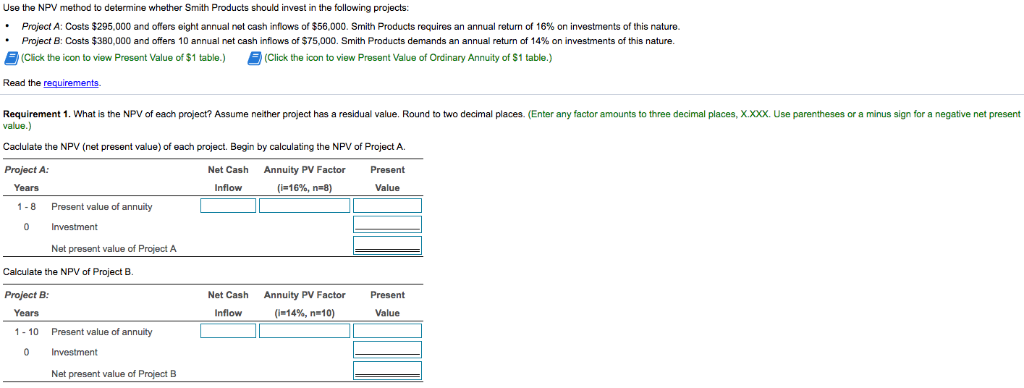

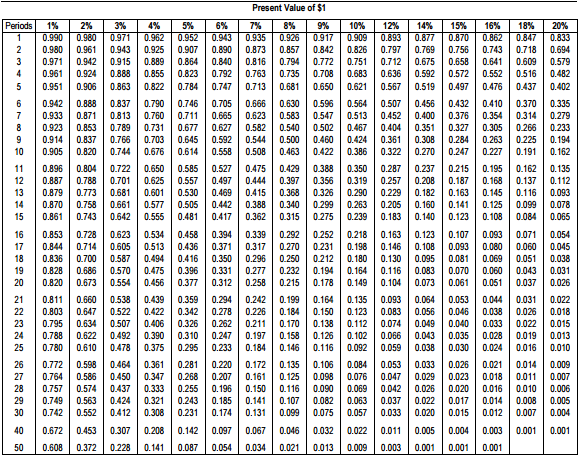

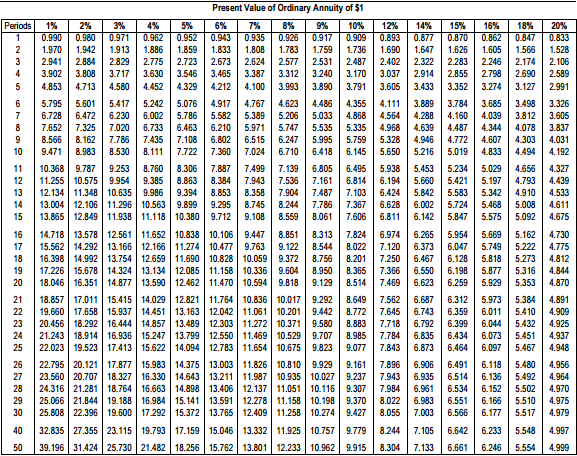

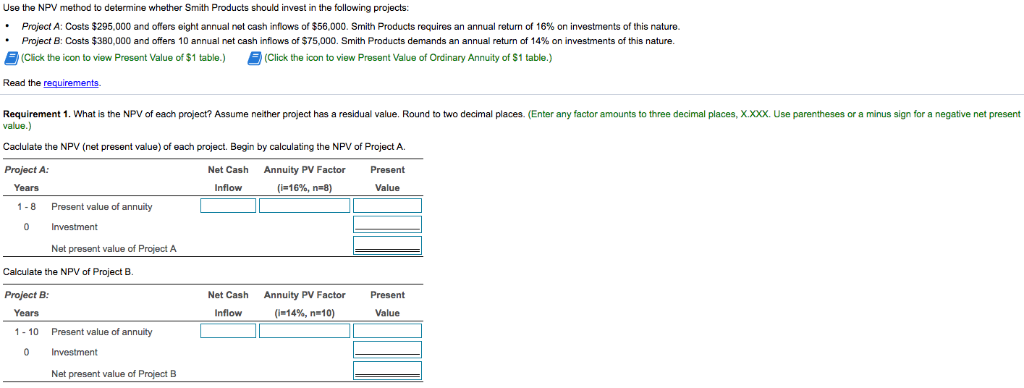

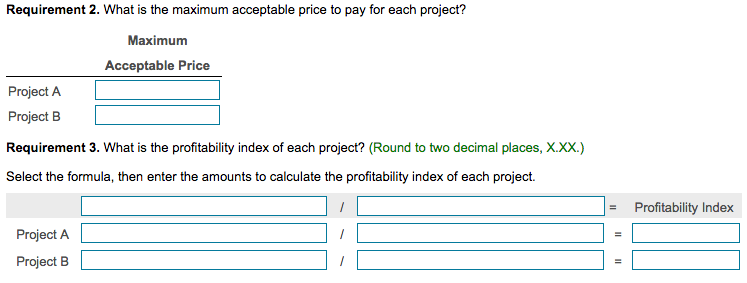

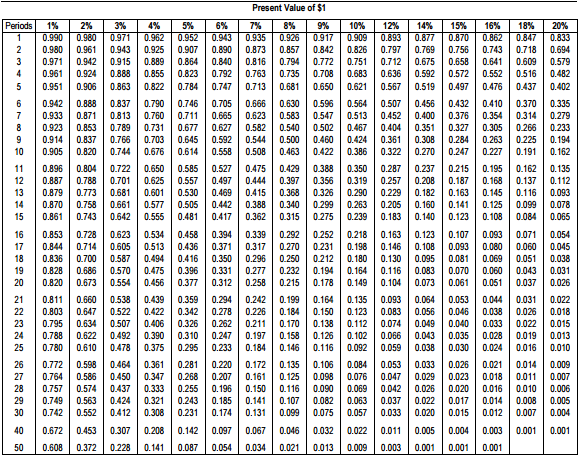

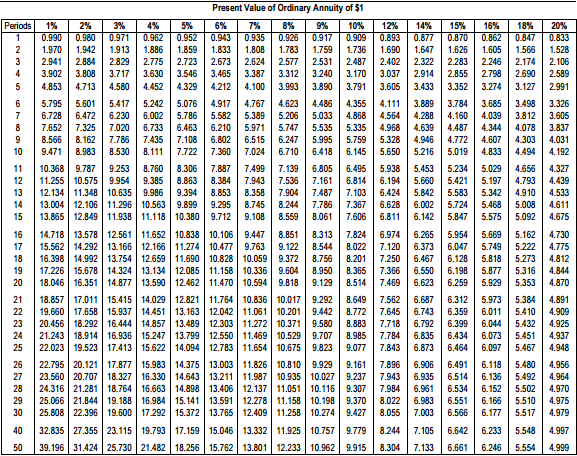

Use the NPV method to determine whether Smith Products should invest in the following projects: Project A: Costs $295,000 and offers eight annual net cash inflows of $56,000. Smith Products requires an annual return of 16% on investments of this naturo. Project B: Costs $380,000 and offers 10 annual net cash inflows of $75,000. Smith Products demands an annual return of 14% on investments of this nature (Click the icon to view Present Value of $1 table.) (Click the icon to view Prosent Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Net Cash Inflow Annuity PV Factor (i=16%, n=8) Present Value Project A: Years 1-8 Present value of annuity 0 Investment Net present value of Project A Calculate the NPV of Project B. Net Cash Inflow Annuity PV Factor ( 114%, n=10) Present Value Project B: Years 1 - 10 Present value of annuity 0 Investment Net present value of Project B Requirement 2. What is the maximum acceptable price to pay for each project? Maximum Acceptable Price Project A Project B Requirement 3. What is the profitability index of each project? (Round to two decimal places, X.XX.) Select the formula, then enter the amounts to calculate the profitability index of each project. = Profitability Index Project A Project B Periods 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 5% 0.952 0.907 0.864 0.823 0.784 6% 0.943 0.890 0.840 0.792 0.747 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.650 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0225 0.475 0.444 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.135 