Use the model in Spreadsheet C04 to solve this problem. (see included file) and answer the following questions. Upload your answers in canvas.

- Set up an amortization schedule for a $30,000 loan to be repaid in equal installments at the end of each of the next 20 years at an interest rate of 10 percent. What is the annual payment? How much is owed on the loan after 15 years of payments have been made?

- Set up an amortization schedule for a $60,000 loan to be repaid in 20 equal annual installments at an interest rate of 10 percent. What is the annual payment? How much is owed on the loan after 10 years of payments have been made?

- Set up an amortization schedule for a $60,000 loan to be repaid in 20 equal annual installments at an interest rate of 20 percent. What is the annual payment?

How much is owed on the loan after eight years of payments have been made?

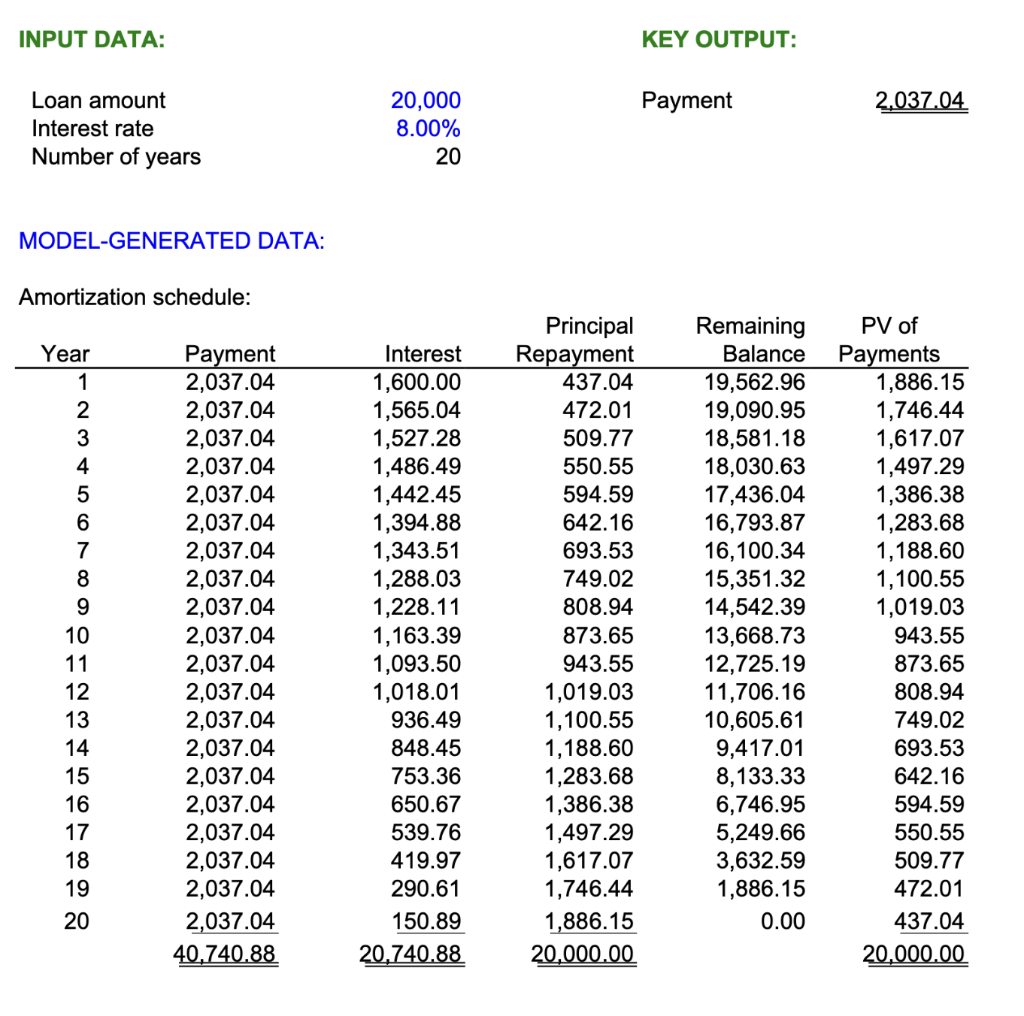

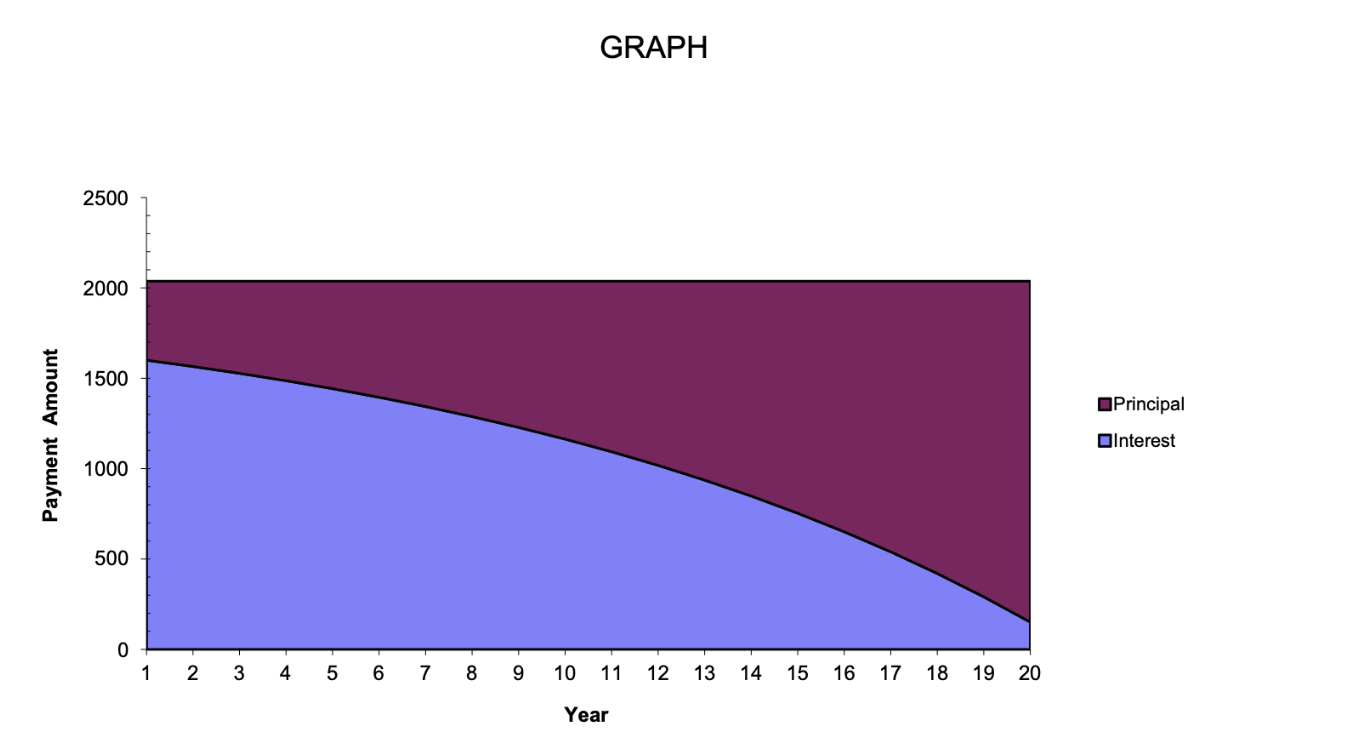

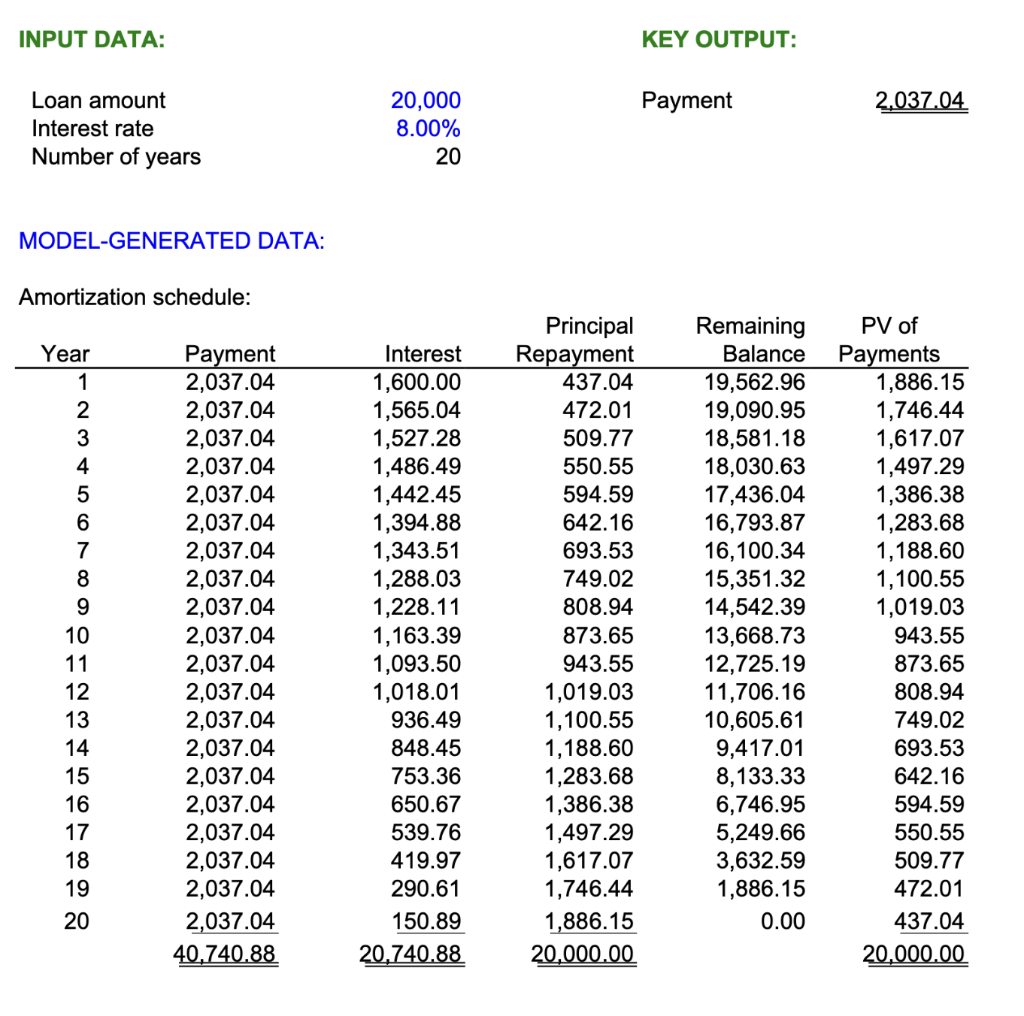

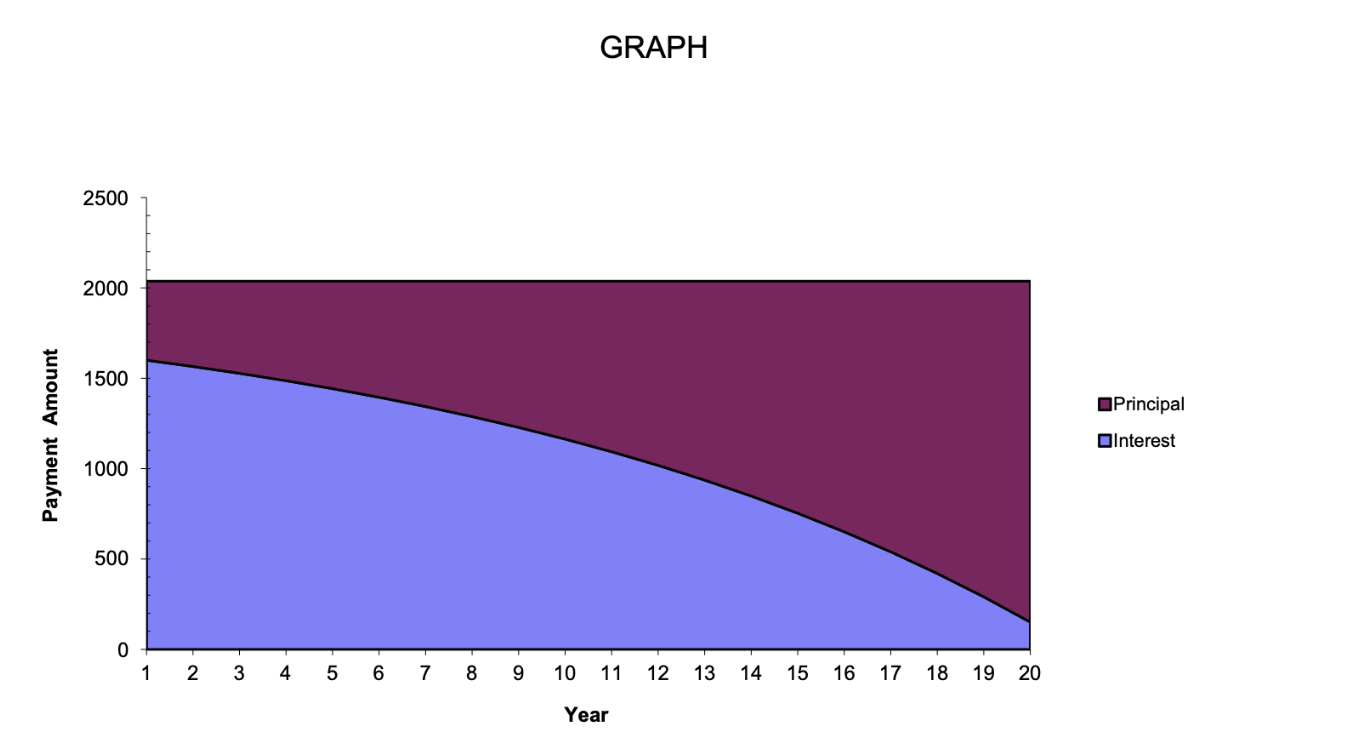

