Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the information provided on the homework handout to answer the below questions. Be sure to follow the question instructions as to how best to

Use the information provided on the homework handout to answer the below questions.Be sure to follow the question instructions as to how best to enter your response.

Do note that while all numbers Account balances and Shares Outstanding are listed as $thousands, you do NOT need to make any changes to input your answers.Example: suppose Long Term Debt was listed as which would represent debt due to $thousandsIf the question was to ask for the amount of debt, you would answer

Compute the Cost of Equity for XYZ Inc.

Compute the WEIGHTED AVERAGE aftertax cost of debt short term and long term combined for XYZ Inc.

Compute the Weights for Short Term Debt, Long Term Debt and Equity.

Compute the Weighted Average Cost of Capital

Calculate the Free Cash Flow for the next three years

Use the Free Cash Flow Method to compute the value of XYZ Inc.

Based on the Free Cash Flow Valuation, compute the Value of XYZs equity and the estimated price per share.

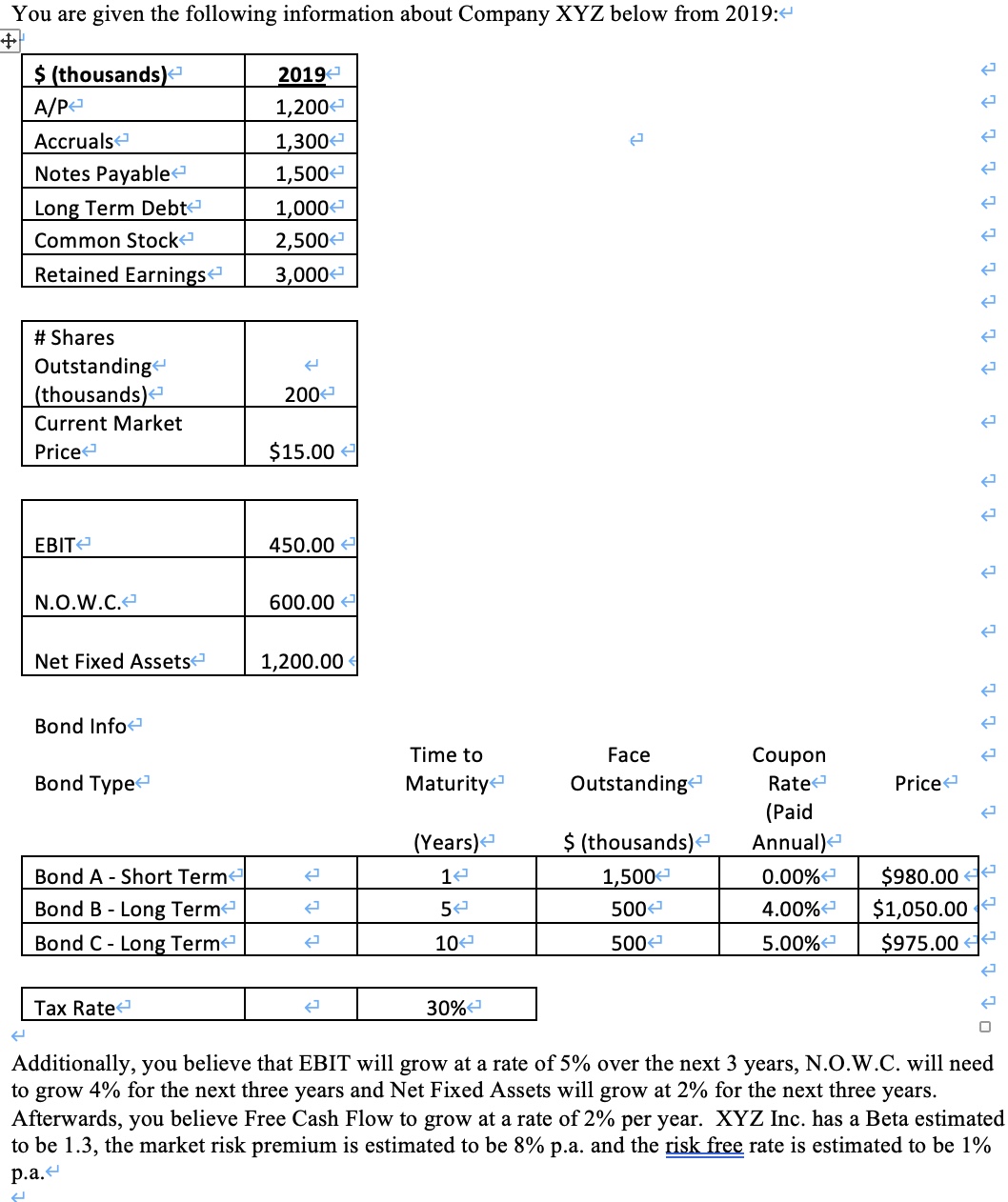

You are given the following information about Company XYZ below from :

Additionally, you believe that EBIT will grow at a rate of over the next years, NOWC will need

to grow for the next three years and Net Fixed Assets will grow at for the next three years.

Afterwards, you believe Free Cash Flow to grow at a rate of per year. XYZ Inc. has a Beta estimated

to be the market risk premium is estimated to be pa and the risk free rate is estimated to be

pa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started