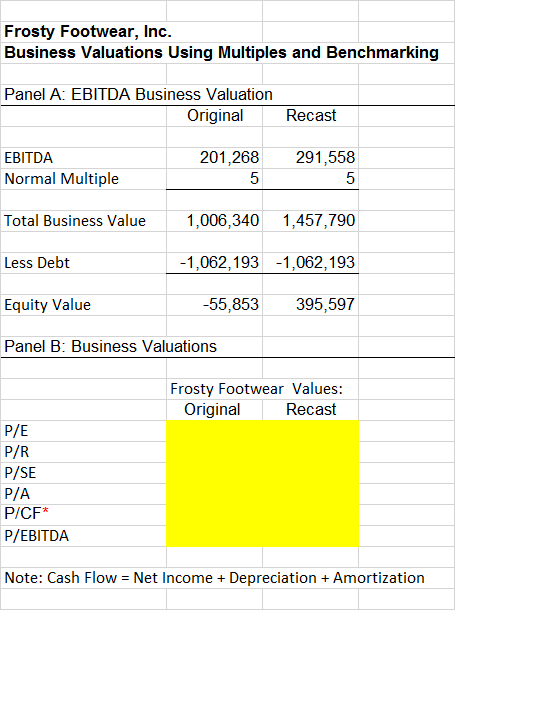

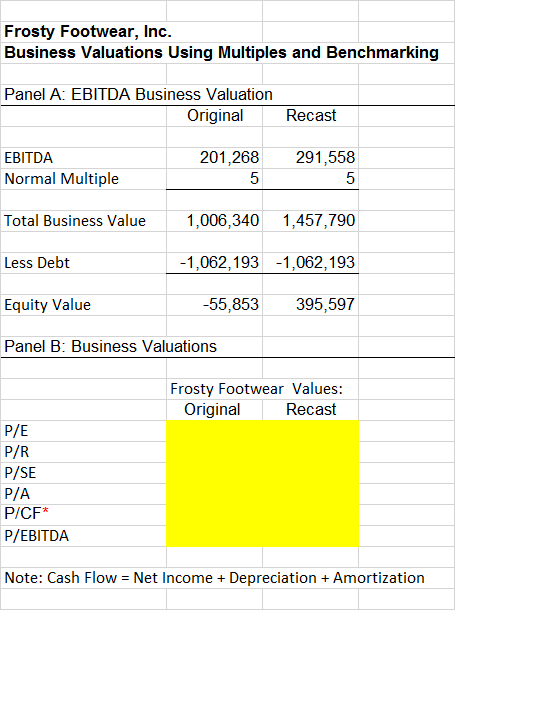

Use the private company transactions method to fill out the yellow highlighted area. This is a private company; therefore you do not need the number of shares to calculate it in total. You are determining entity value not per-share value.

