Question

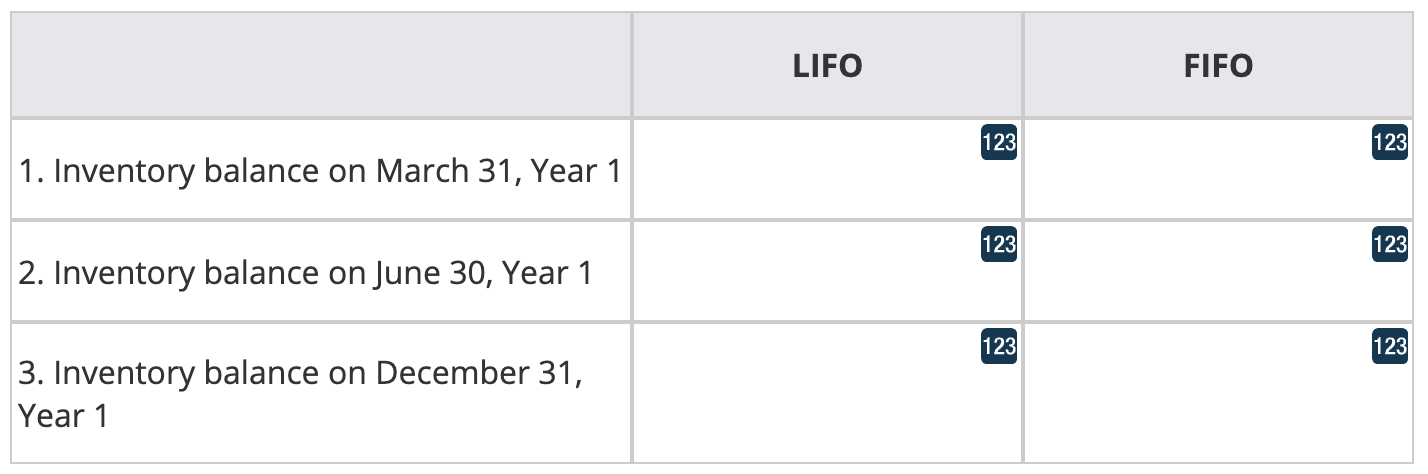

Use the information provided in the exhibits to calculate the inventory amounts as they should be reported in the financial statements prepared under last-in, first-out

Use the information provided in the exhibits to calculate the inventory amounts as they should be reported in the financial statements prepared under last-in, first-out (LIFO) and first-in, first-out (FIFO) inventory cost flow methods. Enter the appropriate amounts in the associated cells. Enter all amounts as positive values. Round all amounts to the nearest whole number.

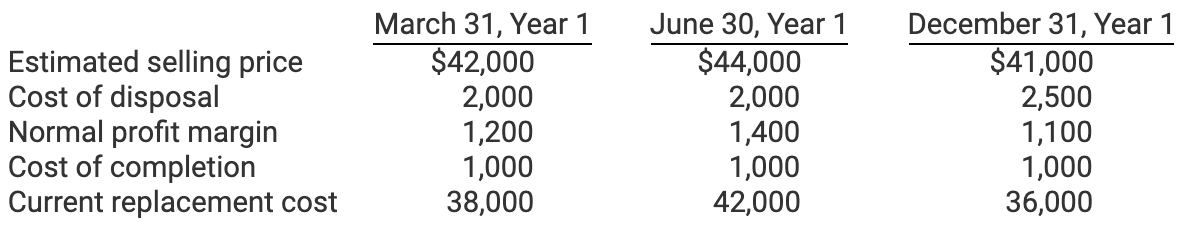

The following data pertain to Company As inventory that was purchased on January5, Year1, for $40,000:

The following data pertain to Company As inventory that was purchased on January5, Year1, for $40,000:

Note: Entire inventory was sold on May 1, Year 2.

To: Bill

From: Rufus Brown

Date: June 1, Year 2

RE: FIFO vs LIFO

Hey Bill,

The company is planning to change its inventory cost flow method from LIFO to FIFO. To get us started, I will need your help in calculating some of the Year 1 quarterly inventory balances under both methods. I know that this is a bit of a challenge, but I have ultimate faith in you. Let me know if I can do anything to help.

Sincerely,

Rufus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started