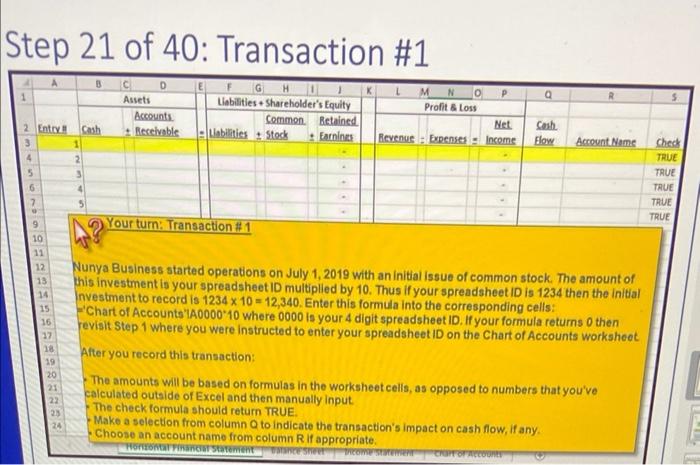

use the spread sheet ID 1870 for equations

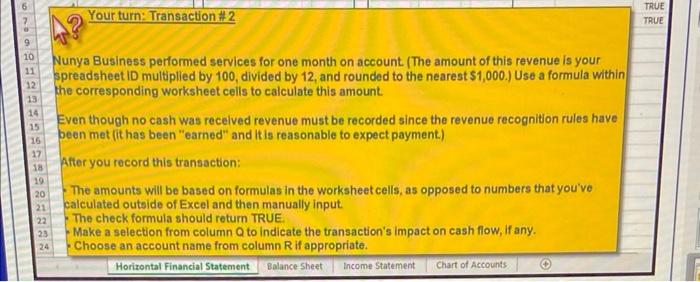

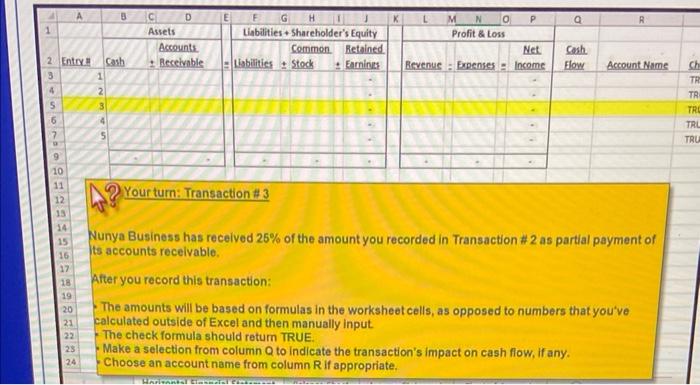

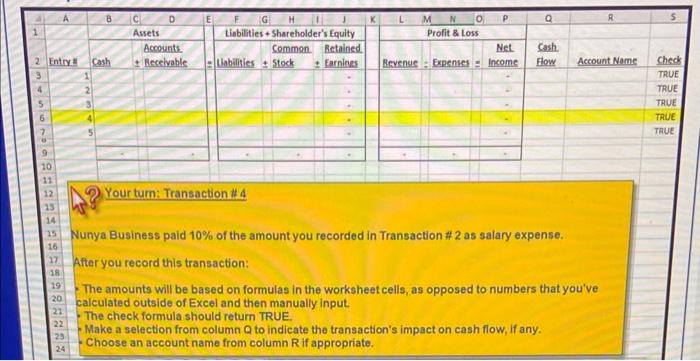

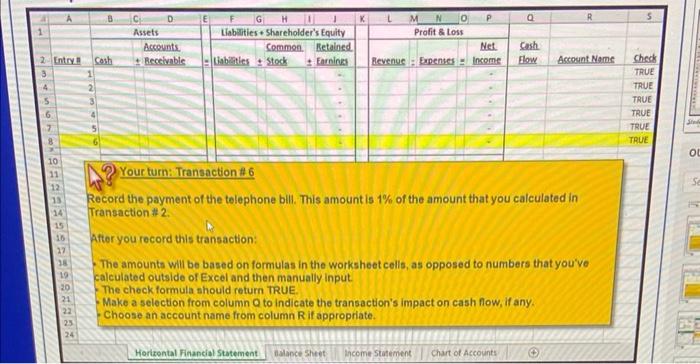

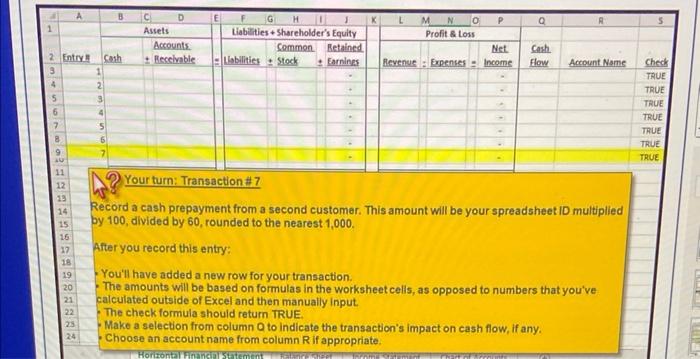

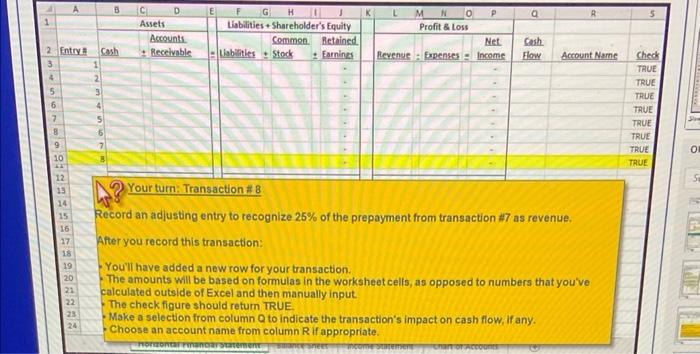

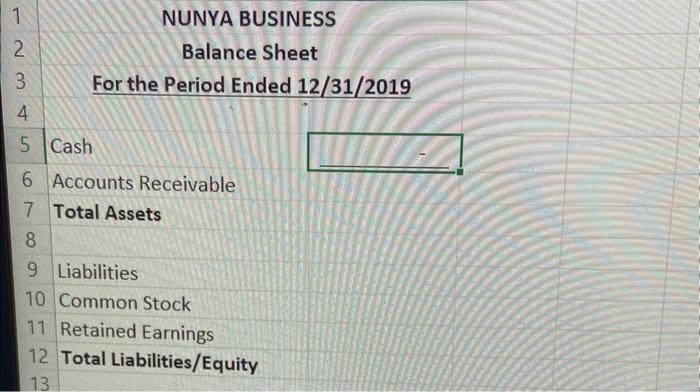

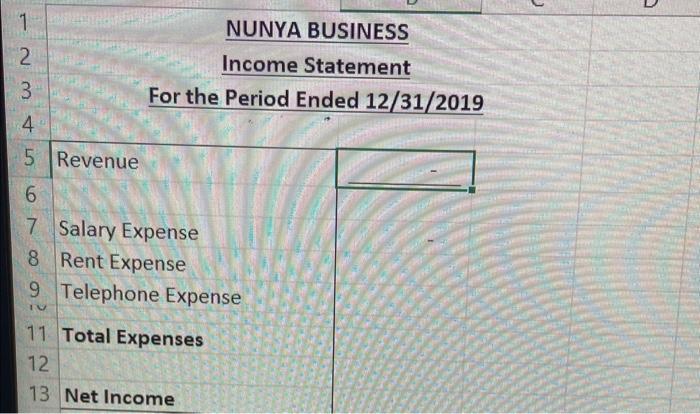

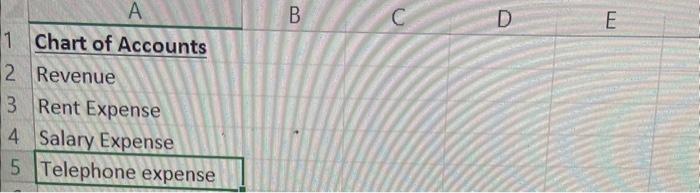

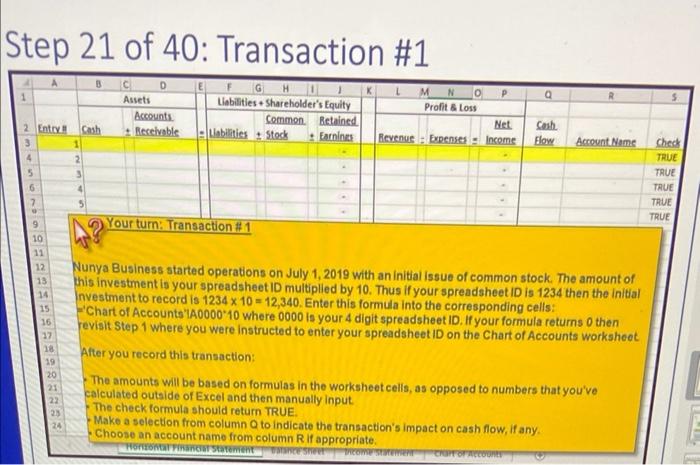

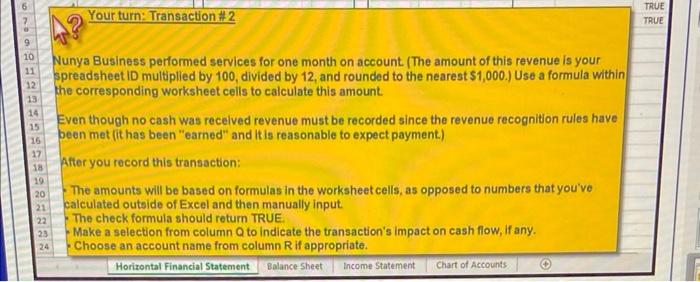

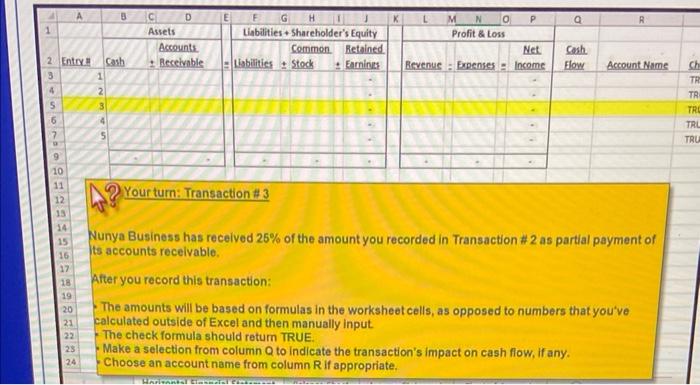

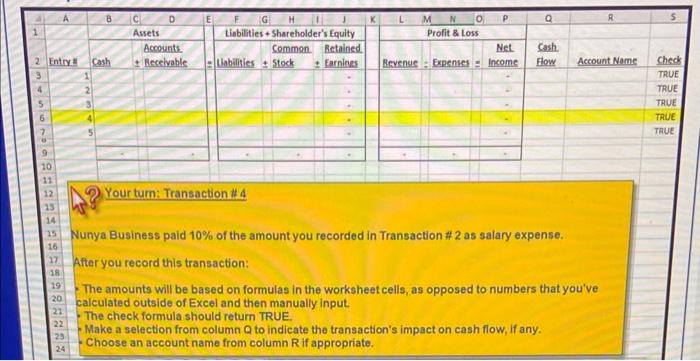

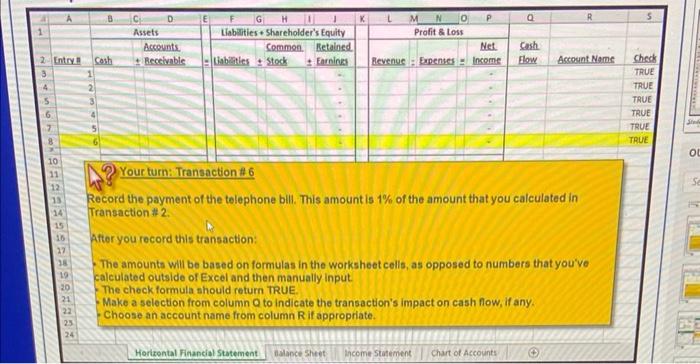

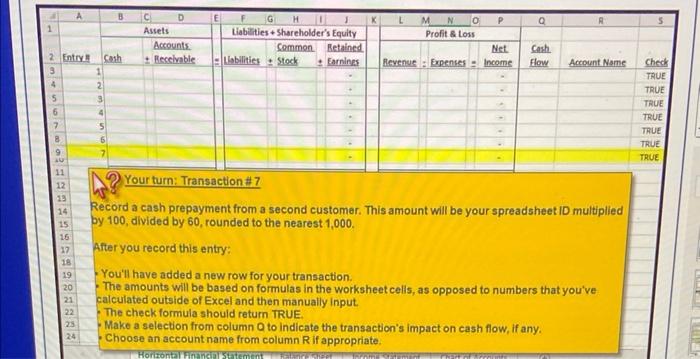

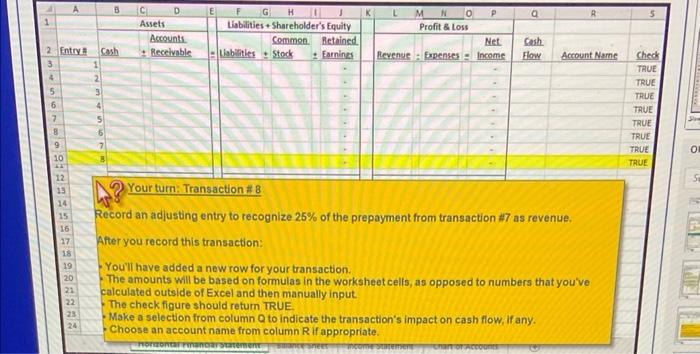

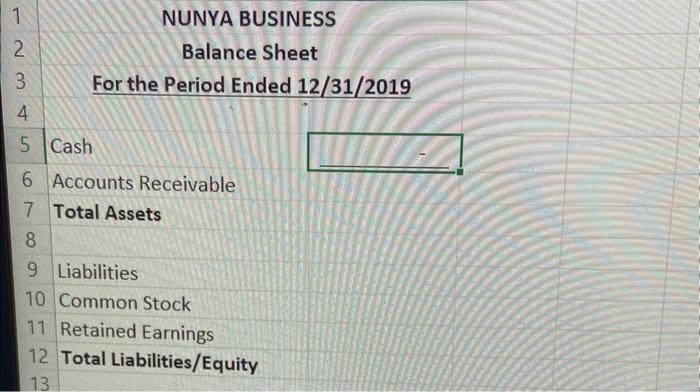

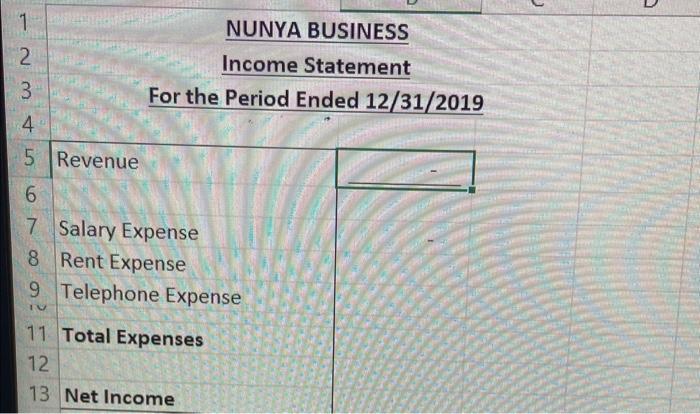

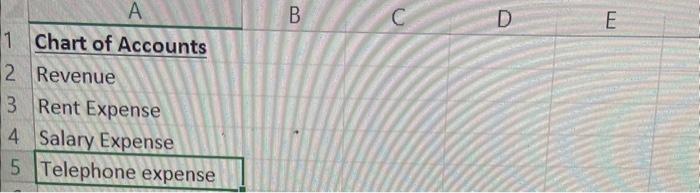

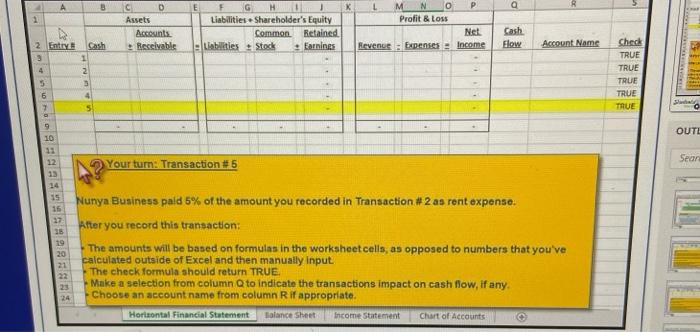

