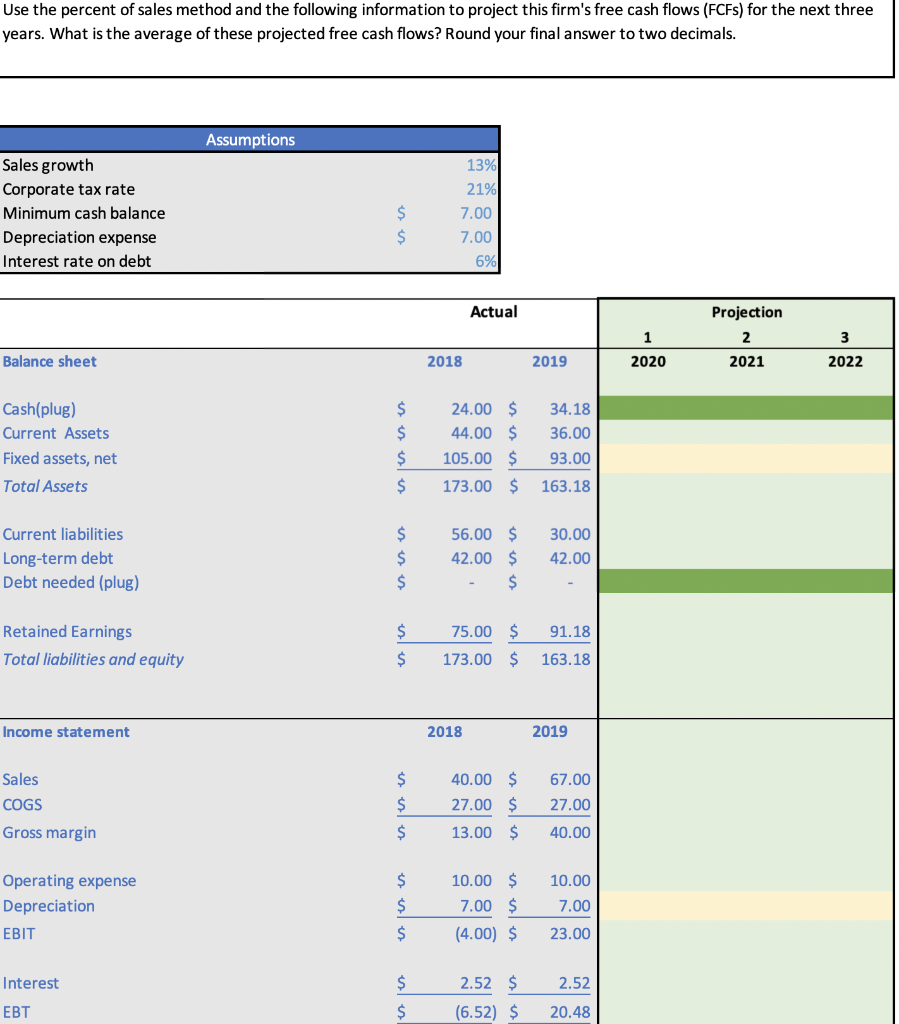

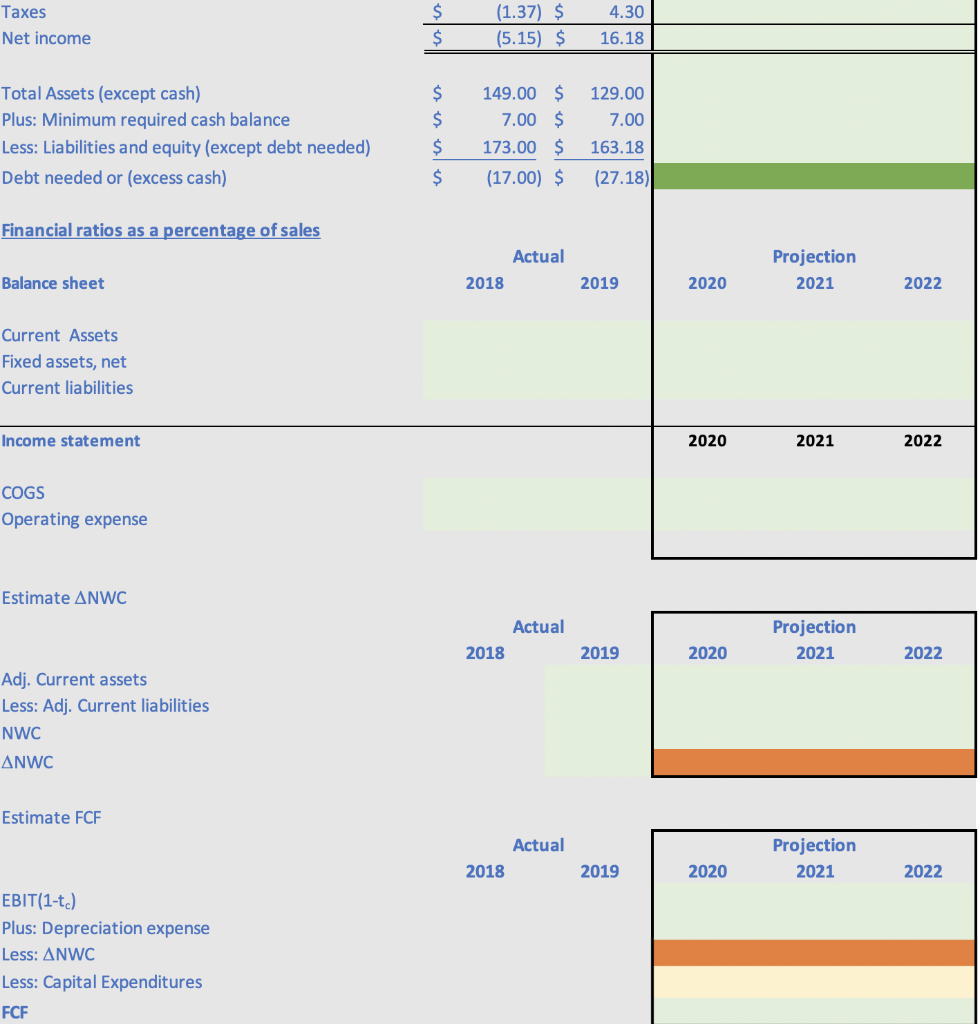

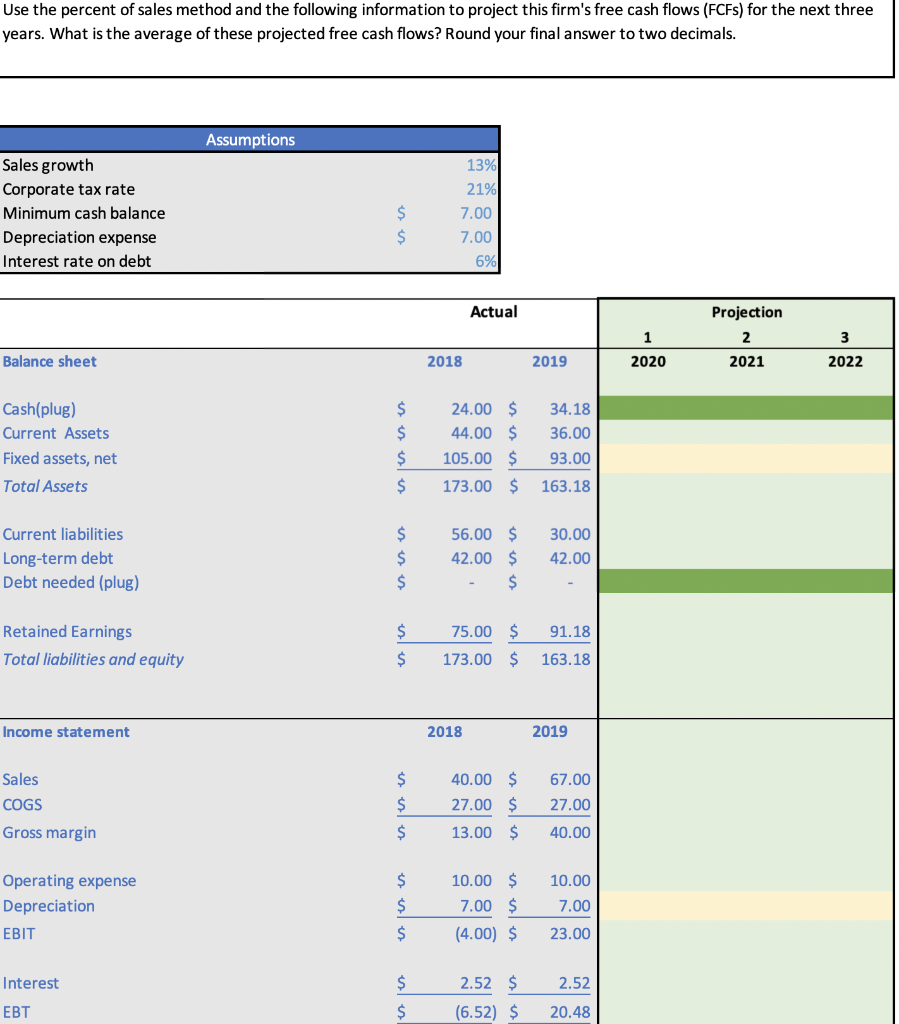

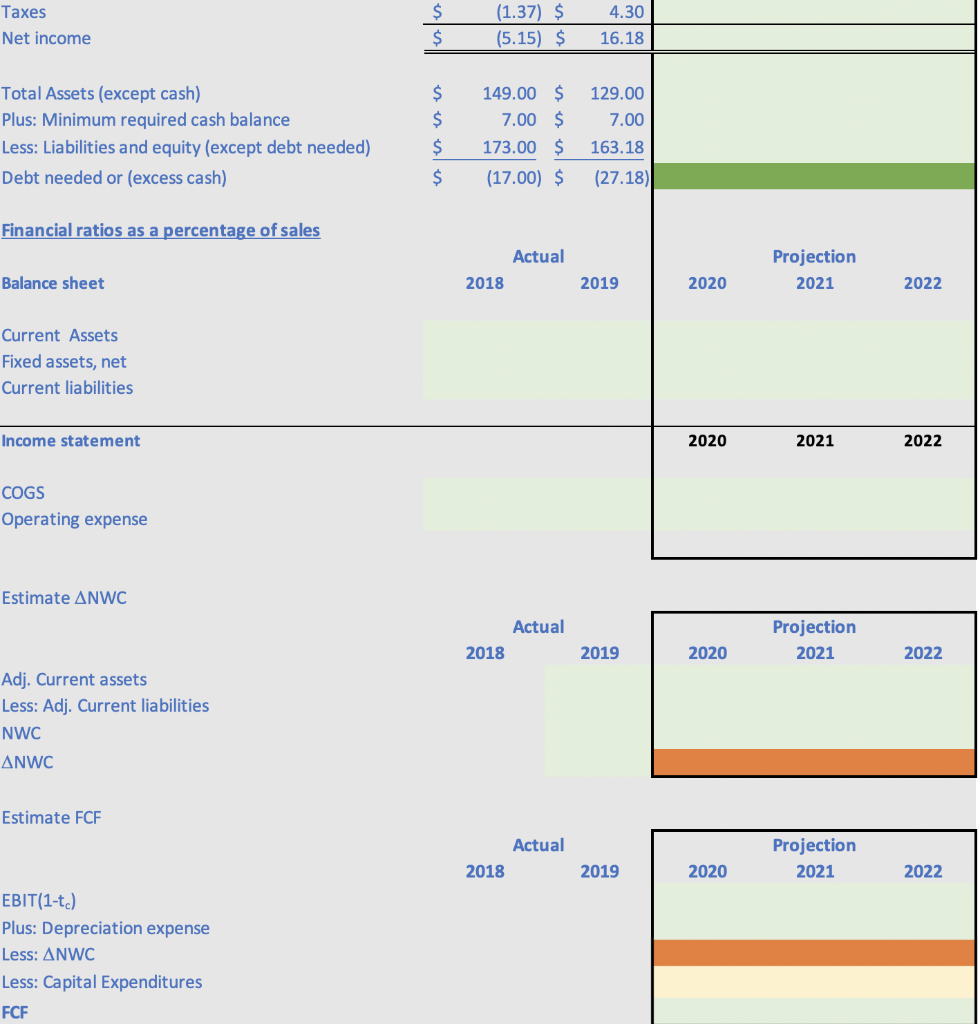

Use the percent of sales method and the following information to project this firm's free cash flows (FCFS) for the next three years. What is the average of these projected free cash flows? Round your final answer to two decimals. Assumptions Sales growth Corporate tax rate Minimum cash balance Depreciation expense Interest rate on debt $ $ 13% 21% 7.00 7.00 6% Actual 1 Projection 2 2021 3 Balance sheet 2018 2019 2020 2022 Cash(plug) Current Assets Fixed assets, net Total Assets $ $ $ $ 24.00 $ 44.00 $ 105.00 $ 173.00 $ 34.18 36.00 93.00 163.18 Current liabilities Long-term debt Debt needed (plug) $ $ $ 56.00 $ 42.00 $ $ 30.00 42.00 75.00 $ 91.18 Retained Earnings Total liabilities and equity $ $ 