Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information in the case below to perform a Porter's Five Forces analysis on both P.F. Changs dine-in and To Go. Do the analyzes

Use the information in the case below to perform a Porter's Five Forces analysis on both P.F. Changs dine-in and To Go. Do the analyzes separately (one 5 forces analysis for dine-in and another 5 forces analysis on To Go). Based upon the analysis, what decision should Adamolekun make about how to invest (first paragraph)?

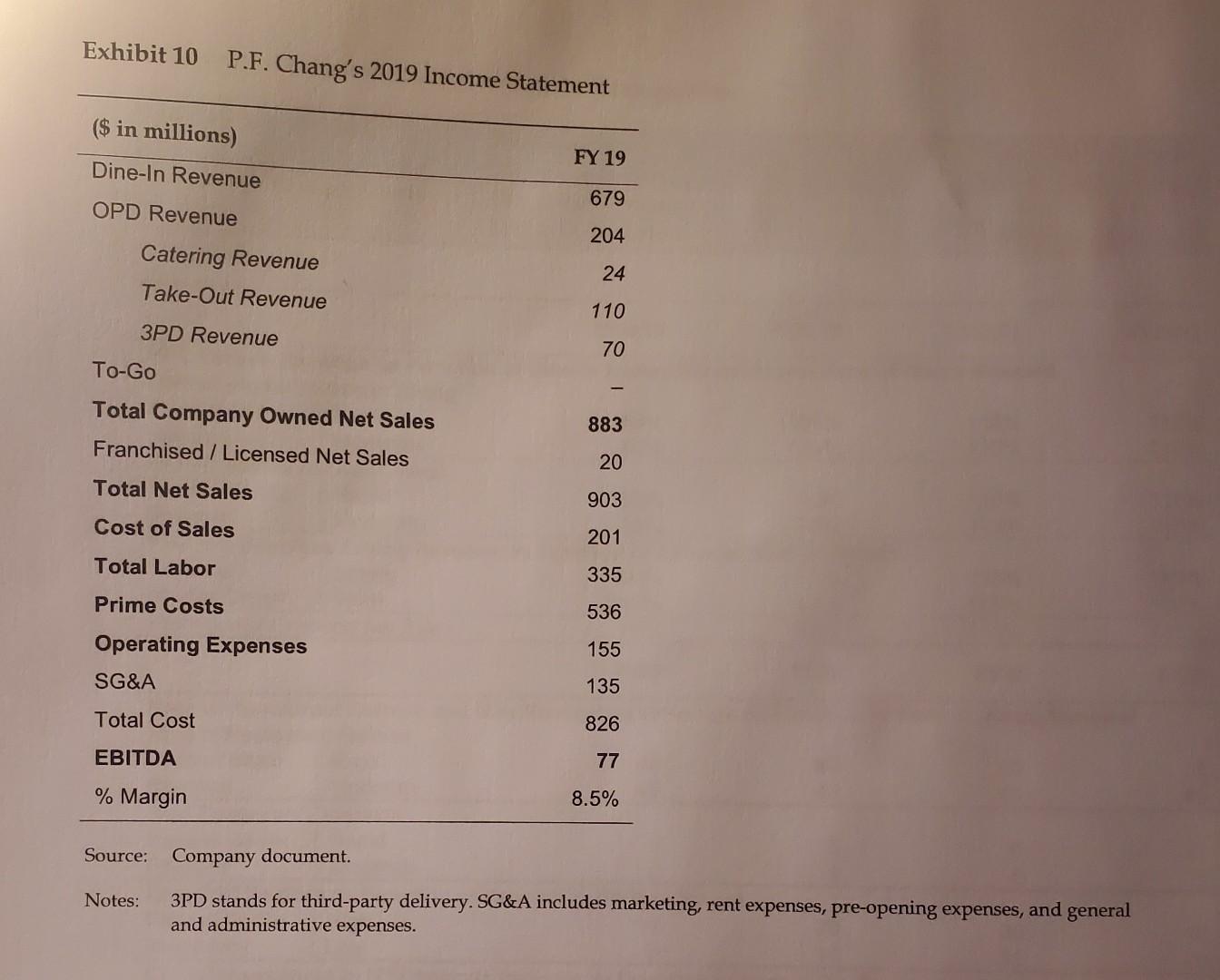

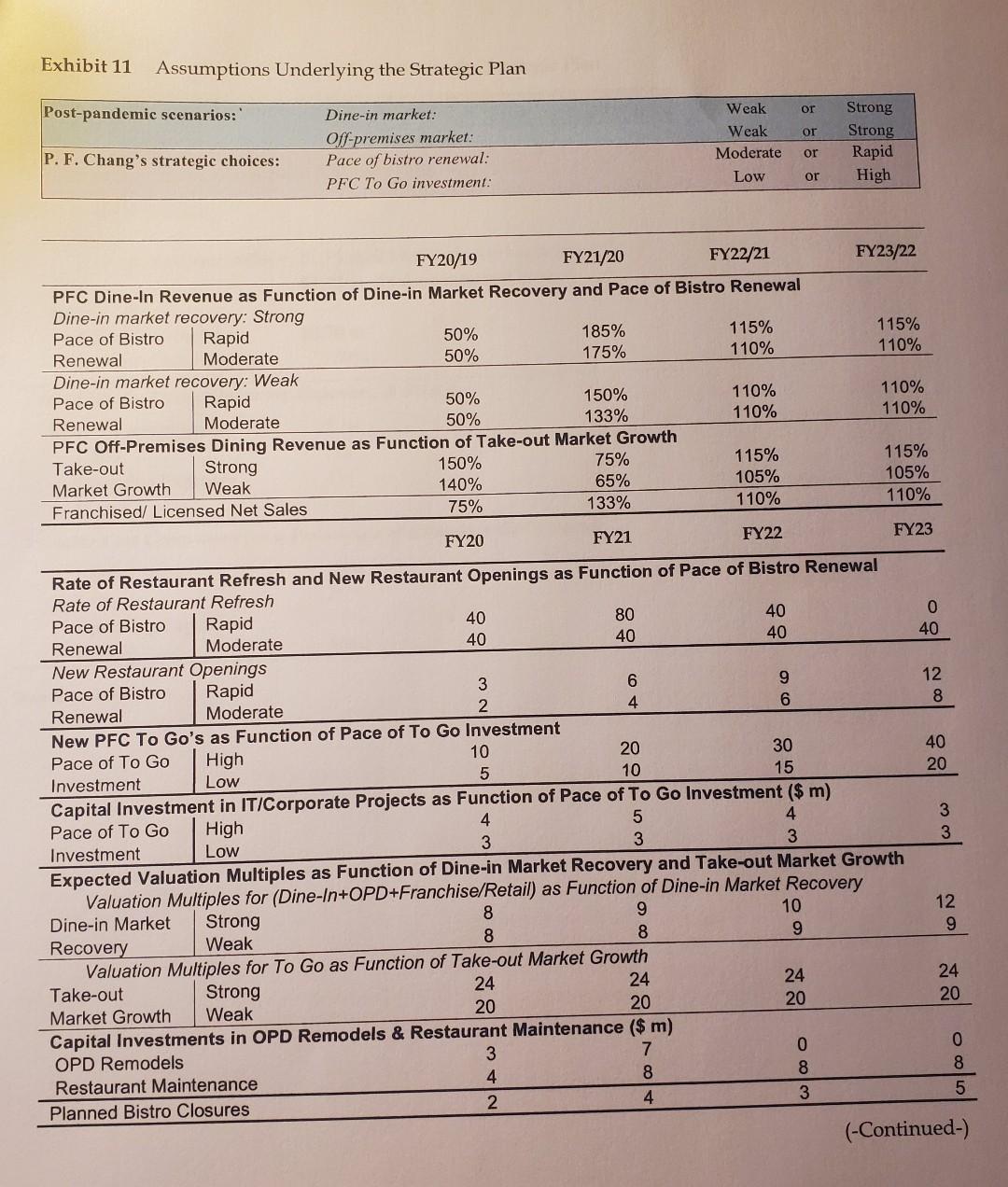

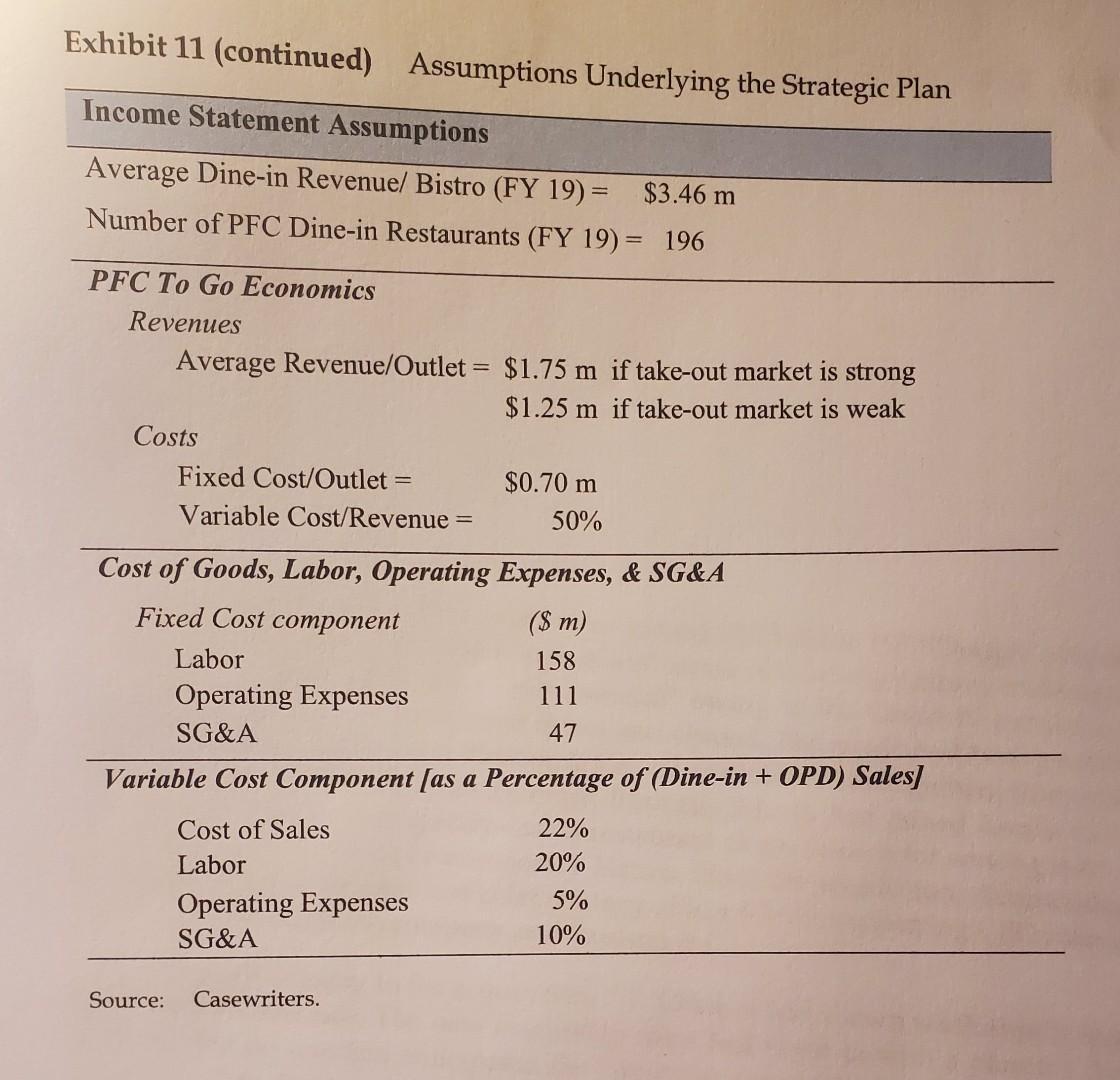

Determining P.F. Chang's' Investment Trajectory Adamolekun could invest aggressively in both dine-in and To Go, or he could take a bet and invest aggressively in one business and moderately in the other, or he could hedge his bets given the economic uncertainty and pursue a moderate level of investment in both businesses. The dine-in and To Go businesses were competing for managerial attention and financial resources, but they were also complementary. Davila explained: "We only have 200 restaurants in the U.S. The To Go stores will increase our visibility and create a halo effect on the dine-in bistros. Reciprocally, if people have an awesome experience at our bistros, they will order more take-out. If our dine-in business is deteriorating, then takeout will suffer because people won't respect our food." The balance of attention between To Go and bistro dining would impact organizational priorities. Bistros would require wok-trained gourmet chefs and hospitable wait staff trained and eager to perform 'theater at the table' with interactive entrees and drinks, whereas To Go locations needed technology-savvy staff who prioritized speed of order fulfilment and customer convenience. The promotional approaches would also be different for bistros and To Go stores. "Improving the dine-in experience would be the easier choice organizationally," Adamolekun reflected, because it is within the wheelhouse of restaurant operations. Refurbishing the bistros would mostly require targeted remodels, some culinary development, and additional training in hospitality. But bistros are our core business, and our staff understands the dine-in business." Expanding the To Go business would be more of an organizational challenge. "Even though we are building To Go within the P.F. Chang's umbrella and the same people will be responsible