Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use the regarding formulas Question 3: (5 marks) Ito invested $4,350 into an account today. After seven years he had an account value of $6,980.58.

use the regarding formulas

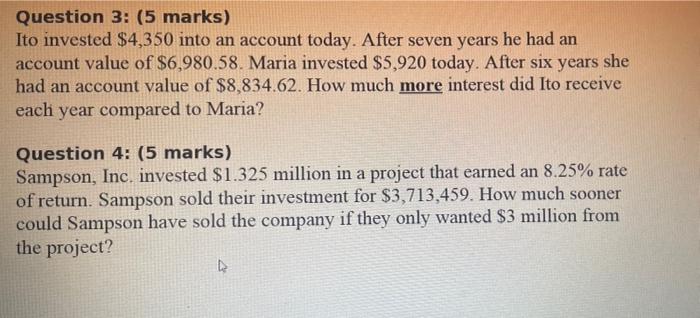

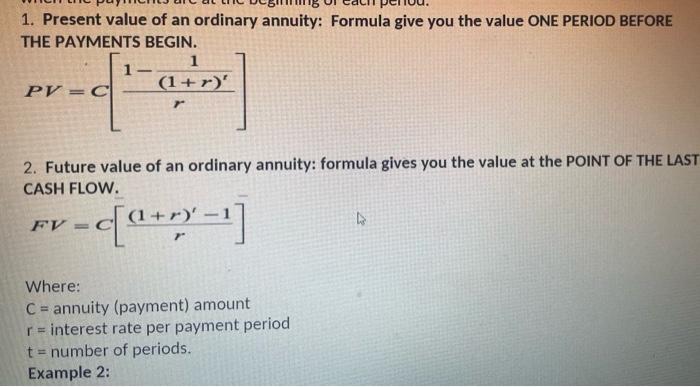

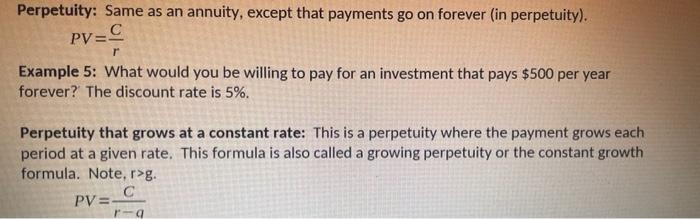

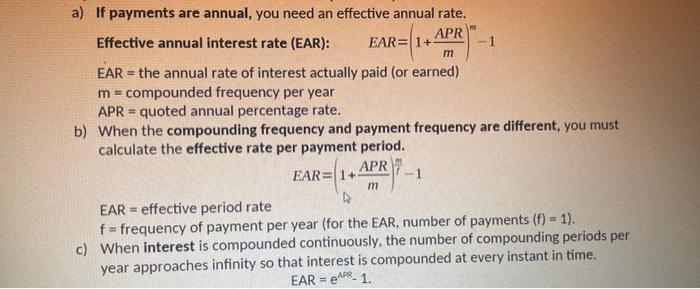

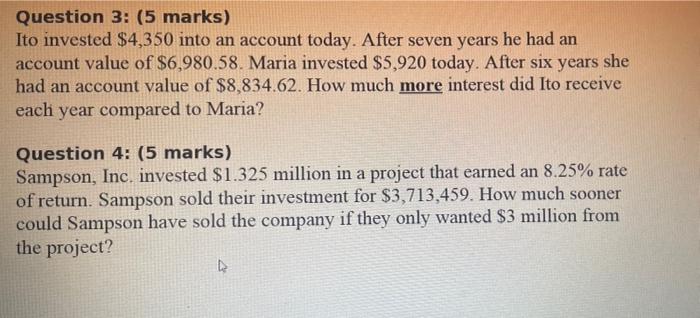

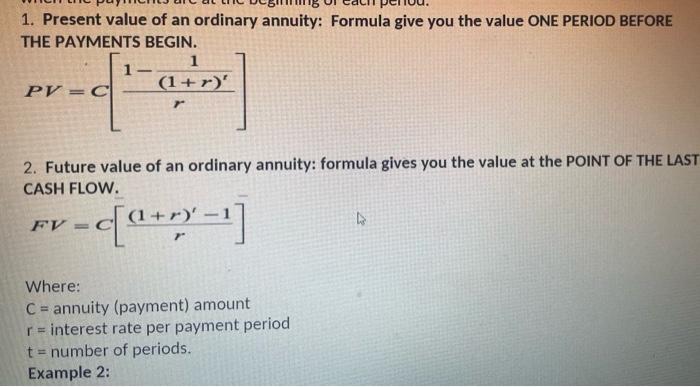

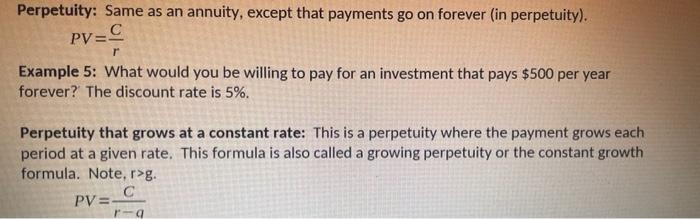

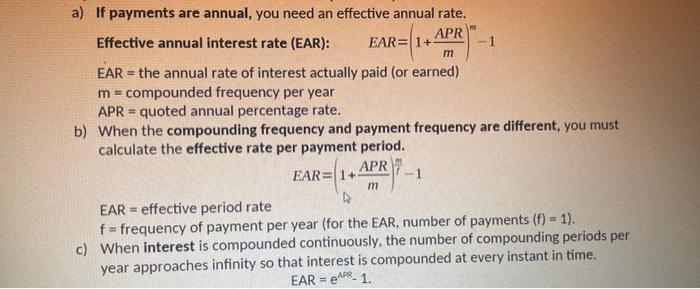

Question 3: (5 marks) Ito invested $4,350 into an account today. After seven years he had an account value of $6,980.58. Maria invested $5,920 today. After six years she had an account value of $8,834.62. How much more interest did Ito receive each year compared to Maria? Question 4: (5 marks) Sampson, Inc. invested $1.325 million in a project that earned an 8.25% rate of return. Sampson sold their investment for $3,713,459. How much sooner could Sampson have sold the company if they only wanted $3 million from the project? 1. Present value of an ordinary annuity: Formula give you the value ONE PERIOD BEFORE THE PAYMENTS BEGIN. 1 1 PV = C (1+r)' - [ 2. Future value of an ordinary annuity: formula gives you the value at the POINT OF THE LAST CASH FLOW. FV = - [@+"-1] Where: C = annuity (payment) amount r = interest rate per payment period t = number of periods. Example 2: Perpetuity: Same as an annuity, except that payments go on forever (in perpetuity). PV= r Example 5: What would you be willing to pay for an investment that pays $500 per year forever? The discount rate is 5%. Perpetuity that grows at a constant rate: This is a perpetuity where the payment grows each period at a given rate. This formula is also called a growing perpetuity or the constant growth formula. Note,r>g. PV=C ra R= m a) If payments are annual, you need an effective annual rate. Effective annual interest rate (EAR): APR EAR=(1+ EAR = the annual rate of interest actually paid (or earned) m = compounded frequency per year APR = quoted annual percentage rate. b) When the compounding frequency and payment frequency are different, you must calculate the effective rate per payment period. APR EAR=1+ -1 m EAR = effective period rate f = frequency of payment per year (for the EAR, number of payments (f) = 1). c) When interest is compounded continuously, the number of compounding periods per year approaches infinity so that interest is compounded at every instant in time. EAR E APR. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started