Answered step by step

Verified Expert Solution

Question

1 Approved Answer

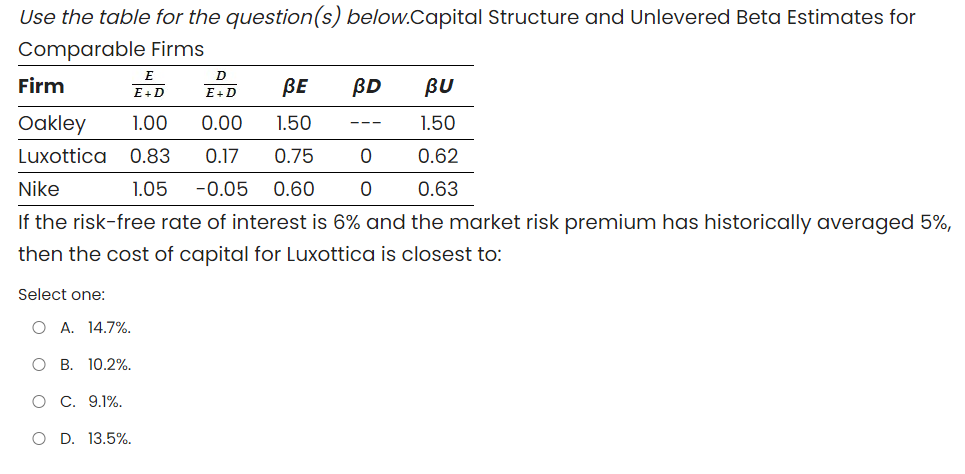

Use the table for the question(s) below.Capital Structure and Unlevered Beta Estimates for Comparable Firms If the risk-free rate of interest is 6% and the

