Answered step by step

Verified Expert Solution

Question

1 Approved Answer

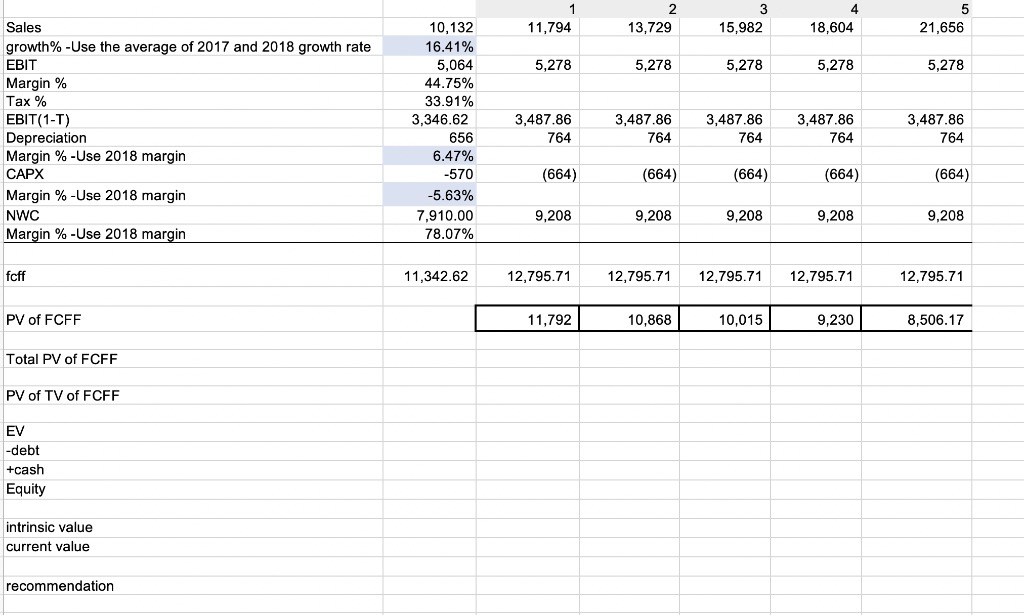

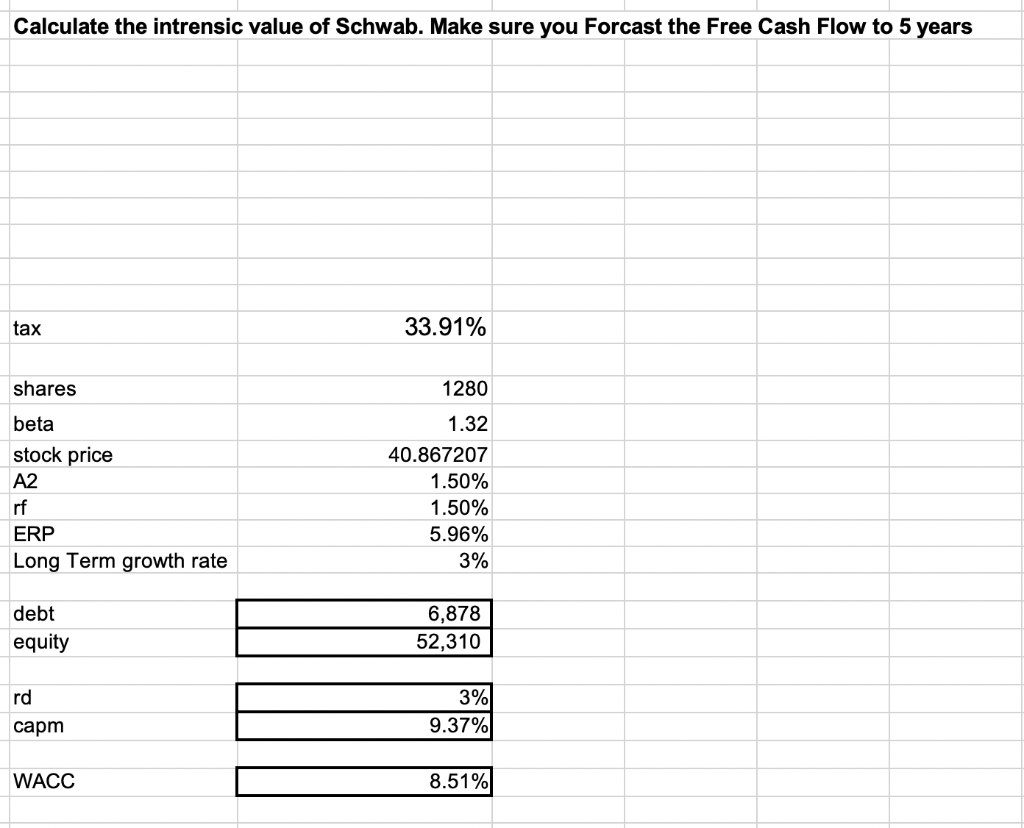

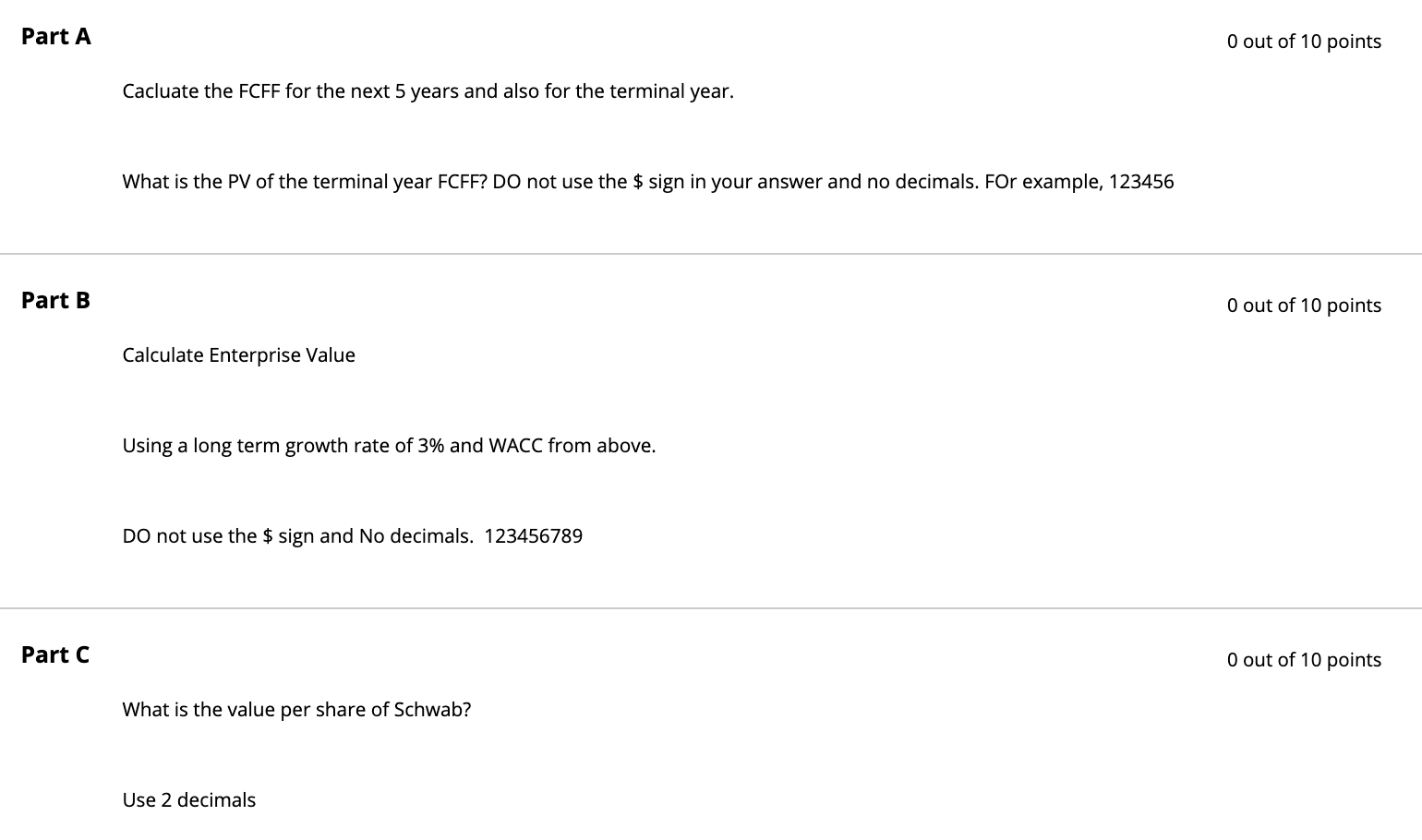

Use the sheet to answer the following questions. Part A) Calculate the FCFF for the next 5 years and also for the terminal year. What

Use the sheet to answer the following questions.