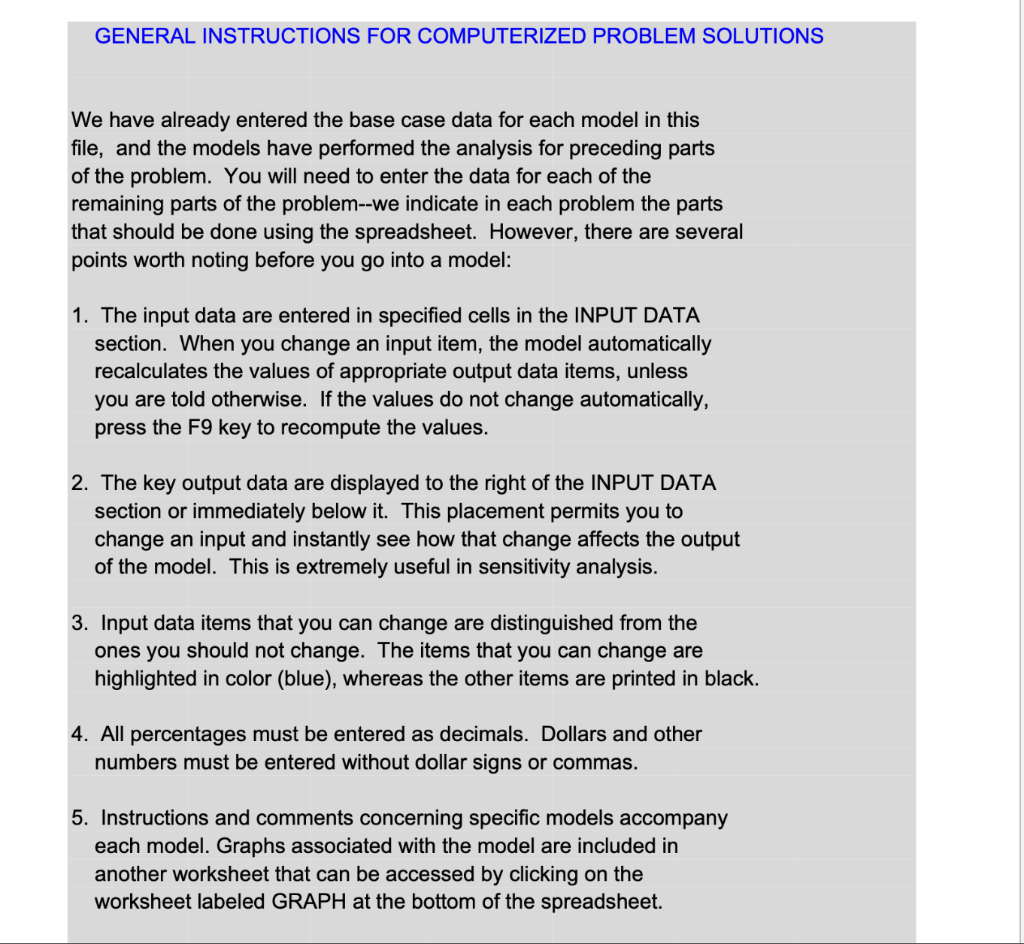

Chapter 4 Spreadsheet Problem Solutions (C04) Amortization Schedule 1. There are a number of instructions with which you should be familiar to use these computerized models. These instructions appear in a separate worksheet labeled INSTRUCTIONS. If you have not already done so, you should read these instructions now. To read these instructions, click on the worksheet labeled INSTRUCTIONS. 2. A graph that shows the total payment, the interest component, and the principal repayment component for the loan will be displayed if you click the worksheet labeled GRAPH at the bottom of this spreadsheet. To return to this worksheet, click on the worksheet labeled C04 at the bottom of the GRAPH worksheet. 3. Begin by arranging the worksheet so that Row 12 is the top line on the screen. This permits you to see the input data and the amortization schedule simultaneously. Then put the pointer on one of the input data cells, enter the new data, and watch the amortization schedule change! Also, work the 20-year problem