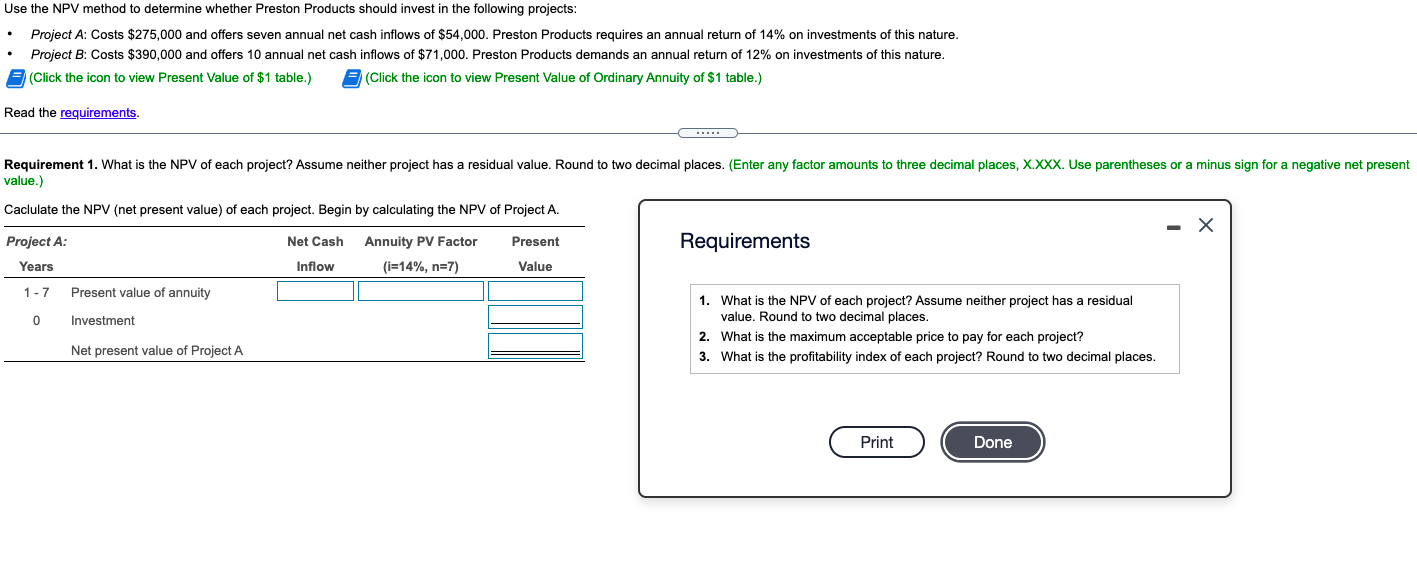

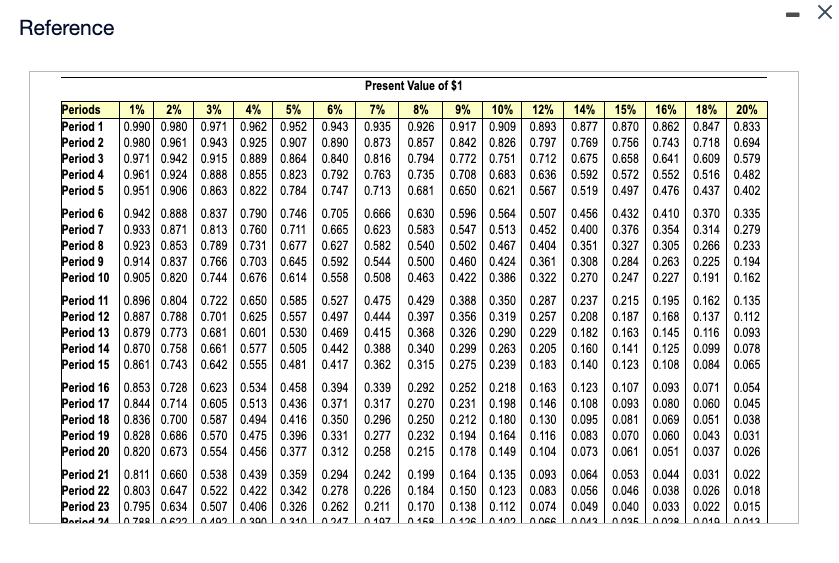

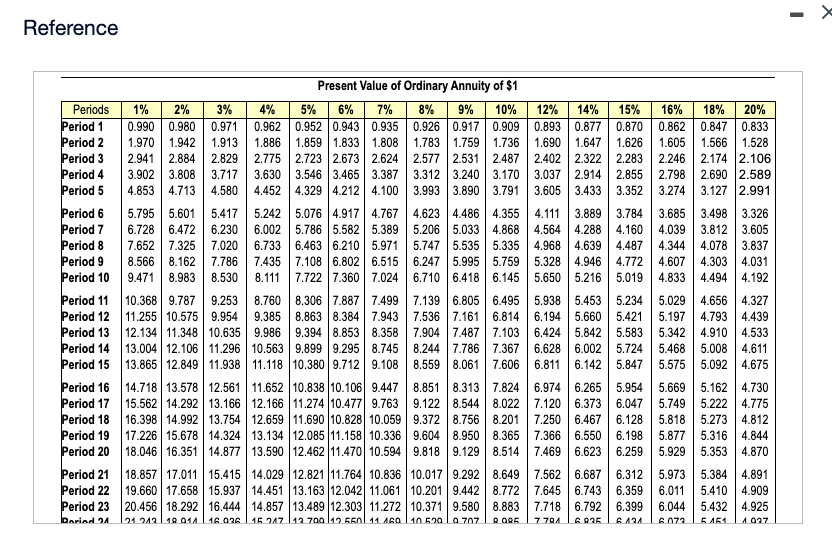

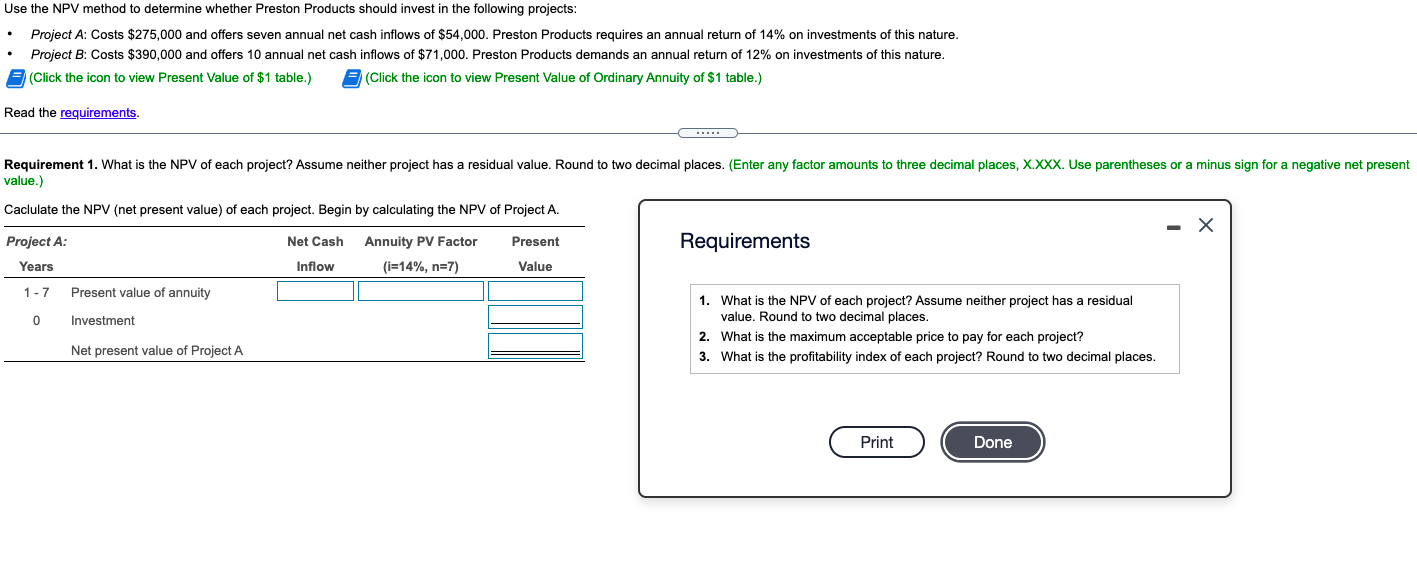

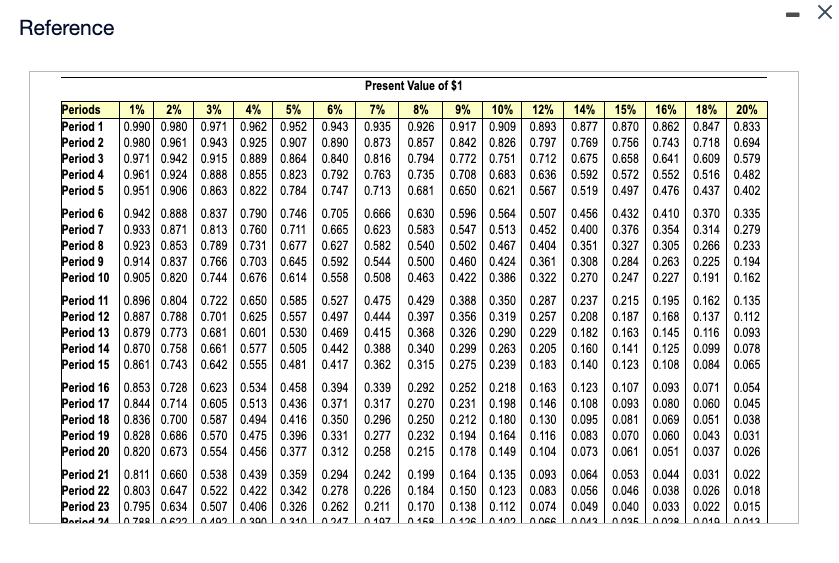

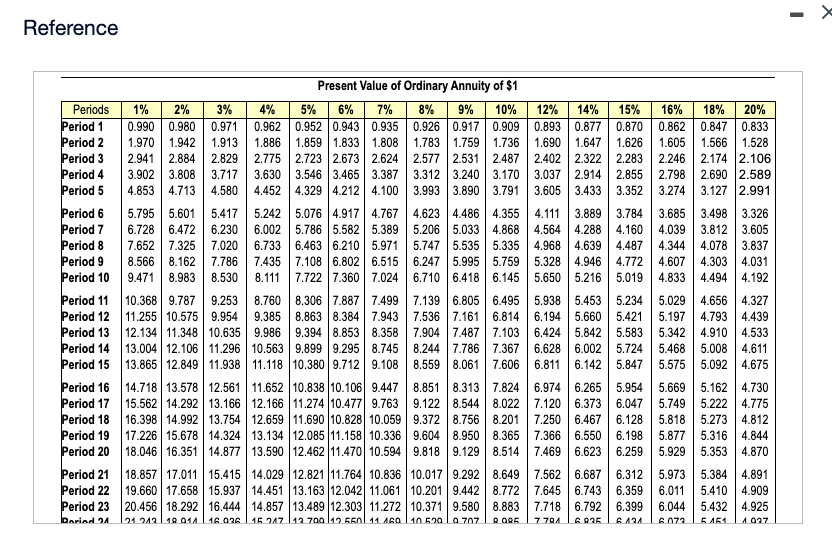

Use the NPV method to determine whether Preston Products should invest in the following projects: Project A: Costs $275,000 and offers seven annual net cash inflows of $54,000. Preston Products requires an annual return of 14% on investments of this nature. Project B: Costs $390,000 and offers 10 annual net cash inflows of $71,000. Preston Products demands an annual return of 12% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Net Cash Present Project A: Years Requirements Annuity PV Factor (i=14%, n=7) Inflow Value 1 - 7 Present value of annuity 0 Investment 1. What is the NPV of each project? Assume neither project has residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. Net present value of Project A Print Done - Reference Present Value of $1 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 9% 10% 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 