Question

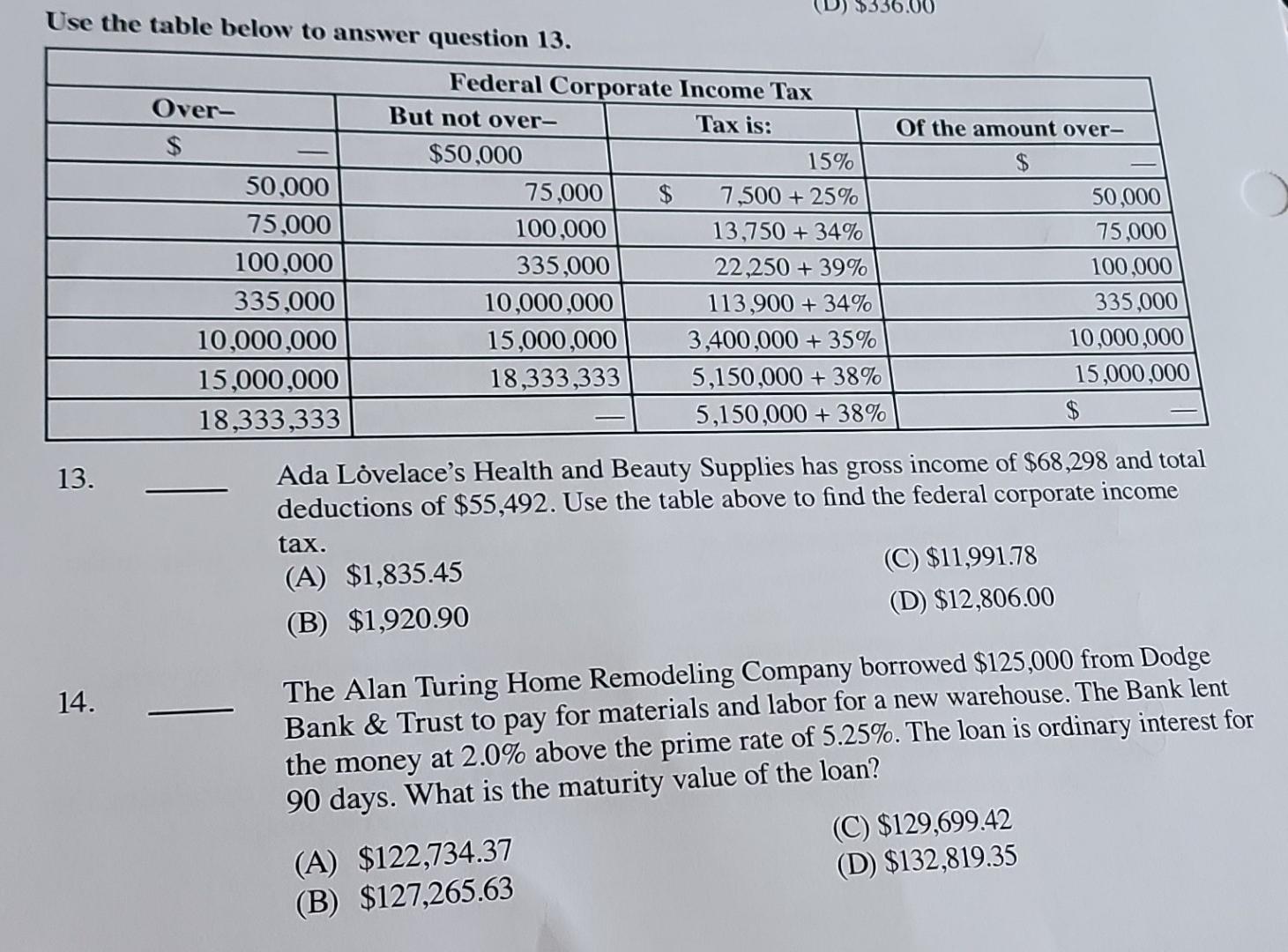

Use the table below to answer question 13. 13. Over- $ 50.000 75.000 100,000 335.000 10,000,000 15,000,000 18,333,333 Federal Corporate Income Tax Tax is: But

Use the table below to answer question 13. 13. Over- $ 50.000 75.000 100,000 335.000 10,000,000 15,000,000 18,333,333 Federal Corporate Income Tax Tax is: But not over- $50,000 tax. (A) $1,835.45 (B) $1,920.90 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 $ 15% 7,500 + 25% 13,750+ 34% 22,250+ 39% 113,900+ 34% 3,400,000 + 35% 5,150,000+ 38% 5,150,000+ 38% Of the amount over- $ 50,000 75,000 100,000 335,000 $ Ada Lovelace's Health and Beauty Supplies has gross income of $68,298 and total deductions of $55,492. Use the table above to find the federal corporate income (C) $11,991.78 (D) $12,806.00 10,000,000 15,000,000 O

Use the table below to answer question 13. 13. 14. 14. Ada Lvelace's Health and Beauty Supplies has gross income of $68,298 and total deductions of $55,492. Use the table above to find the federal corporate income tax. (A) $1,835.45 (C) $11,991.78 (B) $1,920.90 (D) $12,806.00 The Alan Turing Home Remodeling Company borrowed $125,000 from Dodge Bank \& Trust to pay for materials and labor for a new warehouse. The Bank lent the money at 2.0% above the prime rate of 5.25%. The loan is ordinary interest for 90 days. What is the maturity value of the loan? (A) $122,734.37 (C) $129,699.42 (B) $127,265.63 (D) $132,819.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started