Answered step by step

Verified Expert Solution

Question

1 Approved Answer

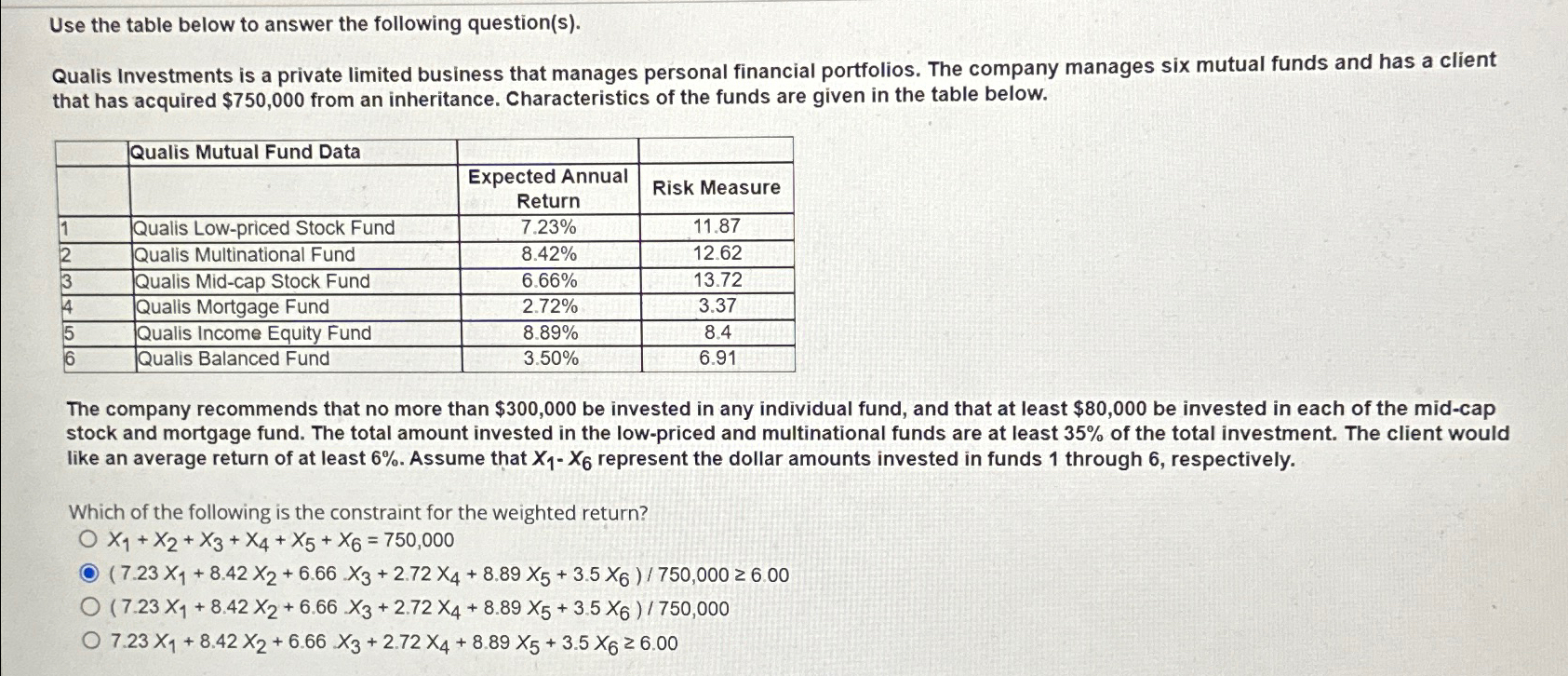

Use the table below to answer the following question ( s ) . Qualis Investments is a private limited business that manages personal financial portfolios.

Use the table below to answer the following questions

Qualis Investments is a private limited business that manages personal financial portfolios. The company manages six mutual funds and has a client that has acquired $ from an inheritance. Characteristics of the funds are given in the table below.

tableQualis Mutual Fund Data,,tableExpected AnnualReturnRisk MeasureQualis Lowpriced Stock Fund,Qualis Multinational Fund,Qualis Midcap Stock Fund,Qualis Mortgage Fund,Qualis Income Equity Fund,Qualis Balanced Fund,

The company recommends that no more than $ be invested in any individual fund, and that at least $ be invested in each of the midcap stock and mortgage fund. The total amount invested in the lowpriced and multinational funds are at least of the total investment. The client would like an average return of at least Assume that represent the dollar amounts invested in funds through respectively.

Which of the following is the constraint for the weighted return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started