Answered step by step

Verified Expert Solution

Question

1 Approved Answer

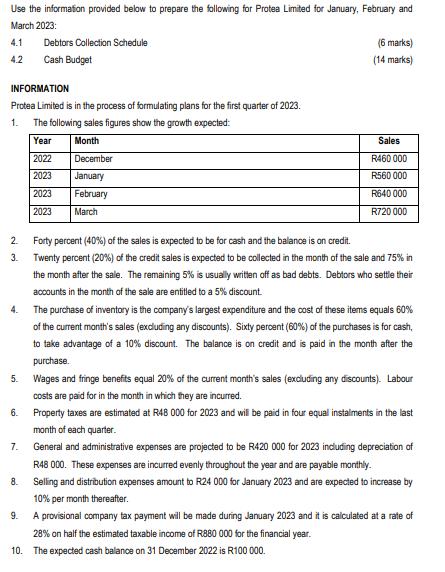

Use the information provided below to prepare the following for Protea Limited for January, February and March 2023: 4.1 4.2 INFORMATION Protea Limited is

Use the information provided below to prepare the following for Protea Limited for January, February and March 2023: 4.1 4.2 INFORMATION Protea Limited is in the process of formulating plans for the first quarter of 2023. The following sales figures show the growth expected: 1. Year Month 2 3. 4. 5. 6. Debtors Collection Schedule Cash Budget 7. 8. 2022 2023 2023 2023 December January February March (6 marks) (14 marks) Sales R460 000 R560 000 Wages and fringe benefits equal 20% of the current month's sales (excluding any discounts). Labour costs are paid for in the month in which they are incurred. Property taxes are estimated at R48 000 for 2023 and will be paid in four equal instalments in the last month of each quarter. General and administrative expenses are projected to be R420 000 for 2023 including depreciation of R48 000. These expenses are incurred evenly throughout the year and are payable monthly. Selling and distribution expenses amount to R24 000 for January 2023 and are expected to increase by 10% per month thereafter. 9. A provisional company tax payment will be made during January 2023 and it is calculated at a rate of 28% on half the estimated taxable income of R880 000 for the financial year. 10. The expected cash balance on 31 December 2022 is R100 000. R640 000 R720 000 Forty percent (40%) of the sales is expected to be for cash and the balance is on credit. Twenty percent (20%) of the credit sales is expected to be collected in the month of the sale and 75% in the month after the sale. The remaining 5% is usually written off as bad debts. Debtors who settle their accounts in the month of the sale are entitled to a 5% discount. The purchase of inventory is the company's largest expenditure and the cost of these items equals 60% of the current month's sales (excluding any discounts). Sixty percent (60%) of the purchases is for cash, to take advantage of a 10% discount. The balance is on credit and is paid in the month after the purchase.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

41 January 20 of credit sales R128 000 75 of credit sales from previous month R360 000 Total Debtors ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started