for both the bistros and the To Go stores, it is a new concept for our staff," Adamolekun reasoned. "Our operators and staff may initially treat To Go as a non-core business. Expanding the To Go business will require more hands-on management as we refine the new operating model." Pursuing rapid bistro refurbishment and aggressive To Go expansion concurrently was feasible but risky. The firm, already highly leveraged at the time of the acquisition, had taken on additional debt during the pandemic. "Our balance sheet capacity is limited at present," Adamolekun reasoned. "Investing aggressively across both businesses could lead us into a difficult financial position if the consumer environment does not improve over the next twelve months as per our expectation. Additionally, our team is already firefighting the challenges wrought by the pandemic. They will be stretched if we start ramping up both businesses simultaneously." Looking Ahead At the time of the acquisition, the incoming management team had planned to get P.F. Chang's on a path to a successful monetization event in a few years. The pandemic had pushed the horizon out somewhat, but Adamolekun knew that an important measure of the success of his strategy would be the enterprise value that P.F. Chang's would command in a few years. One approach to factoring in the uncertainties while developing his three-year plan would be to gauge how various strategic choices might play out in different scenarios. Adamolekun used P.F. Chang's 2019 income statement as a baseline from which to model the potential consequences of various strategic choices in different circumstances (see Exhibit 10). He was conscious that the assumptions buttressing the plan he was developing could be contested and reasonable people could come to different conclusions. Yet, he felt it was important to specify the assumptions and go through how the various options might fare in different circumstances so as to arrive at the most robust approach. (Exhibit 11 lists the assumptions underlying the strategic planning exercise.) The future of P.F. Chang's depended on the strategic plan Adamolekun and the board would eventually choose to follow. Exhibit 10 P.F. Chang's 2019 Income Statement ($ in millions) FY 19 Dine-In Revenue 679 OPD Revenue 204 Catering Revenue 24 Take-Out Revenue 110 3PD Revenue 70 To-Go Total Company Owned Net Sales Franchised / Licensed Net Sales 883 20 Total Net Sales 903 Cost of Sales 201 