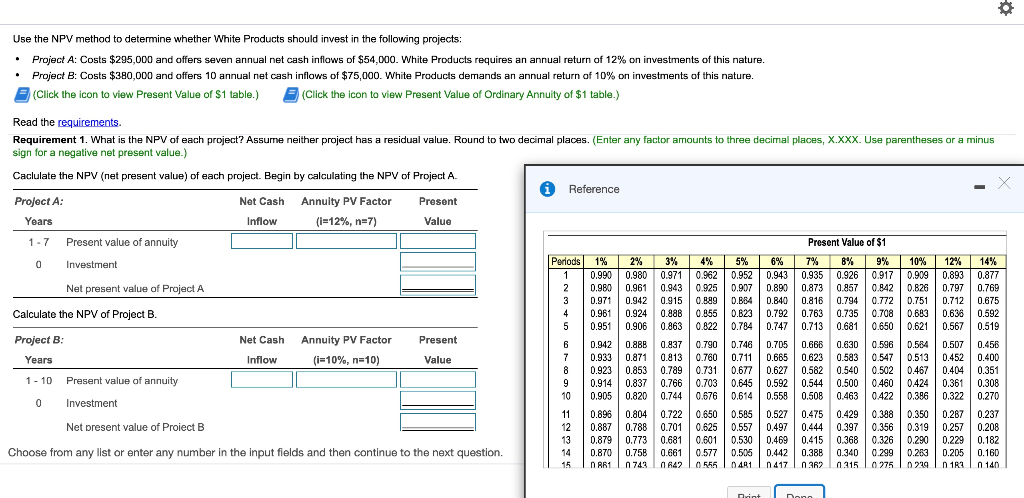

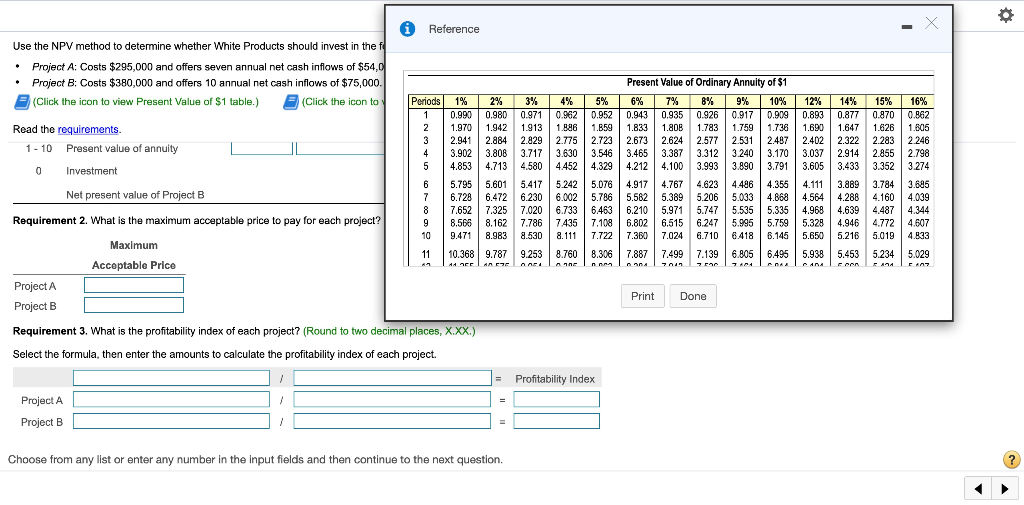

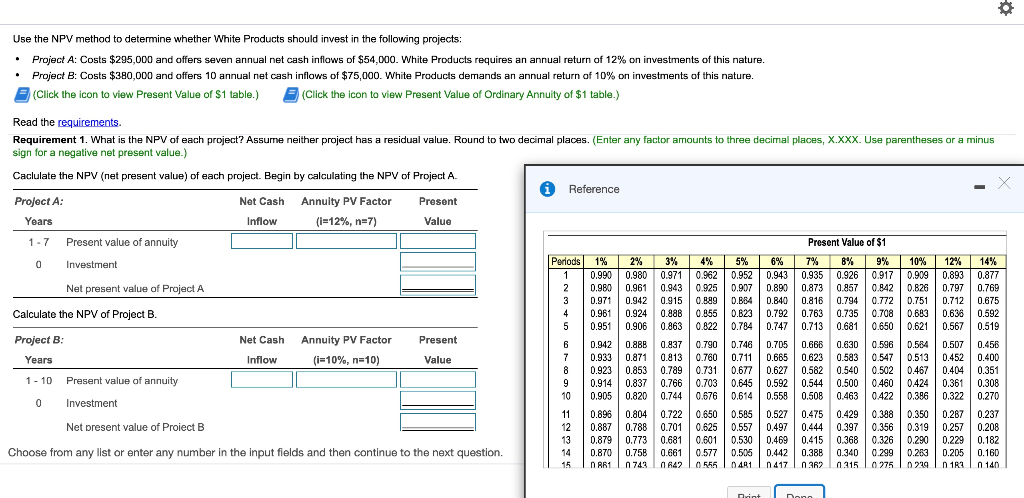

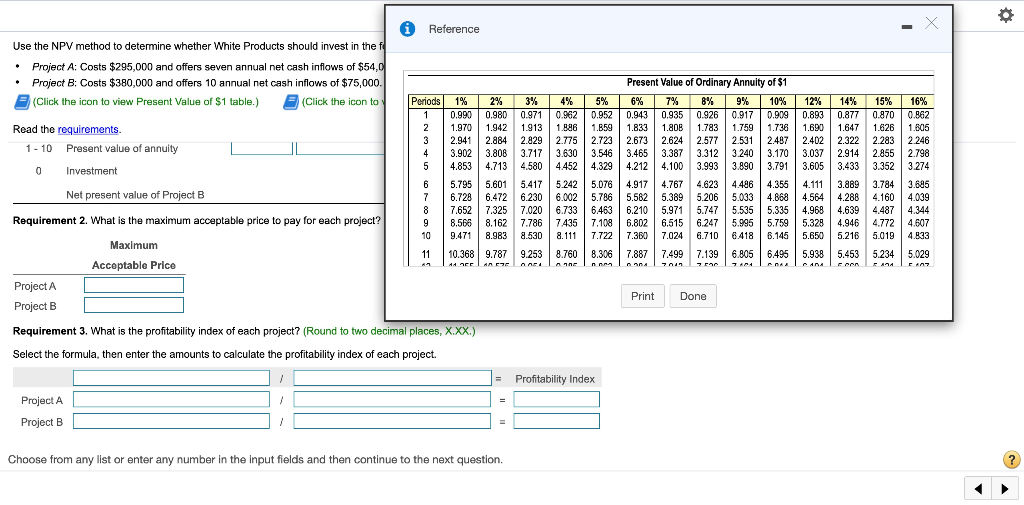

Use the NPV method to determine whether White Products should invest in the following projects: Project A: Costs $295,000 and offers seven annual net cash inflows of $54,000. White Products requires an annual return of 12% on investments of this nature. Project B: Costs $380,000 and offers 10 annual net cash inflows of $75,000. White Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A i Reference Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, n=7) Value 1 - 7 Present value of annuity Present Value of $1 0 Investment Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% | 0.990 0.980 0.971 0.962 0.952 0.9430.935 0.926 0.917 0.909 0.893 0.877 Net present value of Project A 2 0 .9800.961 0.943 0.925 0.907 0.890 0.873 0.8570.842 0.826 0.797 0.769 3 0.971 0.942 0.915 0.889 0.884 0.840 0.816 0.794 0.772 0.751 0.712 0.675 Calculate the NPV of Project B. 0.961 0.924 0.888 0.855 0.623 0.792 0.763 0.735 0.708 0.683 0.638 0.592 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 Project B: Net Cash Annuity PV Factor Present 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.54 0.507 0.456 Years Inflow (i=10%, n=10) Value 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.5830.547 0.452 0.400 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 1-10 Present value of annuity 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 O Investment 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 Net present value of Proiect B 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 Choose from any list or enter any number in the input fields and then continue to the next question. 