Answered step by step

Verified Expert Solution

Question

1 Approved Answer

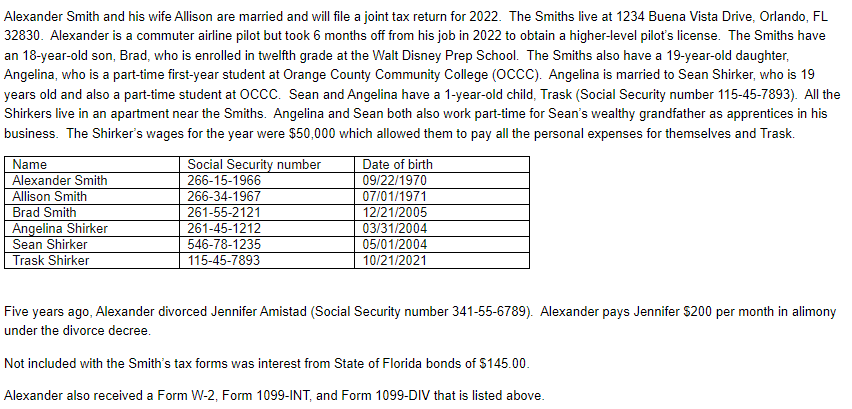

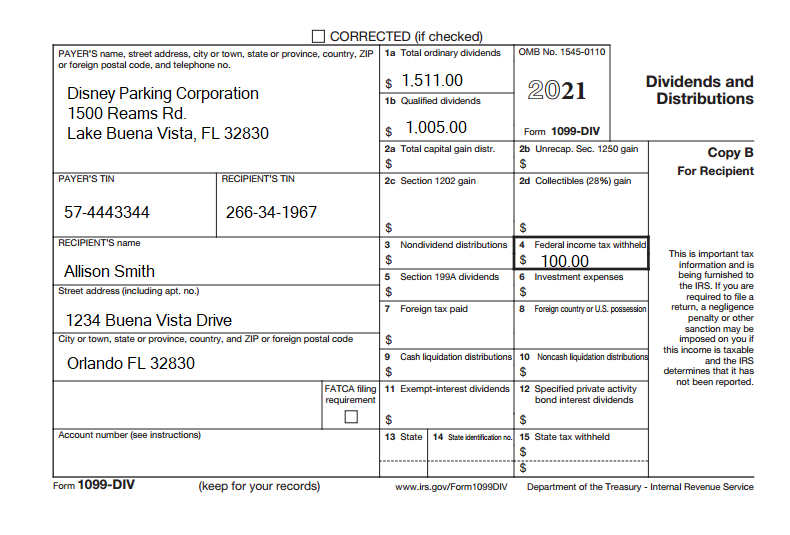

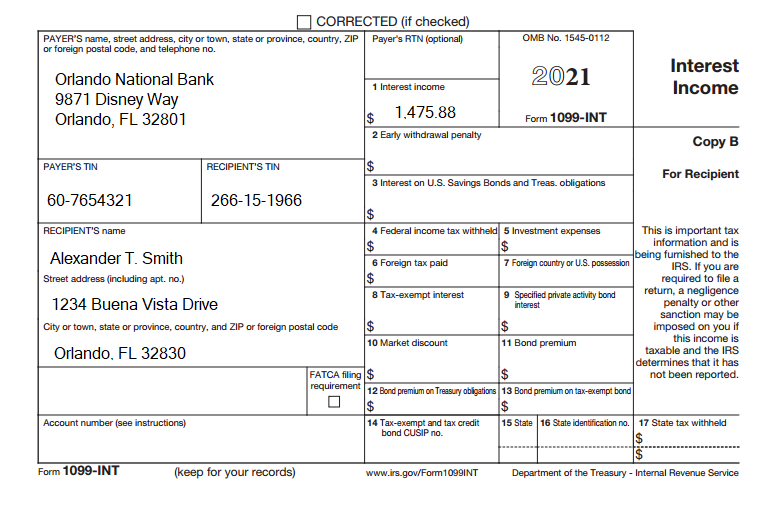

Use the information below from Form W-2, 1099-INT, 1099-DIV and the assignment below to complete the Schedule B form. Alexander Smith and his wife Allison

Use the information below from Form W-2, 1099-INT, 1099-DIV and the assignment below to complete the Schedule B form.

Alexander Smith and his wife Allison are married and will file a joint tax return for 2022. The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandfather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Five years ago, Alexander divorced Jennifer Amistad (Social Security number 341-55-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that is listed above. CORRECTED (if checked) Form 1099-DIV (keep for your records) www.irs.gov/Form10990IV Department of the Treasury - Internal Revenue Service CORRECTED (if checked) Form 1099-INT (keep for your records) www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue Service Y= Wage and Tax 2021 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Intemal Revenue Service. Alexander Smith and his wife Allison are married and will file a joint tax return for 2022. The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandfather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Five years ago, Alexander divorced Jennifer Amistad (Social Security number 341-55-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that is listed above. CORRECTED (if checked) Form 1099-DIV (keep for your records) www.irs.gov/Form10990IV Department of the Treasury - Internal Revenue Service CORRECTED (if checked) Form 1099-INT (keep for your records) www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue Service Y= Wage and Tax 2021 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Intemal Revenue Service

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started