Total Labor 335 Prime Costs 536 155 Operating Expenses SG&A 135 Total Cost 826 EBITDA 77 % Margin 8.5% Source: Company document. Notes: 3PD stands for third-party delivery. SG&A includes marketing, rent expenses, pre-opening expenses, and general and administrative expenses. Exhibit 11 Assumptions Underlying the Strategic Plan Post-pandemic scenarios: or or Dine-in market: Off-premises market: Pace of bistro renewal: PFC To Go investment: Weak Weak Moderate Low Strong Strong Rapid High or P. F. Chang's strategic choices: or FY23/22 115% 110% FY20/19 FY21/20 FY22/21 PFC Dine-In Revenue as Function of Dine-in Market Recovery and Pace of Bistro Renewal Dine-in market recovery: Strong Pace of Bistro Rapid 50% 185% 115% Renewal Moderate 50% 175% 110% Dine-in market recovery: Weak Pace of Bistro Rapid 50% 150% 110% Renewal Moderate 50% 133% 110% PFC Off-Premises Dining Revenue as Function of Take-out Market Growth Take-out Strong 150% 75% 115% Market Growth Weak 140% 65% 105% Franchised/ Licensed Net Sales 75% 133% 110% 110% 110% 115% 105% 110% FY20 FY23 FY21 FY22 32mo5 woo Rate of Restaurant Refresh and New Restaurant Openings as Function of Pace of Bistro Renewal Rate of Restaurant Refresh Rapid Pace of Bistro 40 80 40 0 Renewal Moderate 40 40 40 40 New Restaurant Openings 6 12 Pace of Bistro Rapid 9 4 8 Renewal Moderate 6 New PFC To Go's as Function of Pace of To Go Investment 10 20 High 30 40 Pace of To Go Low 10 15 Investment 20 Capital Investment in IT/Corporate Projects as Function of Pace of To Go Investment ($ m) 4 4 3 Pace of To Go High 3 3 3 Low Investment Expected Valuation Multiples as Function of Dine-in Market Recovery and Take-out Market Growth Valuation Multiples for (Dine-In+OPD+Franchise/Retail) as Function of Dine-in Market Recovery 9 8 10 12 Dine-in Market Strong 8 8 9 9 Weak Recovery Valuation Multiples for To Go as Function of Take-out Market Growth Take-out 24 24 24 Strong 24 20 20 Weak 20 20 Market Growth Capital Investments in OPD Remodels & Restaurant Maintenance ($ m) OPD Remodels 3 7 8 Restaurant Maintenance 4 8 3 5 2 4 Planned Bistro Closures (-Continued-) Exhibit 11 (continued) Assumptions Underlying the Strategic Plan Income Statement Assumptions Average Dine-in Revenue/ Bistro (FY 19) = $3.46 m Number of PFC Dine-in Restaurants (FY 19) = 196 PFC To Go Economics Revenues Average Revenue/Outlet = $1.75 m if take-out market is strong $1.25 m if take-out market is weak Costs Fixed Cost/Outlet = $0.70 m Variable