Answered step by step

Verified Expert Solution

Question

1 Approved Answer

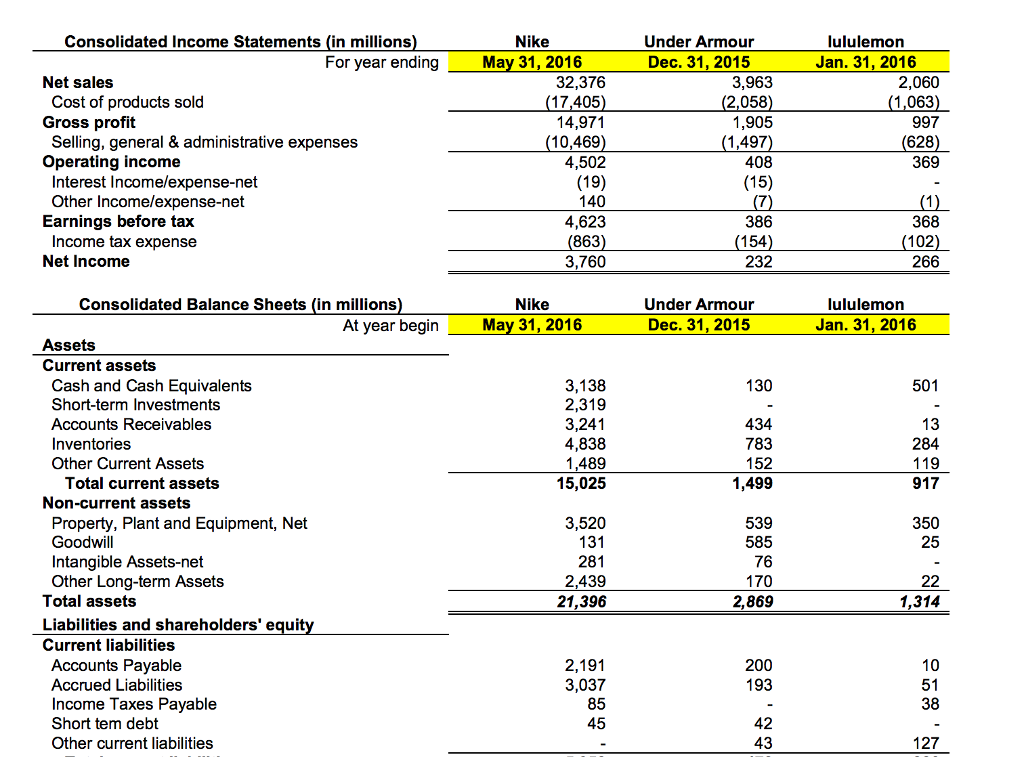

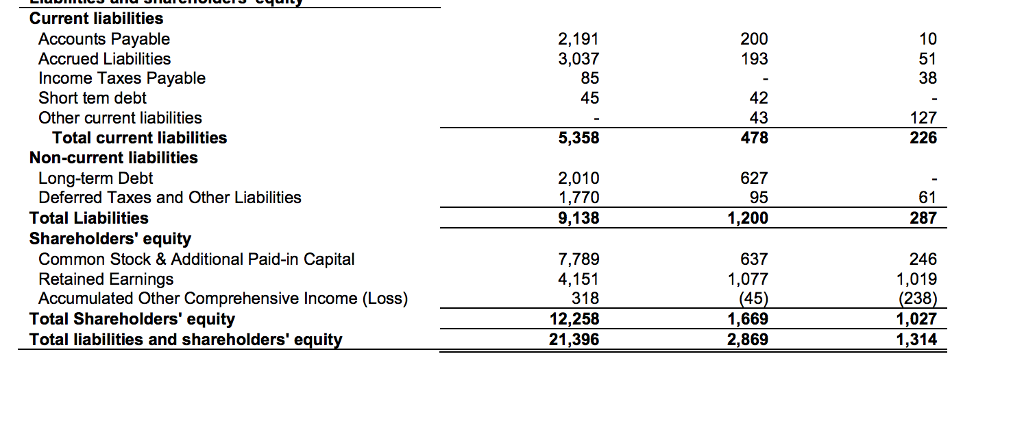

Use the information in next page to calculate Under Armors Gross Margin, Operating Margin, Profit Margin, Asset Turnover, Inventory Turnover, Account Receivable Turnover, Days in

Use the information in next page to calculate Under Armors Gross Margin, Operating Margin, Profit Margin, Asset Turnover, Inventory Turnover, Account Receivable Turnover, Days in Inventory, Days in Receivables, Days in Payables, Cash Operating Cycle, ROA, ROE and Financial Leverage. Use 200-400 words to give an analysis on UA and NIKEs business model/strategies/performance, financial health and competitive positions, based on the values of ratios (We calculated the ratios of NIKE in class)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started