Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the NPV method to determine whether Root Products should invest in the following projects: Project A: Costs $275,000 and offers seven annual net cash

Use the NPV method to determine whether Root Products should invest in the following projects:

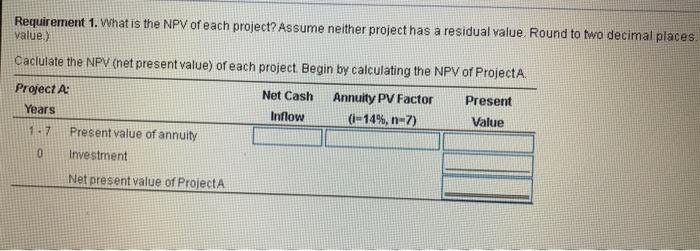

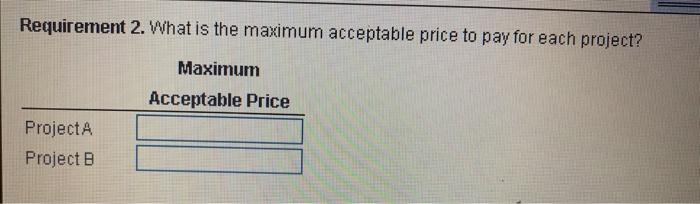

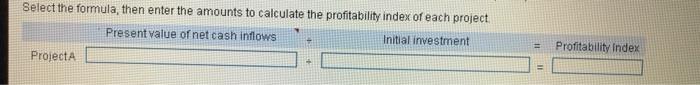

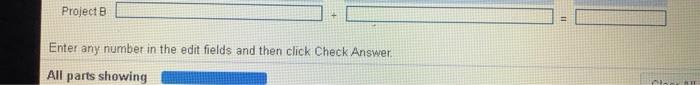

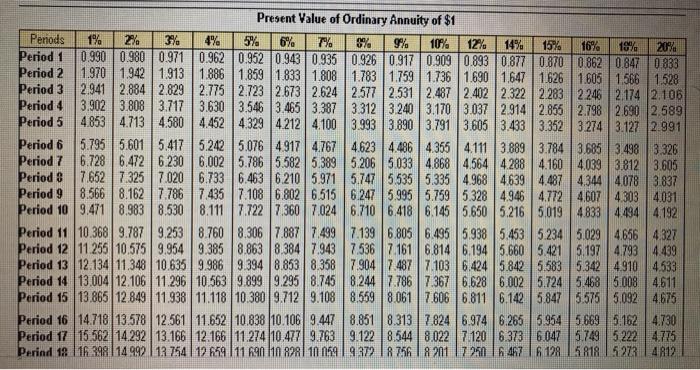

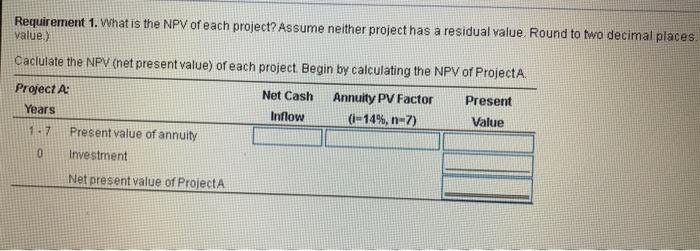

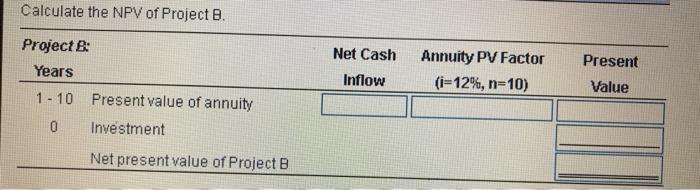

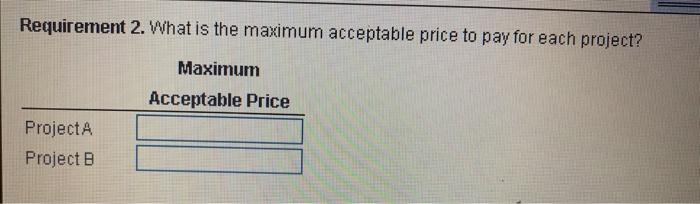

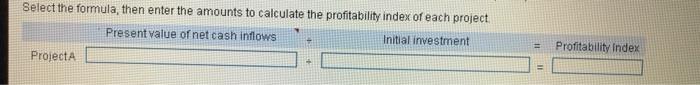

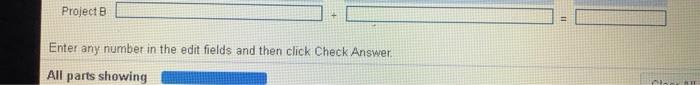

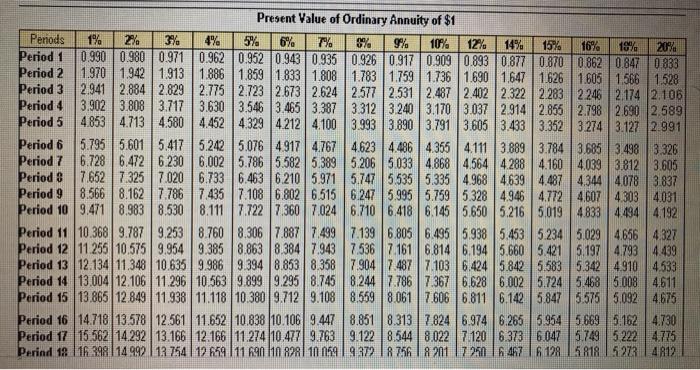

Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places value) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project Project A: Net Cash Annuity PV Factor Present Years Inflow (1-14%, n-7) Value 147 Present value of annuity 0 Investment Net present value of Project A Calculate the NPV of Project B. Project: Years 1 - 10 Present value of annuity 0 Investment Net Cash Inflow Annuity PV Factor (i=12%, n=10) Present Value Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? Maximum Acceptable Price Project A Project B Select the formula, then enter the amounts to calculate the profitability index of each project Present value of net cash inflows Initial investment Profitability Index Project Project Enter any number in the edit fields and then click Check Answer All parts showing Present Value of Ordinary Annuity of $1 Periods 1% 2% 34. 4% 5% 6% 5% 9% 10% 12%. 14%. 15% 16% 18% 20%. Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0362 0.847 0833 Period 2 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1626 1.605 1566 1528 Period 3 2941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.4022 322 2.283 2246 2.174 2.105 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3312 3 240 3.170 3.037 2.914 2.855 2.798 2.690 2,589 Period 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.9933.890 3.791 3.605 3.433 3.352 3274 3.