Answered step by step

Verified Expert Solution

Question

1 Approved Answer

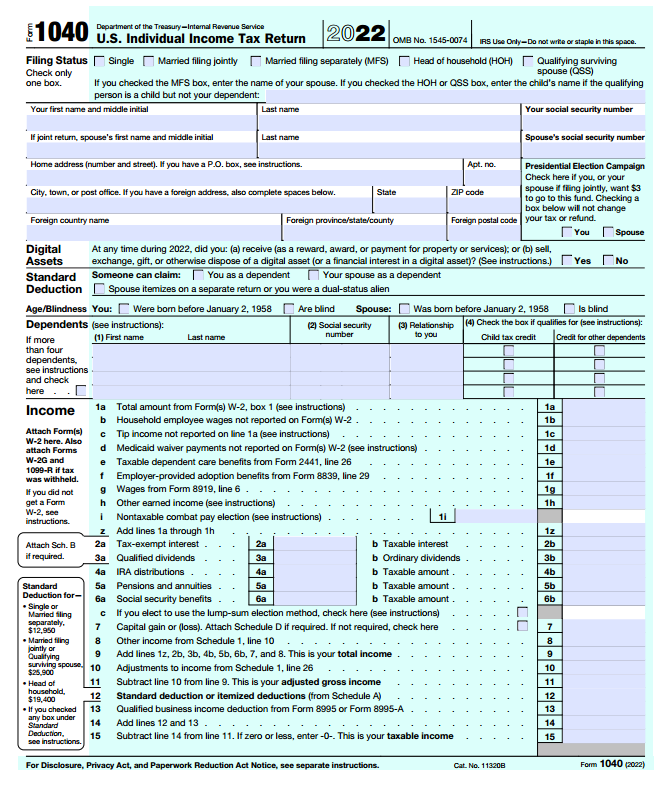

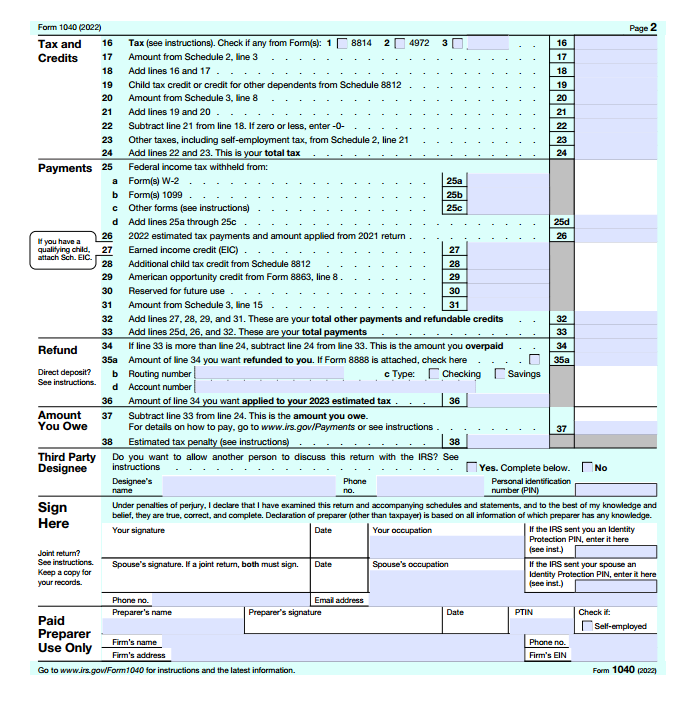

Use the information below from Form W-2, 1099-INT, 1099-DIV and the assignment below, complete the 1040 form: Alexander Smith and his wife Allison are married

Use the information below from Form W-2, 1099-INT, 1099-DIV and the assignment below, complete the 1040 form:

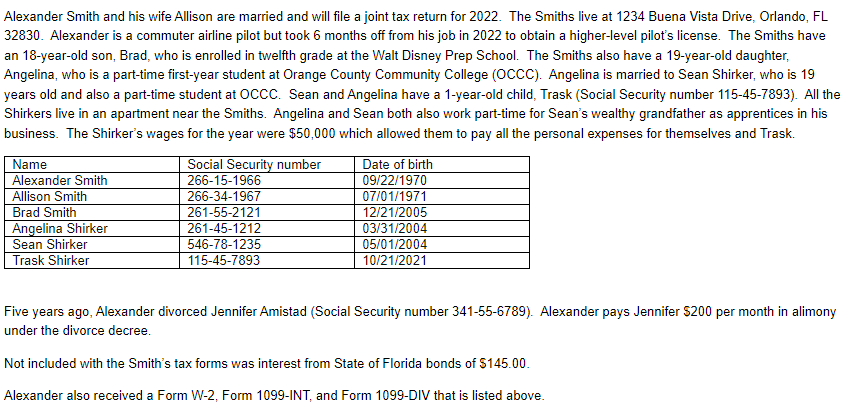

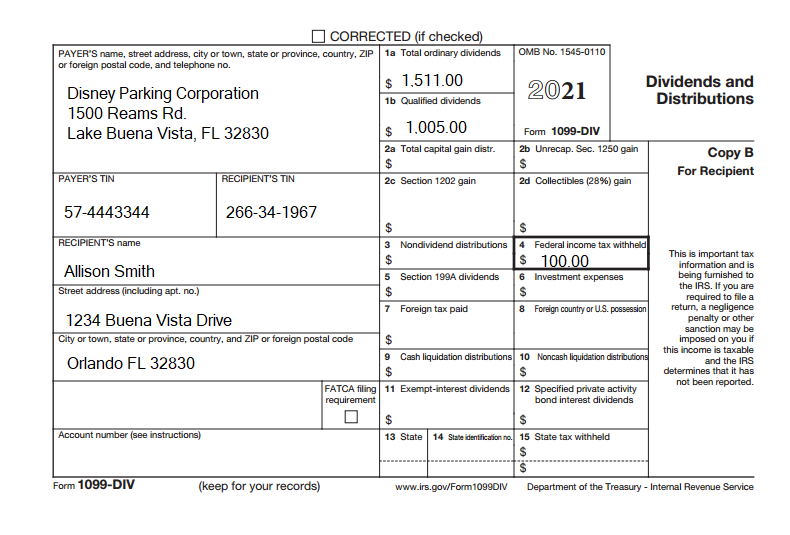

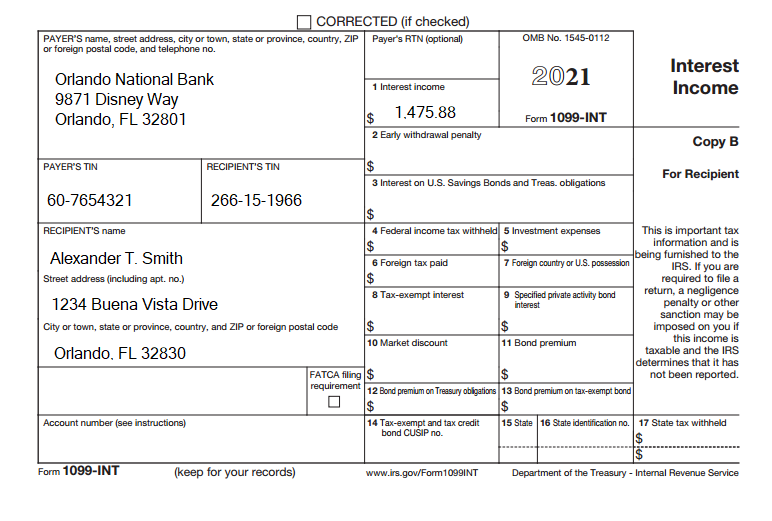

Alexander Smith and his wife Allison are married and will file a joint tax return for 2022. The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandfather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Five years ago, Alexander divorced Jennifer Amistad (Social Security number 341-55-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that is listed above. CORRECTED (if checked) Form 1099-DIV (keep for your records) www.irs.gov/Form10990IV Department of the Treasury - Internal Revenue Service CORRECTED (if checked) Form 1099-INT (keep for your records) www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue Service Y= Wage and Tax 2021 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Intemal Revenue Service. Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, AssetsStandardDeductionexchange,gift,orotherwisedisposeofadigitalasset(orafinancialintereSomeonecanclaim:YouasadependentYourspouseasaSpouseitemizesonaseparatereturnoryouwereadual-statusalien Age/Blindness You: Were bom before January 2, 1958 Are blind Spouse: Was bom before January 2, 1958 is blind Dependents (see instructions): (2) Social security (3) Pelationship (4) Check the bax if qualifies for (see instructions): If more (1) First name Last name than four dependents, see instructions and check here - . Income 1a Total amount from Form(s) W-2, box 1 (see instructions) . b Household employee wages not reported on Form(s) W-2 Attach Form(s) W-2 here. Also c Tip income not reported on line 1 a (see instructions) attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) W-2G and e Taxable dependent care benefits from Form 2441, line 26 1099-R if tax was withheld. I Employer-provided adoption benefits from Form 8839, line 29 If you did nat g Wages from Form 8919 , line 6. get a Form h Other earned income (see instructions) W-2,seeinstructions. I Nontaxable combat pay election (see instructions) . \begin{tabular}{|c|} \hline 1a \\ \hline 1b \\ \hline 1c \\ \hline 1d \\ \hline 1e \\ \hline 11f \\ \hline 1g \\ \hline 1h \\ \hline \\ \hline 1z \\ \hline 2b \\ \hline 3b \\ \hline 4b \\ \hline 5b \\ \hline 6b \\ \hline \\ \hline 7 \\ \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040(2022) Page 2 Sign Under penalties of perjury, I declare that I have examined this return and accomparying schedules and statements, and to the best of my knowledge and Here belief, they are true, oorrect, and complete. Declaration of preparer (ather than taxpayer) is based on all information of which preparer has any knowledge. Alexander Smith and his wife Allison are married and will file a joint tax return for 2022. The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830. Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level pilot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandfather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask. Five years ago, Alexander divorced Jennifer Amistad (Social Security number 341-55-6789). Alexander pays Jennifer $200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that is listed above. CORRECTED (if checked) Form 1099-DIV (keep for your records) www.irs.gov/Form10990IV Department of the Treasury - Internal Revenue Service CORRECTED (if checked) Form 1099-INT (keep for your records) www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue Service Y= Wage and Tax 2021 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Intemal Revenue Service. Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, AssetsStandardDeductionexchange,gift,orotherwisedisposeofadigitalasset(orafinancialintereSomeonecanclaim:YouasadependentYourspouseasaSpouseitemizesonaseparatereturnoryouwereadual-statusalien Age/Blindness You: Were bom before January 2, 1958 Are blind Spouse: Was bom before January 2, 1958 is blind Dependents (see instructions): (2) Social security (3) Pelationship (4) Check the bax if qualifies for (see instructions): If more (1) First name Last name than four dependents, see instructions and check here - . Income 1a Total amount from Form(s) W-2, box 1 (see instructions) . b Household employee wages not reported on Form(s) W-2 Attach Form(s) W-2 here. Also c Tip income not reported on line 1 a (see instructions) attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) W-2G and e Taxable dependent care benefits from Form 2441, line 26 1099-R if tax was withheld. I Employer-provided adoption benefits from Form 8839, line 29 If you did nat g Wages from Form 8919 , line 6. get a Form h Other earned income (see instructions) W-2,seeinstructions. I Nontaxable combat pay election (see instructions) . \begin{tabular}{|c|} \hline 1a \\ \hline 1b \\ \hline 1c \\ \hline 1d \\ \hline 1e \\ \hline 11f \\ \hline 1g \\ \hline 1h \\ \hline \\ \hline 1z \\ \hline 2b \\ \hline 3b \\ \hline 4b \\ \hline 5b \\ \hline 6b \\ \hline \\ \hline 7 \\ \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline \\ \hline \end{tabular} For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040(2022) Page 2 Sign Under penalties of perjury, I declare that I have examined this return and accomparying schedules and statements, and to the best of my knowledge and Here belief, they are true, oorrect, and complete. Declaration of preparer (ather than taxpayer) is based on all information of which preparer has any knowledge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started