Step 21 of 40: Transaction #1 Nunya Business started operations on July 1, 2019 with an initial issue of common stock. The amount of this investment is your spreadsheet ID multiplied by 10. Thus if your spreadsheet ID is 1234 then the initial Investment to record is 123410=12,340. Enter this formula into the corresponding cells: -'Chart of Accounts'lA0000* 10 where 0000 is your 4 digit spreadsheet ID. If your formula returns 0 then revisit Step 1 where you were instructed to enter your spreadsheet ID on the Chart of Accounts worksheot. After you record this transaction: - The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transaction's impact on cash flow, if any. - Choose an account name from column R if appropriate. Nunya Business performed services for one month on account. (The amount of this revenue is your spreadsheet ID multiplied by 100 , divided by 12, and rounded to the nearest $1,000.) Use a formula within the corresponding worksheet cells to calculate this amount. Even though no cash was recelved revenue must be recorded since the revenue recognition rules have been met (it has been "earned" and it is reasonable to expect payment.) After you record this transaction: - The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transaction's impact on cash flow, if any. - Choose an account name from column R if appropriate. Yourtum: Transaction #3 Nunya Business has received 25% of the amount you recorded in Transaction # 2 as partial payment of ts accounts recelvable. After you record this transaction: -The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should retum TRUE. - Make a selection from column Q to indicate the transaction's impact on cash flow, if any. - Choose an account name from column R if appropriate. (4) Yourtum: Transaction #4 Nunya Business paid 10% of the amount you recorded in Transaction #2 as salary expense. After you record this transaction: - The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transaction's impact on cash fiow, if any. - Choose an account name from column R if appropriate. Record the payment of the telephone bill. This amount is 1% of the amount that you calculated in Transaction 