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.8893.784 3.685 3.498 3.326 Period 7 6.728 6.472 6.230 6.0025.786 5.582 5.389 5206 5.033 4.868 4564 4.288 4.160 4.039 3.812 3.605 Period 3 7.652 7.325 7.020 6.733 6.463 6.210 5.9715.747 5535 5.335 4.968 4639 4487 4344 4.078 3.837 Period 9 8.566 8.1627.786 7.435 7.108 6.802 6,515 6247 5.995 5.759 5328 4.946 47724.607 4303 4031 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6145 5.650 5.216 5.019 4833 4494 4.192 Period 11 10.3689.787 9.2538.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4327 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7536 7.161 6814 6.194 5.660 5.421 5.197 4.793 4.439 Period 13 12.134 11.348 10.6359.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4910 4533 Period 14 13.004 12.106 11.296 10563 9.899 9.295 8.745 8.244 7.786 7.3676.6286.002 5.724 5468 5.008 4611 Period 15 13 865 12 849 11.938 11.118 10.380 9.712 9.108 8.5598.061 7.606 6.811 6.142 5847 5.575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.31378246.974 6.265 5954 5669 5.162 4.730 Period 17 15562 14.292 13.166 12.166 11.274 10.477 9763 9.122 8544 8.022 7120 6373 6.047 5.749 5222 4.775 Perind 18 16 398 14992 | 13 754 12 659 11 690 110 828 10 059 9 372 1 8 756 8 2017 250 487 6 128 5 8185273 4812 Project A: Costs $275,000 and offers seven annual net cash inflows of $52,000. Rouse products require an annual return of 14% on investment of this nature.

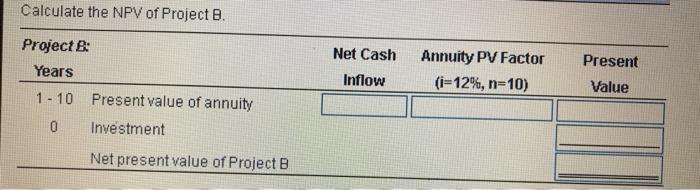

Project B: Costs $385,000 and offers 10 annual net cash inflows of $74,000. Rouse products demands an annual return of 12% on investments of this nature.

Calculate the NPV of each project (Round to two decimal places)

Project A

1-7years* Annuity PV Factor (i=14%, n=7)*

Project B

1-7 years* Annuity PV Factor (i=12%, n=7)*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started