Answered step by step

Verified Expert Solution

Question

1 Approved Answer

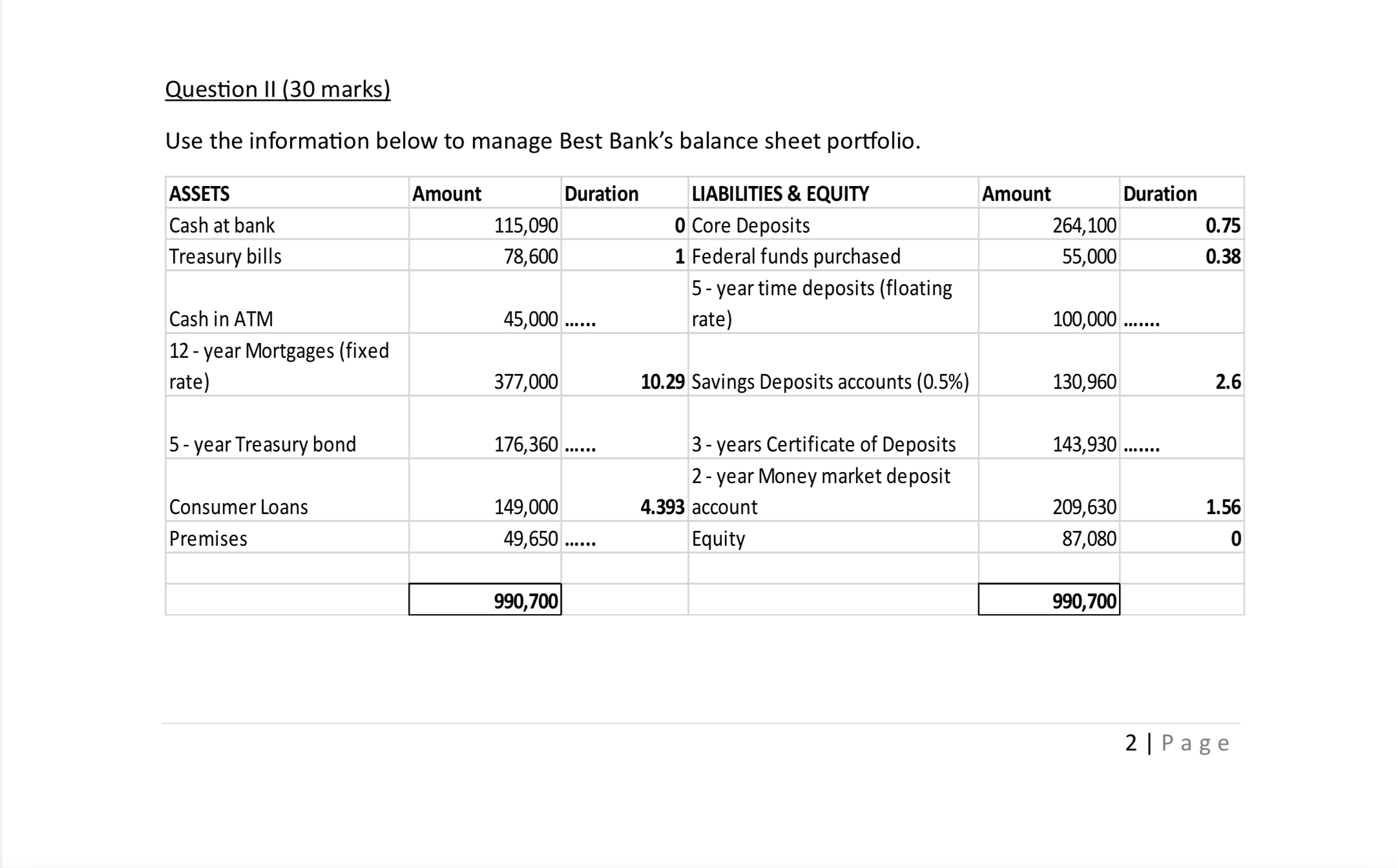

Use the information below to manage Best Bank's balance sheet portfolio. Additional Information: a. The bank plans on giving out some part of the building

