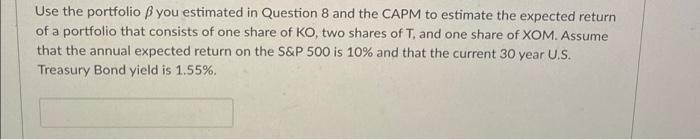

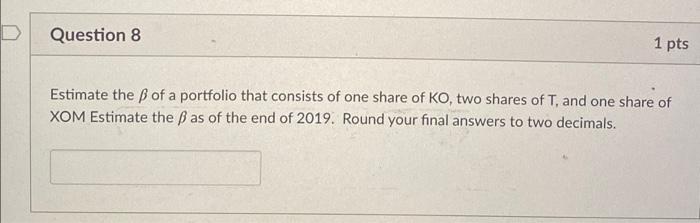

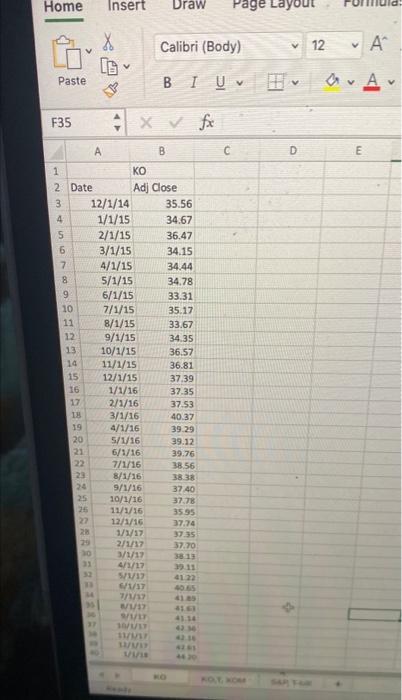

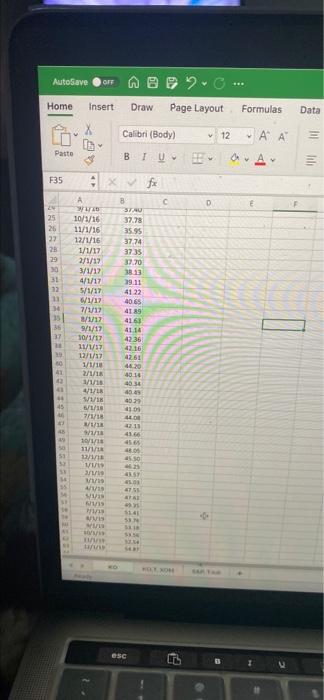

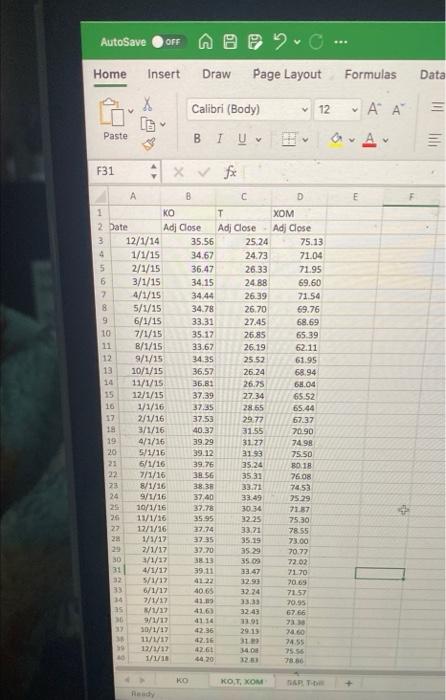

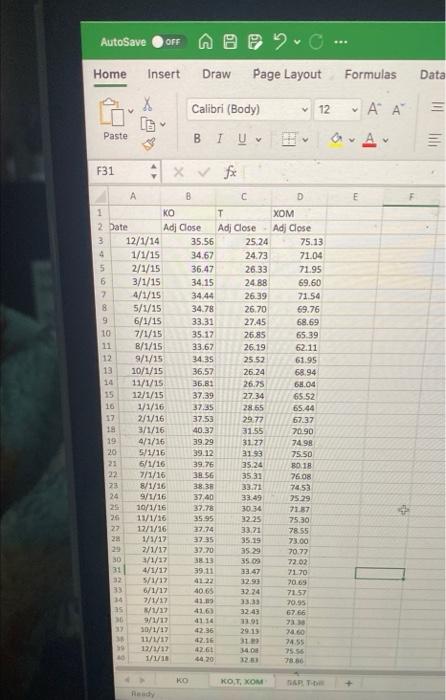

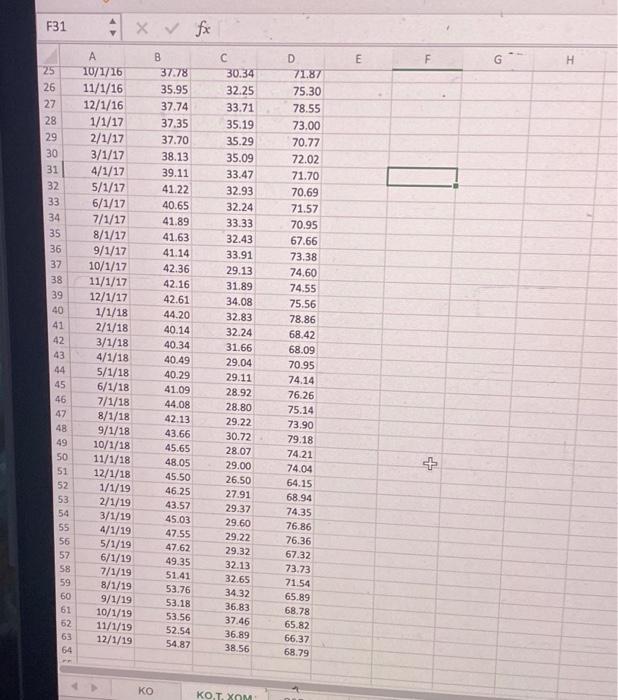

Use the portfolio you estimated in Question 8 and the CAPM to estimate the expected return of a portfolio that consists of one share of KO, two shares of T. and one share of XOM. Assume that the annual expected return on the S&P 500 is 10% and that the current 30 year U.S. Treasury Bond yield is 1.55%. Question 8 1 pts Estimate the of a portfolio that consists of one share of KO, two shares of T, and one share of XOM Estimate the B as of the end of 2019. Round your final answers to two decimals. Home Insert Draw Page X Calibri (Body) 12 V Paste BIU V a. Av F35 x fx A B D E NU 1 KO 2 Date Adj Close 3 12/1/14 35.56 4 1/1/15 34.67 2/1/15 36.47 6 3/1/15 34.15 7 4/1/15 34.44 8 5/1/15 34.78 9 6/1/15 33.31 10 7/1/15 35.17 11 8/1/15 33.67 12 9/1/15 34.35 13 10/1/15 36.57 14 11/1/15 36.81 15 12/1/15 37.39 16 1/1/16 37.35 17 2/1/16 37.53 18 3/1/16 40.37 19 4/1/16 39.29 20 5/1/16 39.12 21 6/1/16 39.76 22 7/1/16 38.56 23 8/1/16 38.38 24 9/1/16 37.40 25 10/1/16 37.78 25 11/1/16 3595 22 12/1/15 37.74 20 1/1/17 3735 2/1/17 37.70 20 3/1/17 38 13 31 4/1/17 5/1/12 4122 137 4065 72 117 AutoSave OFF Home Insert Draw Page Layout Formulas Data X Calibri (Body) v 12 - A Pasto BTU F35 A C D E GY 2 25 26 27 25 8 STAD 37.78 35.95 37.74 3735 37.70 38.13 19.1.1 41.22 4065 4189 4163 OC 31 34 L 36 37 414 10/3/16 11/1/16 12/1/16 1/1/17 2/1/12 3/1/12 4/1/17 51/17 01/17 7/1/12 2/9/17 9/1/17 10/1/12 11/1/17 12/4/17 1/1/18 2/1/18 1/1/15 4/1/ WIN 6/1/18 7/1/18 21/ W/ 10/17 11/1/12 1 19 0 41 OZ 42.36 42.16 4251 4620 401 40.36 4.49 