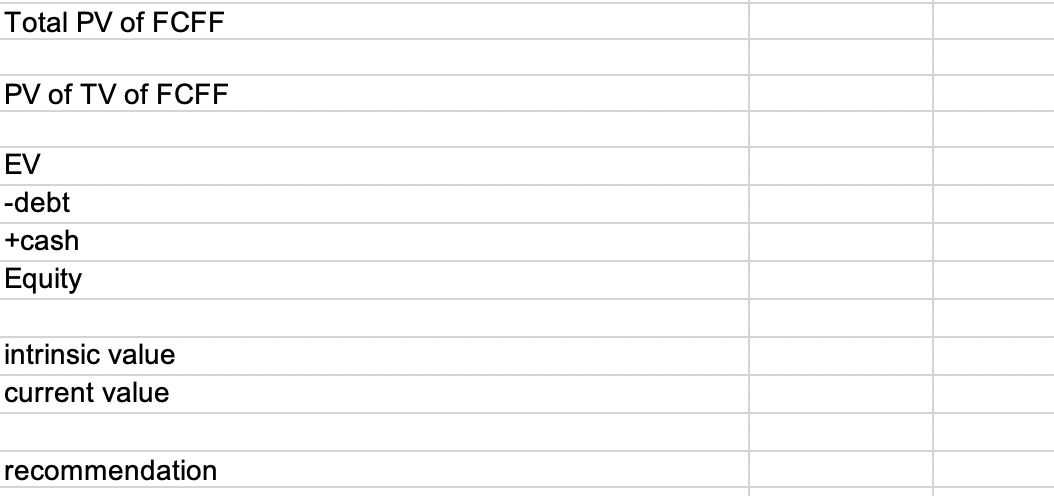

Part A) Calculate the FCFF for the next 5 years and also for the terminal year. What is the PV of the terminal year FCFF?

Part B) Calculate Enterprise Value Using a long term growth rate of 3% and WACC from above.

Part C) What is the value per share of Schwab?

1 11,794 2 13,729 3 15,982 4 18,604 5 21,656 5,278 5,278 5.278 5,278 5,278 Sales growth%-Use the average of 2017 and 2018 growth rate EBIT Margin % Tax % EBIT(1-T) Depreciation Margin %-Use 2018 margin CAPX Margin % -Use 2018 margin NWC Margin % -Use 2018 margin 10,132 16.41% 5,064 44.75% 33.91% 3,346.62 656 6.47% -570 -5.63% 7,910.00 78.07% 3,487.86 764 3,487.86 764 3,487.86 764 3,487.86 764 3,487.86 764 (664) (664) (664) (664) (664) 9,208 9,208 9,208 9,208 9,208 fcff 11,342.62 12,795.71 12,795.71 12,795.71 12,795.71 12.795.71 PV of FCFF 11,792 10,868 10,015 9,230 8,506.17 Total PV of FCFF PV of TV of FCFF EV -debt +cash Equity intrinsic value current value recommendation Calculate the intrensic value of Schwab. Make sure you Forcast the Free Cash Flow to 5 years tax 33.91% shares 1280 beta stock price A2 rf ERP Long Term growth rate 1.32 40.867207 1.50% 1.50% 5.96% 3% debt equity 6,878 52,310 rd 3% 9.37% capm WACC 8.51% Total PV of FCFF PV of TV of FCFF EV -debt +cash Equity intrinsic value current value recommendation Part A O out of 10 points Cacluate the FCFF for the next 5 years and also for the terminal year. What is the PV of the terminal year FCFF? DO not use the $ sign in your answer and no decimals. For example, 123456 Part B O out of 10 points Calculate Enterprise Value Using a long term growth rate of 3% and WACC from above. Do not use the $ sign and No decimals. 123456789 Part C O out of 10 points What is the value per share of Schwab? Use 2 decimals 1 11,794 2 13,729 3 15,982 4 18,604 5 21,656 5,278 5,278 5.278 5,278 5,278 Sales growth%-Use the average of 2017 and 2018 growth rate EBIT Margin % Tax % EBIT(1-T) Depreciation Margin %-Use 2018 margin CAPX Margin % -Use 2018 margin NWC Margin % -Use 2018 margin 10,132 16.41% 5,064 44.75% 33.91% 3,346.62 656 6.47% -570 -5.63% 7,910.00 78.07% 3,487.86 764 3,487.86 764 3,487.86 764 3,487.86 764 3,487.86 764 (664) (664) (664) (664) (664) 9,208 9,208 9,208 9,208 9,208 fcff 11,342.62 12,795.71 12,795.71 12,795.71 12,795.71 12.795.71 PV of FCFF 11,792 10,868 10,015 9,230 8,506.17 Total PV of FCFF PV of TV of FCFF EV -debt +cash Equity intrinsic value current value recommendation Calculate the intrensic value of Schwab. Make sure you Forcast the Free Cash Flow to 5 years tax 33.91% shares 1280 beta stock price A2 rf ERP Long Term growth rate 1.32 40.867207 1.50% 1.50% 5.96% 3% debt equity 6,878 52,310 rd 3% 9.37% capm WACC 8.51% Total PV of FCFF PV of TV of FCFF EV -debt +cash Equity intrinsic value current value recommendation Part A O out of 10 points Cacluate the FCFF for the next 5 years and also for the terminal year. What is the PV of the terminal year FCFF? DO not use the $ sign in your answer and no decimals. For example, 123456 Part B O out of 10 points Calculate Enterprise Value Using a long term growth rate of 3% and WACC from above. Do not use the $ sign and No decimals. 123456789 Part C O out of 10 points What is the value per share of Schwab? Use 2 decimalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started