Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the spreadsheet below to calculate the value to enter on line 26 of form 1120, other deductions 6 Total deductions (ransfer to line 26)

Use the spreadsheet below to calculate the value to enter on line 26 of form 1120, other deductions

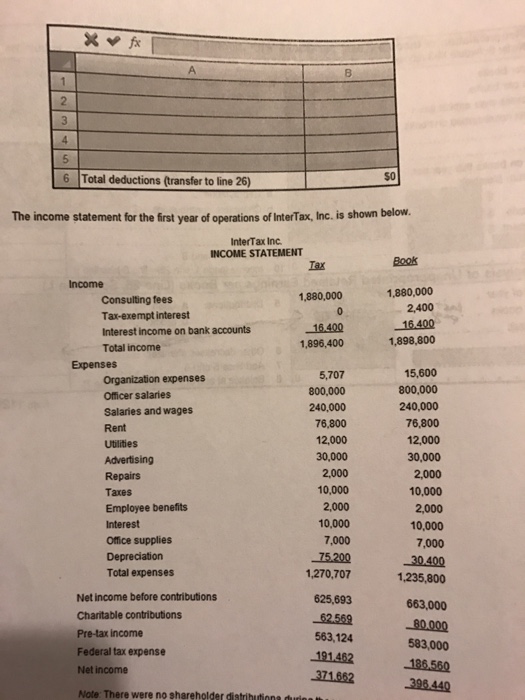

6 Total deductions (ransfer to line 26) The income statement for the first year of operations ofInterTax, Inc. is shown below. InterTax Inc. INCOME STATEMENT 1,880.000 1,880,000 g fees 2,400 Tax-exempt interest Interest income on bank accounts 1,898,800 1,896,400 Total income Expenses 15,600 organization expenses 800.000 800.000 Officer salaries 240,000 240,000 Salaries and wages 76.800 76,800 12,000 12,000 Utilities 30,000 30,000 2,000 2,000 10.000 10,000 Taxes Employee benefits 2,000 2,000 10.000 Interest 10,000 Office supplies 7,000 7,000 Depreciation Total expenses 1,270,707 1,235,800 Net income before contributions 625,693 663,000 Charitable contributions Pre-tax income 563,124 583,000 Federal tax expense Net income Note: There were no shareholder distributiona dudna

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started