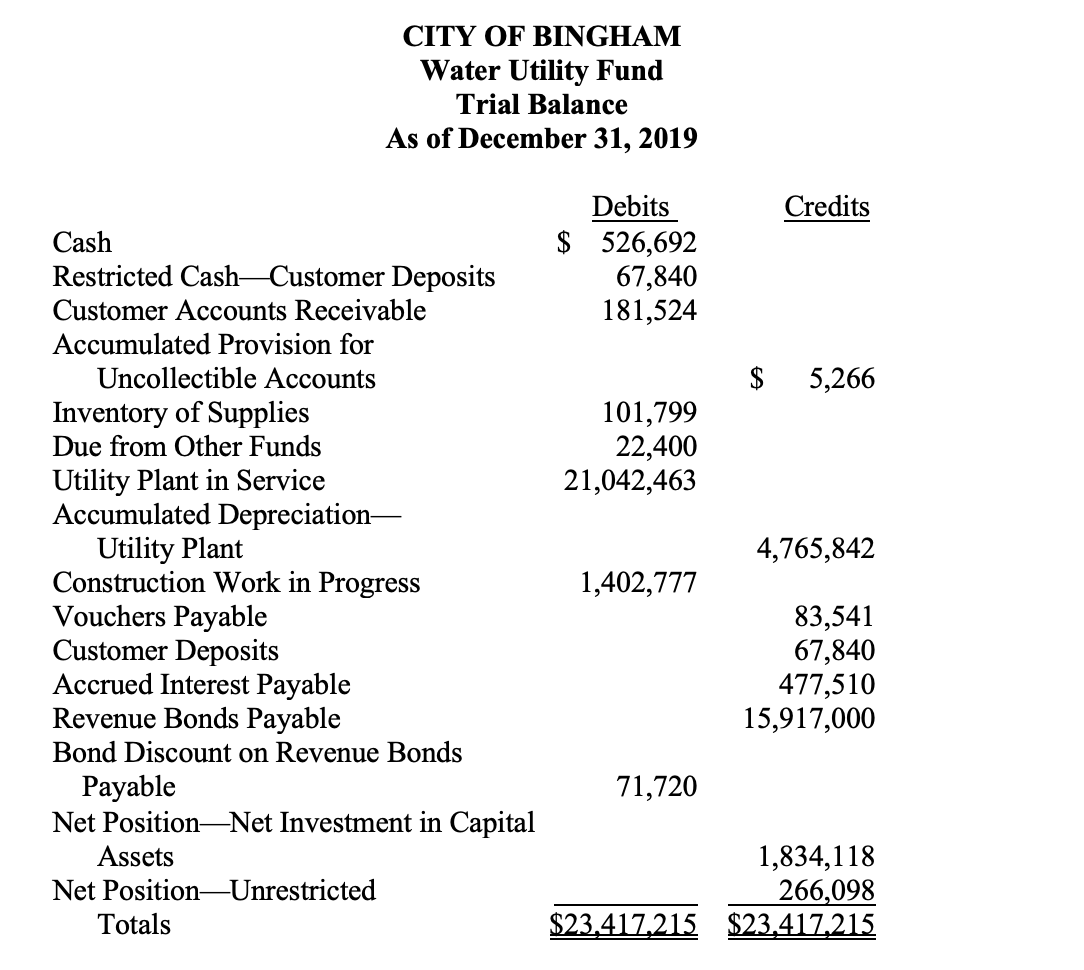

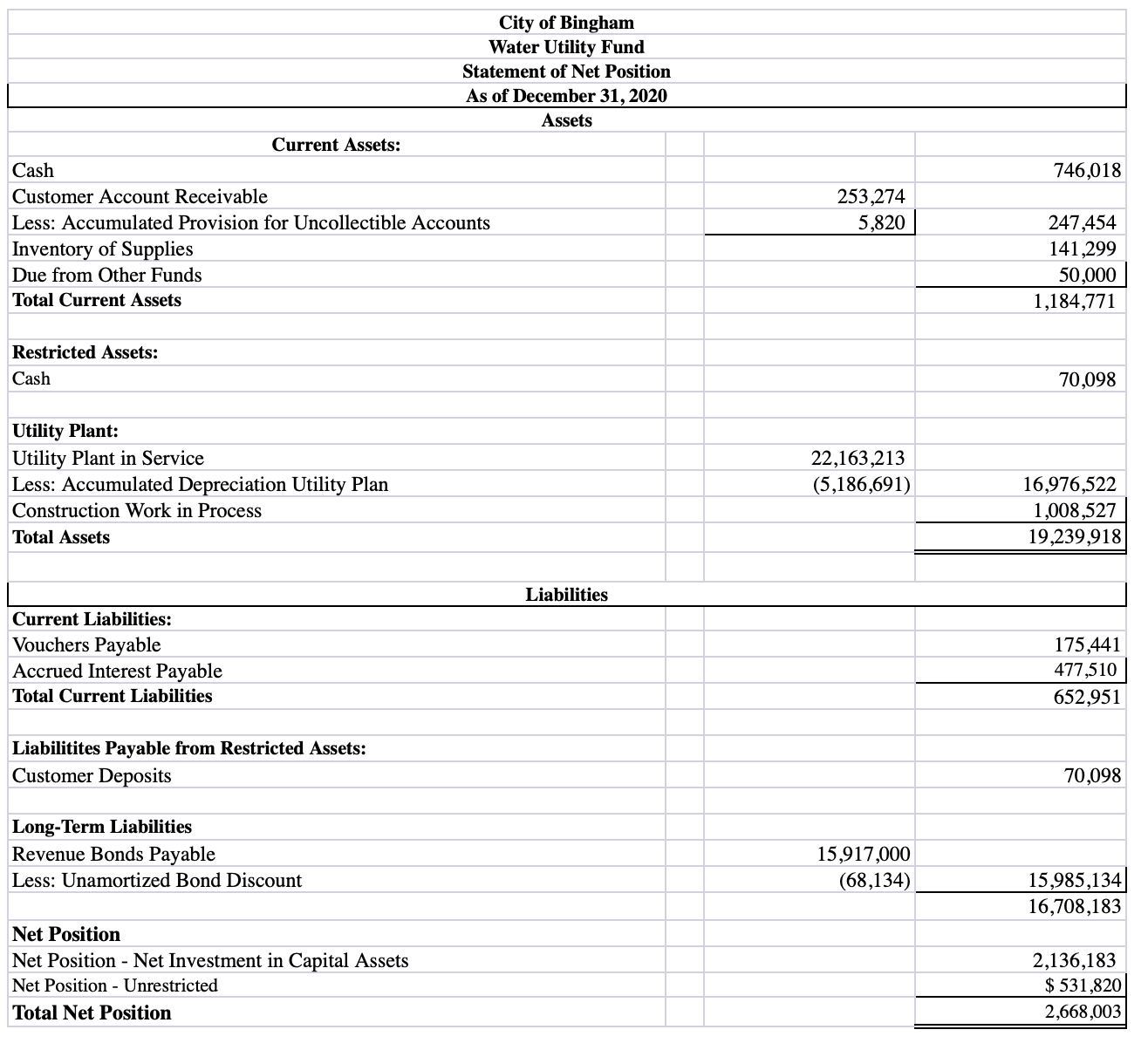

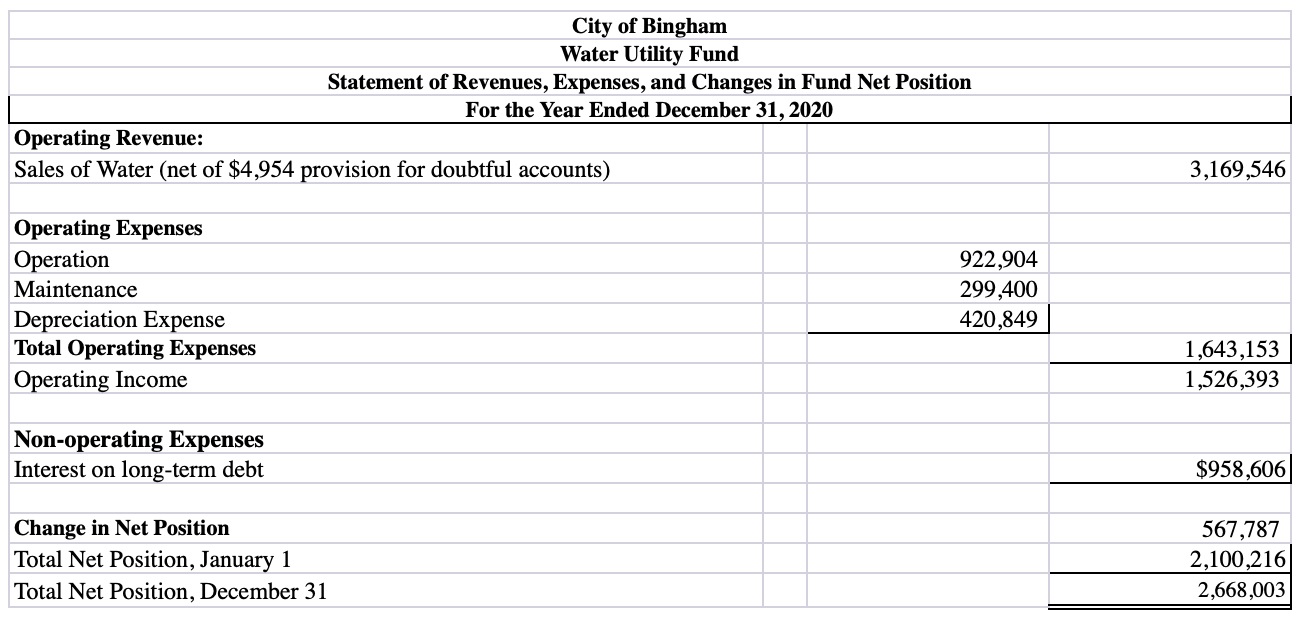

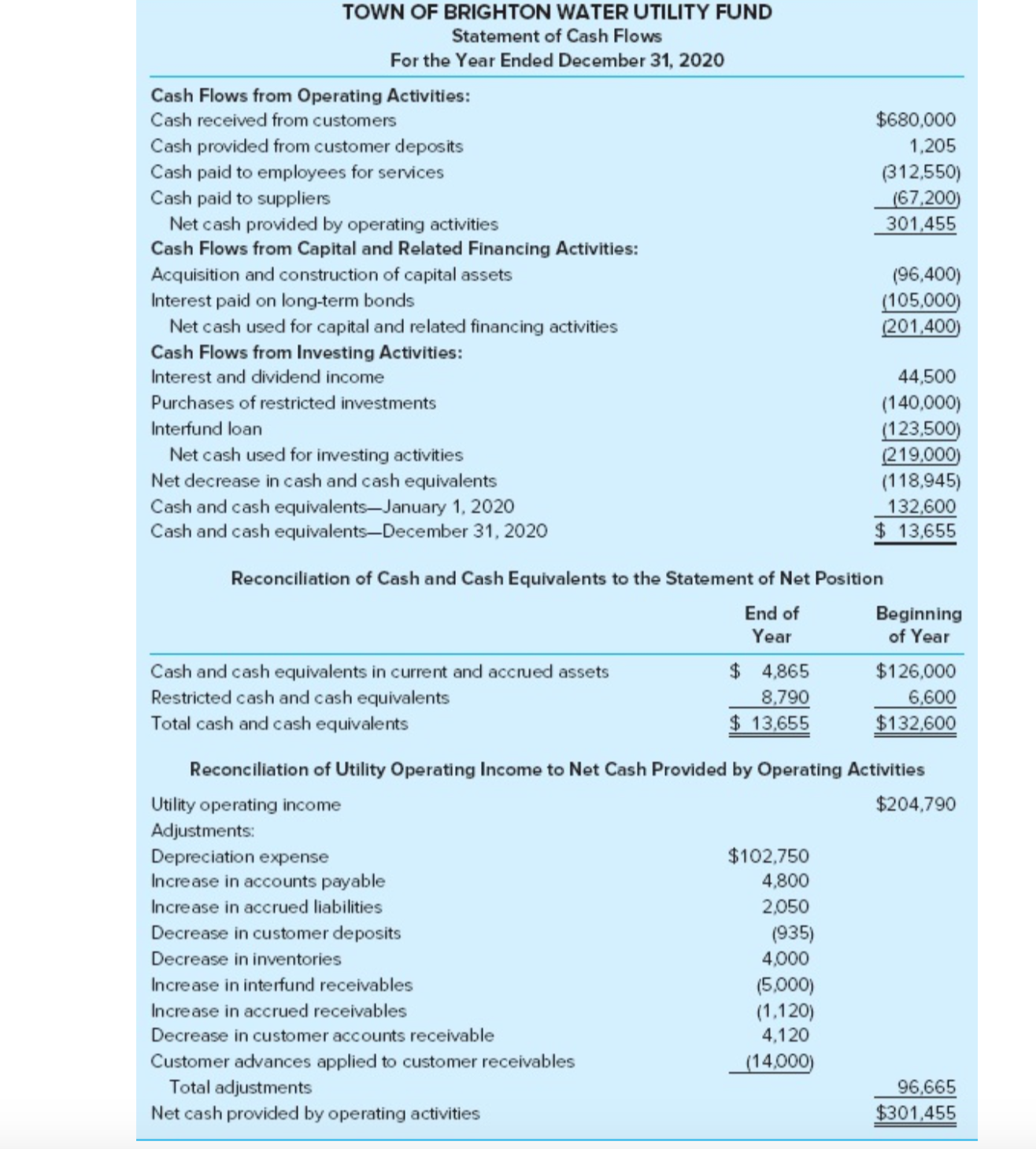

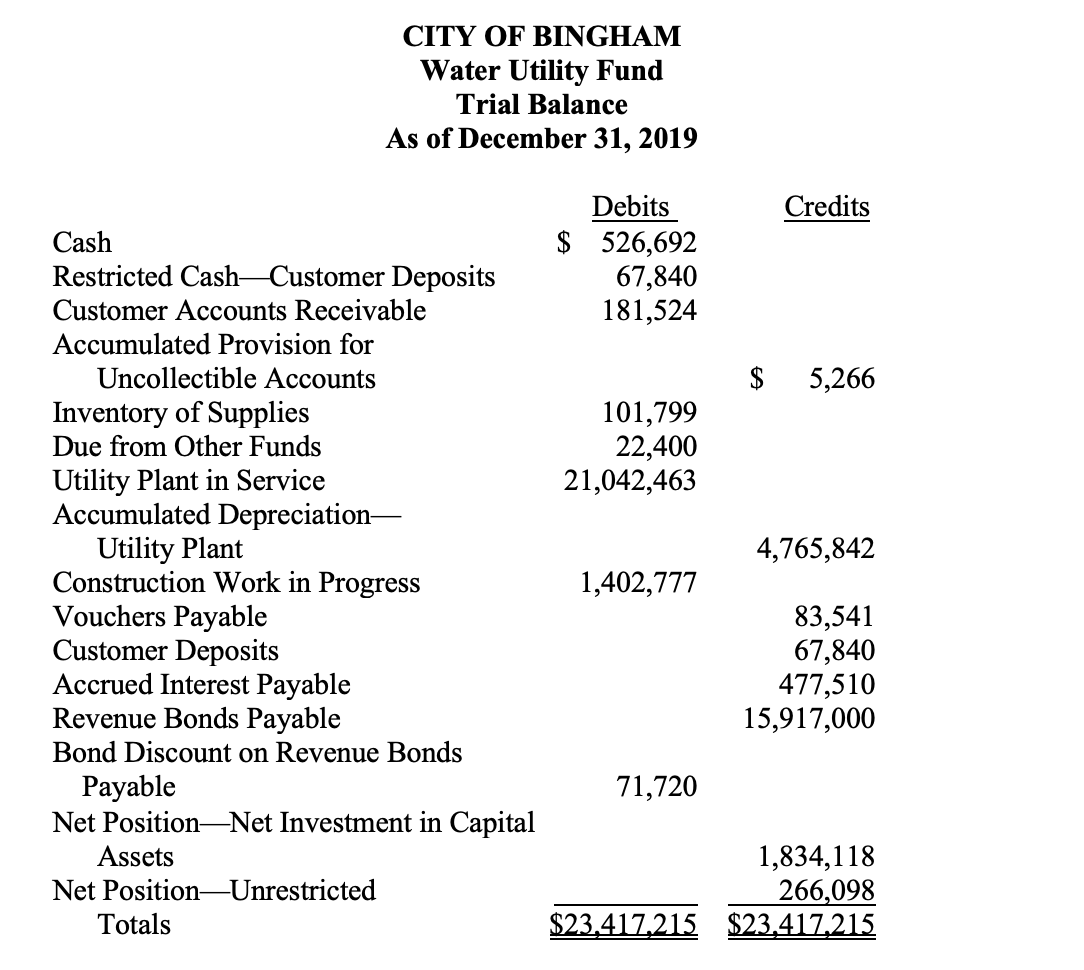

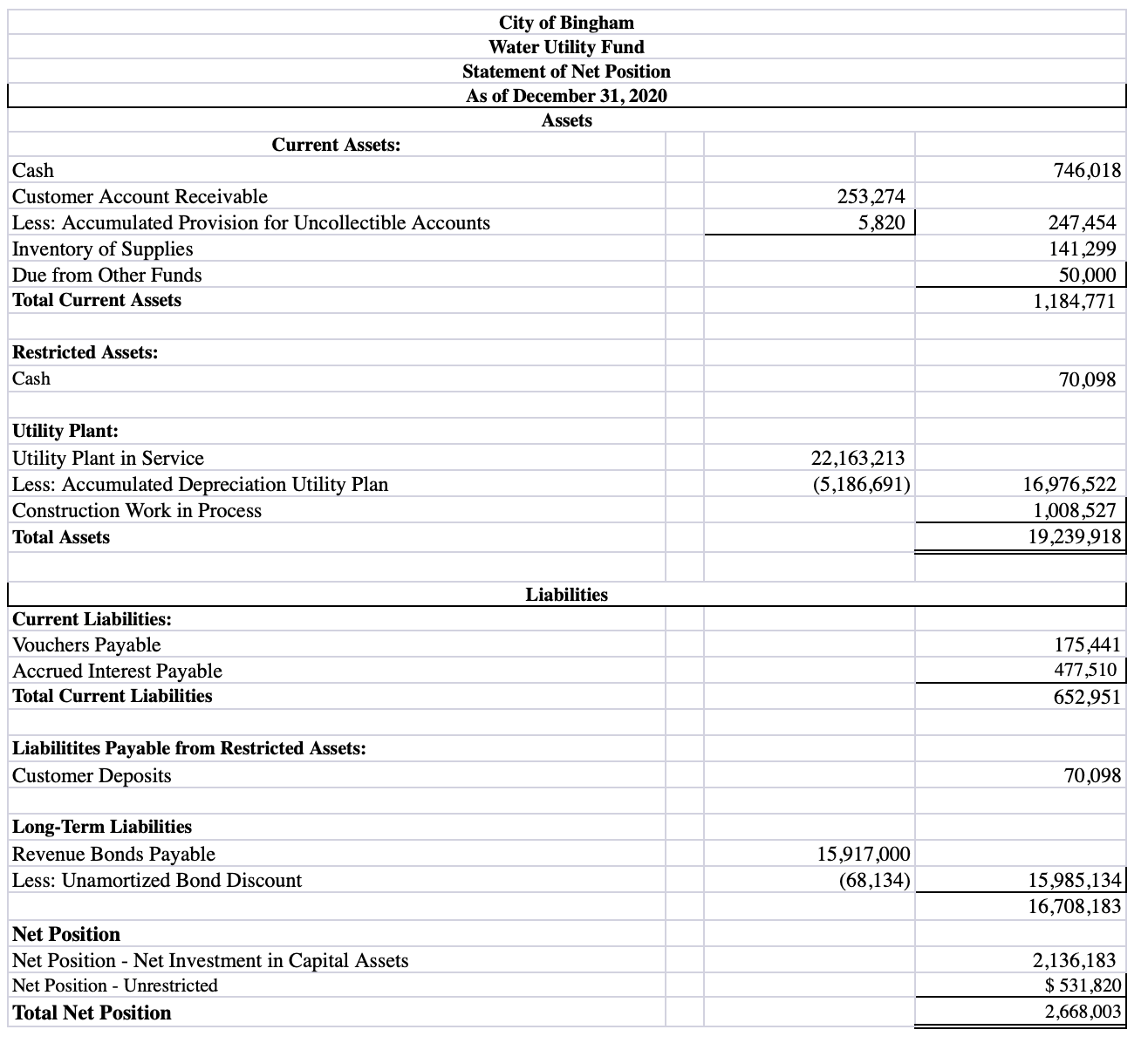

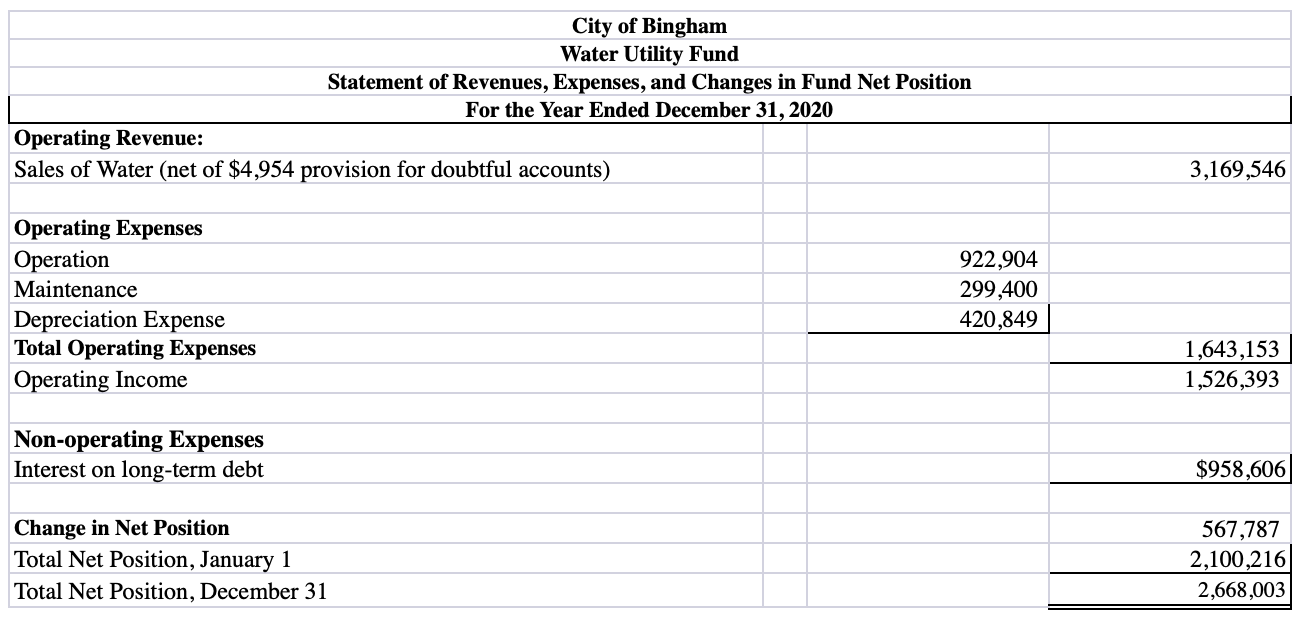

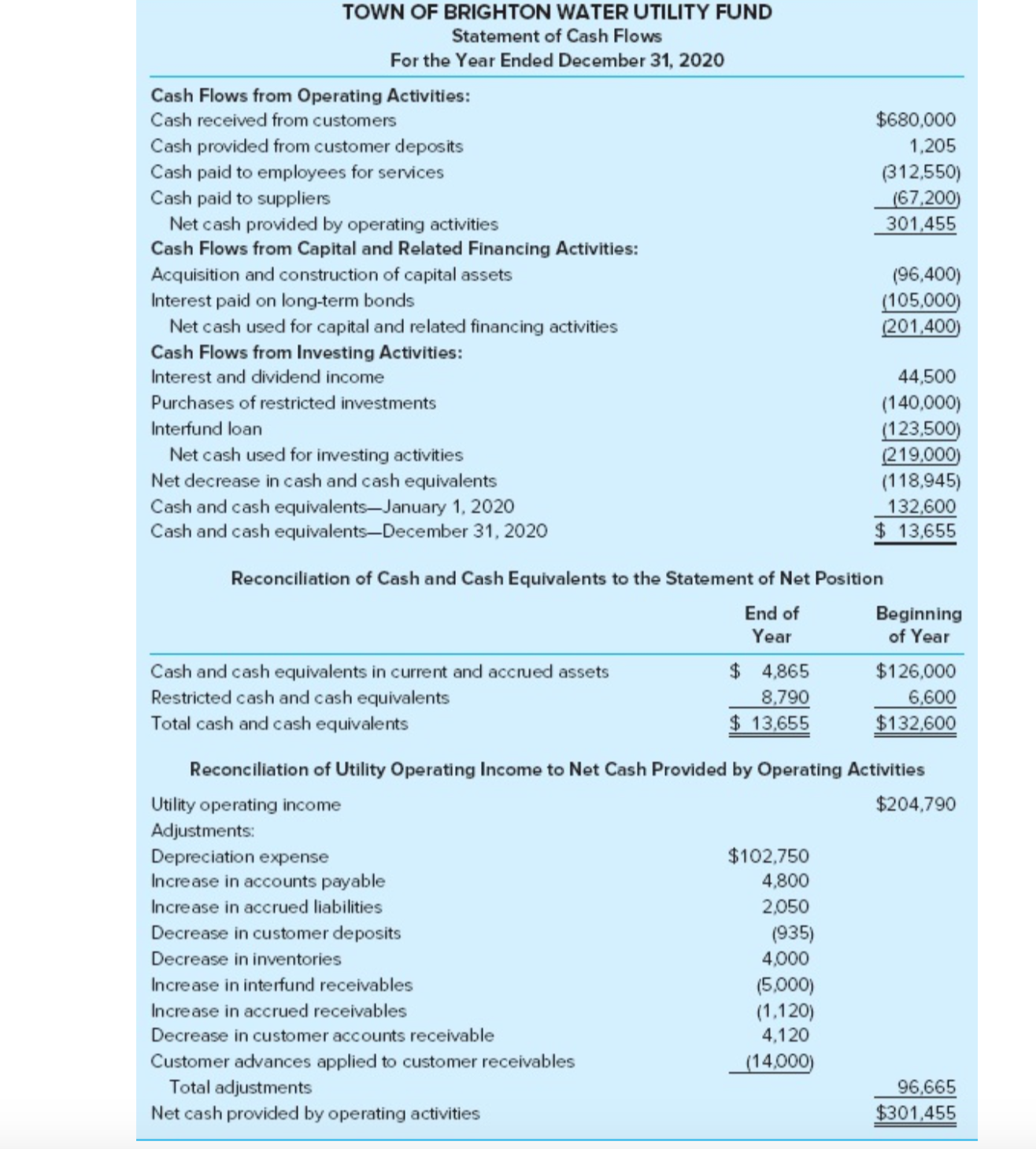

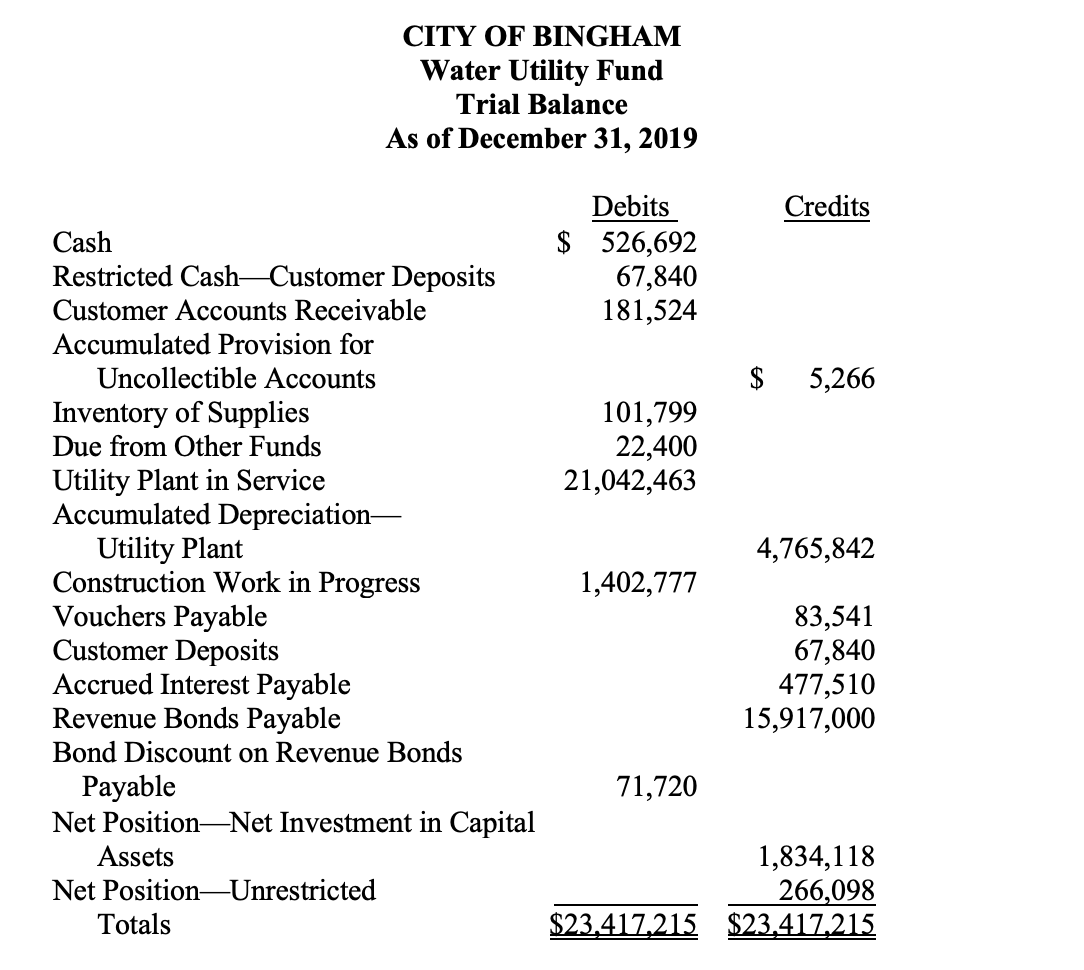

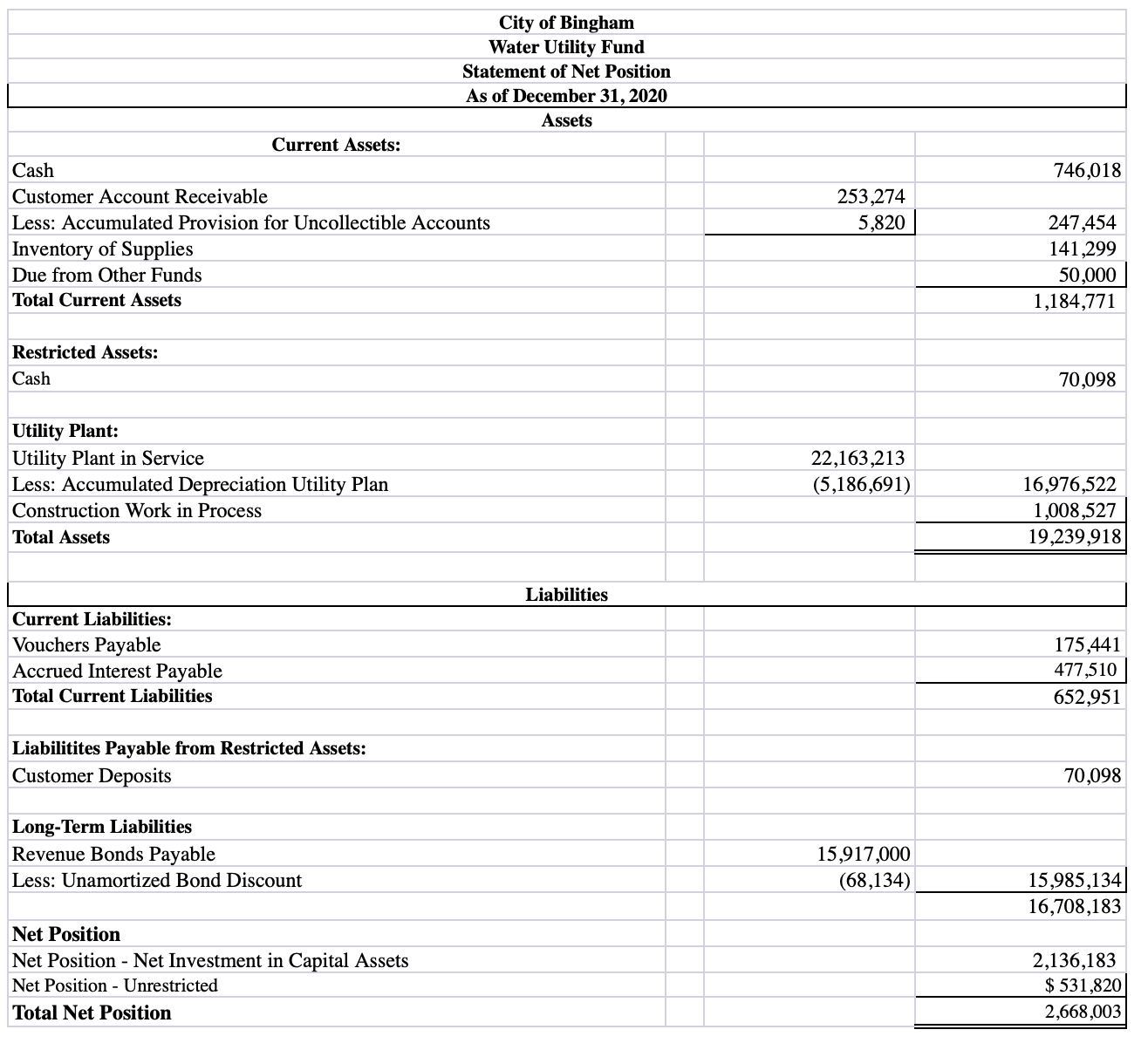

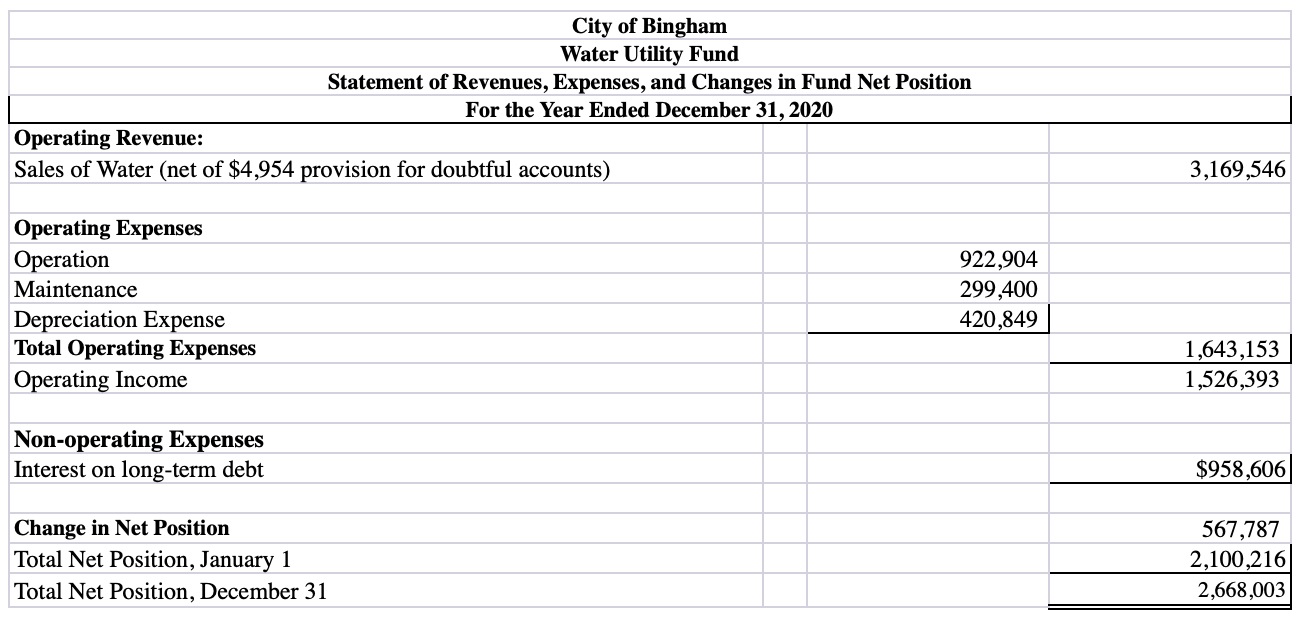

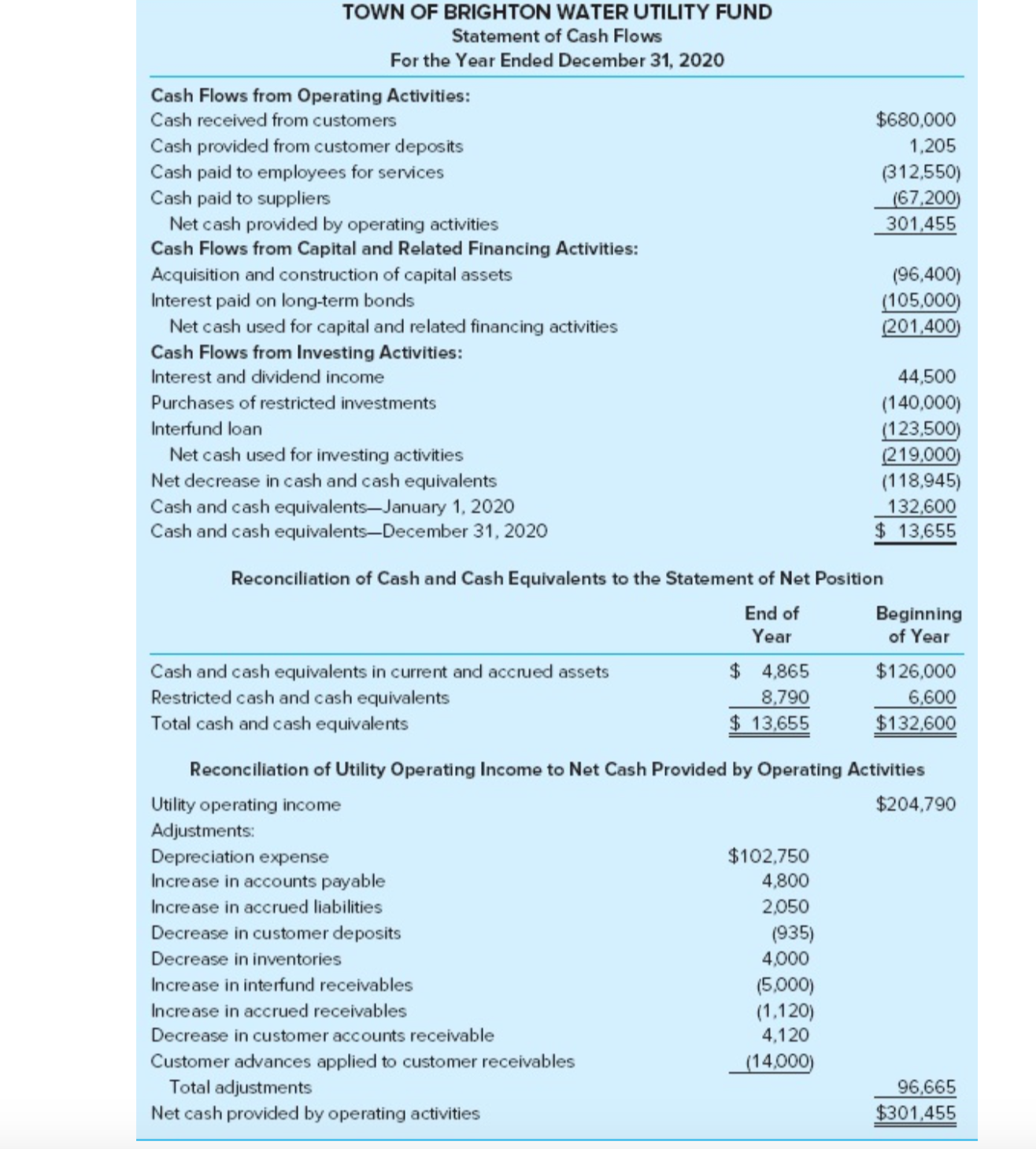

