Answered step by step

Verified Expert Solution

Question

1 Approved Answer

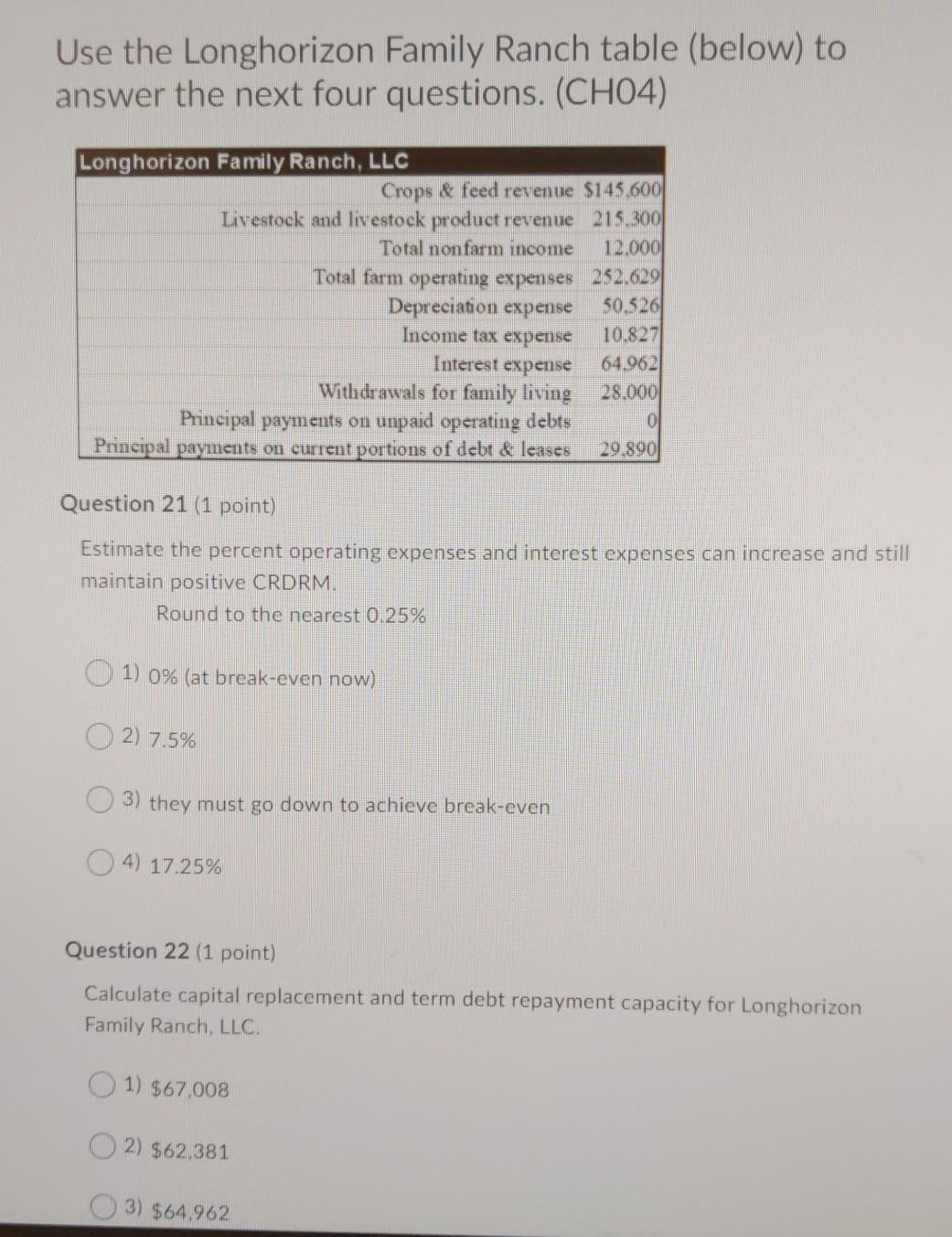

Use the Longhorizon Family Ranch table (below) to answer the next four questions. (CH04) Longhorizon Family Ranch, LLC Crops & feed revenue $145,600 Livestock and

