Question

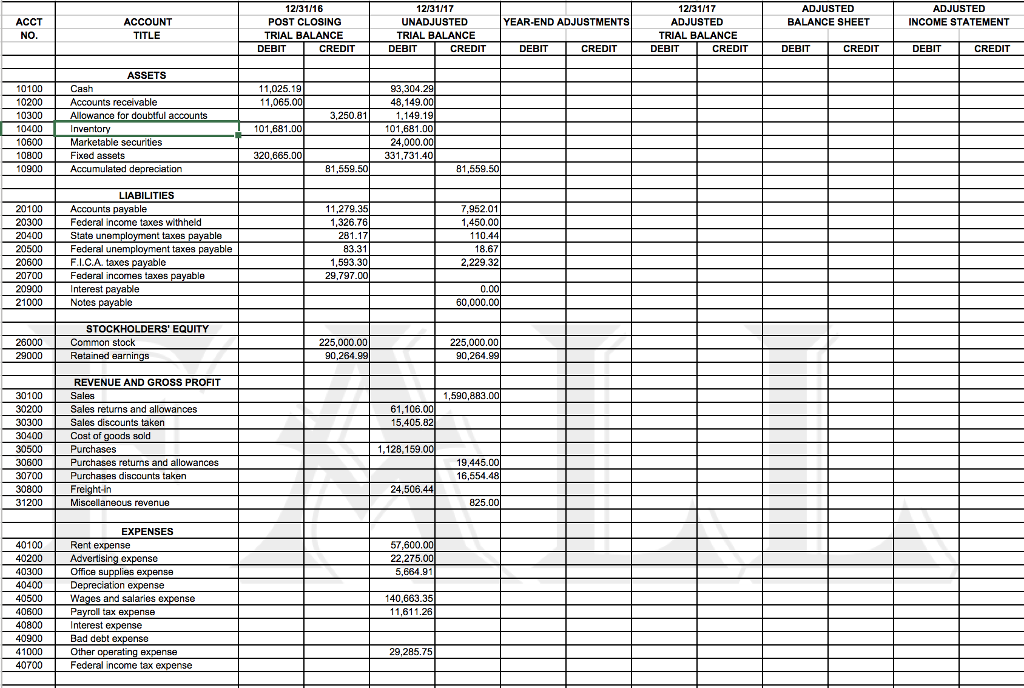

Use the numbers provided to prepare the following adjusting entries, please explain the reasoning. Thank you. Ending Inventory: Inventory and cost of sales adjustment: Waren

Use the numbers provided to prepare the following adjusting entries, please explain the reasoning. Thank you.

Ending Inventory: Inventory and cost of sales adjustment: Waren uses the periodic inventory method. A physical inventory was taken at midnight on December 31, 2017. The cost basis of the inventory on hand is $191,967.00. Adjust the inventory balance and close out the purchase and related accounts to cost of sales. (see pages 77-79 in the SUA Reference Manual.)

Audit Adjustments: The auditors found 2 transactions that were not recorded at December 31, 2017. Make adjusting entries for each of these transactions using the appropriate Excel functions.

i.Waren Sports purchased a new Ford F-150 truck for $25,000 on December 21, 2017. They financed 100% of the purchase from Bank of America under a 5-year, $25,000 note at 4% interest. The first payment is due January 31, 2018. (Do not record depreciation for 2017.) Record the purchase of the truck and accrue interest.

ii.Waren Sports sold $12,000 of football inventory to San Diego State University on December 31, 2017. SDSU signed a promissory note to pay for the items in six months plus interest at 6%.

To record this entry you will need to insert a new row and add a new account, 10500 Notes Receivable, to the yearend worksheet. Because the bad debt expense adjustment (#3 above) did not include this item, you need to include an adjusting entry to add 0.7% of this item to the bad debt expense. No inventory or Cost of Goods Sold adjustment is necessary because Waren uses the periodic inventory method and the items were excluded from the physical count.

12/31/16 POST CLOSING 12/31/17 UNADJUSTED TRIAL BALANCE ADJUSTED BALANCE SHEET ACCT YEAR-END ADJUSTMENTS INCOME STATEMENT ACCOUNT TITLE ADJUSTED TRIAL BALANCE TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT ASSETS 11,025.19 receivable 4,1440 Allowance for doubtful accounts Inventory Marketable secunities Fixed assets Accumulated depreciation 3,250.81 10300 10400 101,681.00 101,681.00 24,000.00 0800 10900 320,665.00 LIABILITIES 7,952.01 20300 20500 X.HX3 I orka ina@# kgda; rykk 21000 Notes payable Federal income taxes withheld Federal unemployment taxes payable 29,797.00 60,000.00 STOCKHOLDERS' EQUITY 26000 29000 Common stock 225,000.00 REVENUE AND GROSS PROFIT Sales 30100 1,590,883.00 30300 30400 30500 30600 30700 Sales discounts taken 15,405.82 Purchases Purchases returns and allowances Purchases discounts taken 1,128,159.0 19,445.00 16,554.48 24,506.44 Miscellanecus revenue 825.00 EXPENSES Rent expense Advertising expense 40400 40500 40600 40800 40900 on Wages and salaries expense Payroll tax nterest expense Bad debt expense 140,663.35 12/31/16 POST CLOSING 12/31/17 UNADJUSTED TRIAL BALANCE ADJUSTED BALANCE SHEET ACCT YEAR-END ADJUSTMENTS INCOME STATEMENT ACCOUNT TITLE ADJUSTED TRIAL BALANCE TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT ASSETS 11,025.19 receivable 4,1440 Allowance for doubtful accounts Inventory Marketable secunities Fixed assets Accumulated depreciation 3,250.81 10300 10400 101,681.00 101,681.00 24,000.00 0800 10900 320,665.00 LIABILITIES 7,952.01 20300 20500 X.HX3 I orka ina@# kgda; rykk 21000 Notes payable Federal income taxes withheld Federal unemployment taxes payable 29,797.00 60,000.00 STOCKHOLDERS' EQUITY 26000 29000 Common stock 225,000.00 REVENUE AND GROSS PROFIT Sales 30100 1,590,883.00 30300 30400 30500 30600 30700 Sales discounts taken 15,405.82 Purchases Purchases returns and allowances Purchases discounts taken 1,128,159.0 19,445.00 16,554.48 24,506.44 Miscellanecus revenue 825.00 EXPENSES Rent expense Advertising expense 40400 40500 40600 40800 40900 on Wages and salaries expense Payroll tax nterest expense Bad debt expense 140,663.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started