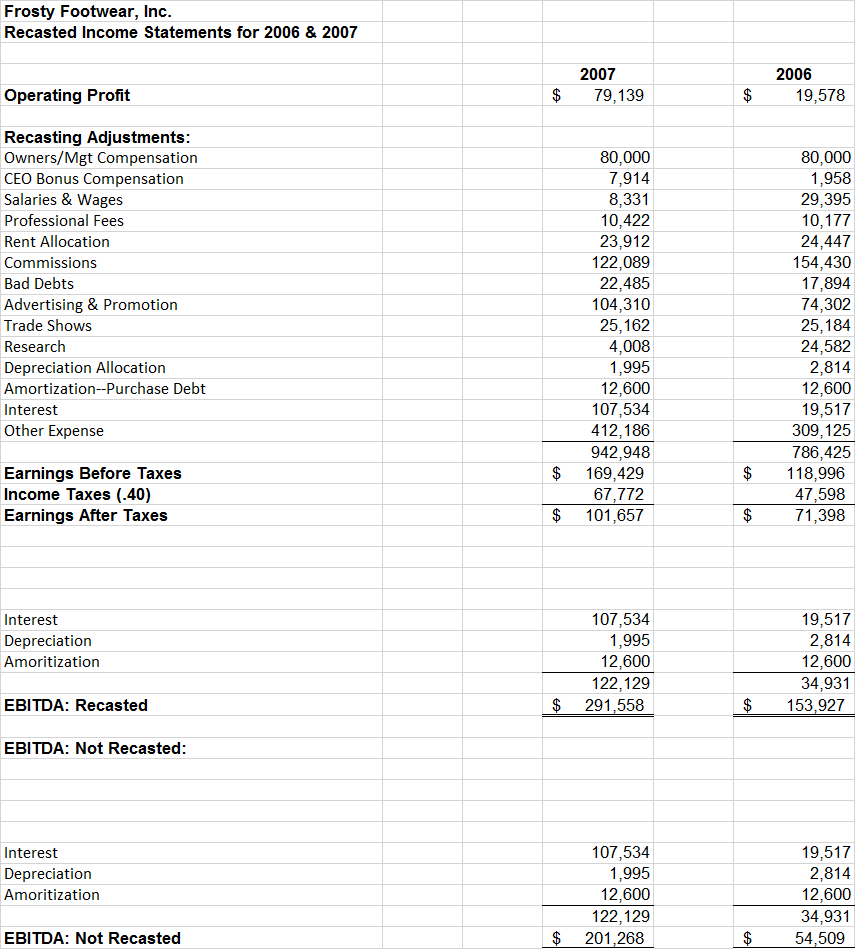

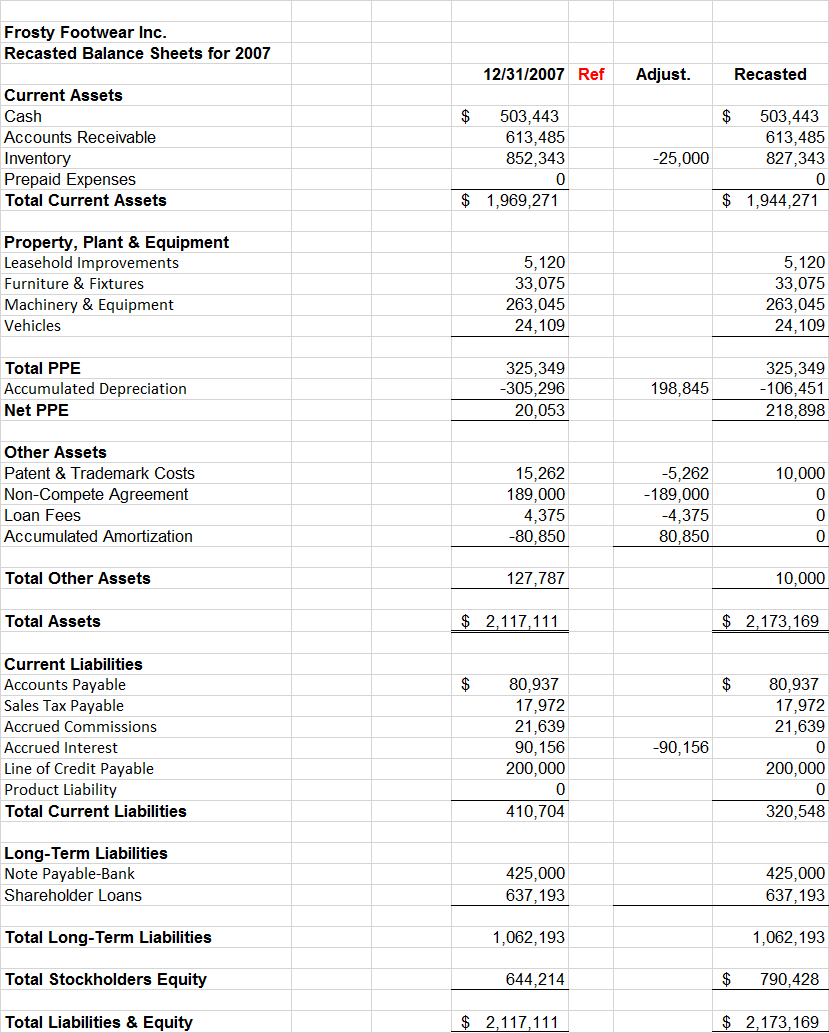

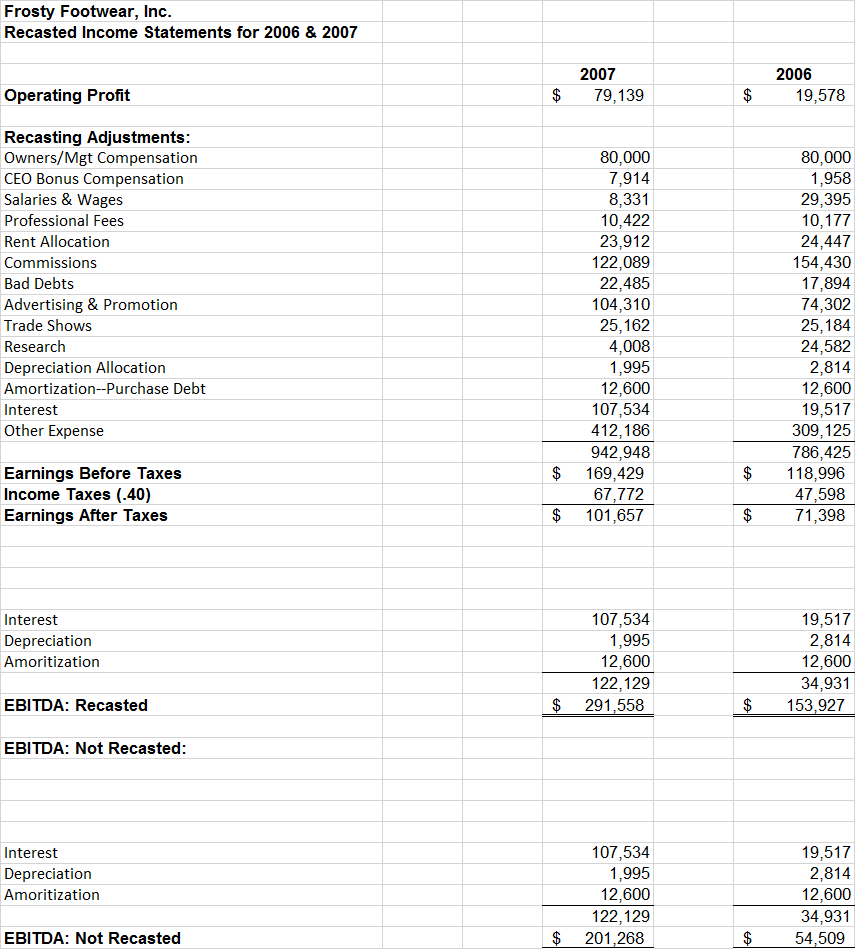

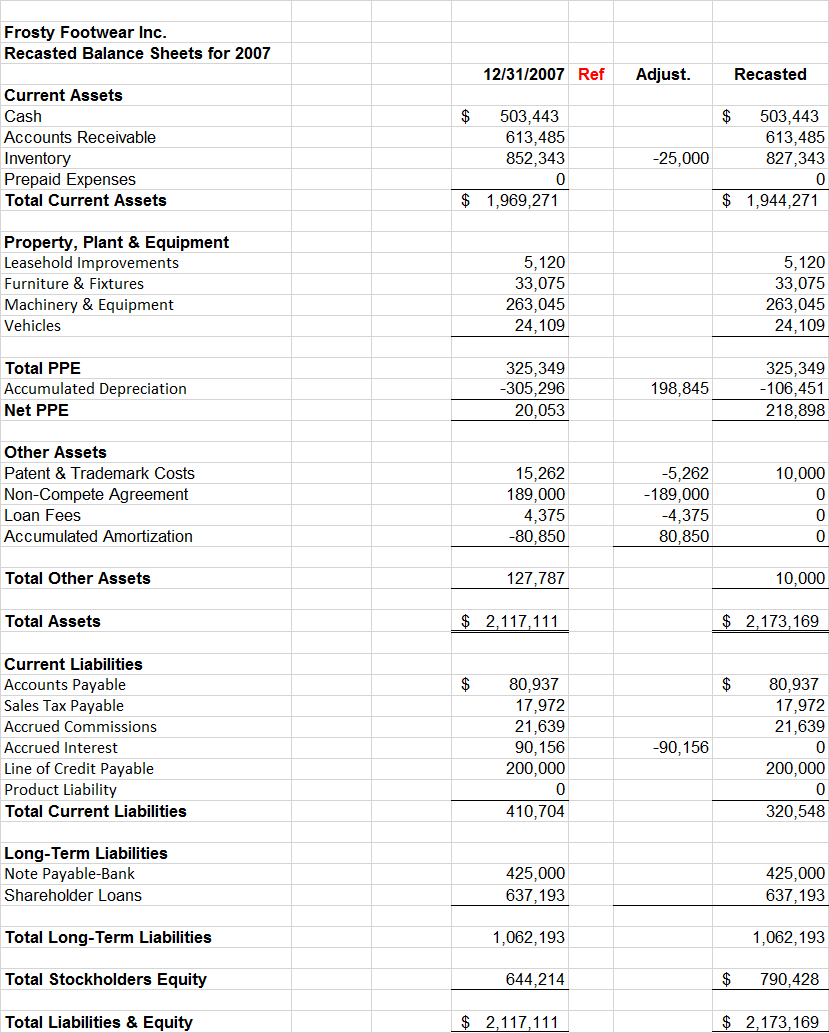

Frosty Footwear, Inc. Recasted Income Statements for 2006 & 2007 2007 2006 19,578 Operating Profit 79,139 Recasting Adjustments: Owners/Mgt Compensation CEO Bonus Compensation Salaries & Wages 80,000 7,914 8,331 10,422 23,912 122,089 22,485 104,310 25,162 4,008 1,995 12,600 107,534 412,186 80,000 1,958 29,395 10,177 24,447 154,430 17,894 74,302 25,184 24,582 2,814 12,600 19,517 309,125 786,425 118,996 47,598 71,398 Professional Fees Rent Allocation Commissions Bad Debts Advertising & Promotion Trade Shows Research Depreciation Allocation Amortization--Purchase Debt Interest Other Expense 942,948 169,429 67,772 101,657 Earnings Before Taxes Income Taxes (.40) Earnings After Taxes $ 107,534 1,995 12,600 122,129 291,558 19,517 2,814 12,600 34,931 Interest