Question

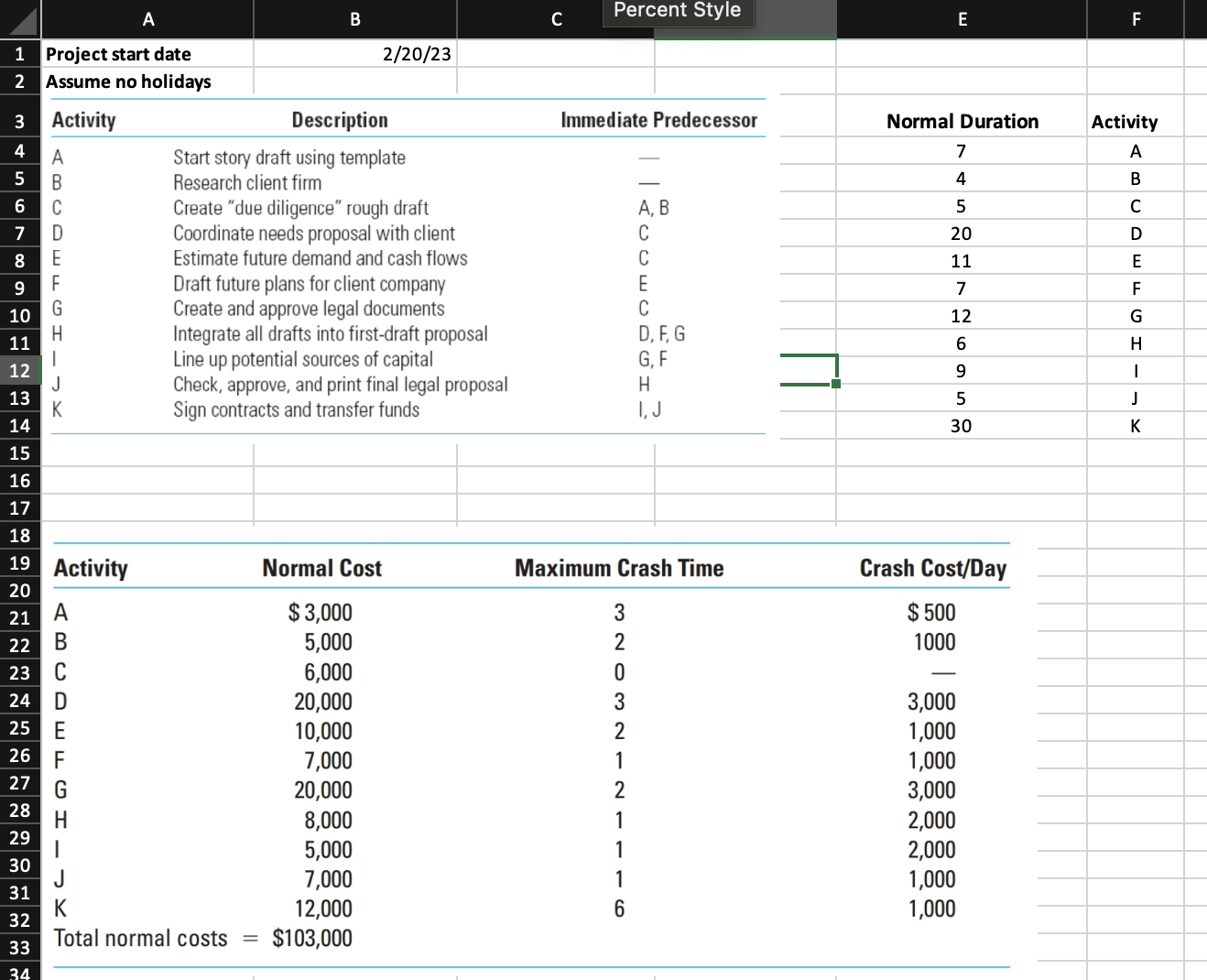

Use the project information contained in the attached Excel file to determine the initial: 1. Project duration & completion date 2. Critical path (CP) 3.

Use the project information contained in the attached Excel file to determine the initial:

1. Project duration & completion date

2. Critical path (CP)

3. Slack for activities not on the CP

Please use Excel to calculate using February 20, 2023 as the start date. (Check numbers: normal project duration is 73 days; normal/direct costs are $103,000. It is important to start from/use the correct starting points).

Apply schedule optimization techniques to reduce project duration to 68 days.Provide the process details for each crashing iteration: (1) activity shortened; (2) crash cost added; (3) new project duration; (4) new project cost; and (5) new critical path. Assume no fixed costs even though fixed cost are mentioned in the case.

A 1 Project start date 2 Assume no holidays 3 4 5 6 7 8 9 10 Activity ABCDEFGH H 11 12 13 14 15 16 17 18 19 Activity 20 21 22 23 24 D 25 E 26 F 27 28 29 30 31 32 33 34 | J K ABCDEFGH B 2/20/23 Description Start story draft using template Research client firm K Total normal costs Create "due diligence" rough draft Coordinate needs proposal with client Estimate future demand and cash flows Draft future plans for client company Create and approve legal documents Integrate all drafts into first-draft proposal Line up potential sources of capital Check, approve, and print final legal proposal Sign contracts and transfer funds Normal Cost $3,000 5,000 6,000 20,000 10,000 7,000 20,000 8,000 5,000 7,000 12,000 $103,000 C Percent Style Immediate Predecessor 3203~~16 A, B C C Maximum Crash Time 6 E C D, F, G G, F H I, J E Normal Duration 7 4 5 20 11 7 12 6 9 5 30 Crash Cost/Day $500 1000 3,000 1,000 1,000 3,000 2,000 2,000 1,000 1,000 F Activity ABCDEFGH -- J K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started