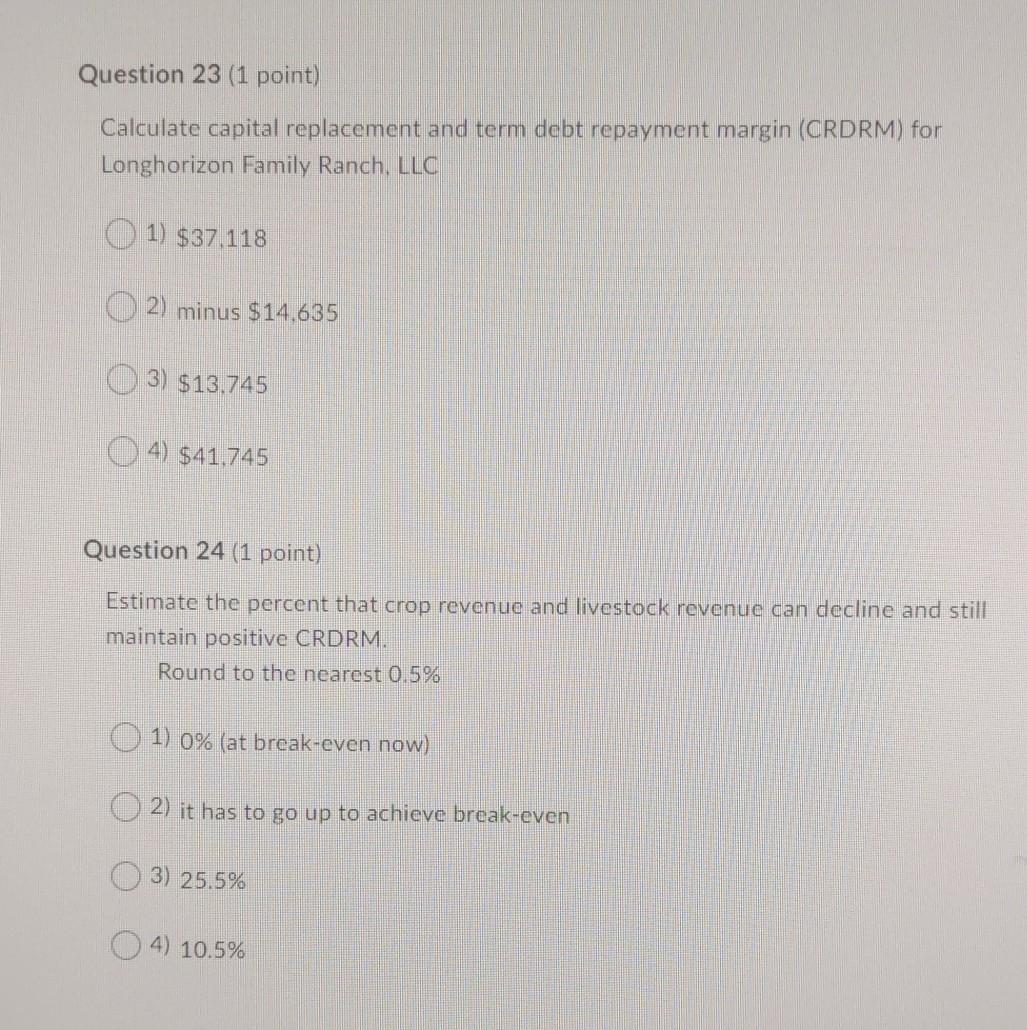

Use the Longhorizon Family Ranch table (below) to answer the next four questions. (CH04) Longhorizon Family Ranch, LLC Crops & feed revenue $145,600 Livestock and livestock product revenue 215.300 Total non farm income 12.000 Total farm operating expenses 252.629 Depreciation expense 50.526 Income tax expense 10.827 Interest expense 64.962 Withdrawals for family living 28.000 Principal yments on unpaid opera debts Principal payments on current portions of debt & leases 19,890 0 Question 21 (1 point) Estimate the percent operating expenses and interest expenses can increase and still maintain positive CRDRM. Round to the nearest 0.25% 1) 0% (at break-even now) 2) 7.5% 3) they must go down to achieve break-even 4) 17.25% Question 22 (1 point) Calculate capital replacement and term debt repayment capacity for Longhorizon Family Ranch, LLC. 1) $67,008 2) $62.381 3) $64.962 Question 23 (1 point) Calculate capital replacement and term debt repayment margin (CRDRM) for Longhorizon Family Ranch, LLC 1) $37.118 2) minus $14.635 3) $13.745 04) $41,745 Question 24 (1 point) Estimate the percent that crop revenue and livestock revenue can decline and still maintain positive CRDRM. Round to the nearest 0.5% 1) 0% (at break-even now) 2) it has to go up to achieve break-even 3) 25.5% 4) 10.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started