0.123 0.112 0.229 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.811 0.803 0.795 0.788 0.780 0.772 0.764 0.757 0.749 0.742 0.672 0.608 2% 0.980 0.961 0.942 0.924 0.905 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.647 0.634 0.622 0.610 0.598 0.586 0.574 0.563 0.552 0.453 0.372 0.577 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.064 0.056 0.049 0.043 0.038 0.033 18% 20% 0.847 0.833 0.7180.694 0.609 0.579 0.516 0.482 0.437 0.402 0.370 0.335 0.314 0.279 0.266 0.233 0.194 0.191 0.162 0.162 0.135 0.137 10.112 0.116 0.093 0.099 0.078 0.084 0.065 0.071 0.054 0.060 0.045 0.051 0.038 0.043 0.031 Present Value of $1 7% 8% 9% 0.935 0.926 0.917 0.873 0.8570.842 0.816 0.794 0.772 0.763 0.735 0.708 0.713 0.681 0.666 0.630 0.596 0.623 0.583 0.547 0.5820.540 0.502 0.544 0.500 0.460 0.508 0.463 0.422 0.429 0.388 0.397 0.356 0.415 0.368 0.326 0.388 0.340 0.299 0.362 0.315 0.275 0.339 0.292 0.317 0.270 0.250 0.232 0.215 0.178 0.199 0.184 0.150 0.170 0.158 0.126 0.146 0.116 0.172 0.135 0.106 0.161 0.125 0.098 0.150 0.116 0.090 0.141 0.107 0.082 0.131 0.099 0.075 0.067 0.046 0.034 0.021 0.013 15 0.252 15% 16% 0.870 0.862 0.756 0.743 0.658 0.641 0.572 0.552 0.497 0.476 0.432 0.410 0.376 0.354 0.327 0.305 0.284 0.263 0.247 0.227 0.215 0.195 0.187 0.168 0.163 0.145 0.141 0.125 0.123 0.108 0.107 0.093 0.093 0.080 0.081 0.069 0.070 0.060 0.061 0.051 0.053 0.044 0.046 0.038 0.040 0.033 0.035 0.028 0.030 0.024 0.026 0.021 0.023 0.018 0.0200.016 0.017 0.014 0.015 0.012 0.004 0.003 0.001 0.001 0.605 0.587 0.296 0212 19 0.570 0.277 0.194 0258 0.037 20 21 0.026 0136 0.522 0.507 0.492 0.478 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.093 0.083 0.074 0.066 0.059 0.053 0.047 0.042 0.037 0.033 0.011 0.003 019 Q.102 0.184 0.092 0.464 0.031 0.026 0.022 0.019 0.016 0.014 