Question

Use the provided templates. o Tab 1 (WACC) provides space to compute ISS WACC which will flow to the second tab. o Tab 2 (CAPEX

-

Use the provided templates. o Tab 1 (WACC) provides space to compute ISS WACC which will flow to the second tab. o Tab 2 (CAPEX Template) provides a format for the capital budgeting analysis o Blue cells are for given data from the problem descriptions below o Orange cells are to be completed by you using a formula referencing the given data.

-

You MUST use Excels financial functions.

o Follow the pattern in the Chapter 12 exhibit o I do not want to see any absolute numbers in the body of the CAPEX analysis (as in,

below the red line in the example).

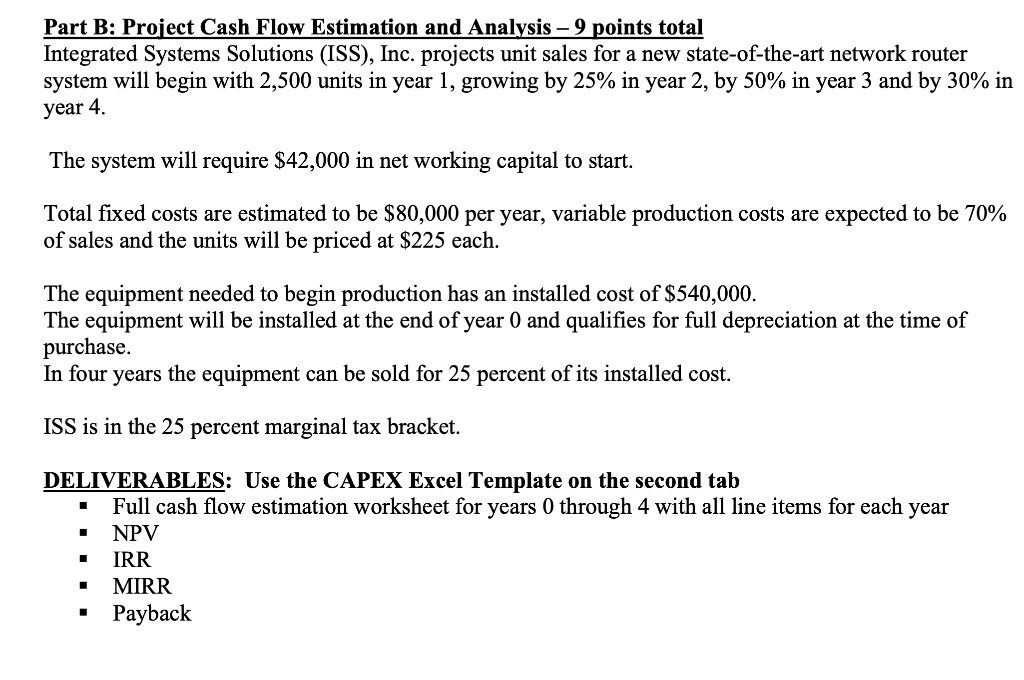

Part B: Project Cash Flow Estimation and Analysis - 9 points total Integrated Systems Solutions (ISS), Inc. projects unit sales for a new state-of-the-art network router system will begin with 2,500 units in year 1, growing by 25% in year 2, by 50% in year 3 and by 30% in year 4. The system will require $42,000 in net working capital to start. Total fixed costs are estimated to be $80,000 per year, variable production costs are expected to be 70% of sales and the units will be priced at $225 each. The equipment needed to begin production has an installed cost of $540,000. The equipment will be installed at the end of year 0 and qualifies for full depreciation at the time of purchase. In four years the equipment can be sold for 25 percent of its installed cost. ISS is in the 25 percent marginal tax bracket. DELIVERABLES: Use the CAPEX Excel Template on the second tab Full cash flow estimation worksheet for years 0 through 4 with all line items for each year NPV IRR MIRR Payback Part B: Project Cash Flow Estimation and Analysis - 9 points total Integrated Systems Solutions (ISS), Inc. projects unit sales for a new state-of-the-art network router system will begin with 2,500 units in year 1, growing by 25% in year 2, by 50% in year 3 and by 30% in year 4. The system will require $42,000 in net working capital to start. Total fixed costs are estimated to be $80,000 per year, variable production costs are expected to be 70% of sales and the units will be priced at $225 each. The equipment needed to begin production has an installed cost of $540,000. The equipment will be installed at the end of year 0 and qualifies for full depreciation at the time of purchase. In four years the equipment can be sold for 25 percent of its installed cost. ISS is in the 25 percent marginal tax bracket. DELIVERABLES: Use the CAPEX Excel Template on the second tab Full cash flow estimation worksheet for years 0 through 4 with all line items for each year NPV IRR MIRR PaybackStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started