Question

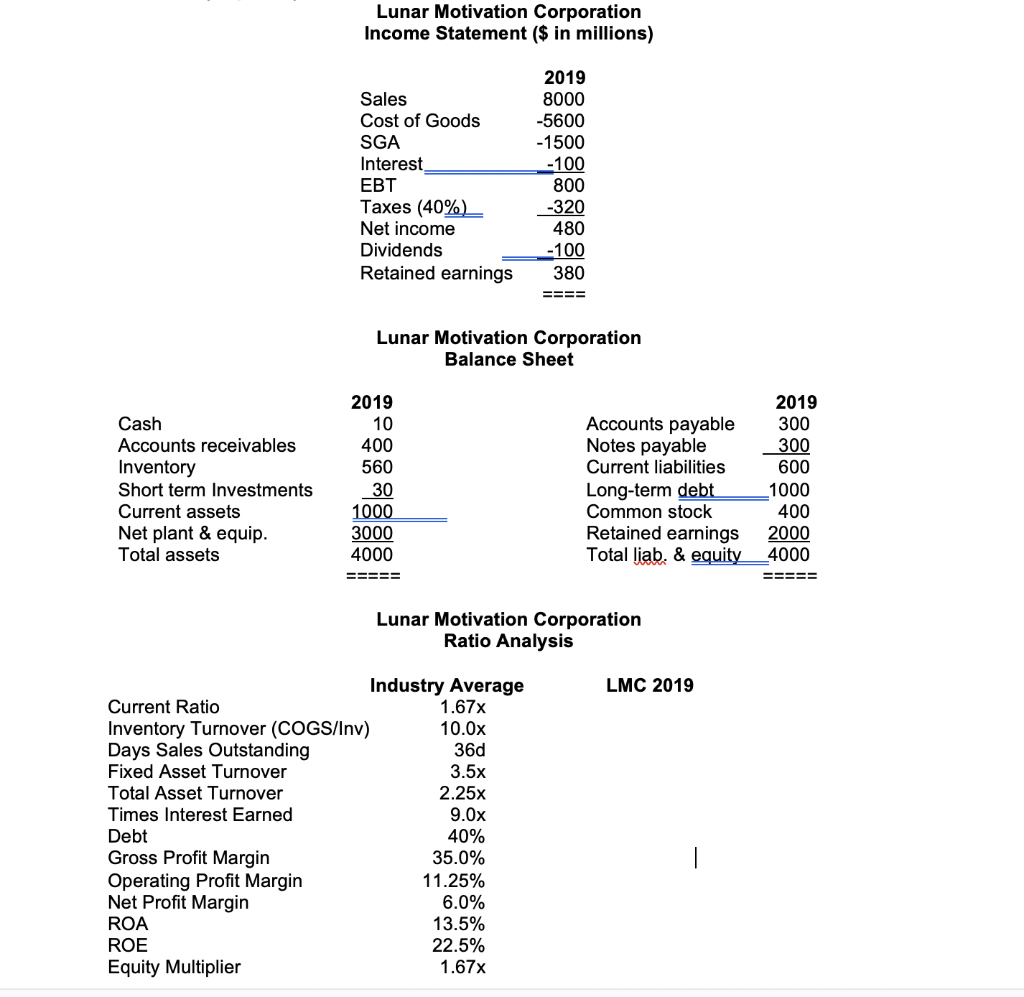

Use the Lunar Motivation Corporation Financial Statements on the previous page to answer the following questions: a. Please conduct a ratio analysis using the ratios

Use the Lunar Motivation Corporation Financial Statements on the previous page to answer the following questions:

a. Please conduct a ratio analysis using the ratios listed on the previous page. Place the answers in the column next to the industry average figures. Show your work to the right.

b. Which two ratios are the most important strengths revealed by your ratio calculations? Be as specific as possible.

c. What are the two most important deficiencies revealed by your calculations for LMC? Be as specific as possible.

d. Utilize the answers above and apply the DuPont relationship to explain the Return on Assets and Return on Equity ratios for LMC and for the industry. Compare the two results. Do any of the answers above help to explain the deficiency noted in comparing the two sets of figures?

e. Please compute the requested items in the table below for 2019. The company has a 14% WACC. Total Net Operating Capital (OC) for 2018 was $3500 million/. Show your calculations.

Net Operating Working Capital (NOWC):

Total Net Operating Capital (OC):

NOPAT:

Net Investment in OC (2019-18 change):

Free Cash Flow (FCF):

Return on Invested Capital (ROIC):

Economic Value Added (EVA):

f. LMC is considering an aggressive program that will increase sales by 35% in 2020. Analyze the prospects for this growth using your calculations above.

Lunar Motivation Corporation Income Statement ($ in millions) 2019 8000 -5600 -1500 -100 Sales Cost of Goods SGA Interest Taxes (40%) Net income Dividends Retained earnings 800 -320 480 -100 380 ==== Lunar Motivation Corporation Balance Sheet Cash Accounts receivables Inventory Short term Investments Current assets Net plant & equip. Total assets 2019 10 400 560 30 1000 3000 4000 ===== 2019 Accounts payable 300 Notes payable 300 Current liabilities 600 Long-term debt 1000 Common stock 400 Retained earnings 2000 Total liab. & equity__4000 = = = = = Lunar Motivation Corporation Ratio Analysis LMC 2019 Industry Average Current Ratio 1.67x Inventory Turnover (COGS/Inv) 10.0x Days Sales Outstanding 36d Fixed Asset Turnover 3.5x Total Asset Turnover 2.25x Times Interest Earned 9.0x Debt 40% Gross Profit Margin 35.0% Operating Profit Margin 11.25% Net Profit Margin 6.0% ROA 13.5% ROE 22.5% Equity Multiplier 1.67x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started