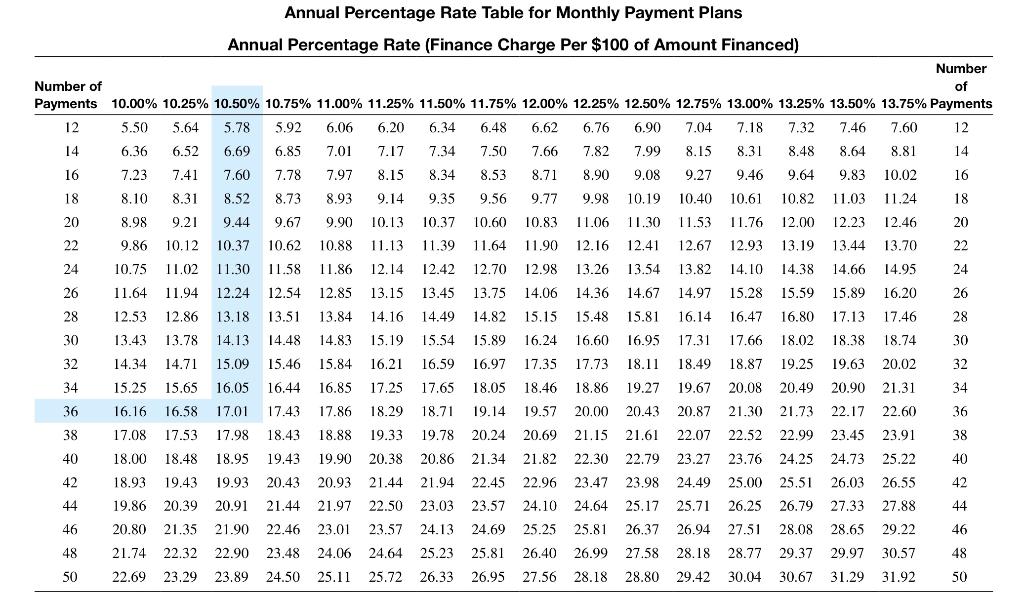

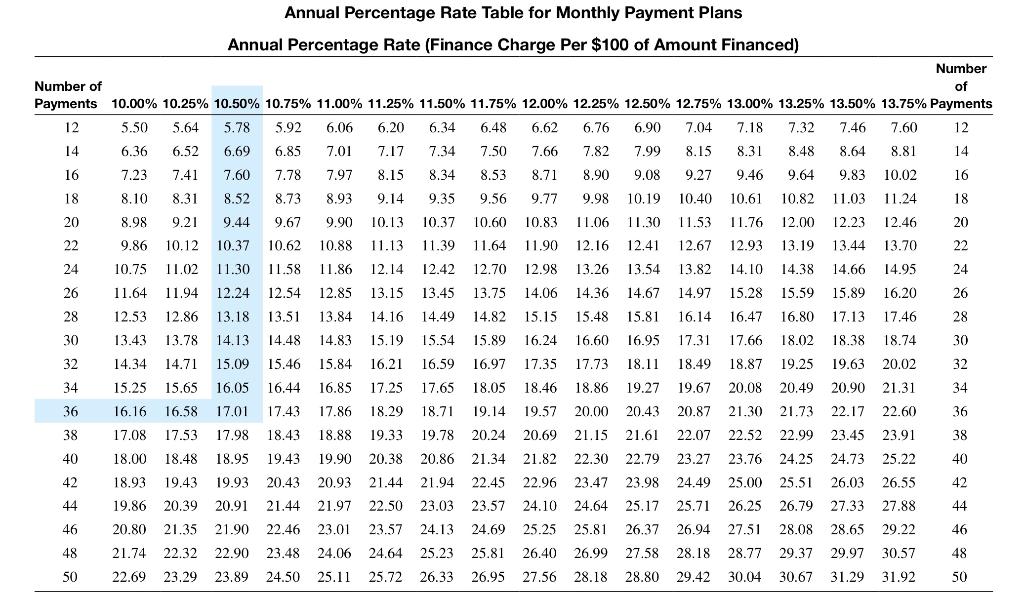

Use the loan payoff table to find the monthly payment and finance charge for the loan. Amount financed; $11,750, number of months; 60 months, APR 12%