Cost/Revenue = 50% = Cost of Goods, Labor, Operating Expenses, & SG&A Fixed Cost component ($ m) Labor 158 Operating Expenses 111 SG&A 47 Variable Cost Component (as a Percentage of (Dine-in + OPD) Sales] Cost of Sales 22% Labor 20% Operating Expenses 5% SG&A 10% Source: Casewriters. Determining P.F. Chang's' Investment Trajectory Adamolekun could invest aggressively in both dine-in and To Go, or he could take a bet and invest aggressively in one business and moderately in the other, or he could hedge his bets given the economic uncertainty and pursue a moderate level of investment in both businesses. The dine-in and To Go businesses were competing for managerial attention and financial resources, but they were also complementary. Davila explained: "We only have 200 restaurants in the U.S. The To Go stores will increase our visibility and create a halo effect on the dine-in bistros. Reciprocally, if people have an awesome experience at our bistros, they will order more take-out. If our dine-in business is deteriorating, then takeout will suffer because people won't respect our food." The balance of attention between To Go and bistro dining would impact organizational priorities. Bistros would require wok-trained gourmet chefs and hospitable wait staff trained and eager to perform 'theater at the table' with interactive entrees and drinks, whereas To Go locations needed technology-savvy staff who prioritized speed of order fulfilment and customer convenience. The promotional approaches would also be different for bistros and To Go stores. "Improving the dine-in experience would be the easier choice organizationally," Adamolekun reflected, because it is within the wheelhouse of restaurant operations. Refurbishing the bistros would mostly require targeted remodels, some culinary development, and additional training in hospitality. But bistros are our core business, and our staff understands the dine-in business." Expanding the To Go business would be more of an organizational challenge. "Even though we are building To Go within the P.F. Chang's umbrella and the same people will be responsible for both the bistros and the To Go stores, it is a new concept for our staff," Adamolekun reasoned. "Our operators and staff may initially treat To Go as a non-core business. Expanding the To Go business will require more hands-on management as we refine the new operating model." Pursuing rapid bistro refurbishment and aggressive To Go expansion