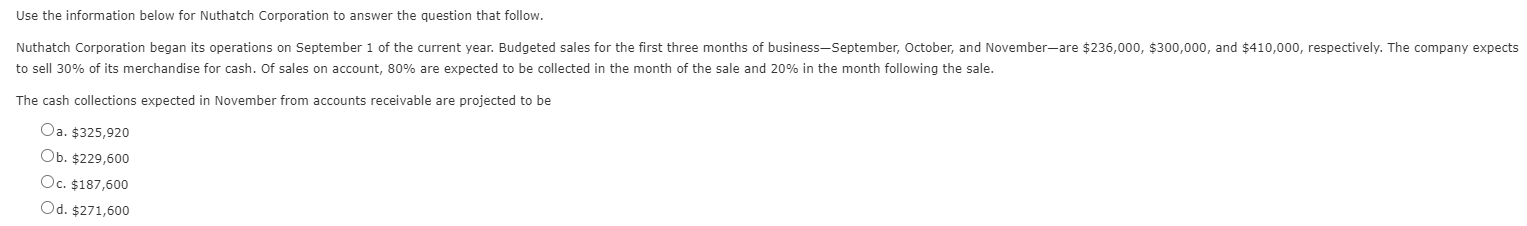

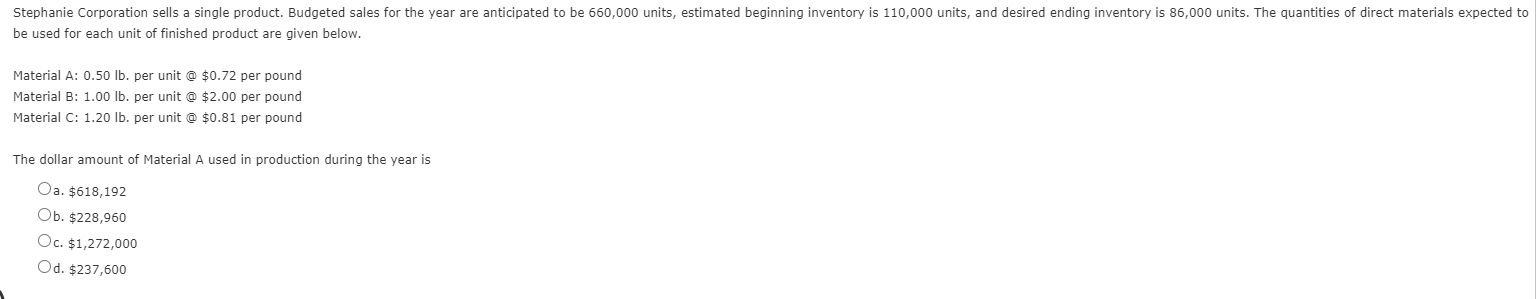

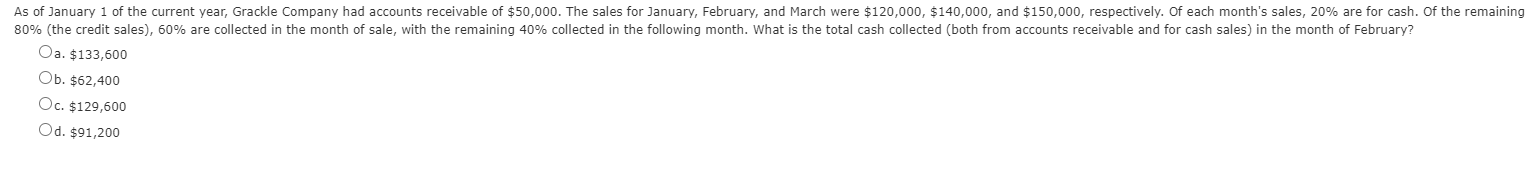

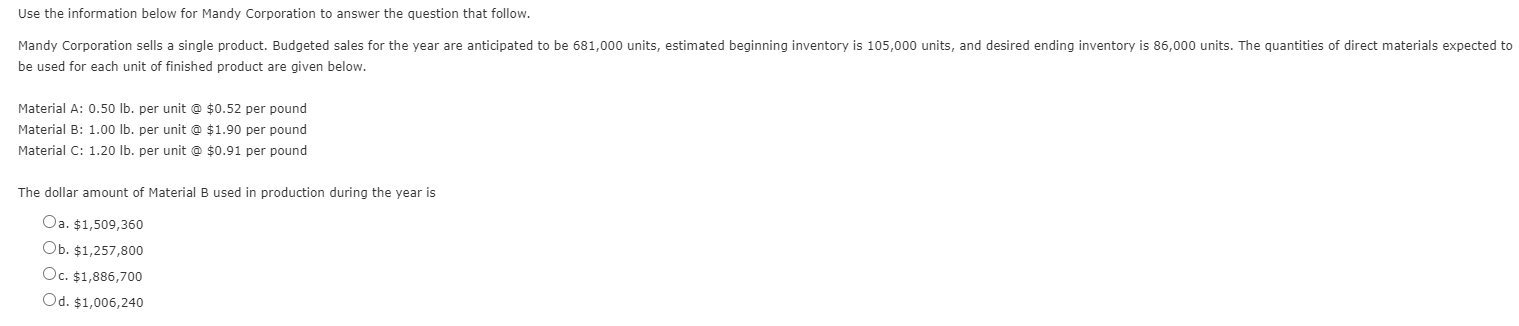

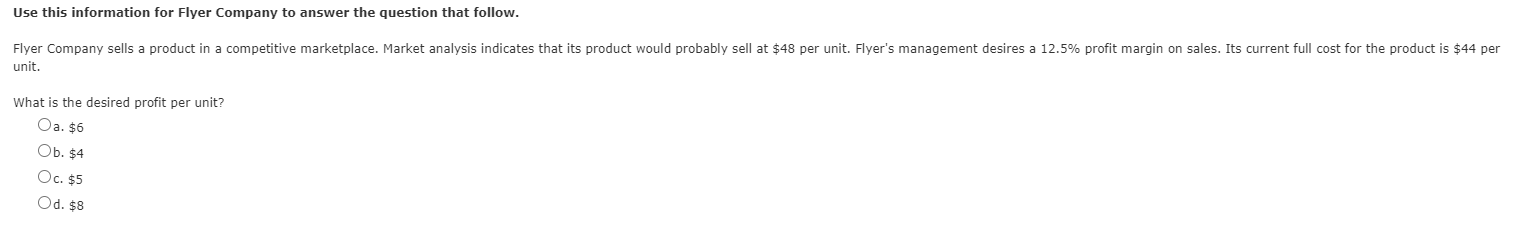

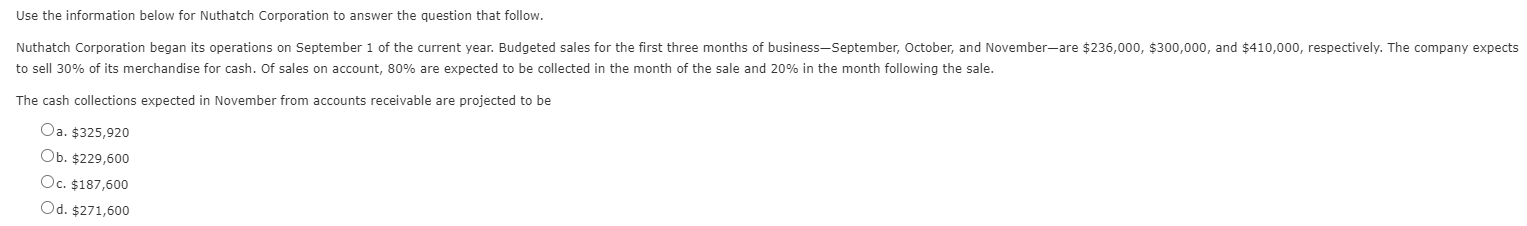

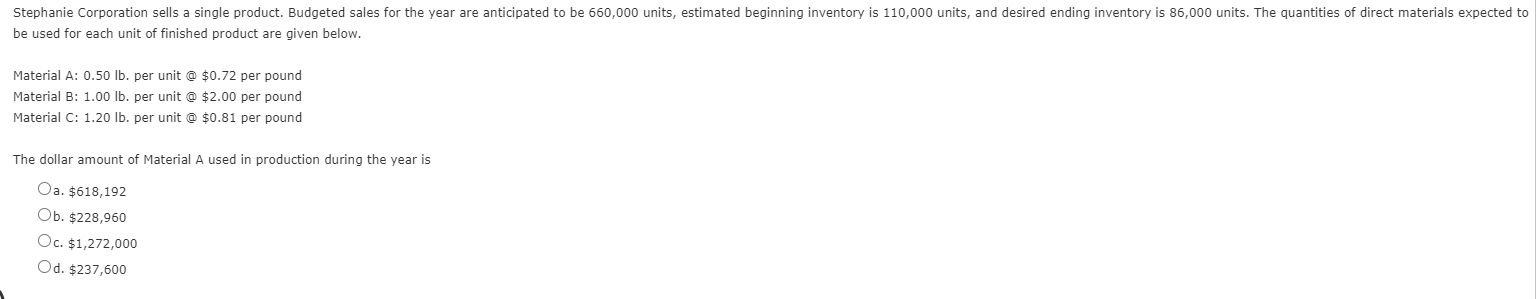

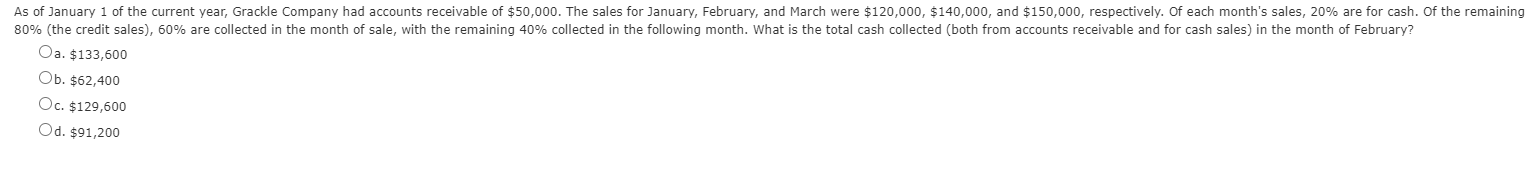

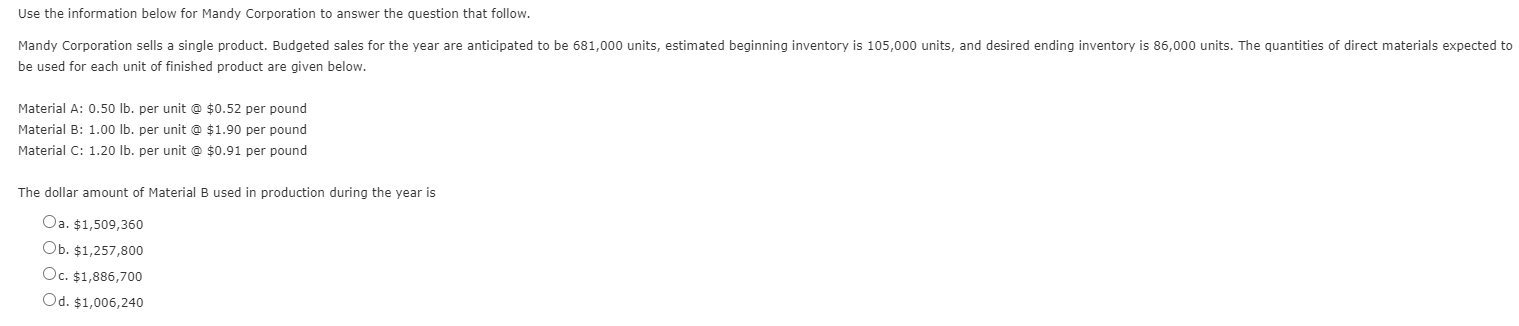

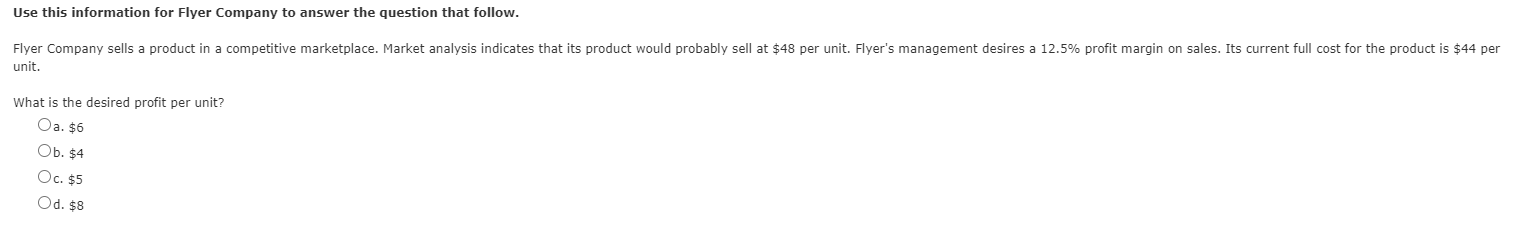

Use the information below for Nuthatch Corporation to answer the question that follow. Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business-September, October, and November-are $236,000, $300,000, and $410,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in November from accounts receivable are projected to be Oa. $325,920 Ob. $229,600 Oc. $187,600 Od. $271,600 Stephanie Corporation sells a single product. Budgeted sales for the year are anticipated