Answered step by step

Verified Expert Solution

Question

1 Approved Answer

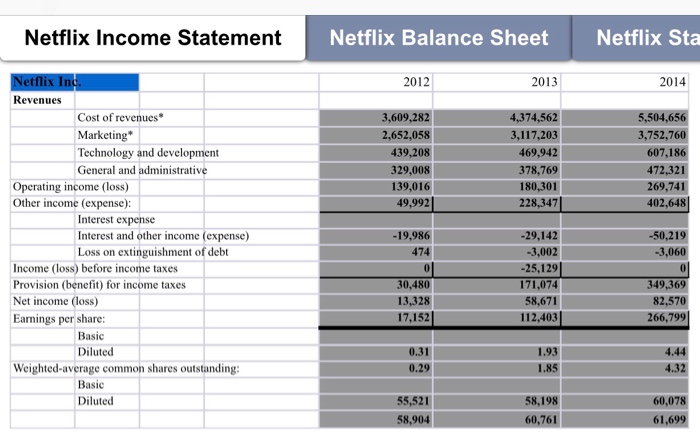

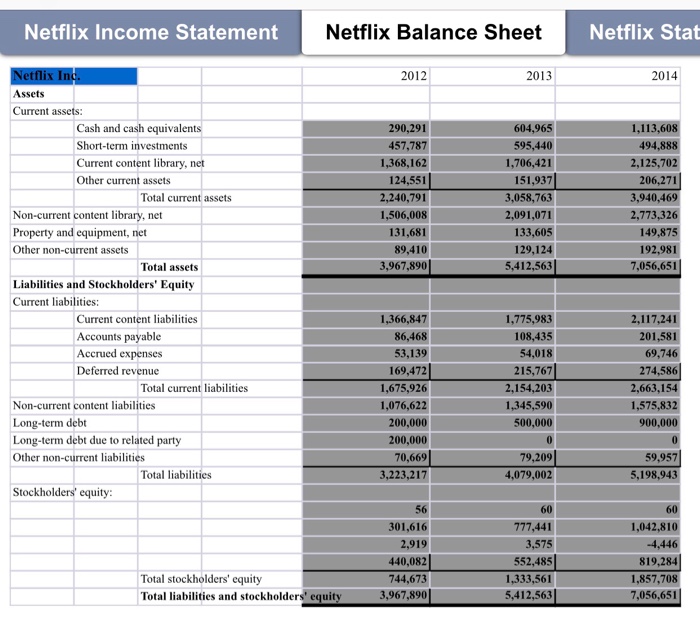

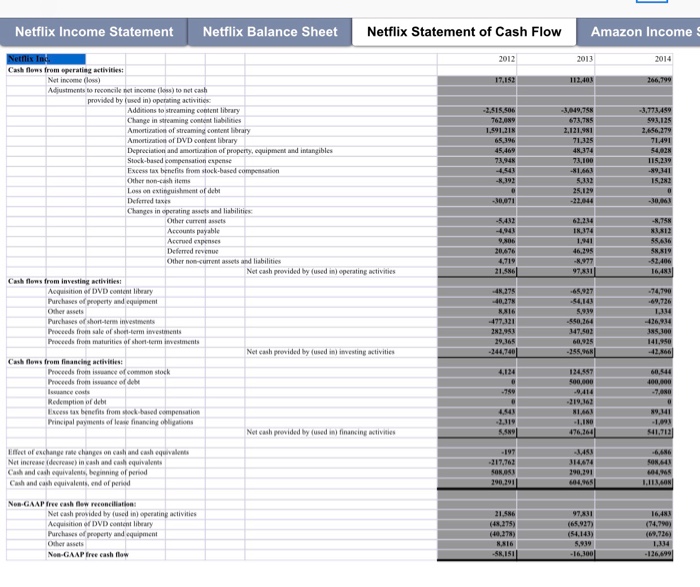

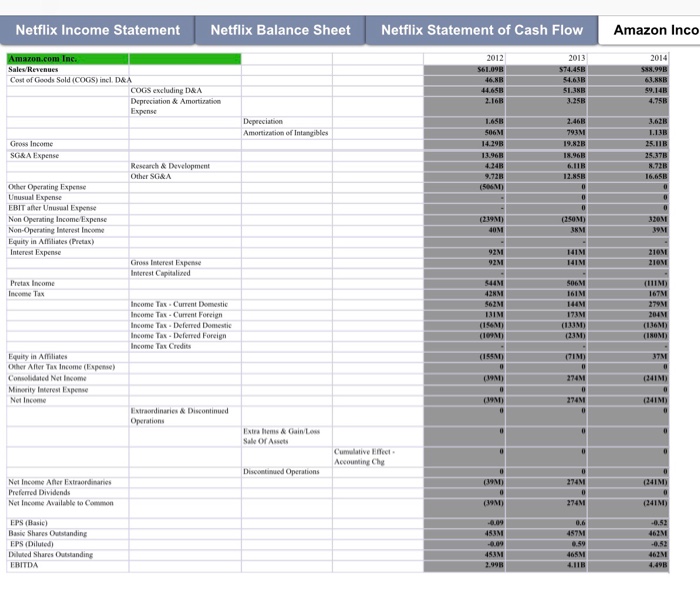

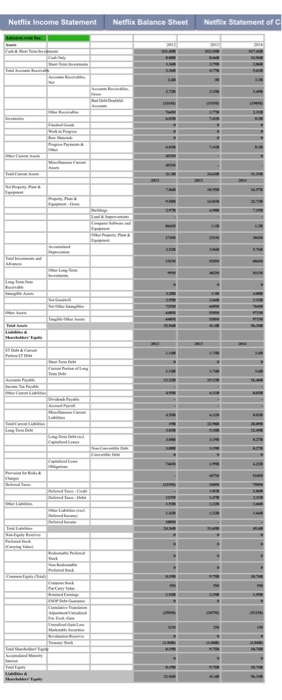

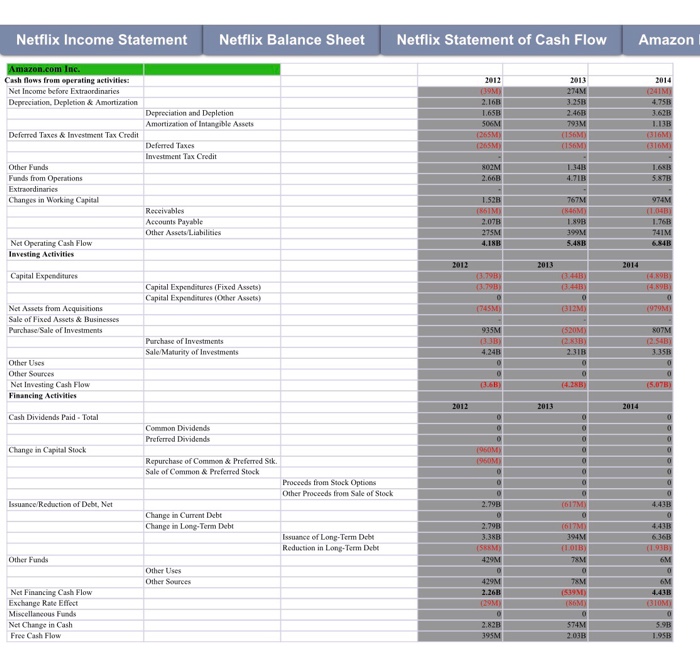

Use the Netflix and Amazon Data Spreadsheet, located in the attached files (pictures) to generate a pro forma forecast and consider what this indicates about

Use the Netflix and Amazon Data Spreadsheet, located in the attached files (pictures) to generate a pro forma forecast and consider what this indicates about the future for these two companies.

Provide the following:

A forecast of Netflix, Inc., and Amazon.com, Inc.'s revenue, costs, and estimated cash flows into the next five years.

The appropriate discount rate for Netflix, Inc., and Amazon.com, Inc.'s forecasted cash flows.

An appropriate risk-adjusted rate of return for use in evaluating an investment in Netflix, Inc., and Amazon.com, Inc.

A determination of the estimated fair market value of 100% of Netflix, Inc., and Amazon.com, Inc.'s equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started