concurrently was feasible but risky. The firm, already highly leveraged at the time of the acquisition, had taken on additional debt during the pandemic. "Our balance sheet capacity is limited at present," Adamolekun reasoned. "Investing aggressively across both businesses could lead us into a difficult financial position if the consumer environment does not improve over the next twelve months as per our expectation. Additionally, our team is already firefighting the challenges wrought by the pandemic. They will be stretched if we start ramping up both businesses simultaneously." Looking Ahead At the time of the acquisition, the incoming management team had planned to get P.F. Chang's on a path to a successful monetization event in a few years. The pandemic had pushed the horizon out somewhat, but Adamolekun knew that an important measure of the success of his strategy would be the enterprise value that P.F. Chang's would command in a few years. One approach to factoring in the uncertainties while developing his three-year plan would be to gauge how various strategic choices might play out in different scenarios. Adamolekun used P.F. Chang's 2019 income statement as a baseline from which to model the potential consequences of various strategic choices in different circumstances (see Exhibit 10). He was conscious that the assumptions buttressing the plan he was developing could be contested and reasonable people could come to different conclusions. Yet, he felt it was important to specify the assumptions and go through how the various options might fare in different circumstances so as to arrive at the most robust approach. (Exhibit 11 lists the assumptions underlying the strategic planning exercise.) The future of P.F. Chang's depended on the strategic plan Adamolekun and the board would eventually choose to follow. Exhibit 10 P.F. Chang's 2019 Income Statement ($ in millions) FY 19 Dine-In Revenue 679 OPD Revenue 204 Catering Revenue 24 Take-Out Revenue 110 3PD Revenue 70 To-Go Total Company Owned Net Sales Franchised / Licensed Net Sales 883 20 Total Net Sales 903 Cost of Sales 201 Total Labor 335 Prime Costs 536 155 Operating Expenses SG&A 135 Total Cost 826 EBITDA 77 % Margin 8.5% Source: Company document. Notes: 3PD stands for third-party delivery. SG&A includes marketing, rent expenses, pre-opening expenses, and general and administrative expenses. Exhibit 11 Assumptions Underlying the Strategic Plan Post-pandemic scenarios: or or Dine-in market: Off-premises market: Pace of bistro renewal: PFC To Go investment: Weak Weak Moderate Low Strong Strong Rapid High or P. F. Chang's strategic choices: or FY23/22 115% 110% FY20/19 FY21/20 FY22/21 PFC Dine-In Revenue as Function of Dine-in Market Recovery and Pace of Bistro Renewal Dine-in market recovery: Strong Pace of Bistro Rapid 50% 185% 115% Renewal Moderate 50% 175% 110% Dine-in market recovery: Weak Pace of Bistro Rapid 50% 150% 110% Renewal Moderate 50% 133% 110% PFC Off-Premises Dining Revenue as Function of Take-out Market Growth Take-out Strong 150% 75% 115% Market Growth Weak 140% 65% 105% Franchised/ Licensed Net Sales 75% 133% 110% 110% 110% 115% 105% 110% FY20 FY23 FY21 FY22 32mo5 woo Rate of Restaurant Refresh and New Restaurant Openings as Function of Pace of Bistro Renewal Rate of Restaurant Refresh Rapid Pace of Bistro 40 80 40 0 Renewal Moderate 40 40 40 40 New Restaurant Openings 6 12 Pace of Bistro Rapid 9 4 8 Renewal Moderate 6 New PFC To Go's as Function of Pace of To Go Investment 10 20 High 30 40 Pace of To Go Low 10 15 Investment 20 Capital Investment in IT/Corporate Projects as Function of Pace of To Go Investment ($ m) 4 4 3 Pace of To Go High 3 3 3 Low Investment Expected Valuation Multiples as Function of Dine-in Market Recovery and Take-out Market Growth Valuation Multiples for (Dine-In+OPD+Franchise/Retail) as Function of Dine-in Market Recovery 9 8 10 12 Dine-in Market Strong 8 8 9 9 Weak Recovery Valuation Multiples for To Go as Function of Take-out Market Growth Take-out 24 24 24 Strong 24 20 20 Weak 20 20 Market Growth Capital Investments in OPD Remodels & Restaurant Maintenance ($ m) OPD Remodels 3 7 8 Restaurant Maintenance 4 8 3 5 2 4 Planned Bistro Closures (-Continued-) Exhibit 11 (continued) Assumptions Underlying the Strategic Plan Income Statement Assumptions Average Dine-in Revenue/ Bistro (FY 19) = $3.46 m Number of PFC Dine-in Restaurants (FY 19) = 196 PFC To Go Economics Revenues Average Revenue/Outlet = $1.75 m if take-out market is strong $1.25 m if take-out market is weak Costs Fixed Cost/Outlet = $0.70 m Variable Cost/Revenue = 50% = Cost of Goods, Labor, Operating Expenses, & SG&A Fixed Cost component ($ m) Labor 158 Operating Expenses 111 SG&A 47 Variable Cost Component (as a Percentage of (Dine-in + OPD) Sales] Cost of Sales 22% Labor 20% Operating Expenses 5% SG&A 10% Source: Casewriters

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started