173.00 $ 163.18 Income statement 2018 2019 67.00 Sales COGS Gross margin $ $ $ 40.00 $ 27.00 $ 13.00 $ 27.00 40.00 Operating expense Depreciation EBIT $ $ $ 10.00 $ 7.00 $ (4.00) $ 10.00 7.00 23.00 Interest 2.52 $ 2.52 $ $ EBT (6.52) $ 20.48 Taxes Net income $ $ (1.37) $ (5.15) $ 4.30 16.18 129.00 7.00 Total Assets (except cash) Plus: Minimum required cash balance Less: Liabilities and equity (except debt needed) Debt needed or (excess cash) $ $ $ $ 149.00 $ 7.00 $ 173.00 $ (17.00) $ 163.18 (27.18) Financial ratios as a percentage of sales Actual Projection 2021 Balance sheet 2018 2019 2020 2022 Current Assets Fixed assets, net Current liabilities Income statement 2020 2021 2022 COGS Operating expense Estimate ANWC Actual 2018 Projection 2021 2019 2020 2022 Adj. Current assets Less: Adj. Current liabilities NWC ANWC Estimate FCF Actual 2018 Projection 2021 2019 2020 2022 EBIT(1-tc) Plus: Depreciation expense Less: ANWC Less: Capital Expenditures FCF Use the percent of sales method and the following information to project this firm's free cash flows (FCFS) for the next three years. What is the average of these projected free cash flows? Round your final answer to two decimals. Assumptions Sales growth Corporate tax rate Minimum cash balance Depreciation expense Interest rate on debt $ $ 13% 21% 7.00 7.00 6% Actual 1 Projection 2 2021 3 Balance sheet 2018 2019 2020 2022 Cash(plug) Current Assets Fixed assets, net Total Assets $ $ $ $ 24.00 $ 44.00 $ 105.00 $ 173.00 $ 34.18 36.00 93.00 163.18 Current liabilities Long-term debt Debt needed (plug) $ $ $ 56.00 $ 42.00 $ $ 30.00 42.00 75.00 $ 91.18 Retained Earnings Total liabilities and equity $ $ 173.00 $ 163.18 Income statement 2018 2019 67.00 Sales COGS Gross margin $ $ $ 40.00 $ 27.00 $ 13.00 $ 27.00 40.00 Operating expense Depreciation EBIT $ $ $ 10.00 $ 7.00 $ (4.00) $ 10.00 7.00 23.00 Interest 2.52 $ 2.52 $ $ EBT (6.52) $ 20.48 Taxes Net income $ $ (1.37) $ (5.15) $ 4.30 16.18 129.00 7.00 Total Assets (except cash) Plus: Minimum required cash balance Less: Liabilities and equity (except debt needed) Debt needed or (excess cash) $ $ $ $ 149.00 $ 7.00 $ 173.00 $ (17.00) $ 163.18 (27.18) Financial ratios as a percentage of sales Actual Projection 2021 Balance sheet 2018 2019 2020 2022 Current Assets Fixed assets, net Current liabilities Income statement 2020 2021 2022 COGS Operating expense Estimate ANWC Actual 2018 Projection 2021 2019 2020 2022 Adj. Current assets Less: Adj. Current liabilities NWC ANWC Estimate FCF Actual 2018 Projection 2021 2019 2020 2022 EBIT(1-tc) Plus: Depreciation expense Less: ANWC Less: Capital Expenditures FCF