Question

Use the solver function in Excel to complete the table (fill in all the shaded cells) for a one year fixed for floating swap that

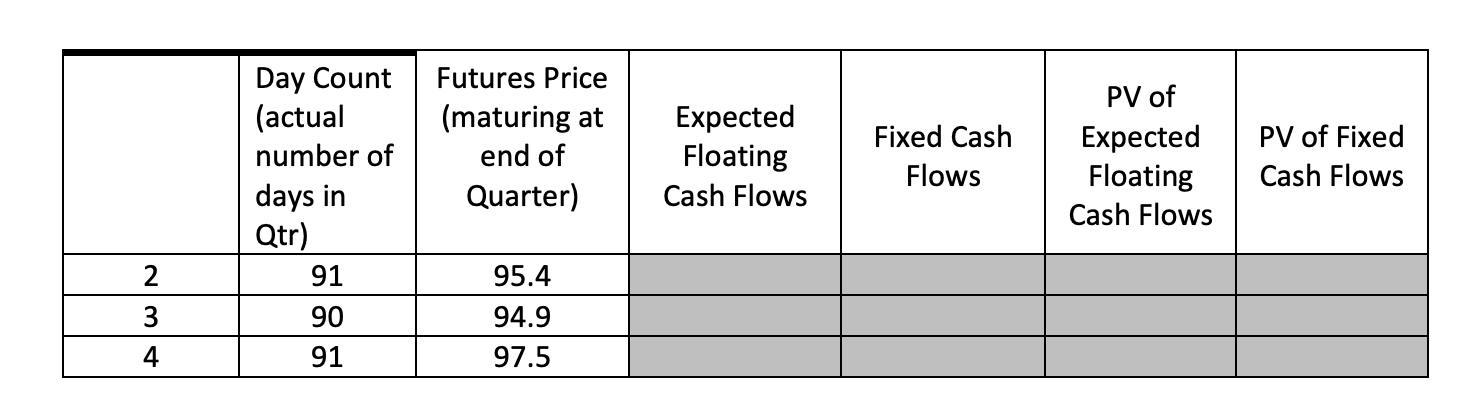

Use the solver function in Excel to complete the table (fill in all the shaded cells) for a one year fixed for floating swap that makes quarterly payments with a notional value of $75,000,000. Assume that all payments are calculated using a (Actual/360) basis and that the current 3 mo LIBOR rate is 3%. (to complete this table you need to: 1) estimate the floating payments, 2) calculate the fixed payments based on an assumed swap rate 3) calculate the PV of each floating and fixed CF 4) use solver in Excel to calculate the swap rate (the rate that would make the PV of the fixed CFs and Floating CFs equal).

\begin{tabular}{|c|l|c|c|c|c|c|} \hline & \begin{tabular}{l} Day Count \\ (actual \\ number of \\ days in \\ Qtr) \end{tabular} & \begin{tabular}{c} Futures Price \\ (maturing at \\ end of \\ Quarter) \end{tabular} & \begin{tabular}{c} Expected \\ Floating \\ Cash Flows \end{tabular} & \begin{tabular}{c} Fixed Cash \\ Flows \end{tabular} & \begin{tabular}{c} PV of \\ Expected \\ Floating \\ Cash Flows \end{tabular} & \begin{tabular}{c} PV of Fixed \\ Cash Flows \end{tabular} \\ \hline 2 & 91 & 95.4 & & & & \\ \hline 3 & 90 & 94.9 & & & & \\ \hline 4 & 91 & 97.5 & & & & \\ \hline \end{tabular}

\begin{tabular}{|c|l|c|c|c|c|c|} \hline & \begin{tabular}{l} Day Count \\ (actual \\ number of \\ days in \\ Qtr) \end{tabular} & \begin{tabular}{c} Futures Price \\ (maturing at \\ end of \\ Quarter) \end{tabular} & \begin{tabular}{c} Expected \\ Floating \\ Cash Flows \end{tabular} & \begin{tabular}{c} Fixed Cash \\ Flows \end{tabular} & \begin{tabular}{c} PV of \\ Expected \\ Floating \\ Cash Flows \end{tabular} & \begin{tabular}{c} PV of Fixed \\ Cash Flows \end{tabular} \\ \hline 2 & 91 & 95.4 & & & & \\ \hline 3 & 90 & 94.9 & & & & \\ \hline 4 & 91 & 97.5 & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started