Question

Use the Spectrum Brands dataset posted on Blackboard to value a 6-month call option with a $50 strike price. The current 6-month T-bill rate

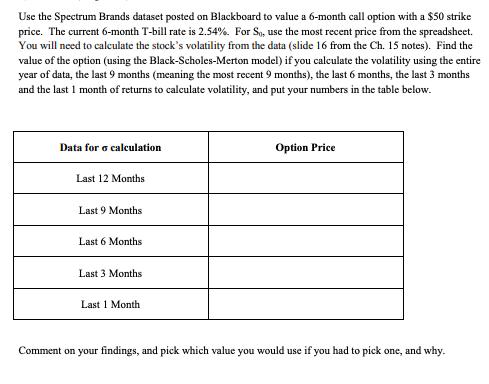

Use the Spectrum Brands dataset posted on Blackboard to value a 6-month call option with a $50 strike price. The current 6-month T-bill rate is 2.54%. For So, use the most recent price from the spreadsheet. You will need to calculate the stock's volatility from the data (slide 16 from the Ch. 15 notes). Find the value of the option (using the Black-Scholes-Merton model) if you calculate the volatility using the entire year of data, the last 9 months (meaning the most recent 9 months), the last 6 months, the last 3 months and the last 1 month of returns to calculate volatility, and put your numbers in the table below. Data for o calculation Last 12 Months Last 9 Months Last 6 Months Last 3 Months Last 1 Month Option Price Comment on your findings, and pick which value you would use if you had to pick one, and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App