46.39 1/ 445 GO 4400 31 19 450 53 08 OSS STE ST 15 w SAN GA SEL 475 ATA M ws w 33 118 DO AutoSave OFF @20 Home Insert Draw Page Layout Formulas Data Calibri (Body) 12 AM = Paste BIU v F31 fe A E ut N A B D KO T XOM 2 Date Adj Close Adj Close Adj Close 3 12/1/14 35.56 25.24 75.13 4 1/1/15 34.67 24.73 71.04 2/1/15 36.47 26.33 71.95 6 3/1/15 34.15 24.88 69.60 2 4/1/15 34.44 26.39 71.54 8 5/1/15 34.78 26.70 69.76 9 6/1/15 33.31 27.45 68.69 10 7/1/15 35.17 26.85 65 39 11 B/1/15 33.67 26.19 62.11 12 9/1/15 34.35 25.52 61.95 13 10/1/15 36.57 26.24 68.94 14 11/1/15 36.81 26.75 68.04 15 12/1/15 37.39 27.34 65.52 16 1/1/16 37,35 2855 65.44 17 2/1/16 37.53 29.77 67.37 18 3/1/16 40.37 31.55 70.90 19 4/1/16 39.29 31.27 74.98 20 5/1/16 39.12 31.93 75.50 23 6/1/16 39.76 35.24 8018 22 7/1/16 38.56 35 31 7608 73 8/1/16 38 38 33.71 7453 24 9/1/16 37.40 33.49 75.29 25 10/1/16 37.78 3034 7137 26 11/1/16 35.95 32.25 75.30 27 12/1/16 27.74 33.21 78.55 28 1/1/17 3735 3519 73.00 29 7/1/17 37.70 35 29 70.77 30 3/1/27 38 13 35.09 72.02 31 4/1/17 39.11 33.47 7170 32 5/1/17 4122 32.93 20.65 33 6/1/17 40.65 32 24 71.57 36 7/1/17 41 33.33 70.95 35 1/17 416) 32.43 67.66 10 9/1/12 4114 3301 37 30/1/17 42.36 29.13 11/1/17 7455 12/1/17 4261 340 7556 1/11 44 20 1250 78.80 4.60 42.16 3 KOT, XOM THPT Ready AutoSave OFF @20 Home Insert Draw Page Layout Formulas Data Calibri (Body) 12 AM = Paste BIU v F31 fe A E ut N A B D KO T XOM 2 Date Adj Close Adj Close Adj Close 3 12/1/14 35.56 25.24 75.13 4 1/1/15 34.67 24.73 71.04 2/1/15 36.47 26.33 71.95 6 3/1/15 34.15 24.88 69.60 2 4/1/15 34.44 26.39 71.54 8 5/1/15 34.78 26.70 69.76 9 6/1/15 33.31 27.45 68.69 10 7/1/15 35.17 26.85 65 39 11 B/1/15 33.67 26.19 62.11 12 9/1/15 34.35 25.52 61.95 13 10/1/15 36.57 26.24 68.94 14 11/1/15 36.81 26.75 68.04 15 12/1/15 37.39 27.34 65.52 16 