Periods 1% 2% 3% 4% 5% 6% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 Period 3 0.971 0.942 0.915 0.8890.864 0.840 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 Period 9 0.914 0.837 0.766 0.703 0.645 0.592 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 Period 11 0.896 0.804 0.722 0.650 0.585 0.527 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 Period 16 0.853 0.7280.623 0.534 0.458 0.394 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 Period 18 0.836 0.700 0.587 0.494 0.416 0.350 Period 19 0.828 0.686 0.570 0.475 0.396 0.331 Period 20 0.820 0.673 0.554 0.456 0.377 0.312 Period 21 0.811 0.660 0.538 0.439 0.359 0.294 Period 22 0.803 0.647 0.522 0.422 0.342 0.278 Period 23 0.795 0.634 0.507 0.4060.326 0.262 Dariad 24 799 1 06221 102 200 210 247 12% 14% 15% 16% 18% 20% 0.893 0.877 0.870 0.862 0.847 0.833 0.797 0.769 0.756 0.743 0.7180.694 0.712 0.675 0.658 0.641 0.609 0.579 0.636 0.592 0.572 0.552 0.516 0.482 0.567 0.519 0.497 0.476 0.437 0.402 0.507 0.456 0.432 0.410 0.370 0.335 0.452 0.400 0.376 0.354 0.314 0.279 0.404 0.351 0.327 0.305 0.266 0.233 0.361 