Use the "post-closing trial balance for year 2019", the trial balances from "Statement of Net Position" and "Statement of Revenues, Expenses, and Changes in Fund Net Position" to prepare Statement of Cash Flows for the Water Utility Fund for the year ended December 31, 2020. (See Illustration 7-8 (the last picture) for an example format.)

CITY OF BINGHAM Water Utility Fund Trial Balance As of December 31, 2019 Debits Credits Cash $ 526,692 Restricted CashCustomer Deposits 67,840 Customer Accounts Receivable 181,524 Accumulated Provision for Uncollectible Accounts $ 5,266 Inventory of Supplies 101,799 Due from Other Funds 22,400 Utility Plant in Service 21,042,463 Accumulated Depreciation Utility Plant 4,765,842 Construction Work in Progress 1,402,777 Vouchers Payable 83,541 Customer Deposits 67,840 Accrued Interest Payable 477,510 Revenue Bonds Payable 15,917,000 Bond Discount on Revenue Bonds Payable 71,720 Net PositionNet Investment in Capital Assets 1,834,118 Net PositionUnrestricted 266 098 Totals m M City of Bingbam Water Utility Fund Statement of Net Position As of December 31, 2020 Assets Current Assets: Cash 746,0 18 Customer Account Receivable 253,274 Less: Accumulated Provision for Uncollectible Accounts 5,820 247,454 Inventory of Supplies 