14 0.870 0.750 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 15 R1 In 7430 642 0555 0 481 1 0 417 0362 0315102750229 n 182 In 140 Dint I Dono O 0 Reference Use the NPV method to determine whether White Products should invest in the f Project A: Costs $295,000 and offers seven annual net cash inflows of $54,0 Project B: Costs $380,000 and offers 10 annual net cash inflows of $75,000. (Click the icon to view Present Value of $1 table.) (Click the icon to Read the requirements. 1-10 Present value of annuity 0 Investment Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.9090.893 0.877 0.870 0.862 1.970 1.942 1.913 1.886 1.859 1.833 1.80B 1.783 1.759 1.736 1.690 1.647 1.628 1.805 | 2.9412.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 3.685 6.728 6.472 6.230 6.002 5.786 5.562 5.389 5.033 4.868 4.564 4.288 4.160 4.039 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4487 4.344 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.9955.759 5.3284.946 4.772 4.607 10 9.471 8.983 8.530 8.111 7.722 7.380 7.024 6.710 6.418 8.145 5.650 5.216 5.019 4.833 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.1396.805 6.495 5.9385.453 5.234 5.029 A1 ACE TANZANInne Inn 707 17ANTALANA CON LA FA7 Net present value of Project B 5.206 Requirement 2. What is the maximum acceptable price to pay for each project? Maximum Acceptable Price L Project A Project B Print Done Requirement 3. What is the profitability index of each project? (Round to two decimal places, X.XX.) Select the formula, then enter the amounts to calculate the profitability index of each project. = Profitability Index Project A Project B Choose from any list or enter any number in the input fields and then continue to the next