with interest rates of 3 percent and 25 percent, go to the graph and notice the difference in the size of the payments and the difference in the breakdown between interest and principal. 4. Cells F25..F44 contain the present value of each annual payment discounted at the appropriate interest rate. As you change the interest rate you can see what happens to each discounted payment. The sum of this range is equal to the original amount of the loan. INPUT DATA: KEY OUTPUT: Payment 2.037.04 Loan amount Interest rate Number of years 20,000 8.00% 20 MODEL-GENERATED DATA: Amortization schedule: Year 1 10 11 234567899128456789 Payment 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 2,037.04 40.740.88 Interest 1,600.00 1,565.04 1,527.28 1,486.49 1,442.45 1,394.88 1,343.51 1,288.03 1,228.11 1,163.39 1,093.50 1,018.01 936.49 848.45 753.36 650.67 539.76 419.97 290.61 150.89 20.740.88 Principal Repayment 437.04 472.01 509.77 550.55 594.59 642.16 693.53 749.02 808.94 873.65 943.55 1,019.03 1,100.55 1,188.60 1,283.68 1,386.38 1,497.29 1,617.07 1,746.44 1,886.15 20,000.00 Remaining Balance 19,562.96 19,090.95 18,581.18 18,030.63 17,436.04 16,793.87 16,100.34 15,351.32 14,542.39 13,668.73 12,725.19 11,706.16 10,605.61 9,417.01 8,133.33 6,746.95 5,249.66 3,632.59 1,886.15 0.00 PV of Payments 1,886.15 1,746.44 1,617.07 1,497.29 1,386.38 1,283.68 1,188.60 1,100.55 1,019.03 943.55 873.65 808.94 749.02 693.53 642.16 594.59 550.55 509.77 472.01 437.04 20.000.00 20 GRAPH 2500 2000 1500 Principal Payment Amount Interest 1000 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Year GENERAL INSTRUCTIONS FOR COMPUTERIZED PROBLEM SOLUTIONS We have already entered the base case data for each model in this file, and the models have performed the analysis for preceding parts of the problem. You will need to enter the data for each of the remaining parts of the problem--we indicate in each problem the parts that should be done using the spreadsheet. However, there are several points worth noting before you go into a model: 1. The input data are entered in specified cells in the INPUT DATA section. When you change an input item, the model automatically recalculates the values of appropriate output data items, unless you are told otherwise. If the values do not change automatically, press the F9 key to recompute the values. 2. The key output data are displayed to the right of the INPUT DATA section or immediately below it. This placement permits you to change an input and instantly see how that change affects the output of the model. This is extremely useful in sensitivity analysis. 3. Input data items that you can change are distinguished from the ones you should not change. The items that you can change are highlighted in color (blue), whereas the other items are printed in black. 4. All percentages must be entered as decimals. Dollars and other numbers must be entered without dollar signs or commas. 5. Instructions and comments concerning specific models accompany each model. Graphs associated with the model are included in another worksheet that can be accessed by clicking on the worksheet labeled GRAPH at the bottom of the spreadsheet