to be 660,000 units, estimated beginning inventory is 110,000 units, and desired ending inventory is 86,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below. Material A: 0.50 lb. per unit @ $0.72 per pound Material B: 1.00 lb. per unit @ $2.00 per pound Material C: 1.20 lb. per unit @ $0.81 per pound The dollar amount of Material A used in production during the year is Oa. $618,192 Ob. $228,960 Oc. $1,272,000 Od. $237,600 As of January 1 of the current year, Grackle Company had accounts receivable of $50,000. The sales for January, February, and March were $120,000, $140,000, and $150,000, respectively. Of each month's sales, 20% are for cash. Of the remaining 80% (the credit sales), 60% are collected in the month of sale, with the remaining 40% collected in the following month. What is the total cash collected (both from accounts receivable and for cash sales) in the month of February? Oa. $133,600 Ob. $62,400 Oc. $129,600 Od. $91,200 Use the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 681,000 units, estimated beginning inventory is 105,000 units, and desired ending inventory is 86,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below. Material A: 0.50 lb. per unit @ $0.52 per pound Material B: 1.00 lb. per unit @ $1.90 per pound Material C: 1.20 lb. per unit @ $0.91 per pound The dollar amount of Material B used in production during the year is Oa. $1,509,360 Ob. $1,257,800 Oc. $1,886,700 Od. $1,006, 240 Use this information for Flyer Company to answer the question that follow. Flyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer's management desires a 12.5% profit margin on sales. Its current full cost for the product is $44 per unit. What is the desired profit per unit? Oa. $6 Ob. $4 Oc. $5 Od. $8