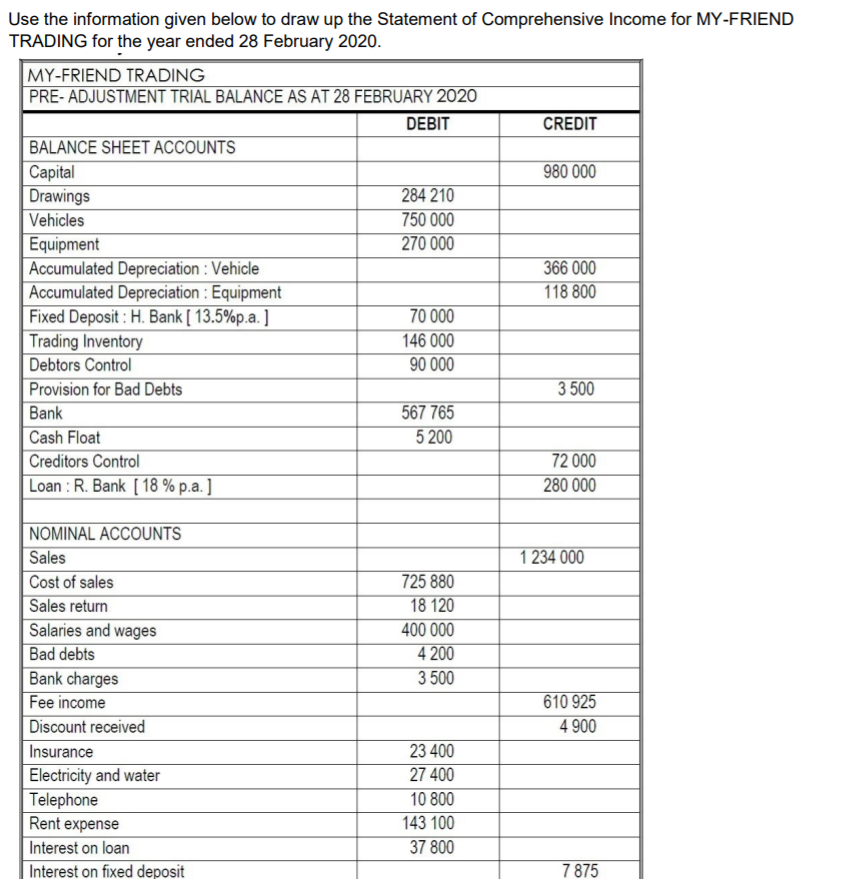

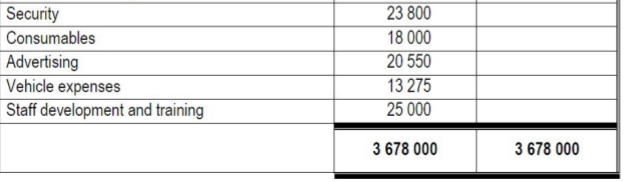

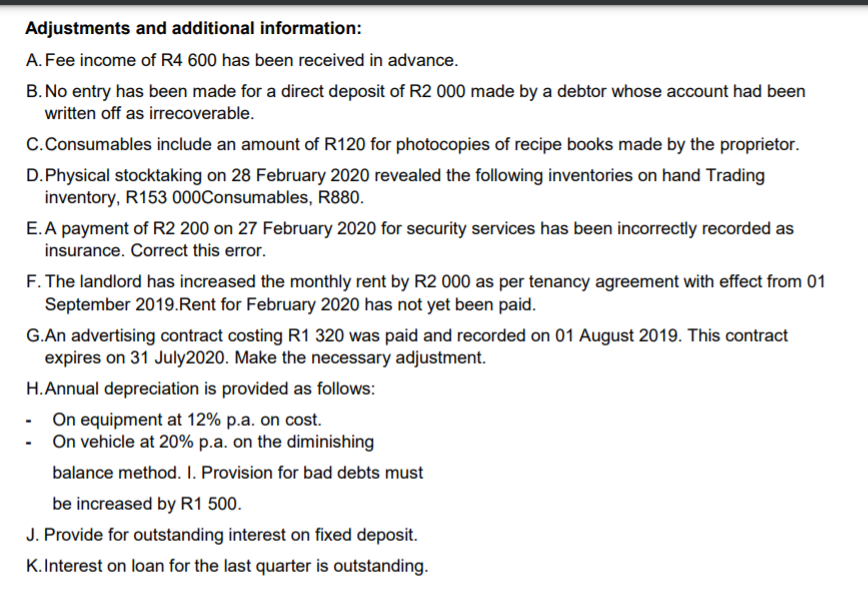

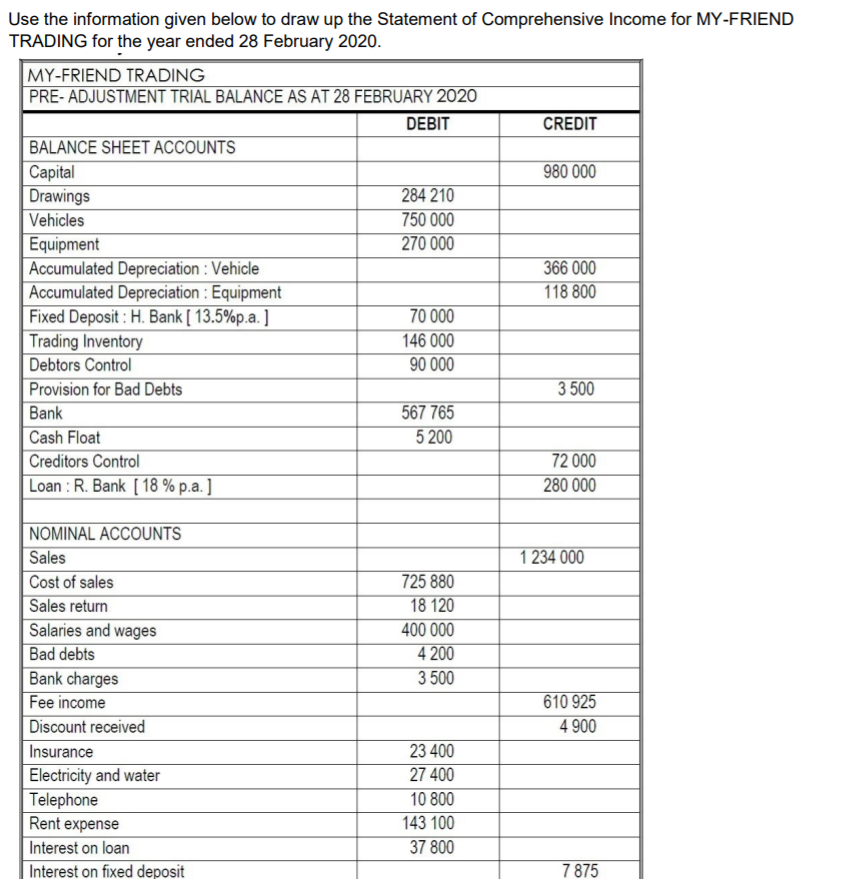

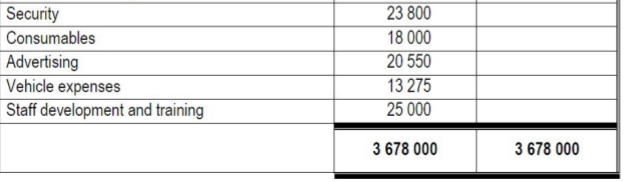

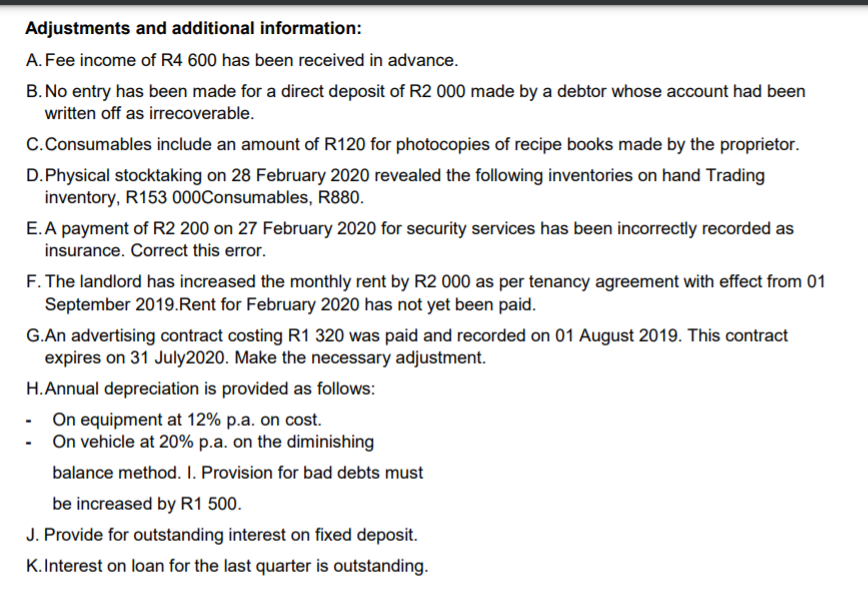

Use the information given below to draw up the Statement of Comprehensive Income for MY-FRIEND TRADING for the year ended 28 February 2020. MY-FRIEND TRADING PRE- ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2020 DEBIT CREDIT BALANCE SHEET ACCOUNTS Capital 980 000 Drawings 284 210 Vehicles 750 000 Equipment 270 000 Accumulated Depreciation : Vehicle 366 000 Accumulated Depreciation : Equipment 118 800 Fixed Deposit : H. Bank [ 13.5%p.a.] 70 000 Trading Inventory 146 000 Debtors Control 90 000 Provision for Bad Debts 3 500 Bank 567 765 Cash Float 5 200 Creditors Control 72 000 