0.308 0.284 0.263 0.225 0.194 0.322 0.270 0.247 0.227 0.1910.162 0.287 0.237 0.215 0.195 0.162 0.135 0.257 0.208 0.187 0.168 0.137 0.112 0.229 0.182 0.163 0.145 0.116 0.093 0.205 0.1600.141 0.125 0.099 0.078 0.183 0.140 0.123 0.108 0.084 0.065 0.163 0.123 0.107 0.093 0.071 0.054 0.146 0.108 0.093 0.080 0.060 0.045 0.130 0.095 0.081 0.069 | 0.051 0.038 0.116 0.083 0.070 | 0.060 0.043 0.031 0.104 0.073 0.061 0.051 0.037 0.026 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.339 0.317 0.296 0.277 0.258 0.292 0.270 0.250 0.232 0.215 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.242 0.226 0.211 n 107 0.199 0.184 0.170 n 159 0.1640.135 0.150 0.123 0.138 0.112 0126 n 102 0.093 0.083 0.074 066 0.064 0.053 0.044 0.031 0.022 0.056 0.046 0.038 0.026 0.018 0.049 0.040 0.033 0.022 0.015 nn26 n10 012 Reference 12% 14% 15% 0.893 0.877 0.870 1.690 1.647 1.626 2.402 2.322 2.283 3.037 2.914 2.855 3.605 3.433 3.352 16% 0.862 1.605 2.246 2.798 3.274 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 3.685 4.039 4.344 4.607 4.833 3.498 3.326 3.812 3.605 4.078 3.837 4.303 4.031 4.494 4.192 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 bariad 24 Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.4864.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.1616.814 12.134 11.348 10.635 | 9.986 9.394 8.853 8.358 7.904 7.487 7.103 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 15.562 14.292 13.166 12.166 11.274 10.4771 9.763 9.122 8.544 8.022 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.129 8.514 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 24 212 1 19.014 16 026 15 247 12 700 112 5501 11 460 10 520 10 707 R095 4.111 3.889 3.784 4.564 4.288 4.160 4.968 4.639 4.487 5.328 4.946 4.772 5.6505.216 5.019 5.938 5.453 5.234 6.194 5.660 5.421 6.424 5.842 5.583 6.628 6.002 5.724 6.811 6.142 5.847 6.9746.265 5.954 7.1206.373 6.047 7.250 6.467 6.128 7.366 6.550 6.198 7.469 6.623 6.259 5.029 5.197 5.342 5.468 5.575 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 5.669 5.749 5.818 5.877 5.929 5.1624.730 5.222 4.775 5.273 4.812 5.316 4.844 5.353 4.870 7.5626.687 6.312 7.645 6.743 6.359 7.718 6.792 6.399 7 704 6925 6424 5.973 6.011 6.044 6072 5.384 4.891 5.410 4.909 5.432 4.925 5.151 1027