Depreciation Amoritization EBITDA: Recasted 153,927 EBITDA: Not Recasted: 19,517 2,814 12,600 34,931 107,534 1,995 12,600 122,129 Interest Depreciation Amoritization EBITDA: Not Recasted 201,268 54,509 %24 %24 %24 Frosty Footwear Inc. Recasted Balance Sheets for 2007 12/31/2007 Ref Adjust. Recasted Current Assets 503,443 503,443 Cash 613,485 827,343 Accounts Receivable 613,485 Inventory Prepaid Expenses -25,000 852,343 $ 1,969,271 $ 1,944,271 Total Current Assets Property, Plant & Equipment Leasehold Improvements 5,120 33,075 263,045 24,109 5,120 33,075 263,045 24,109 Furniture & Fixtures Machinery & Equipment Vehicles 325,349 -305,296 325,349 -106,451 218,898 Total PPE Accumulated Depreciation 198,845 Net PPE 20,053 Other Assets -5,262 Patent & Trademark Costs 15,262 189,000 4,375 -80,850 10,000 Non-Compete Agreement -189,000 -4,375 80,850 Loan Fees Accumulated Amortization Total Other Assets 127,787 10,000 $ 2,117,111 $ 2,173,169 Total Assets Current Liabilities Accounts Payable Sales Tax Payable 80,937 17,972 21,639 80,937 17,972 21,639 90,156 200,000 Accrued Commissions Accrued Interest -90,156 Line of Credit Payable Product Liability 200,000 410,704 Total Current Liabilities 320,548 Long-Term Liabilities ank Note Payable 425,000 425,000 637,193 637,193 Shareholder Loans 1,062,193 Total Long-Term Liabilities 1,062,193 Total Stockholders Equity 644,214 790,428 $ 2,117,111 $ 2,173,169 Total Liabilities & Equity Frosty Footwear, Inc. Business Valuations Using Multiples and Benchmarking Panel A: EBITDA Business Valuation Original Recast 291,558 201,268 EBITDA Normal Multiple 1,006,340 Total Business Value 1,457,790 Less Debt -1,062,193 -1,062,193 -55,853 Equity Value 395,597 Panel B: Business Valuations Frosty Footwear Values: Original Recast P/E P/R P/SE P/A P/CF* P/EBITDA Note: Cash Flow = Net Income + Depreciation + Amortization