets) (6 marks) a. Federal tax owed =$ b. Provincial tax owed =$ RRSP Calculations: Calculate how much your tax refund will be from Assignment 2: Taxes Answer Sheet investing in an RRSP for each of the following cases (using Ontario tax rates): 3. Your taxable income is $25,000. (8 marks) a. Your effective tax rate (combined federal and provincial) = % b. If you invest $500 in a RRSP, your refund = c. If you invest $1000 in a RRSP, your refund = d. If you invest $2000 in a RRSP, your refund = 4. Your taxable income is $60,000. ( 8 marks) a. Your effective tax rate (combined federal and provincial) = % b. If you invest $500 in a RRSP, your refund = c. If you invest $1000 in a RRSP, your refund = d. If you invest $2000 in a RRSP, your refund =