Answered step by step

Verified Expert Solution

Question

1 Approved Answer

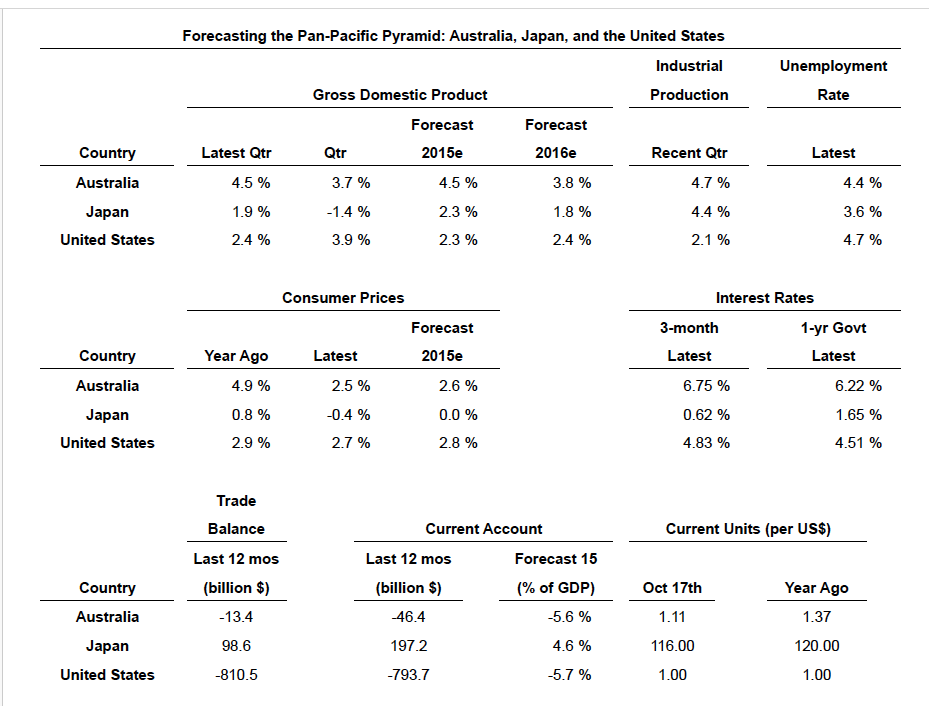

Use the table provided. Assuming International Fisherlong dashone version of Purchasing Power Paritylong dashapplies to the coming year, forecast the following future spot exchange rates

Use the table provided. Assuming International Fisherlong dashone version of Purchasing Power Paritylong dashapplies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies:

a Japanese yen to US dollar in one year

The future spot exchange rate for Japanese yenUS dollar in one year is Yen$Round to two decimal places.

Part

b Japanese yen to Australian dollar in one year

The future spot exchange rate for Japanese yenAustralian dollar in one year is YA$ Round to two decimal places.

Part

c Australian dollar to US dollar in one year:

The future spot exchange rate for Australian dollarUS dollar in one year is A$

$Round to four decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started