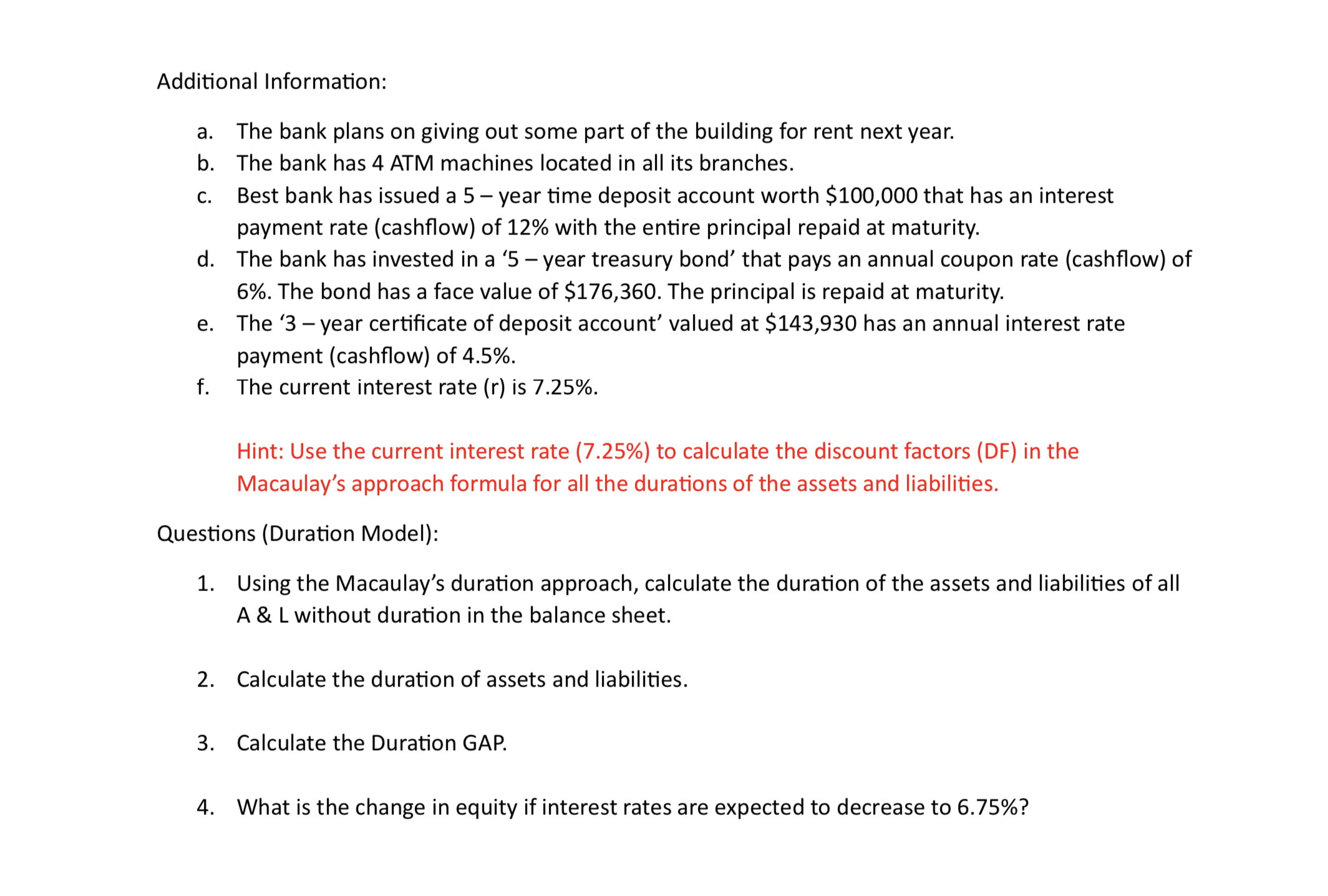

Use the information below to manage Best Bank's balance sheet portfolio. Additional Information: a. The bank plans on giving out some part of the building for rent next year. b. The bank has 4 ATM machines located in all its branches. c. Best bank has issued a 5 - year time deposit account worth $100,000 that has an interest payment rate (cashflow) of 12% with the entire principal repaid at maturity. d. The bank has invested in a ' 5 - year treasury bond' that pays an annual coupon rate (cashflow) of 6%. The bond has a face value of $176,360. The principal is repaid at maturity. e. The ' 3 - year certificate of deposit account' valued at $143,930 has an annual interest rate payment (cashflow) of 4.5%. f. The current interest rate (r) is 7.25%. Hint: Use the current interest rate (7.25\%) to calculate the discount factors (DF) in the Macaulay's approach formula for all the durations of the assets and liabilities. Questions (Duration Model): 1. Using the Macaulay's duration approach, calculate the duration of the assets and liabilities of all A \& L without duration in the balance sheet. 2. Calculate the duration of assets and liabilities. 3. Calculate the Duration GAP. 4. What is the change in equity if interest rates are expected to decrease to 6.75%

Use the information below to manage Best Bank's balance sheet portfolio. Additional Information: a. The bank plans on giving out some part of the building for rent next year. b. The bank has 4 ATM machines located in all its branches. c. Best bank has issued a 5 - year time deposit account worth $100,000 that has an interest payment rate (cashflow) of 12% with the entire principal repaid at maturity. d. The bank has invested in a ' 5 - year treasury bond' that pays an annual coupon rate (cashflow) of 6%. The bond has a face value of $176,360. The principal is repaid at maturity. e. The ' 3 - year certificate of deposit account' valued at $143,930 has an annual interest rate payment (cashflow) of 4.5%. f. The current interest rate (r) is 7.25%. Hint: Use the current interest rate (7.25\%) to calculate the discount factors (DF) in the Macaulay's approach formula for all the durations of the assets and liabilities. Questions (Duration Model): 1. Using the Macaulay's duration approach, calculate the duration of the assets and liabilities of all A \& L without duration in the balance sheet. 2. Calculate the duration of assets and liabilities. 3. Calculate the Duration GAP. 4. What is the change in equity if interest rates are expected to decrease to 6.75% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started