Answered step by step

Verified Expert Solution

Question

1 Approved Answer

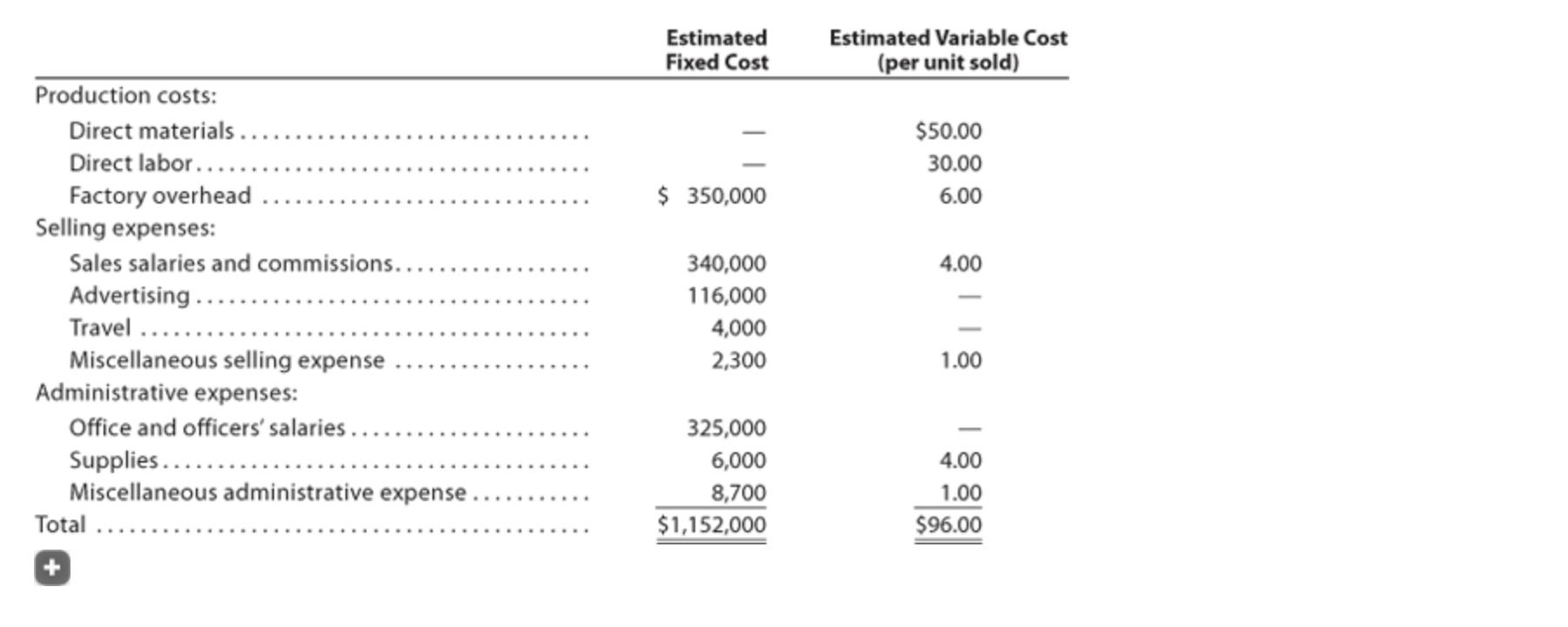

Production costs: Direct materials.. Direct labor..... Factory overhead Selling expenses: Sales salaries and commissions... Advertising... Travel ...... Miscellaneous selling expense Administrative expenses: Office and

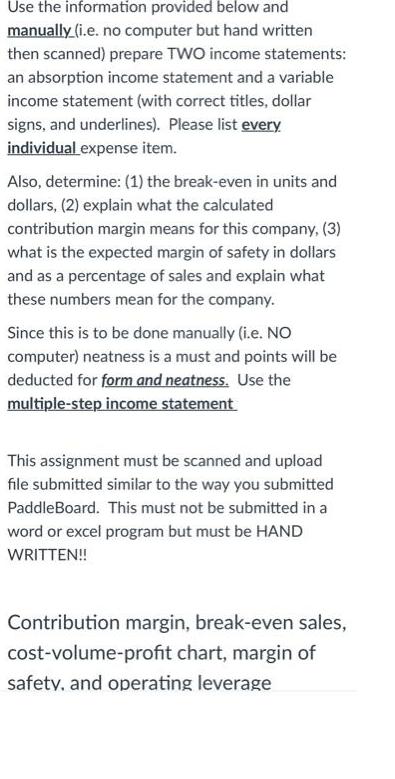

Production costs: Direct materials.. Direct labor..... Factory overhead Selling expenses: Sales salaries and commissions... Advertising... Travel ...... Miscellaneous selling expense Administrative expenses: Office and officers' salaries.. Supplies........ Miscellaneous administrative expense. Total ..... Estimated Fixed Cost $ 350,000 340,000 116,000 4,000 2,300 325,000 6,000 8,700 $1,152,000 Estimated Variable Cost (per unit sold) $50.00 30.00 6.00 4.00 1.00 4.00 1.00 $96.00 Use the information provided below and manually_(i.e. no computer but hand written then scanned) prepare TWO income statements: an absorption income statement and a variable income statement (with correct titles, dollar signs, and underlines). Please list every individual expense item. Also, determine: (1) the break-even in units and dollars, (2) explain what the calculated contribution margin means for this company, (3) what is the expected margin of safety in dollars and as a percentage of sales and explain what these numbers mean for the company. Since this is to be done manually (i.e. NO computer) neatness is a must and points will be deducted for form and neatness. Use the multiple-step income statement This assignment must be scanned and upload file submitted similar to the way you submitted PaddleBoard. This must not be submitted in a word or excel program but must be HAND WRITTEN!! Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Page 1 IMPORTANT Dear Student I have answered this question belore but Im again answering ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started