Loan: R. Bank [ 18 % p.a. ] 280 000 1 234 000 725 880 18 120 400 000 4 200 3500 NOMINAL ACCOUNTS Sales Cost of sales Sales return Salaries and wages Bad debts Bank charges Fee income Discount received Insurance Electricity and water Telephone Rent expense Interest on loan Interest on fixed deposit 610 925 4900 23 400 27 400 10 800 143 100 37 800 7 875 Security Consumables Advertising Vehicle expenses Staff development and training 23 800 18 000 20 550 13 275 25 000 3 678 000 3 678 000 Adjustments and additional information: A. Fee income of R4 600 has been received in advance. B. No entry has been made for a direct deposit of R2 000 made by a debtor whose account had been written off as irrecoverable. C. Consumables include an amount of R120 for photocopies of recipe books made by the proprietor. D.Physical stocktaking on 28 February 2020 revealed the following inventories on hand Trading inventory, R153 000Consumables, R880. E. A payment of R2 200 on 27 February 2020 for security services has been incorrectly recorded as insurance. Correct this error. F. The landlord has increased the monthly rent by R2 000 as per tenancy agreement with effect from 01 September 2019.Rent for February 2020 has not yet been paid. G.An advertising contract costing R1 320 was paid and recorded on 01 August 2019. This contract expires on 31 July 2020. Make the necessary adjustment. H.Annual depreciation is provided as follows: On equipment at 12% p.a. on cost. On vehicle at 20% p.a. on the diminishing balance method. I. Provision for bad debts must be increased by R1 500. J. Provide for outstanding interest on fixed deposit. K. Interest on loan for the last quarter is outstanding