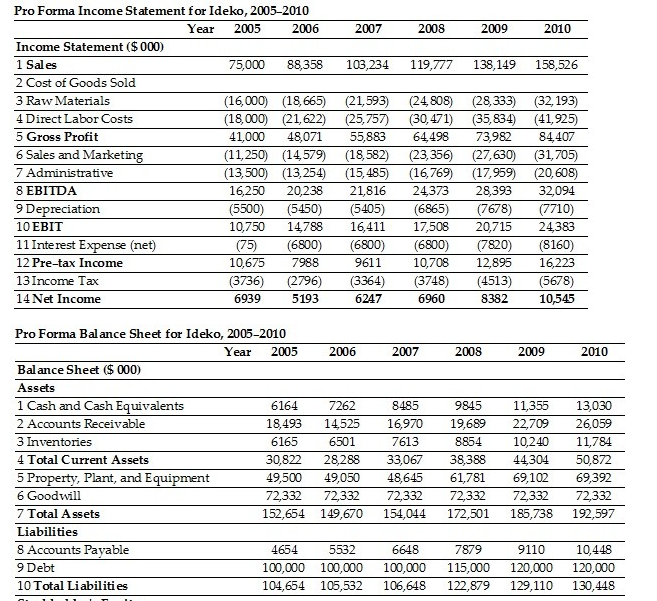

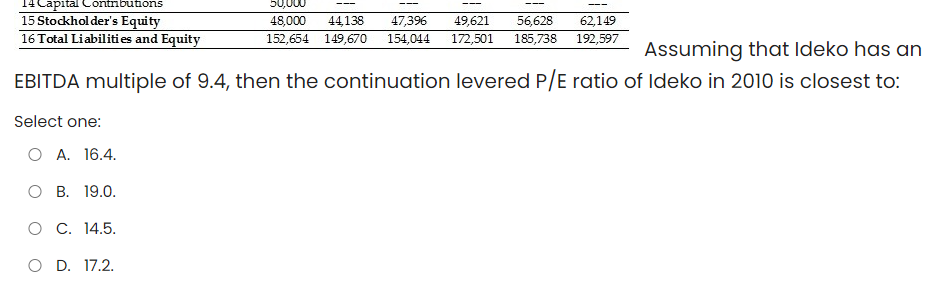

Use the table for the question(s) below.Capital Structure and Unlevered Beta Estimates for Comparable Firms If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Luxottica is closest to: Select one: A. 14.7%. B. 10.2%. C. 9.1%. D. 13.5%. Pro Forma Income Statement for Ideko, 2005-2010 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & Year & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline \multicolumn{8}{|l|}{ Income Statement ($000)} \\ \hline 1 Sales & & 75,000 & 88,358 & 103,234 & 119,777 & 138,149 & 158,526 \\ \hline \multicolumn{8}{|l|}{2 Cost of Goods Sold } \\ \hline 3 Raw Materials & & (16,000) & (18,665) & (21,593) & (24,808) & (28,333) & (32,193) \\ \hline 4 Direct Labor Costs & & (18,000) & (21,622) & (25,757) & (30,471) & (35,834) & (41,925) \\ \hline 5 Gross Profit & & 41,000 & 48,071 & 55,883 & 64,498 & 73,982 & 84,407 \\ \hline 6 Sales and Marketing & & (11,250) & (14,579) & (18,582) & (23,356) & (27,630) & (31,705) \\ \hline 7 Administrative & & (13,500) & (13,254) & (15,485) & (16,769) & (17,959) & (20,608) \\ \hline 8 EBITDA & & 16,250 & 20,238 & 21,816 & 24,373 & 28,393 & 32,094 \\ \hline 9 Depreciation & & (5500) & (5450) & (5405) & (6865) & (7678) & (7710) \\ \hline 10EBIT & & 10,750 & 14,788 & 16,411 & 17,508 & 20,715 & 24,383 \\ \hline 11 Interest Expense (net) & & (75) & (6800) & (6800) & (6800) & (7820) & (8160) \\ \hline 12 Pre-tax Income & & 10,675 & 7988 & 9611 & 10,708 & 12,895 & 16,223 \\ \hline 13Income Tax & & (3736) & (2796) & (3364) & (3748) & (4513) & (5678) \\ \hline 14 Net Income & & 6939 & 5193 & 6247 & 6960 & 8382 & 10,545 \\ \hline \end{tabular} Pro Forma Bal ance Sheet for Ideko, 2005-2010 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & Year & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline \multicolumn{8}{|l|}{ Bal ance Sheet (\$000) } \\ \hline \multicolumn{8}{|l|}{ Assets } \\ \hline 1 Cash and Cash Equivalents & & 6164 & 7262 & 8485 & 9845 & 11,355 & 13,030 \\ \hline 2 Accounts Receivable & & 18,493 & 14,525 & 16,970 & 19,689 & 22,709 & 26,059 \\ \hline 3 Inventories & & 6165 & 6501 & 7613 & 8854 & 10,240 & 11,784 \\ \hline 4 Total Current Assets & & 30,822 & 28,288 & 33,067 & 38,388 & 44,304 & 50,872 \\ \hline 5 Property, Plant, and Equipment & & 49,500 & 49,050 & 48,645 & 61,781 & 69,102 & 69,392 \\ \hline 6 Goodwill & & 72,332 & 72,332 & 72,332 & 72,332 & 72,332 & 72,332 \\ \hline 7 Total Assets & & 152,654 & 149,670 & 154,044 & 172,501 & 185,738 & 192,597 \\ \hline \multicolumn{8}{|l|}{ Liabilities } \\ \hline 8 Accounts Payable & & 4654 & 5532 & 6648 & 7879 & 9110 & 10,448 \\ \hline 9 Debt & & 100,000 & 100,000 & 100,000 & 115,000 & 120,000 & 120,000 \\ \hline 10 Total Liabilities & & 104,654 & 105,532 & 106,648 & 122,879 & 129,110 & 130,448 \\ \hline \end{tabular} EBITDA multiple of 9.4 , then the continuation levered P/E ratio of Ideko in 2010 is closest to: Select one: A. 16.4 . B. 19.0 . C. 14.5 . D. 17.2