22. After you record this transaction: -The amounts will be based on formulas in the worksheet cells, as opposed to numbers that youve calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transaction's impact on cash flow, if any. Choose an account name from column R if appropriate. Your turn: Transaction #7 Record a cash prepayment from a second customer. This amount will be your spreadsheet ID multiplied by 100 , divided by 60 , rounded to the nearest 1,000 . After you record this entry: - You'll have added a new row for your transaction. -The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transaction's impact on cash flow, if any. - Choose an account name from column R if appropriate. (9) Your tum: Transaction # 8 tecord an adjusting entry to recognize 25% of the prepayment from transaction #7 as revenue. After you record this transaction: Youlli have added a new row for your transaction. -The amounts will be based on formulas in the worksheet cells, as opposed to numbers that you've calculated outside of Excel and then manually input. -The check figure should retum TRUE. - Make a seloction from column Q to indicate the transaction's impact on cash flow, if any. - Choose an account name from column R if appropriate. NUNYA BUSINESS Balance Sheet For the Period Ended 12/31/2019 Cash 6 Accounts Receivable Total Assets Liabilities 10 Common Stock 11 Retained Earnings 12 Total Liabilities/Equity 13 NUNYA BUSINESS Income Statement For the Period Ended 12/31/2019 Revenue Salary Expense Rent Expense Telephone Expense Total Expenses 12 13 Net Income (6) Your tum: Transaction # 5 Nunya Business pald 5% of the amount you recorded in Transaction # 2 as rent expense. Atter yourecord this transaction: - The amounts will be based on formulas in the worksheet cella, as opposed to numbers that you've calculated outside of Excel and then manually input. - The check formula should return TRUE. - Make a selection from column Q to indicate the transactions impact on cash flow, if any. - Choose an account name from column R if appropriate