1/1/16 37,35 2855 65.44 17 2/1/16 37.53 29.77 67.37 18 3/1/16 40.37 31.55 70.90 19 4/1/16 39.29 31.27 74.98 20 5/1/16 39.12 31.93 75.50 23 6/1/16 39.76 35.24 8018 22 7/1/16 38.56 35 31 7608 73 8/1/16 38 38 33.71 7453 24 9/1/16 37.40 33.49 75.29 25 10/1/16 37.78 3034 7137 26 11/1/16 35.95 32.25 75.30 27 12/1/16 27.74 33.21 78.55 28 1/1/17 3735 3519 73.00 29 7/1/17 37.70 35 29 70.77 30 3/1/27 38 13 35.09 72.02 31 4/1/17 39.11 33.47 7170 32 5/1/17 4122 32.93 20.65 33 6/1/17 40.65 32 24 71.57 36 7/1/17 41 33.33 70.95 35 1/17 416) 32.43 67.66 10 9/1/12 4114 3301 37 30/1/17 42.36 29.13 11/1/17 7455 12/1/17 4261 340 7556 1/11 44 20 1250 78.80 4.60 42.16 3 KOT, XOM THPT Ready 31 fx E G H A 125 10/1/16 26 11/1/16 27 12/1/16 28 1/1/17 29 2/1/17 30 3/1/17 31 4/1/17 32 5/1/17 33 6/1/17 34 7/1/17 35 8/1/17 36 9/1/17 37 10/1/17 38 11/1/17 39 12/1/17 40 1/1/18 41 2/1/18 42 3/1/18 43 4/1/18 44 5/1/18 45 6/1/18 46 7/1/18 47 8/1/18 48 9/1/18 49 10/1/18 50 11/1/18 51 12/1/18 52 1/1/19 53 2/1/19 54 3/1/19 55 4/1/19 56 5/1/19 57 6/1/19 58 7/1/19 59 8/1/19 60 9/1/19 61 10/1/19 62 11/1/19 63 12/1/19 64 37.78 35.95 37.74 37.35 37.70 38.13 39.11 41.22 40.65 41.89 41.63 41.14 42.36 42.16 42.61 44.20 40.14 40.34 40.49 40.29 41.09 44.08 42.13 43.66 45.65 48.05 45.50 46.25 43.57 45.03 47.55 47.62 49.35 51.41 53.76 53.18 53.56 52.54 54.87 C 30.34 32.25 33.71 35.19 35.29 35.09 33.47 32.93 32.24 33.33 32.43 33.91 29.13 31.89 34.08 32.83 32.24 31.66 29.04 29.11 28.92 28.80 29.22 30.72 28.07 29.00 26.50 27.91 29.37 29.60 29.22 29.32 32.13 32.65 34. 32 36.83 37.46 36.89 38.56 mm D 71.87 75.30 78.55 73.00 70.77 72.02 71.70 70.69 71.57 70.95 67.66 73.38 74.60 74.55 75.56 78.86 68.42 68.09 70.95 74.14 76.26 75.14 73.90 79.18 74.21 74.04 64.15 68.94 74.35 76.86 76.36 67.32 73.73 71.54 65.89 68.78 65.82 66.37 68.79 + KOO RTX