Use the table for the question(s) below.Capital Structure and Unlevered Beta Estimates for Comparable Firms If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%, then the cost of capital for Luxottica is closest to: Select one: A. 14.7%. B. 10.2%. C. 9.1%. D. 13.5%. Pro Forma Income Statement for Ideko, 2005-2010 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & Year & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline \multicolumn{8}{|l|}{ Income Statement ($000)} \\ \hline 1 Sales & & 75,000 & 88,358 & 103,234 & 119,777 & 138,149 & 158,526 \\ \hline \multicolumn{8}{|l|}{2 Cost of Goods Sold } \\ \hline 3 Raw Materials & & (16,000) & (18,665) & (21,593) & (24,808) & (28,333) & (32,193) \\ \hline 4 Direct Labor Costs & & (18,000) & (21,622) & (25,757) & (30,471) & (35,834) & (41,925) \\ \hline 5 Gross Profit & & 41,000 & 48,071 & 55,883 & 64,498 & 73,982 & 84,407 \\ \hline 6 Sales and Marketing & & (11,250) & (14,579) & (18,582) & (23,356) & (27,630) & (31,705) \\ \hline 7 Administrative & & (13,500) & (13,254) & (15,485) & (16,769) & (17,959) & (20,608) \\ \hline 8 EBITDA & & 16,250 & 20,238 & 21,816 & 24,373 & 28,393 & 32,094 \\ \hline 9 Depreciation & & (5500) & (5450) & (5405) & (6865) & (7678) & (7710) \\ \hline 10EBIT & & 10,750 & 14,788 & 16,411 & 17,508 & 20,715 & 24,383 \\ \hline 11 Interest Expense (net) & & (75) & (6800) & (6800) & (6800) & (7820) & (8160) \\ \hline 12 Pre-tax Income & & 10,675 & 7988 & 9611 & 10,708 & 12,895 & 16,223 \\ \hline 13Income Tax & & (3736) & (2796) & (3364) & (3748) & (4513) & (5678) \\ \hline 14 Net Income & & 6939 & 5193 & 6247 & 6960 & 8382 & 10,545 \\ \hline \end{tabular} Pro Forma Bal ance Sheet for Ideko, 2005-2010 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & Year & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \hline \multicolumn{8}{|l|}{ Bal ance Sheet (\$000) } \\ \hline \multicolumn{8}{|l|}{ Assets } \\ \hline 1 Cash and Cash Equivalents & & 6164 & 7262 & 8485 & 9845 & 11,355 & 13,030 \\ \hline 2 Accounts Receivable & & 18,493 & 14,525 & 16,970 & 19,689 & 22,709 & 26,059 \\ \hline 3 Inventories & & 6165 & 6501 & 7613 & 8854 & 10,240 & 11,784 \\ \hline 4 Total Current Assets & & 30,822 & 28,288 & 33,067 & 38,388 & 44,304 & 50,872 \\ \hline 5 Property, Plant, and Equipment & & 49,500 & 49,050 & 48,645 & 61,781 & 69,102 & 69,392 \\ \hline 6 Goodwill & & 72,332 & 72,332 & 72,332 & 72,332 & 72,332 & 72,332 \\ \hline 7 Total Assets & & 152,654 & 149,670 & 154,044 & 172,501 & 185,738 & 192,597 \\ \hline \multicolumn{8}{|l|}{ Liabilities } \\ \hline 8 Accounts Payable & & 4654 & 5532 & 6648 & 7879 & 9110 & 10,448 \\ \hline 9 Debt & & 100,000 & 100,000 & 100,000 & 115,000 & 120,000 & 120,000 \\ \hline 10 Total Liabilities & & 104,654 & 105,532 & 106,648 & 122,879 & 129,110 & 130,448 \\ \hline \end{tabular} EBITDA multiple of 9.4 , then the continuation levered P/E ratio of Ideko in 2010 is closest to: Select one: A. 16.4 . B. 19.0 . C. 14.5 . D. 17.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started