Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE SAME NUMBERS THAT ARE IN THE PROBLEM PLEASE!!!!!!!!!! The following is a payroll sheet for Shamrock Imports for the month of September 2020

USE THE SAME NUMBERS THAT ARE IN THE PROBLEM PLEASE!!!!!!!!!!

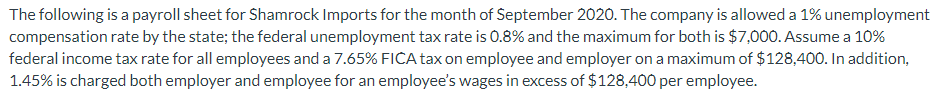

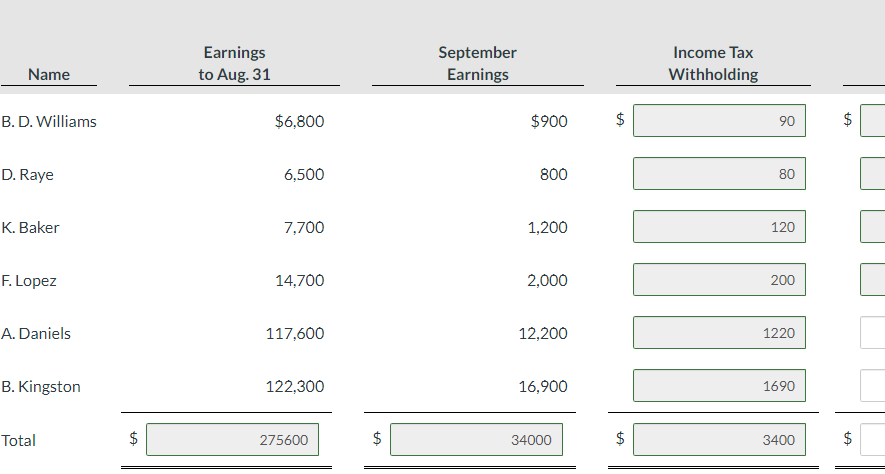

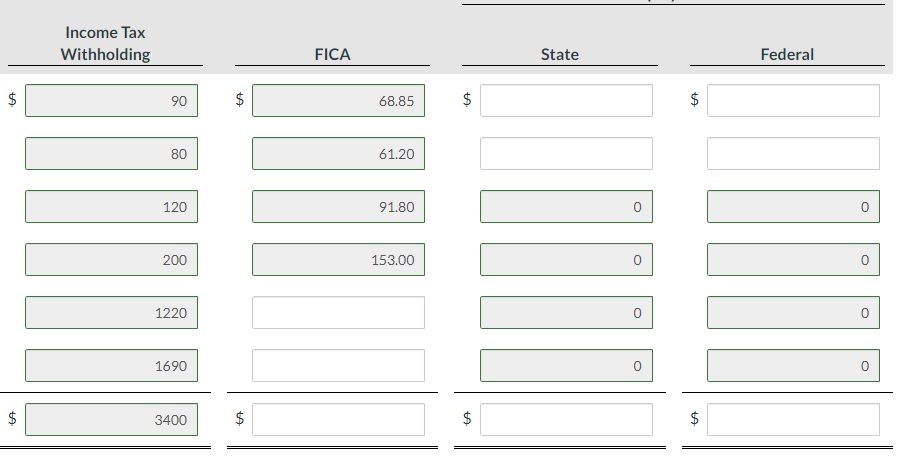

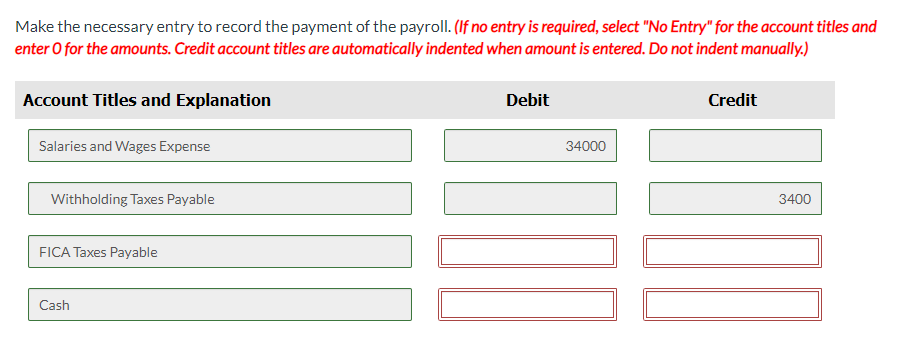

The following is a payroll sheet for Shamrock Imports for the month of September 2020 . The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10\% federal income tax rate for all employees and a 7.65% FICA tax on employee and employer on a maximum of $128,400. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $128,400 per employee. Make the necessary entry to record the payment of the payroll. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started