Question

Use the information provided below to prepare the Cash Flow Statement of Rolex Limited for the year ended 31 December 2021. Additional information All purchases

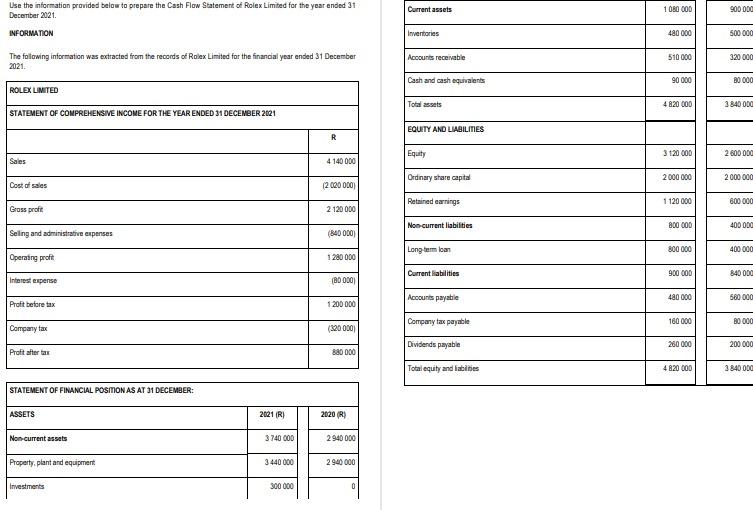

Use the information provided below to prepare the Cash Flow Statement of Rolex Limited for the year ended 31 December 2021.

Additional information

All purchases of inventories are on credit.

The selling and administrative expenses include depreciation of R320 000.

Property, plant and equipment were purchased during the year but there were no disposals.

The total dividends for the year ended 31 December 2021 amounted to R360 000.

The issued share capital consisted of 100 000 ordinary shares. The market price of the shares on 31 December 2021 was R35.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started