Question

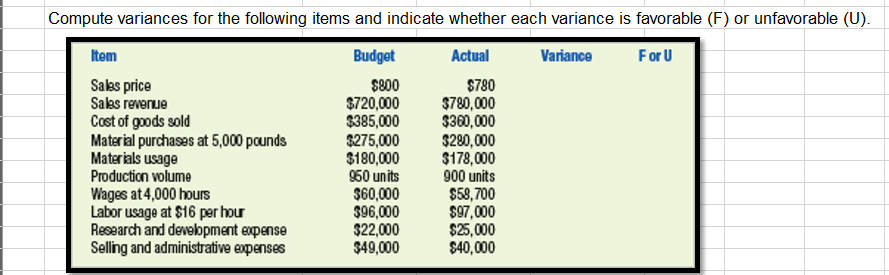

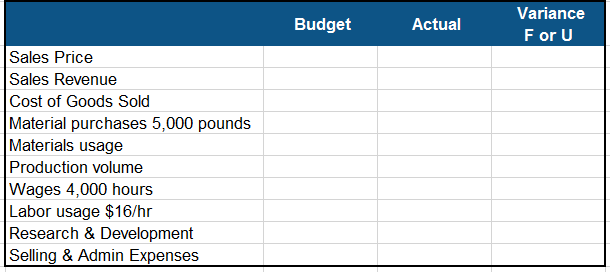

Use the information provided in Exercise 8-1A. Determine the sales and variable cost volume variances. Classify the variances as favorable (F) or unfavorable (U). Comment

Use the information provided in Exercise 8-1A.

Determine the sales and variable cost volume variances.

Classify the variances as favorable (F) or unfavorable (U).

Comment on the usefulness of the variances with respect to performance evaluation and identify the member of the management team most likely to be responsible for these variances.

Determine the amount of fixed cost that will appear in the flexible budget.

Determine the fixed cost per unit based on planned activity and the fixed cost per unit based on actual activity. Assuming Allard uses information in the master budget to price the company's product, comment on how the fixed cost volume variance could affect the company's profitability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started