Answered step by step

Verified Expert Solution

Question

1 Approved Answer

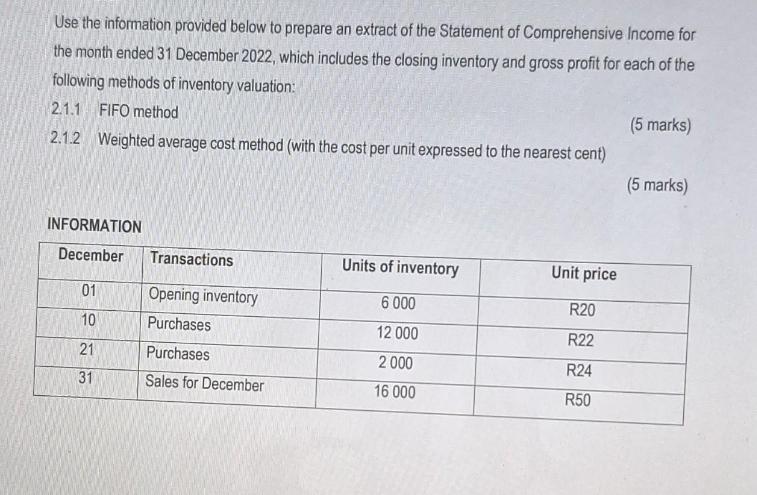

Use the information provided below to prepare an extract of the Statement of Comprehensive Income for the month ended 31 December 2022, which includes

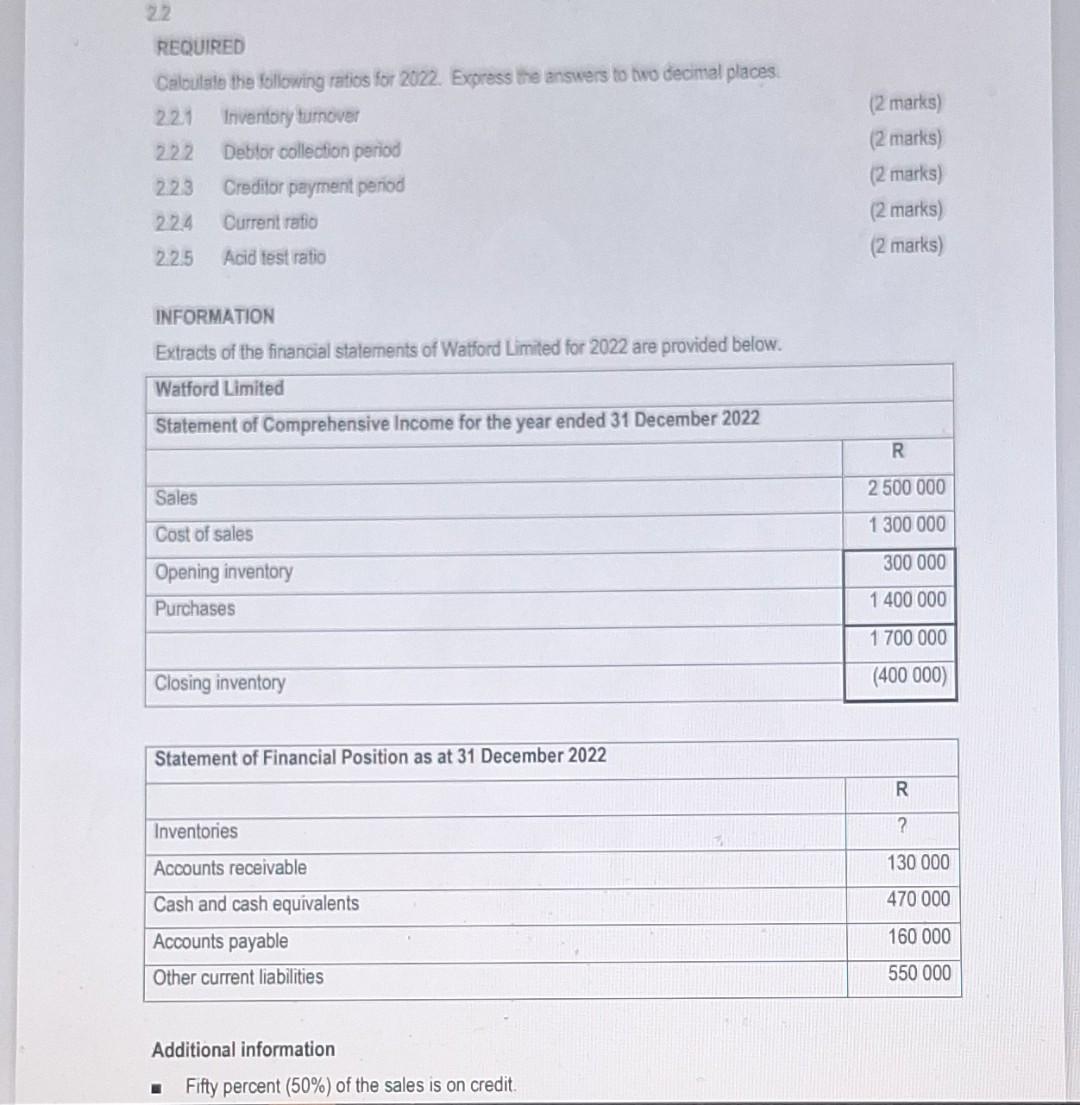

Use the information provided below to prepare an extract of the Statement of Comprehensive Income for the month ended 31 December 2022, which includes the closing inventory and gross profit for each of the following methods of inventory valuation: 2.1.1 FIFO method 2.1.2 Weighted average cost method (with the cost per unit expressed to the nearest cent) INFORMATION December Transactions 01 10 21 31 Opening inventory Purchases Purchases Sales for December Units of inventory 6 000 12 000 2000 16 000 Unit price R20 R22 R24 R50 (5 marks) (5 marks) 2.2 REQUIRED Calculate the following ratios for 2022. Express the answers to two decimal places. 2.2.1 Inventory turnover 222 Debtor collection period 2.2.3 Creditor payment period 224 Current ratio 2.2.5 Acid test ratio INFORMATION Extracts of the financial statements of Watford Limited for 2022 are provided below. Watford Limited Statement of Comprehensive Income for the year ended 31 December 2022 Sales Cost of sales Opening inventory Purchases Closing inventory Statement of Financial Position as at 31 December 2022 Inventories Accounts receivable Cash and cash equivalents Accounts payable Other current liabilities Additional information Fifty percent (50%) of the sales is on credit. (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) R 2 500 000 1 300 000 300 000 1 400 000 1 700 000 (400 000) R ? 130 000 470 000 160 000 550 000

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

21 22 1 Inventory Turnover Ratio Inventory Turnover Ratio Cost of Goods Sold Average Inventory Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started