0.011 0.010 0.008 0.007 0.001 0.361 0.347 0.333 0.321 0.308 0.208 0.141 0.029 0.022 0.018 0.015 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.001 0.450 0.437 0.424 0.412 0.307 0228 0.084 0.076 0.069 0.063 0.057 0.022 0.009 0.196 0.185 0.174 0.097 0.054 0.025 0.022 0.020 0.005 0.001 0.142 0.087 3.889 6 20 3.812 7.02. ' 6,938 S 5234 s 50 5.421 4.793 | 6 62 Present Value of Ordinary Annuity of $1 | Periods | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | E | 10 | 11 | 14 | 15 | 16 | 18 | 20 | 0.990 | 0.920 | 0.971 | 0.962 | 0.952 | 0.243 | 0.935 | 0.92 | 0.911 | 0.909 | 0.893 | 0.71 | 0.870 | 0.862 | 0.347 | 0.333 - 1.970 | 1.942 | 1.913 | 1.386 1.233 | 1.808 | 1.73 | 1.759 | 1.736 | 1.690 | 1.E47 | 1.528 | 1.605 - 1.565 | 1.528 - 2.941 2884 | 2829 2.775 2.673 2.624 | 2577 | 2,531 | 2.487 | 2.402 | 2.322 2.233 | 2 246 2,174 | 2,106 3.902 | 3,803 | 3.717 3.337 3.312 3 240 | 3.170 3.037 | 2.914 | 2.855 | | 2793 2,590 | 2.500 4.853 - 4.713 4.580 3.993 3.390 3.791 3.605 | 3.433 3.352 | 3.274 3,127 - 2.991 5.795 - 5.601 | 5.417 4.485 4.355 4.111 3.784 3.498 3,326 6.728 - 6.472 6 230 5.033 4868 4.564 4.238 4.160 - 3.605 7.652 7.325 5.747 5,535 5.335 4.968 4.639 4.487 4.078 - 3.337 8.566 | 8 162 | 1.725 5 995 5.759 5.328 4.46 4.772 - 4.031 9.471 | 8,983 - 8 530 | 8.111 | 7.722 6.710 | 6.418 | 6.145 5.650 | 5 216 5.019 4.494 4.192 | 10.358 9.787 | 9 253 | 8.750 | 3.306 7.139 6.805 | 4.327 11.255 10.575 | 9 954 - 9.305 | 8.863 7.535 1.161 6.814 6.194 5.197 - 4.439 12.134 | 11.348 | 10.635 | 9.986 | 9.394 8.253 8.358 | 7.904 7.487 7.103 6.424 5 242 5.583 5.342 4.910 4.593 14 | 13.004 | 12.108 | 11.298 | 10.53 | 9.899 | 9.295 | 8.745 | 8,244 | 7,785 1.367 6.002 5.724 - 5.463 5.008 - 4.511 15 | 13.255 | 12.849 | 11.938 | 11.118 | 10.380 | 9.712 | 9.108 | 8,559 | 8.061 | 7.606 | 6.811 | 6.142 | 5.847 - 4.675 | 14.718 | 13.578 | 12,561 | 11.552 | 10.333 | 10.106 | 9.447 | 2 851 | 8 313 6.974 | 6.255 5.954 4.730 15.552 14.292 | 13.168 | 12.15 T11.274 10.471 - 9.763 | 9.12 7.120 6.373 6.047 4.775 16.398 | 14.992 | 13,754 | 12 559 | 11.590 | 10.828 | 10.059 | 9.372 8.755 .201 1.250 6.467 6.128 4.812 19 17.226 | 15.678 | 14.324 | 13.134 | 12.085 | 11.158 | 10.236 | 2.604 8 950 8.365 7.366 6.550 6.198 4.844 | 18.046 | 16.351 | 14.877 | 13.590 | 12.462 | 11.470 | 10.594 | 9.818 9.129 1.469 4.370 18.857 | 17.011 | 15.415 | 14.029 | 12.821 | 11.784 | 10.236 | 10.017 7.562 4.391 19.650 | 17.558 | 15.937 | 14.451 | 13.163 | 12.042 | 11.051 | 10.201 9.442 7.645 4.909 20.456 | 18.292 | 16.444 | 14.357 | 13.489 | 12.303 | 11.272 | 10.371 9 580 1.718 4.925 21.243 | 18.914 | 16.936 | 15 247 | 13.799 | 12.550 | 11.469 | 10.529 9.707 7.784 4,937 22.023 | 19.523 | 17.413 15.522 | 14.094 12.783 11.654 | 10.675 | 9.323 7.843 5.467 4.948 22.795 20.121 | 17.877 | 15.983 | 14.375 | 13.003 11.226 | 10.810 9.161 7.896 6.906 5.420 4.956 23.550 | 20.707 | 18.327 | 16.330 | 14.643 | 13.211 | 11.987 | 10.935 | 10.027 | 9.237 | 7.943 6.935 4.984 24.316 | 21.231 | 18764 | 16.563 | 14.398 | 13.406 | 12.137 | 11.051 | 10.116 | 9.307 | 7.984 6.051 6 534 6.152 5 52 - 4.970 | 25.056 | 21.844 | 19.188 | 16.984 | 15.141 | 13.591 | 12.278 | 11.158 | 10.198 | 9.370 | 3.022 | 6.983 6.551 6.165 5.510 - 4.75 | 25.208 | 22.398 | 19,600 | 11 292 | 15.372 | 13.765 | 12.409 | 11.258 | 10.274 | 9.427 | 8.055 | 7.003 6.566 6.171 4.979 32.835 | 27.355 | 23.115 | 19.793 | 17.159 | 15.046 | 13.332 | 11.925 | 10.757 | 9.779 | 8,244 | 1.105 6.642 6.233 5,548 4.997 | 39.196 | 31.424 | 25.730 | 21.482 | 18. 256 | 15.762 | 13.801 | 12.233 | 10.962 | 9.915 | 8.304 | 7.133 , | 6.661 | 6,246 | 5.554 | 4.999 7.324 8.544 2 8 9 8 5.492 5.517