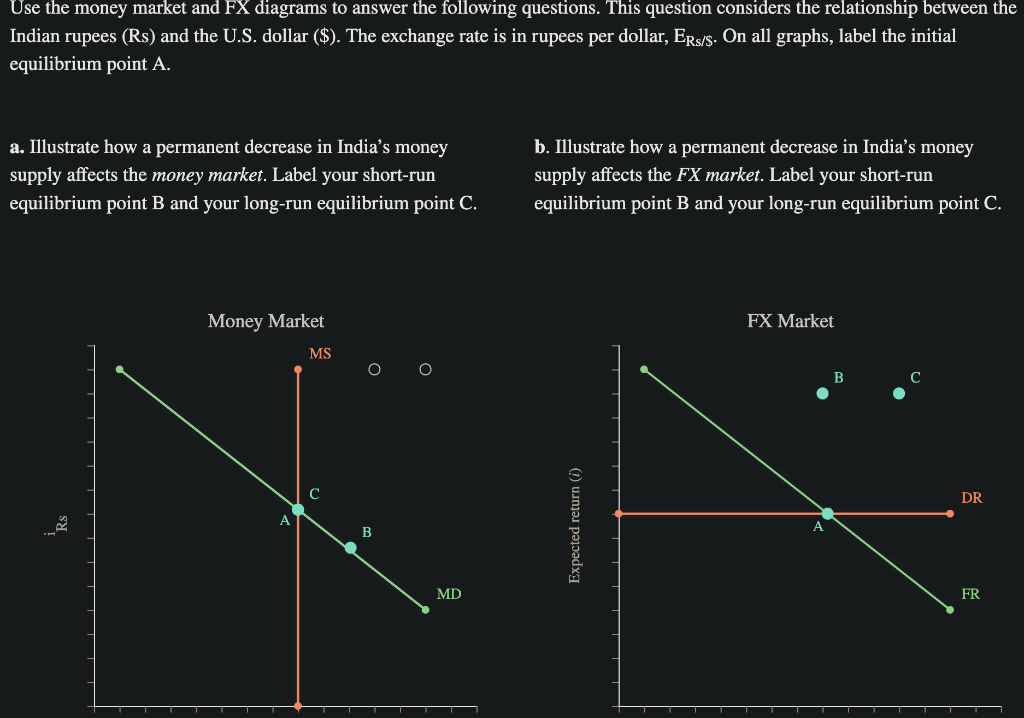

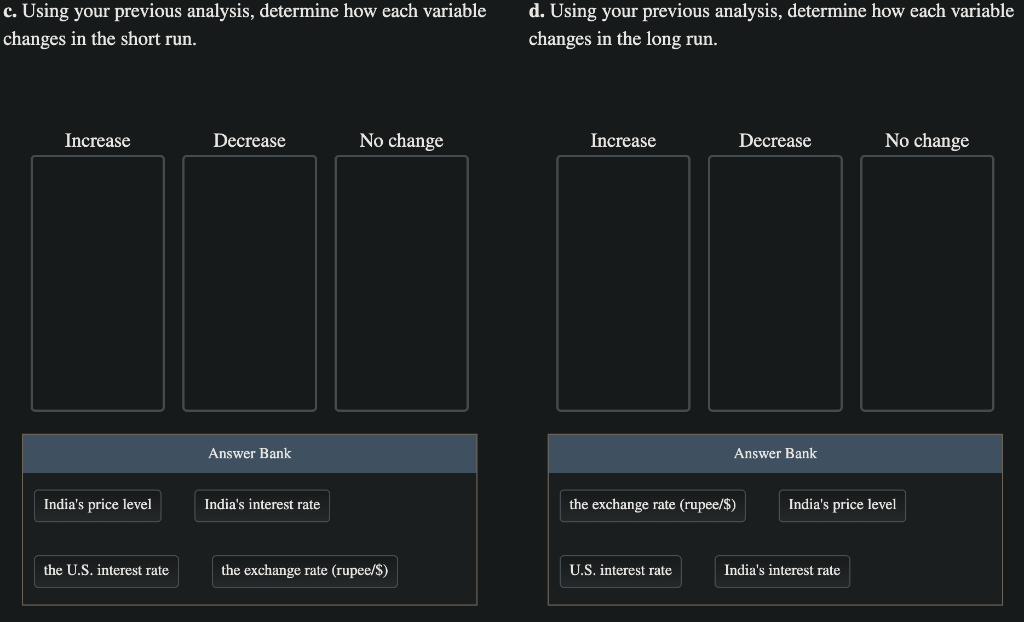

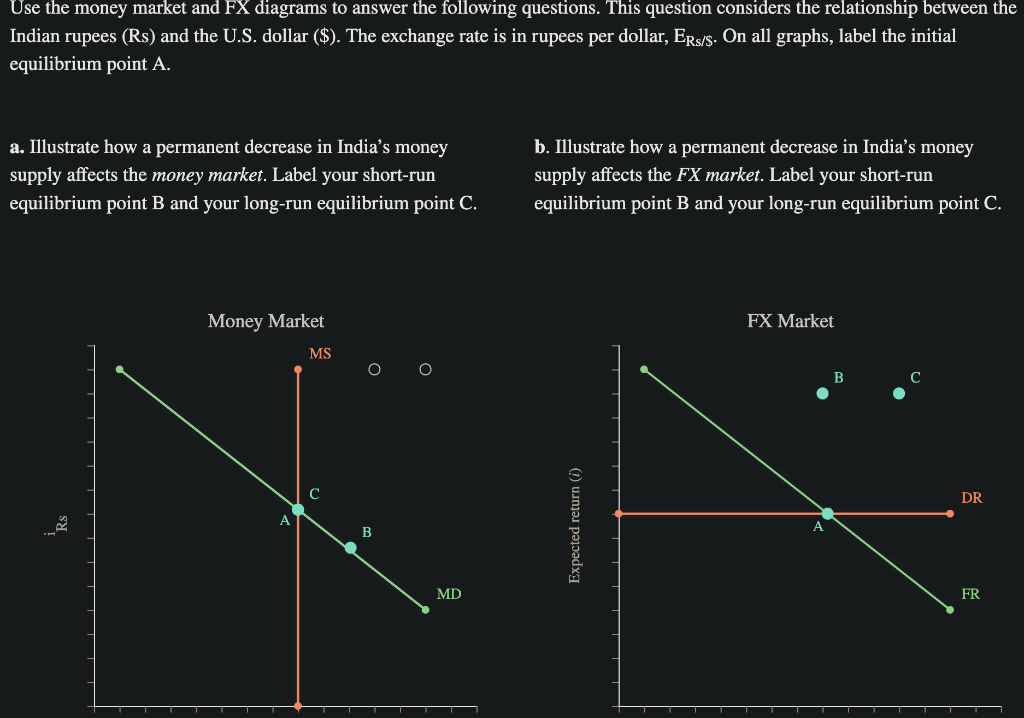

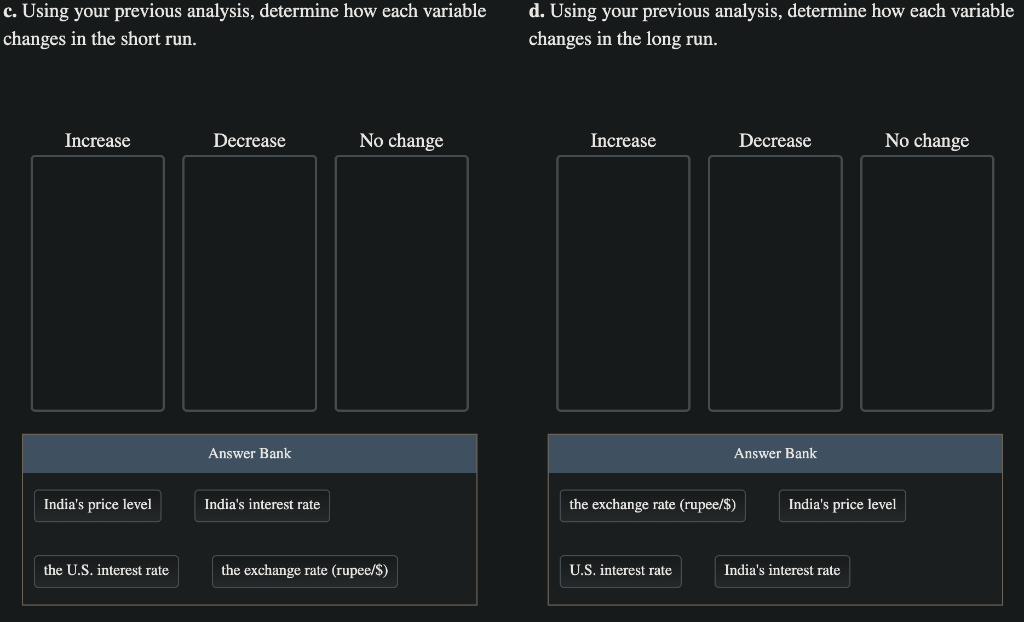

Use the money market and FX diagrams to answer the following questions. This question considers the relationship between the Indian rupees (Rs) and the U.S. dollar ($). The exchange rate is in rupees per dollar, Ers/s. On all graphs, label the initial equilibrium point A. a. Illustrate how a permanent decrease in India's money supply affects the money market. Label your short-run equilibrium point B and your long-run equilibrium point C. b. Illustrate how a permanent decrease in India's money supply affects the FX market. Label your short-run equilibrium point B and your long-run equilibrium point C. Money Market FX Market MS O DR A Expected return () B MD FR T T c. Using your previous analysis, determine how each variable changes in the short run. d. Using your previous analysis, determine how each variable changes in the long run. Increase Decrease No change Increase Decrease No change Answer Bank Answer Bank India's price level India's interest rate the exchange rate (rupee/$) India's price level the U.S. interest rate the exchange rate (rupee/$) U.S. interest rate India's interest rate Use the money market and FX diagrams to answer the following questions. This question considers the relationship between the Indian rupees (Rs) and the U.S. dollar ($). The exchange rate is in rupees per dollar, Ers/s. On all graphs, label the initial equilibrium point A. a. Illustrate how a permanent decrease in India's money supply affects the money market. Label your short-run equilibrium point B and your long-run equilibrium point C. b. Illustrate how a permanent decrease in India's money supply affects the FX market. Label your short-run equilibrium point B and your long-run equilibrium point C. Money Market FX Market MS O DR A Expected return () B MD FR T T c. Using your previous analysis, determine how each variable changes in the short run. d. Using your previous analysis, determine how each variable changes in the long run. Increase Decrease No change Increase Decrease No change Answer Bank Answer Bank India's price level India's interest rate the exchange rate (rupee/$) India's price level the U.S. interest rate the exchange rate (rupee/$) U.S. interest rate India's interest rate