Annual Percentage Rate Table for Monthly Payment Plans Annual Percentage Rate (Finance Charge Per $100 of Amount Financed) 7.78 Number Number of of Payments 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 12.00% 12.25% 12.50% 12.75% 13.00% 13.25% 13.50% 13.75% Payments 12 5.50 5.64 5.78 5.92 6.06 6,20 6.34 6.48 6.62 6.76 6.90 7.04 7.18 7.32 7.46 7.60 12 14 6.36 6.52 6.69 6.85 7.01 7.17 7.34 7.50 7.66 7.82 7.99 8.15 8.31 8.48 8.64 8.81 14 16 7.23 7.41 7.60 7.97 8.15 8.34 8.53 8.71 8.90 9.08 9.27 9.46 9.64 9.83 10.02 16 18 8.10 8.31 8.52 8.73 8.93 9.14 9.35 9.56 9.77 9.98 10.19 10.40 10,61 10.82 11.03 11.24 18 20 8.98 9.21 9.44 9.67 9.90 10.13 10.37 10.60 10.83 11.06 11.30 11.53 11.76 12.00 12.23 12.46 20 22 9.86 10.12 10.37 10.62 10.88 11.13 11.39 11.64 11.90 12.16 12.41 12.67 12.93 13.19 13.44 13.70 22 24 10.75 11.02 11.30 11.58 11.86 12.14 12.42 12.70 12.98 13.26 13.54 13.82 14.10 14.38 14.66 14.95 24 26 11.64 11.94 12.24 12.54 12.85 13.15 13.45 13.75 14.06 14.36 14.67 14.97 15.28 15.59 15.89 16.20 26 28 12.53 12.86 13.18 13.51 13,84 14.16 14.49 14.82 15.15 15.48 15.81 16.14 16.47 16.80 17.13 17.46 28 30 13.43 13.78 14.13 14.48 14.83 15.19 15.54 15.89 16.24 16.60 16.95 17.31 17.66 18.02 18.38 18.74 30 32 14.34 14.71 15.09 15.46 15.84 16.21 16.59 16.97 17.35 17.73 18.11 18.49 18.87 19.25 19.63 20.02 32 34 15.25 15.65 16.05 16.44 16.85 17.25 17.65 18.05 18.46 18.86 19.27 19.67 20.08 20.49 20.90 21.31 34 36 16.16 16.58 17.01 17.43 17.86 18.29 18.71 19.14 19.57 20.00 20.43 20.87 21.30 21.73 22.17 22.60 36 38 17.08 17.53 17.98 18.43 18.88 19.33 19.78 20.24 20.69 21.15 21.61 22.07 22.52 22.99 22.99 23.45 23.45 23.91 38 40 18.00 18.48 18.95 19.43 19.90 20.38 20.86 21.34 21.82 22.30 22.79 23.27 23.76 24.25 23.76 24.25 24.73 24.73 25.22 40 42 18.93 19.43 19.93 20.43 20.93 21.44 21.94 22.45 22.96 23.47 23.98 24.49 25.00 25.51 26.03 26.55 42 44 19.86 20.39 20.91 21.44 21.97 22.50 23.03 23.57 24.10 24.64 25.17 25.71 26.25 26.79 27.33 27.88 44 46 20.80 21.35 21.90 22.46 23.01 23.57 24.13 24.69 25.25 25.81 26.37 26.94 27.51 28.08 28.65 29.22 46 48 21.74 22.32 22.90 23.48 24.06 24.64 25.23 25.81 26.40 26.99 27.58 28.18 28.77 29.37 29.97 30.57 48 50 22.69 23.29 23.89 24.50 25.11 25.72 26.33 26.95 27.56 28.18 28.80 29.42 30.04 30.67 31.29 31.92 50