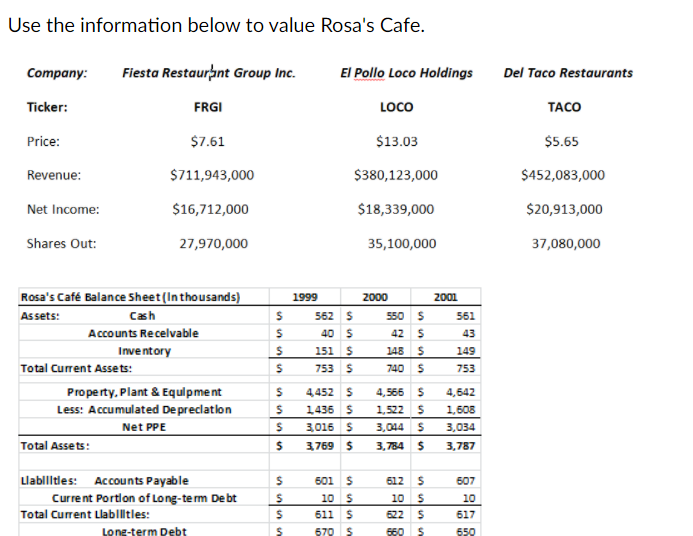

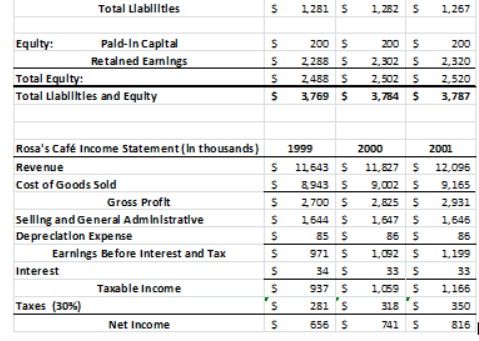

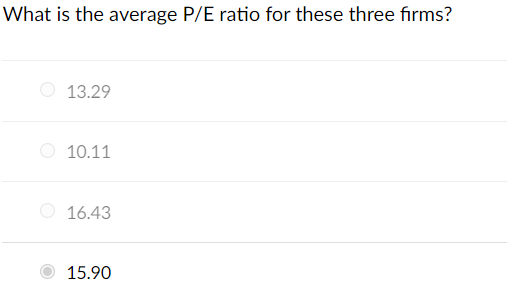

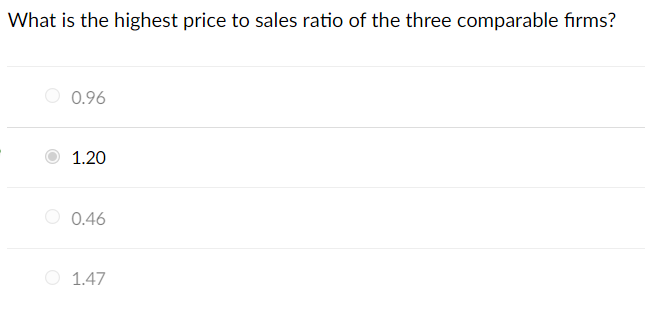

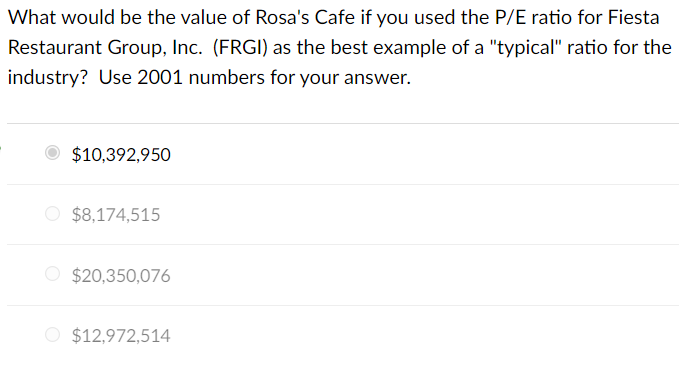

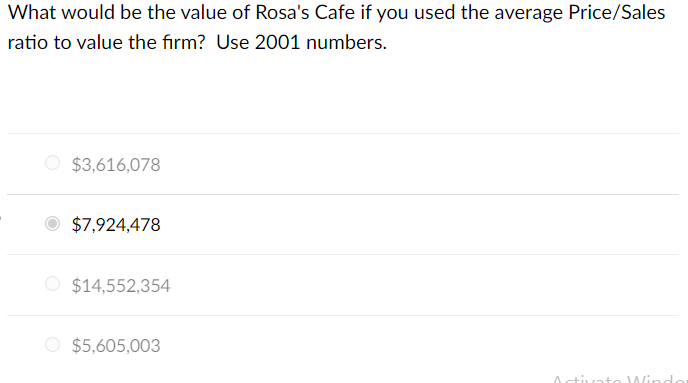

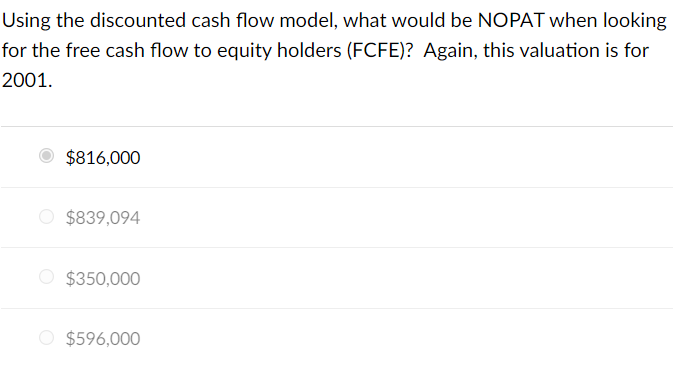

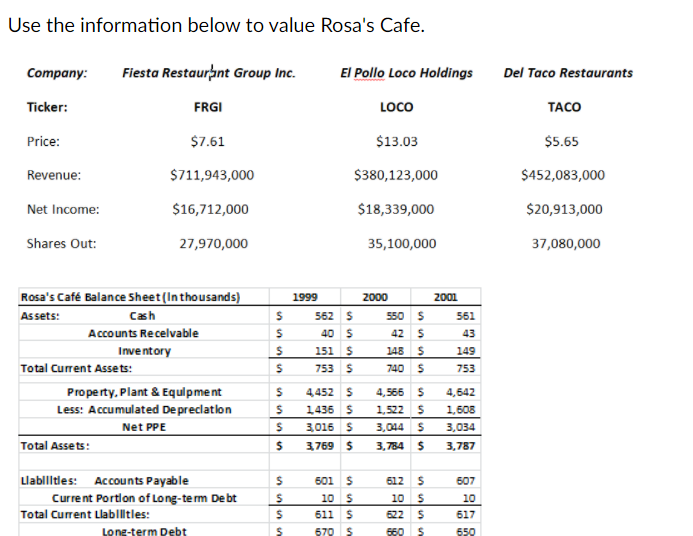

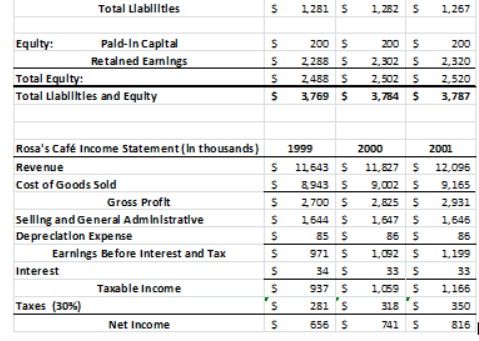

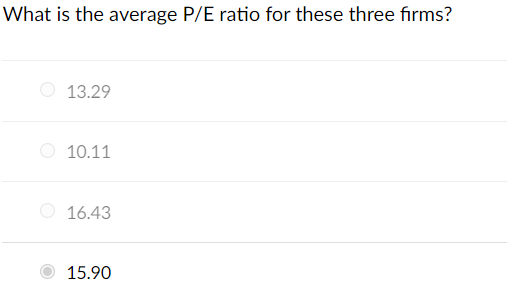

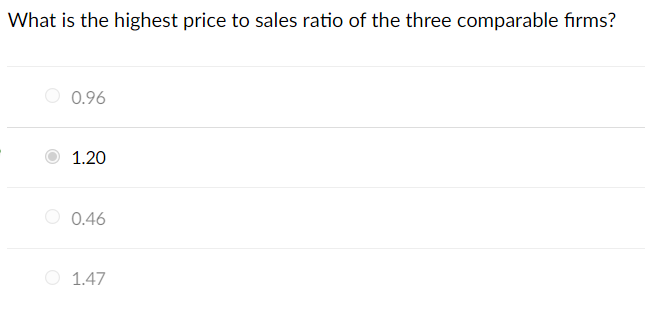

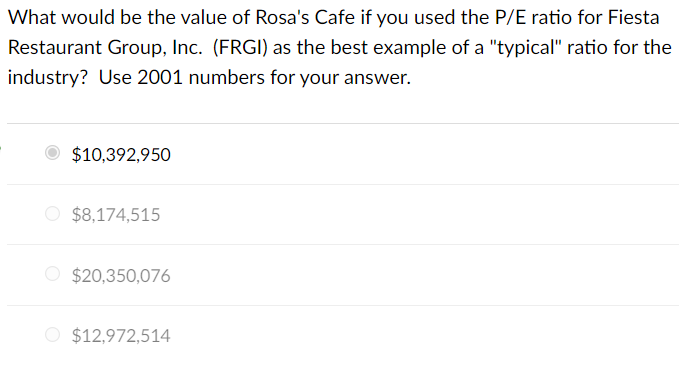

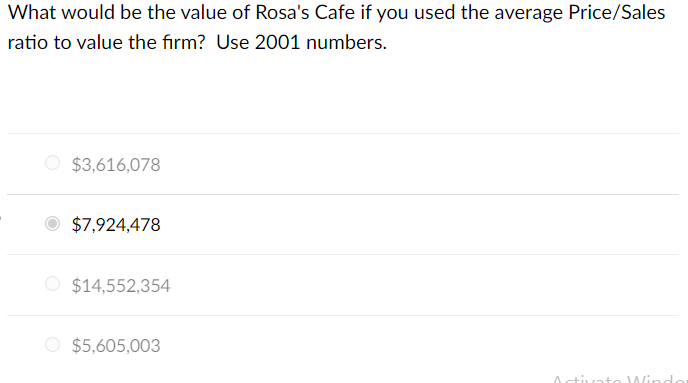

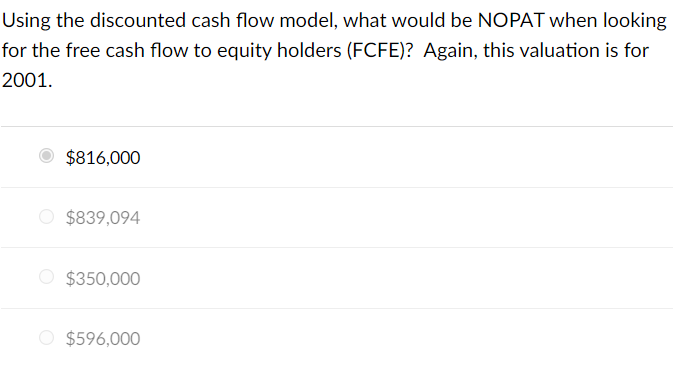

Use the information below to value Rosa's Cafe. Company: Fiesta Restaurant Group Inc. El Pollo Loco Holdings Del Taco Restaurants Ticker: FRGI LOCO TACO Price: $7.61 $13.03 $5.65 Revenue: $711,943,000 $380,123,000 $18,339,000 $452,083,000 $20,913,000 Net Income: $16,712,000 Shares Out: 27,970,000 35,100,000 37,080,000 2000 550 S 42 Rosa's Caf Balance Sheet(In