Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information provided below to answer the following questions: 2.1 2.1.1 2.1.2 2.1.3 2.1.4 2.1.5 2.1.6 2.1.7 2.2 2.3 Calculate the following ratios.

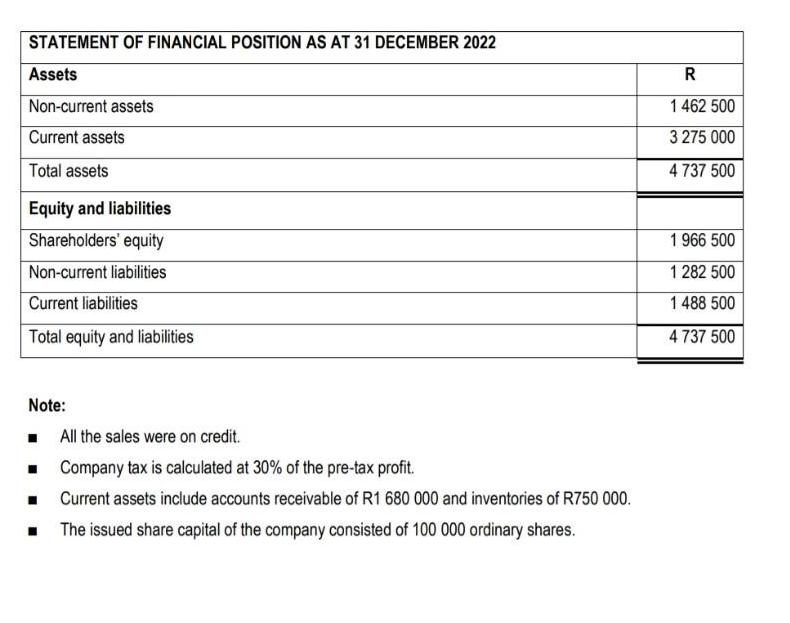

Use the information provided below to answer the following questions: 2.1 2.1.1 2.1.2 2.1.3 2.1.4 2.1.5 2.1.6 2.1.7 2.2 2.3 Calculate the following ratios. Express the answers to two decimal places. Gross profit margin Total asset turnover Return on equity Current ratio Debt-equity ratio Earnings per share Finance cost coverage Comment on the acid test ratio which was 1.12:1 in 2021 and 1.70:1 in 2022. Suggest TWO (2) possible reasons for a drop in the gross profit margin ratio from 2021 to 2022. INFORMATION WOOLIES LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 Sales Cost of sales Gross profit Operating expenses (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (4 marks) (2 marks) R ? (6 765 000) 1 272 500 (922 500) Cost of sales Gross profit Operating expenses Earnings before interest and tax Interest expense Earnings before tax Company tax Earnings after interest and tax (6 765 000) 1 272 500 (922 500) 350 000 ? 227 500 ? ? STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 Assets Non-current assets Current assets Total assets Equity and liabilities Shareholders' equity Non-current liabilities Current liabilities Total equity and liabilities Note: All the sales were on credit. Company tax is calculated at 30% of the pre-tax profit. Current assets include accounts receivable of R1 680 000 and inventories of R750 000. The issued share capital of the company consisted of 100 000 ordinary shares. R 1 462 500 3 275 000 4 737 500 1 966 500 1 282 500 1 488 500 4 737 500

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

21 Ratios Calculation 211 Gross profit margin Gross profit margin Gross profit Sales x 100 Gross profit Sales Cost of sales provided Gross profit marg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started