141,299 Due from Other Funds 50,000 Total Current Assets 1,184,771 Restricted Assets: Cash 70,098 Utility Plant: Utility Plant in Service 22,163,213 Less: Accumulated Depreciation Utility Plan (5,186,691) 16,976,522 Construction Work in Process 1,008,527 Total Assets 19,239,918 Liabilities Current Liabilities: Vouchers Payable 175,441 Accrued Interest Payable 477,510 Total Current Liabilities 652,951 Liabilitites Payable from Restricted Assets: Customer Deposits 70,098 Long-Term Liabilities Revenue Bonds Payable 15,917,000 Less: Unamortized Bond Discount (68,134) 15,985,134 16,708,183 Net Position Net Position - Net Investment in Capital Assets 2,136,183 Net Position - Unrestricted $ 531,820 Total Net Position 2,668,003 City of Bingham Water Utility Fund Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Operating Revenue: Sales of Water (net of $4,954 provision for doubtful accounts) 3,169,546 Operating Expenses Operation 922,904 Maintenance 299,400 Depreciation Expense 420,849 Total Operating Expenses 1,643,153 Operating Income 1,526,393 Non-operating Expenses Interest on long-term debt $958,606 Change in Net Position 567,787 Total Net Position, January 1 2,100,216 Total Net Position, DeCembeI 31 2,668,003 TOWN OF BRIGHTON WATER UTILITY FUND Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities: Cash received from customers $680,000 Cash provided from customer deposits 1.205 Cash paid to employees for services (312,550) Cash paid to suppliers (67.200) Net cash provided by operating activities 301.455 Cash Flows from Capital and Related Financing Activities: Acquisition and construction of capital assets (96,400) Interest paid on long-term bonds (105,000) Net cash used for capital and related financing activities (201,400) Cash Flows from Investing Activities: Interest and dividend income 44,500 Purchases of restricted investments (140,000) Interfund loan (123,500) Net cash used for investing activities (219,000) Net decrease in cash and cash equivalents (118,945) Cash and cash equivalents-January 1, 2020 132.600 Cash and cash equivalents-December 31, 2020 $ 13,655 Reconciliation of Cash and Cash Equivalents to the Statement of Net Position End of Beginning Year of Year Cash and cash equivalents in current and accrued assets $ 4.865 $126,000 Restricted cash and cash equivalents 8,790 6.600 Total cash and cash equivalents $ 13.655 $132,600 Reconciliation of Utility Operating Income to Net Cash Provided by Operating Activities Utility operating income $204,790 Adjustments: Depreciation expense $102,750 Increase in accounts payable 4,800 Increase in accrued liabilities 2,050 Decrease in customer deposits (935) Decrease in inventories 4,000 Increase in interfund receivables (5,000) Increase in accrued receivables (1,120) Decrease in customer accounts receivable 4,120 Customer advances applied to customer receivables (14,000) Total adjustments 96,665 Net cash provided by operating activities $301,455