thousands) Assets: Cash Accounts Receivable Inventory Total Current Assets: Property. Plant & Equipment Less: Accumulated Depreciation Net PPE Total Assets 1999 562 $ 40 $ 151 $ 753 S 2001 561 43 $ S 5 S 148 5 740 5 149 753 $ S S 44525 1.4365 3,016 S 4,566 5 1.522 5 3,044 $ 3,784 5 4,642 1,608 3,034 3,787 $ 3.769 $ 5 Llabilities: Accounts Payable Current Portion of Long-term Debt Total Current Llabilities: Long-term Debt lu 601 $ 10 S 611 S 570 S 612 S 10 622 560 ilu 507 10 617 650 S Total Llabilities $ 1.281 S 1,2825 1.267 $ s 200 S 2288 S Equity: Pald-In Capltal Retalned Earnings Total Equity Total Llabilities and Equlty ll 200 5 2,302 5 2,502 5 3,784 5 200 2,320 2,520 3,787 2.488 5 3.769 $ 5 Rosa's Caf Income Statement(In thousands) Revenue Cost of Goods Sold Gross Profit Selling and General Administrative Depreciation Expense Earnings Before Interest and Tax Interest Taxable income Taxes (30%) Net Income V V V V V 1999 $ 11,543 5 8.943 $ 5 S 2.700 5 1644 5 85 S S S 9715 34 S 5 937 S 2815 $ 655 S 2000 2001 11,827 5 12,096 9,002 $ 9,165 2,825 5 2.931 1,547 5 1,645 86 5 86 1.092 1,199 33 5 33 1.0595 1.166 3185 350 741 5 816 What is the average P/E ratio for these three firms? 13.29 O 10.11 16.43 15.90 What is the highest price to sales ratio of the three comparable firms? 0.96 1.20 0.46 1.47 What would be the value of Rosa's Cafe if you used the P/E ratio for Fiesta Restaurant Group, Inc. (FRGI) as the best example of a "typical" ratio for the industry? Use 2001 numbers for your answer. $10,392,950 $8,174,515 $20,350,076 $12,972,514 What would be the value of Rosa's Cafe if you used the average Price/Sales ratio to value the firm? Use 2001 numbers. $3,616,078 $7,924,478 $14,552,354 $5,605,003 Using the discounted cash flow model, what would be NOPAT when looking for the free cash flow to equity holders (FCFE)? Again, this valuation is for 2001. $816,000 $839,094 $350,000 $596,000